Last analysis expected upwards movement for Silver. The target was 26.09.

Price moved upwards and was 2.673 short of the target. It made a new high, then turned lower, and has been moving sideways for four days.

Downwards movement looks like a typically deep second wave correction. Price remains above the invalidation point on the hourly chart.

Click on the charts below to enlarge.

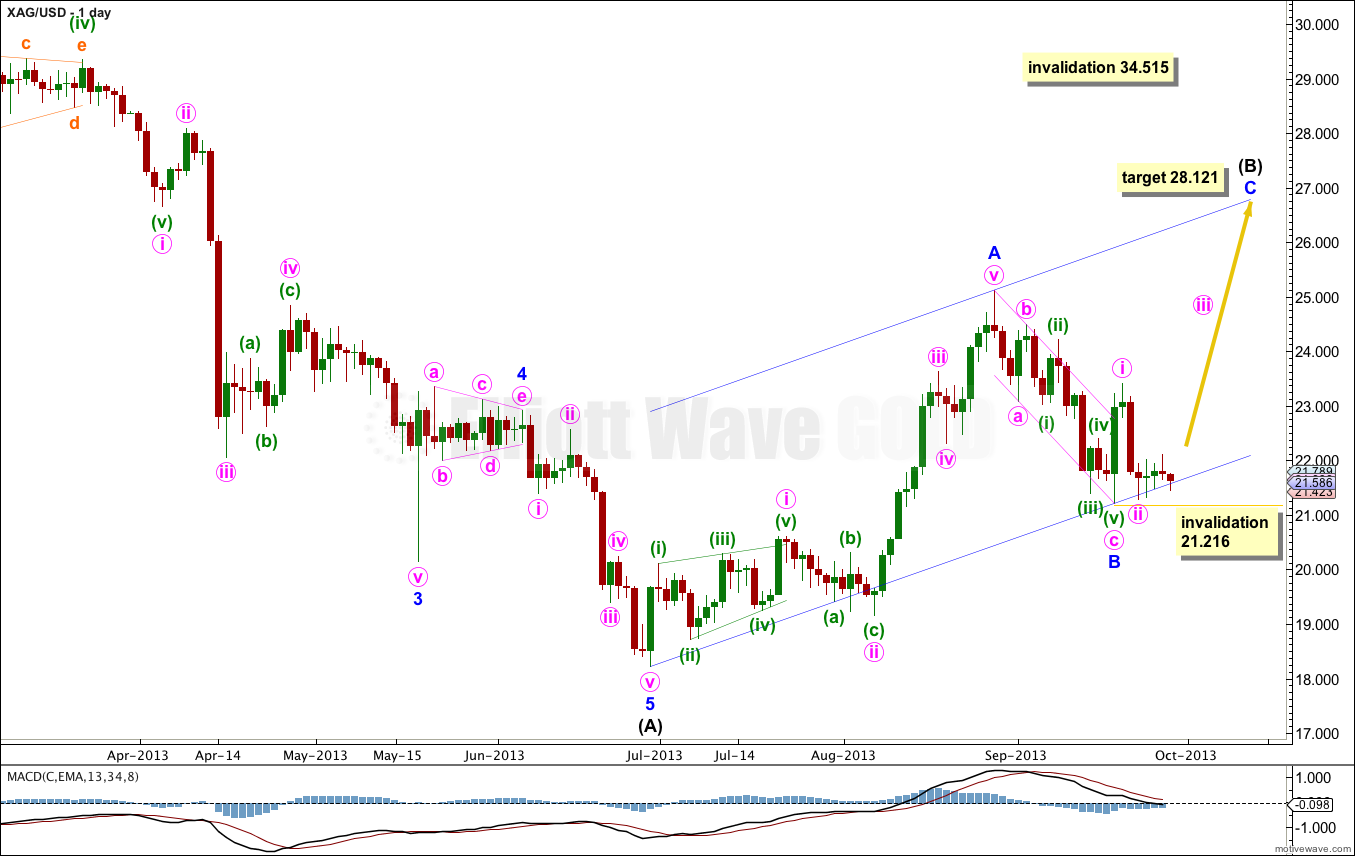

A downwards zigzag is unfolding at primary wave degree. Within the zigzag intermediate wave (A) is complete. Intermediate wave (B) is an incomplete zigzag.

Within minor wave B the structure may be an almost complete zigzag, or this may only be minute wave a of a flat or double for minor wave B.

At 28.121 minor wave C would reach equality with minor wave A.

Within minor wave C no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 21.216.

Sideways movement for the last four days looks like a combination or double flat unfolding. It would be incomplete; one more final small wave down should complete it.

At this stage the combination looks like a double. When this second structure labeled subminuette wave y is completed the probability that the correction is complete will be extremely high. The only way it could continue would be as a very rare triple.

At 24.55 minute wave iii would reach 1.618 the length of minute wave i. This target should be about 5 to 8 days away.

Minuette wave (ii) within minute wave iii may not move beyond the start of minuette wave (i). This wave count is invalidated with movement below 21.291.

Hi Lara,

Do you have alternate charting on Silver in the event of invalidation of the current wave count/chart?

Yes, but I have not published it. I’m expecting gold and silver to move together here.

My alternate would be seeing minor wave B as continuing lower as a double zigzag.