Yesterday’s analysis expected some downwards movement, but not as much as we got. The target was 1,394, but price fell through this and invalidated the hourly wave count. Price remains above the invalidation point on both daily wave counts.

The wave count remains the same.

Click on the charts below to enlarge.

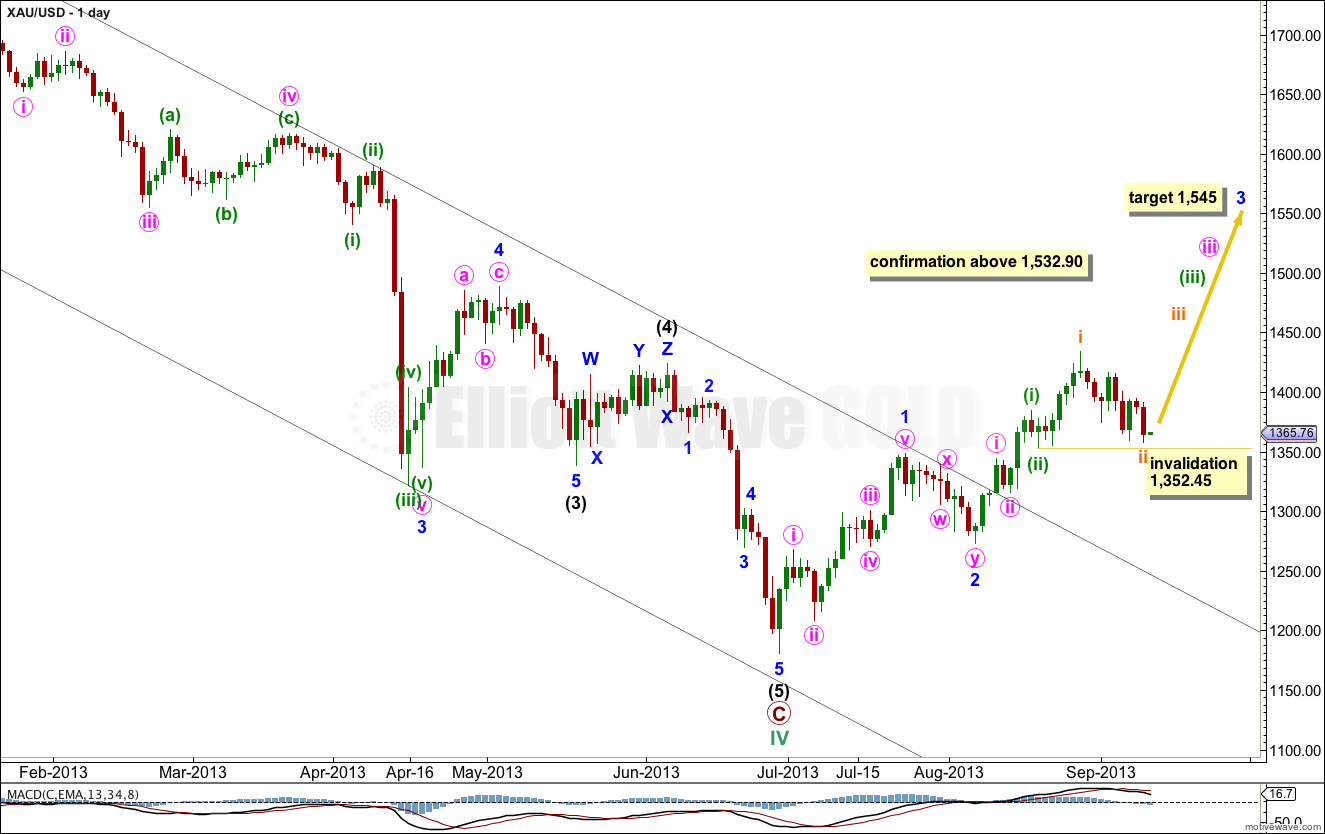

Main Wave Count.

This wave count agrees with MACD. If upwards movement is within a third wave, then it should show an increase in upwards momentum beyond the end of minor wave 1. Because we have not seen that increase in upwards momentum yet (on the one to six hourly time frames) we may not have seen the middle of the third wave.

At 1,545 minor wave 3 would reach 1.618 the length of minor wave 1.

Within minor wave 3 subminuette wave ii may not move beyond the start of subminuette wave i. This wave count is invalidated at minute wave degree with movement below 1,352.45.

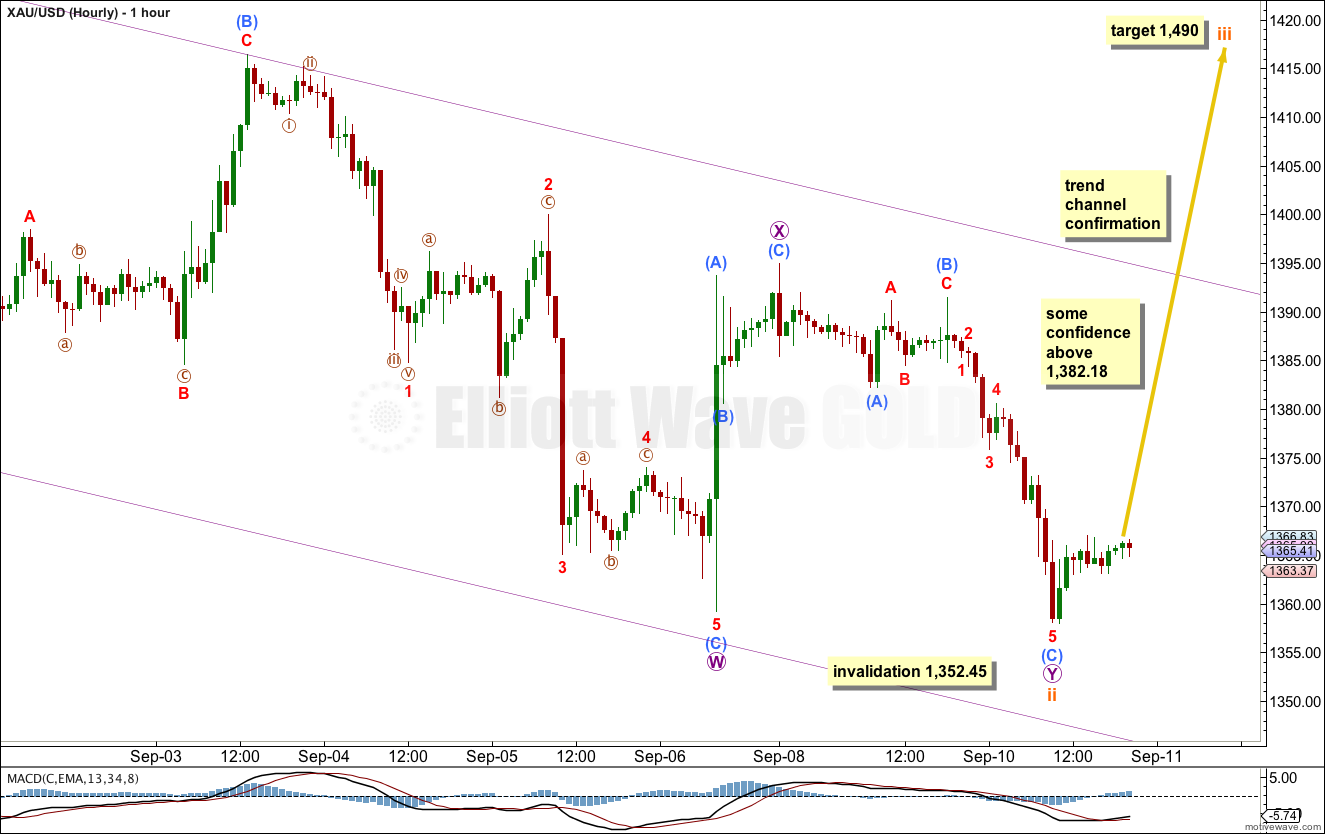

Movement slightly below 1,359.25 has changed the structure of subminuette wave ii, which remains viable. Downwards movement for Tuesday must be a continuation of subminuette wave ii as a double zigzag.

Within the second zigzag labeled microwave Y submicro wave (B) is just 0.08 short of 2.618 the length of submicro wave (A).

We need to see price move above 1,382.18 to have confidence that subminuette wave ii is over and a third wave is underway. At that stage upwards movement could not be just a fourth wave correction within a new downwards impulse, and so the downwards wave labeled micro wave Y would have to be a completed three wave structure.

Further movement above the parallel channel containing this downwards correction would provide trend channel confirmation of a trend change.

If subminuette wave ii moves lower it may not move beyond the start of subminuette wave i. This wave count is invalidated with movement below 1,352.45.

If this wave count is invalidated with downwards movement then we should use the second daily possibility below.

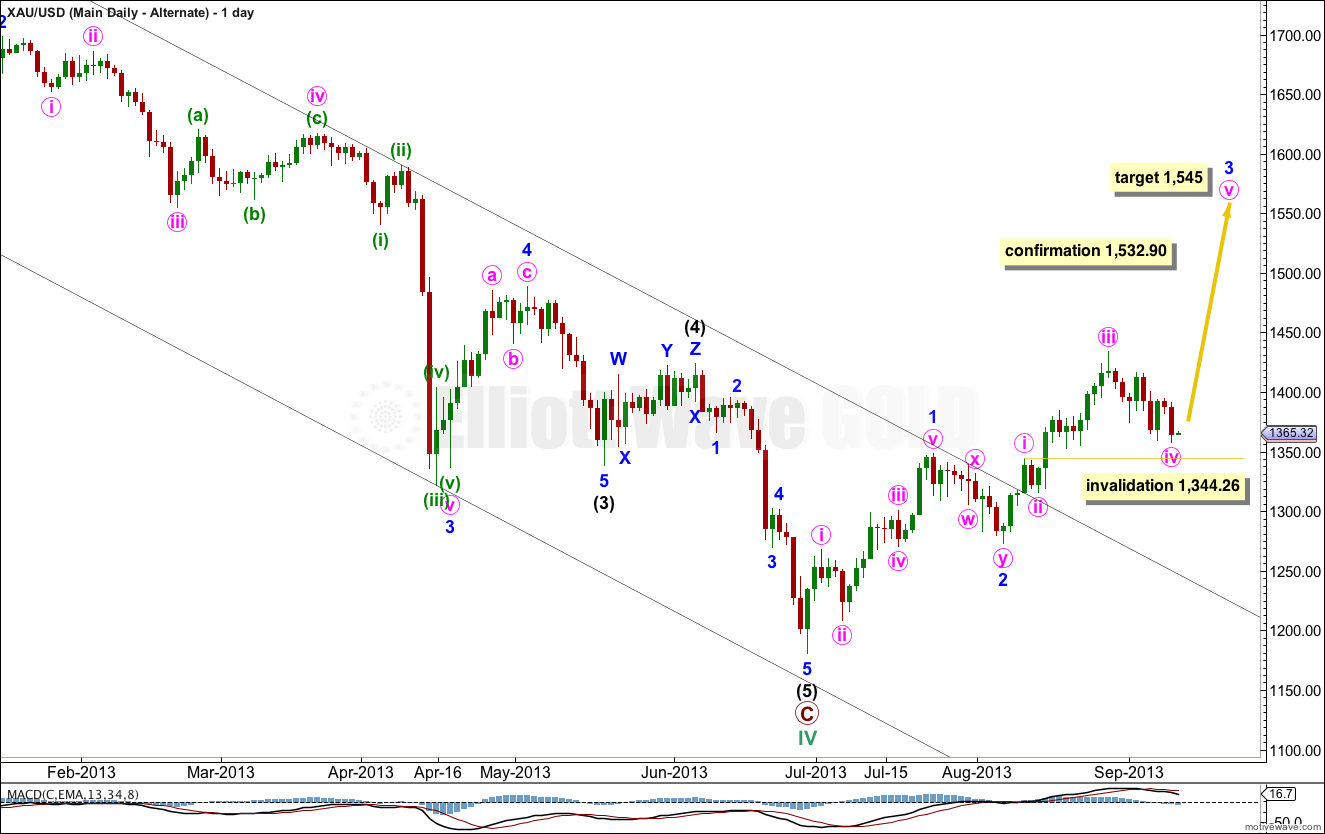

It is possible that this downwards movement is a fourth wave correction for minute wave iv, and that minute wave iii is complete.

Minute wave iii is just 2.51 longer than 1.618 the length of minute wave i.

This wave count also expects more upwards movement from gold, but for a fifth wave not the middle of a third. The difference is in expected momentum; the first daily chart expects a strong increase in momentum.

Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 1,344.26.

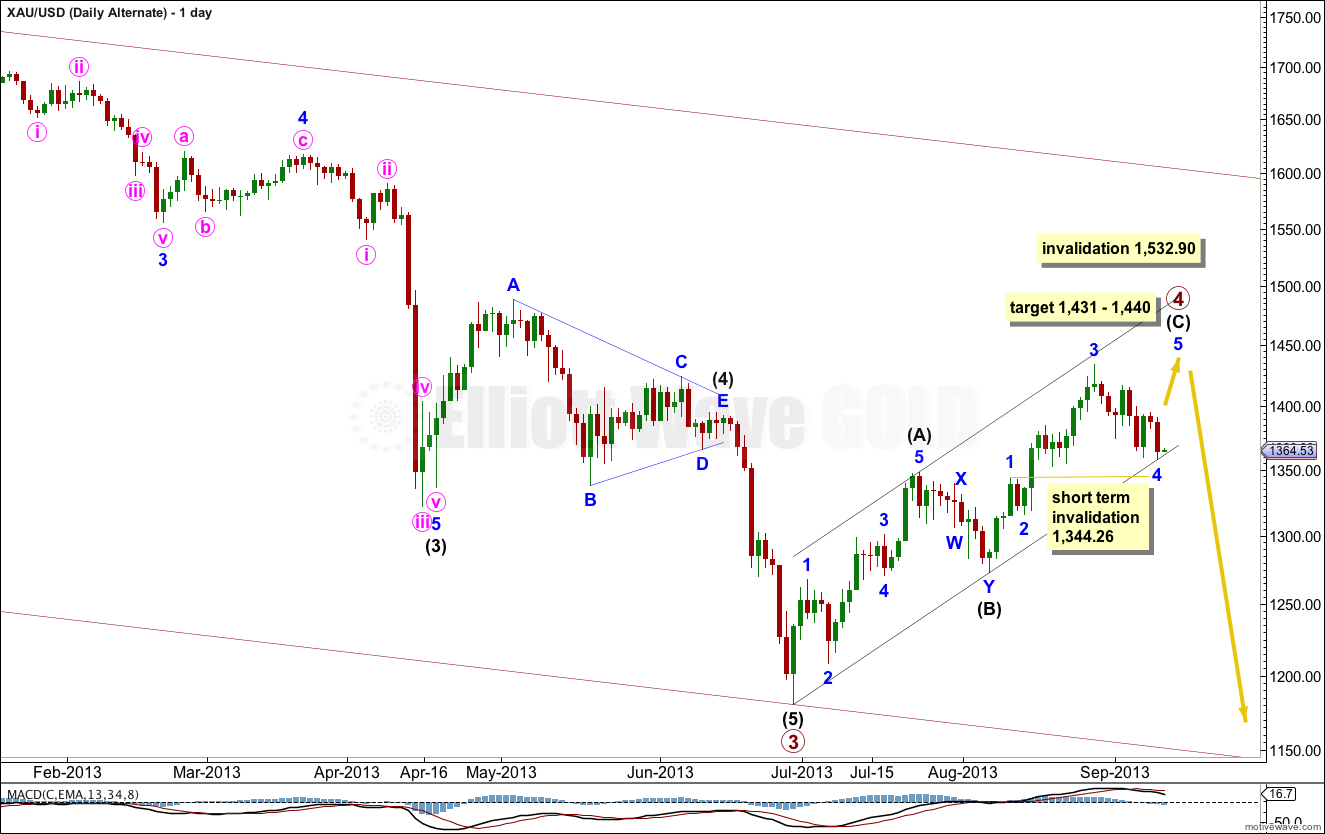

Alternate Wave Count.

If cycle wave a is unfolding as an impulse then recent upwards movement is primary wave 4 within the impulse. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Primary wave 4 is incomplete.

This wave count is an alternate because there are no Fibonacci ratios at intermediate degree within primary wave 3 of cycle wave III. I have spent much time trying to see a better fit in terms of ratios which meets all EW rules for this wave count, but so far I cannot. This does not mean it does not exist!

For this alternate wave count we need to see minor wave 3 within intermediate wave (C) as completed; there is not enough room for upwards movement if the third wave is extending.

At 1,440 intermediate wave (C) would reach intermediate wave (A). At 1,431 minor wave 5 would reach 0.618 the length of minor wave 3. This gives us a $9 target zone for one final upwards wave. Thereafter, the downwards trend should resume.

There is no downwards invalidation point (beyond the short term) for this alternate.