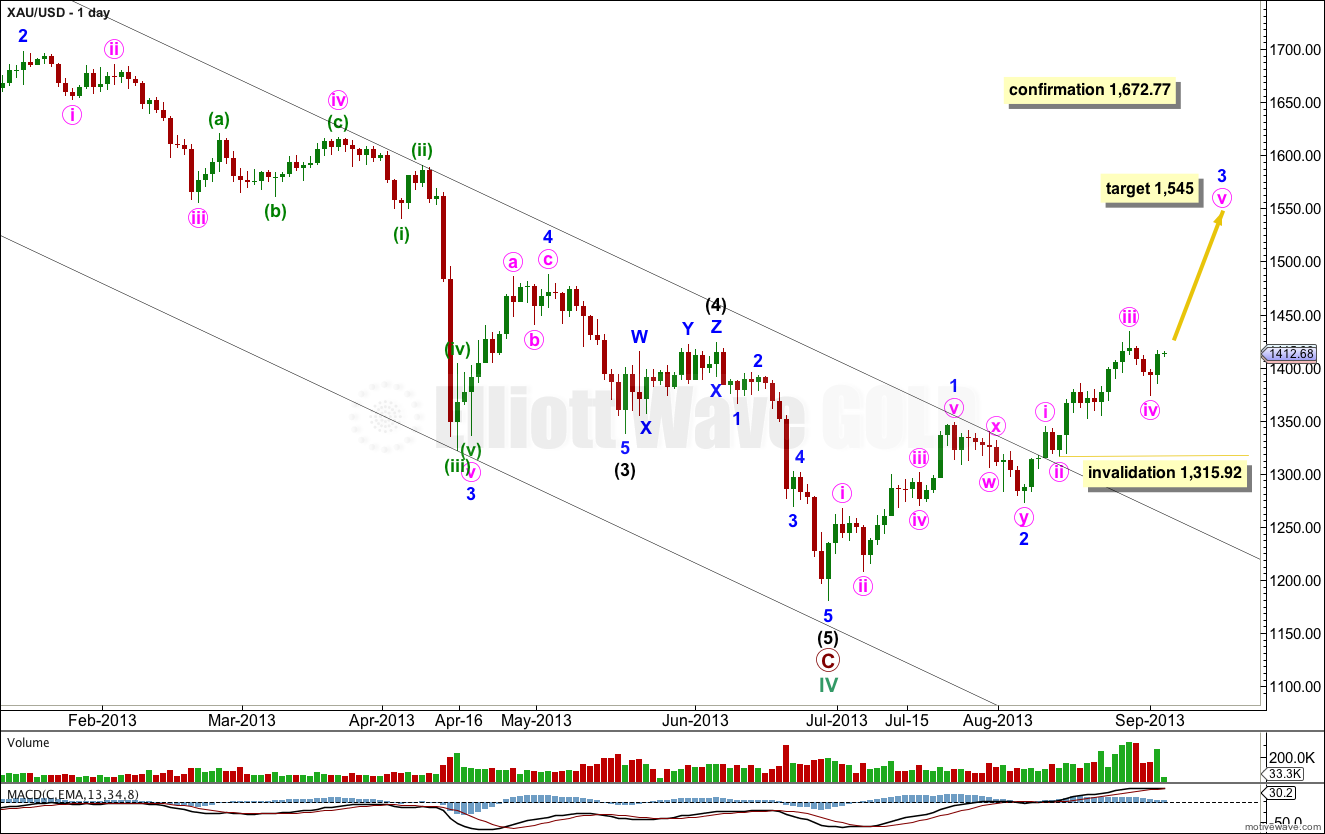

Price moved higher as expected. The main wave count remains the same.

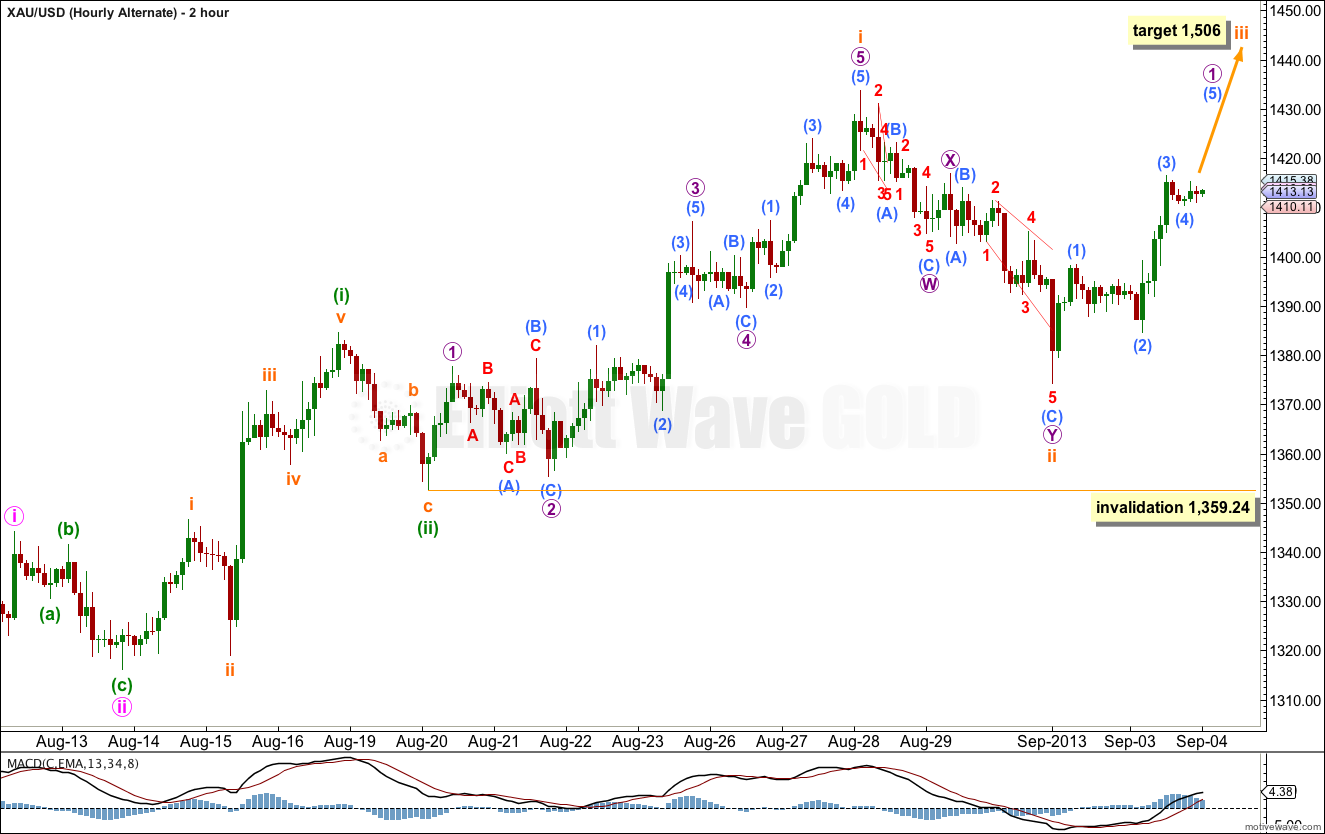

I have a new alternate hourly wave count for you today. Both hourly wave counts expect more upwards movement, and the difference is in expected momentum.

Click on the charts below to enlarge.

Primary wave C may be complete.

A best fit parallel channel is so far clearly breached by upwards movement, no matter how the channel is drawn. This indicates a probable trend change.

Cycle wave V should last between one to several years and is most likely to take price to new all time highs.

In the short term at 1,545 minor wave 3 would reach 1.618 the length of minor wave 1.

Within the new upwards trend of cycle wave V, within minute wave iii no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,315.92.

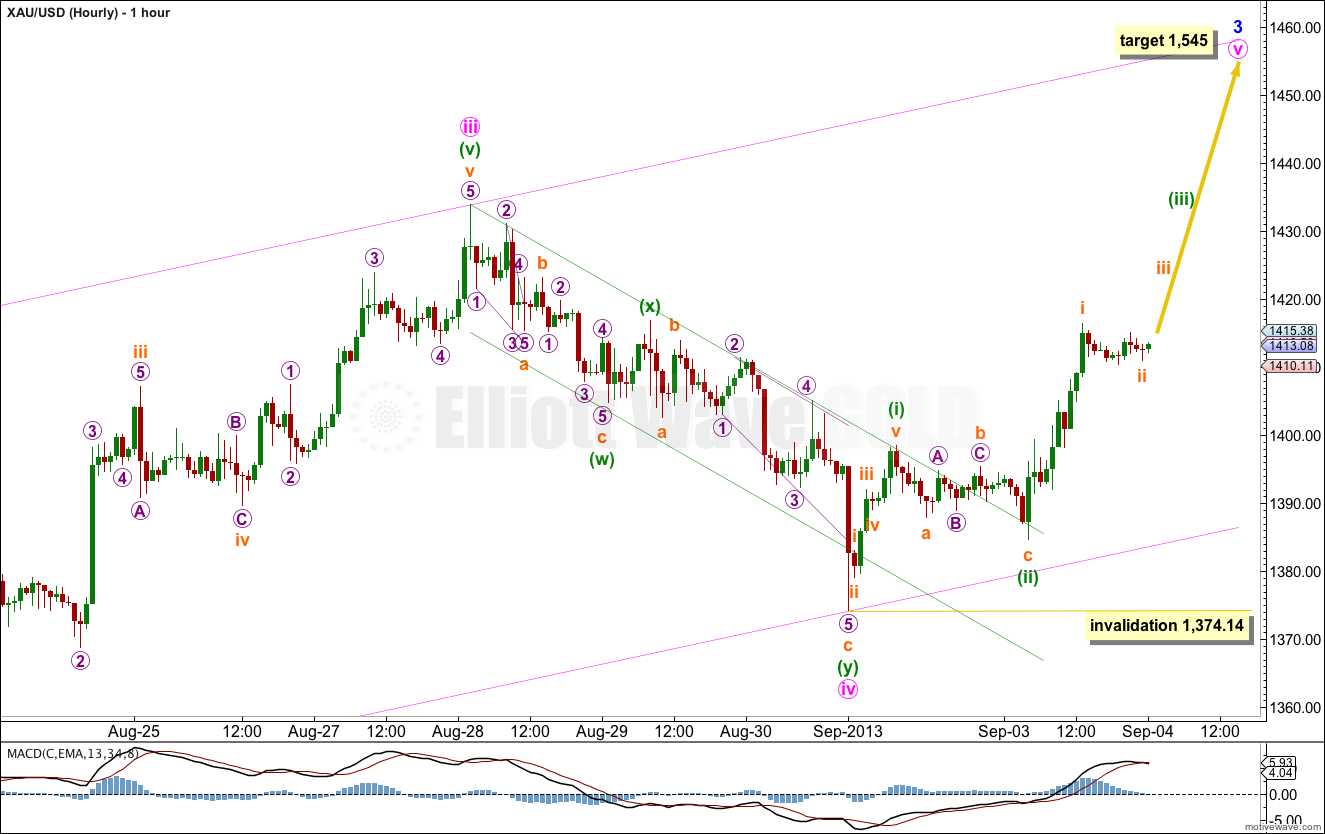

Main Hourly Wave Count.

Finally we have a nice clear channel breach of the small channel containing minute wave iv downwards. Once the channel was clearly breached price continued to rise.

So far within minute wave v we may have a series of two first and second waves. This would expect a small increase in upwards momentum over the next one to three days as the middle of minuette wave (iii) within minute wave v unfolds.

Within minute wave v no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,374.14.

Alternate Hourly Wave Count.

This alternate wave count is identical to the main wave count up to the low at 1,316.05 labeled minute wave ii. Thereafter, I have simply moved the degree of labeling within each of the two subsequent upwards impulses and their corresponding downwards corrections, down one degree.

We may be seeing a more extended minor wave 3 which has begun with a series of first and second waves. This alternate wave count also expects more upwards movement, but it expects a strong increase in upwards momentum.

This wave count fits better with MACD. The only problem with it is the duration of subminuette wave ii in comparison with minuette wave (ii) and minute wave ii, one and two degrees higher. Subminuette wave ii is longer in duration giving a lack of proportion to this wave count.

If we see a strong increase in upwards momentum over the next few days I would use this as my main wave count.

Within minuette wave (iii) subminuette wave ii may not move beyond the start of subminuette wave i. This wave count is invalidated with movement below 1,359.24.