Yesterday I published a new alternate. I had been searching for a viable bullish wave count to align with my wave count for silver.

Today I will publish both this alternate and the main wave count. I do not favour either, and the invalidation / confirmation point is very close by. We should have clarity within the next 24 hours.

Click on the charts below to enlarge.

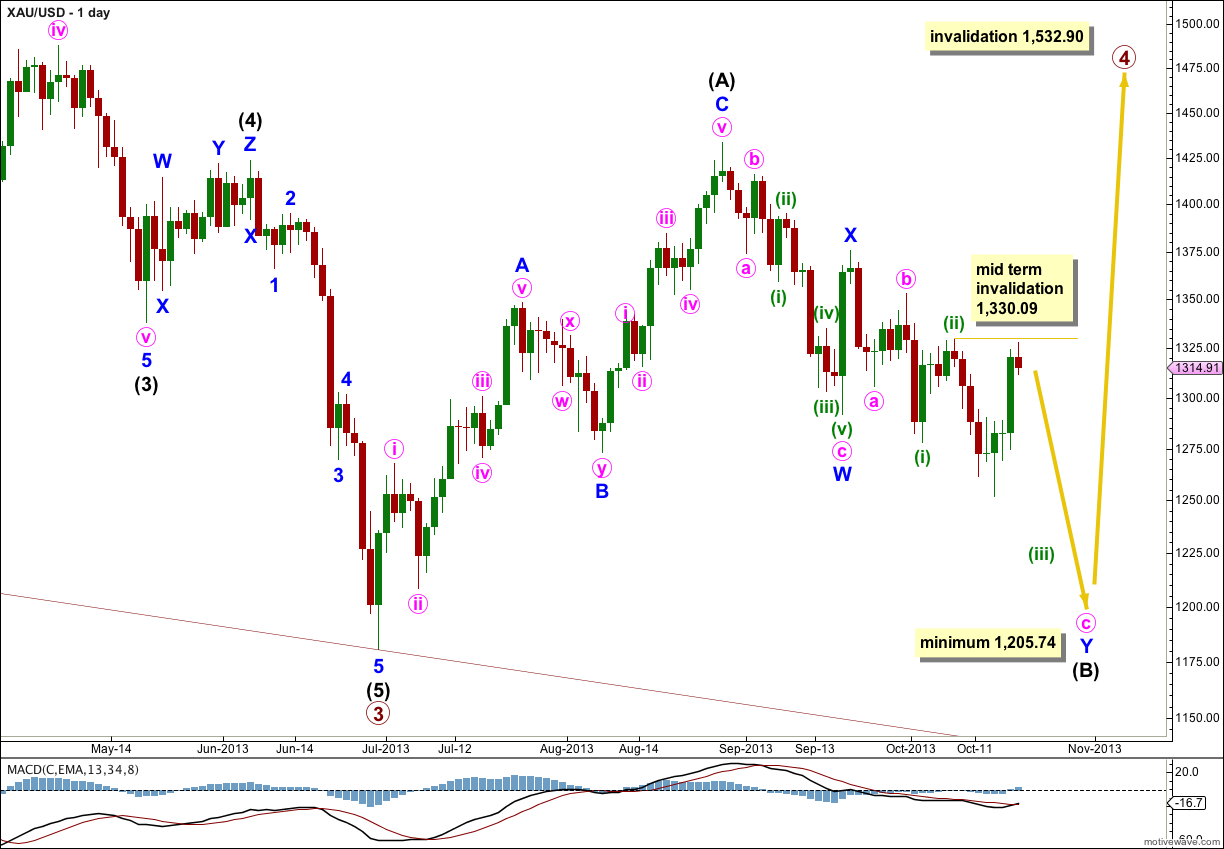

Main Wave Count.

Flat corrections are extremely common structures, particularly in fourth waves. Primary wave 2 was a rare running flat, and primary wave 4 may exhibit alternation if it is a more common expanded flat or a still common regular flat. Primary wave 4 may also exhibit alternation if it is shallow; primary wave 2 was very deep.

Primary wave 2 lasted 53 weeks. It would be likely that primary wave 4 will continue for longer to be better in proportion to primary wave 2.

It is most likely that primary wave 4 is not over and is unfolding as a large flat correction. Within the flat intermediate wave (B) is an incomplete double zigzag. Within the second zigzag of this double, labeled minute wave y, minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated at this stage and for some time yet with movement above 1,532.90.

Within the flat correction intermediate wave (B) must be at least 90% the length of intermediate wave (A). This wave count requires more downwards movement to this minimum at 1,205.74.

Within an expanded flat the B wave is 105% the length of the A wave, so this wave count allows for a new low as quite likely, because expanded flats are the most common type of flat.

Intermediate wave (B) would be about three or so weeks away from ending.

At the hourly chart level the last high is difficult to fit into this wave count. This gives the final fifth wave a strong three wave look, and fifth waves may only subdivide into five wave structures.

If upwards movement is a correction for subminuette wave ii then it must be over now. There is almost no room left for upwards movement.

At 1,209 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

Subminuette wave ii may not move beyond the start of the first wave. This wave count is invalidated with movement above 1,330.09.

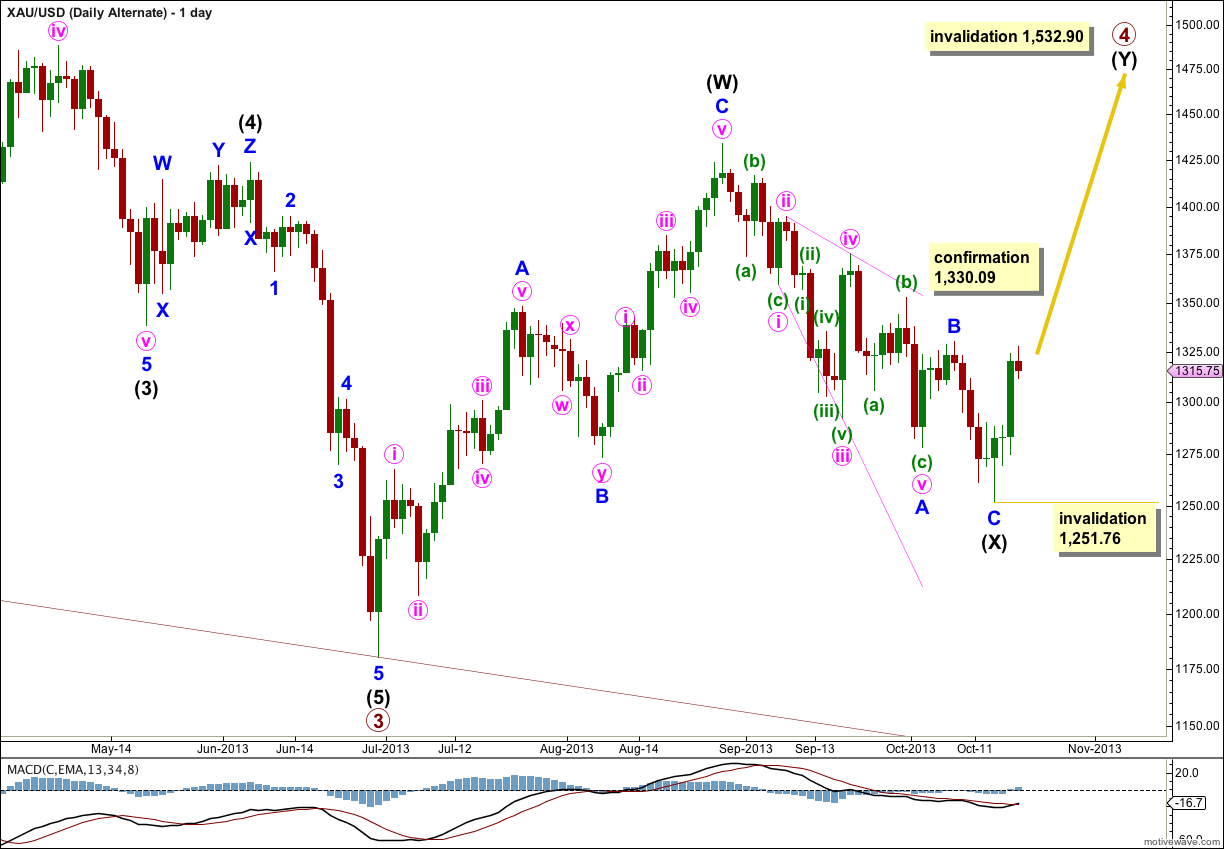

Alternate Wave Count.

At this stage it is possible that Gold has completed its downwards wave and is in the early stages of the next wave up which would last at least a month.

If primary wave 4 is a double zigzag, then within the double intermediate wave (X) may be complete.

Within intermediate wave (X) minor wave A may be a completed leading expanding diagonal. However, within this structure the third wave is the longest, and minute wave ii is only 0.48 of minute wave i, less than the normal range of 0.66 to 0.81. These two problems reduce the probability of this wave count.

Within leading diagonals the second and fourth subwaves must subdivide into zigzags, and the first, third and fifth waves are most commonly zigzags but may also be impulses. If one of these three actionary waves is an impulse, it is usually the third wave.

Within the zigzag of intermediate wave (X) there is no Fibonacci ratio between minor waves A and C.

Movement above 1,330.09 would invalidate the main wave count and confirm this alternate.

At this stage upwards movement for the last few days looks most strongly like an almost completed five wave impulse.

The fourth wave of this impulse, minuette wave (iv), may be a completed expanded flat correction. This fits the price extreme at 1,328.05 very nicely, whereas this high does not fit within the main wave count.

Minuette wave (iii) is 4.61 short of 1.618 the length of minuette wave (i). At 1,349 minuette wave (v) would reach equality in length with minuette wave (i).

There is perfect alternation within this wave count between minuette waves (ii) and (iv). Minuette wave (ii) is a relatively deep 52% zigzag. Minuette wave (iv) is a shallow 23% expanded flat.

If minuette wave (iv) continues further as a double flat or double combination then it may not move into minuette wave (i) price territory. This wave count is invalidated in the short term with movement below 1,288.72.

When minuette wave (v) makes a new high, when it may be considered complete, then the invalidation point must move down to the start of minute wave i at 1,251.76. Minute wave ii may not move beyond the start of minute wave i.

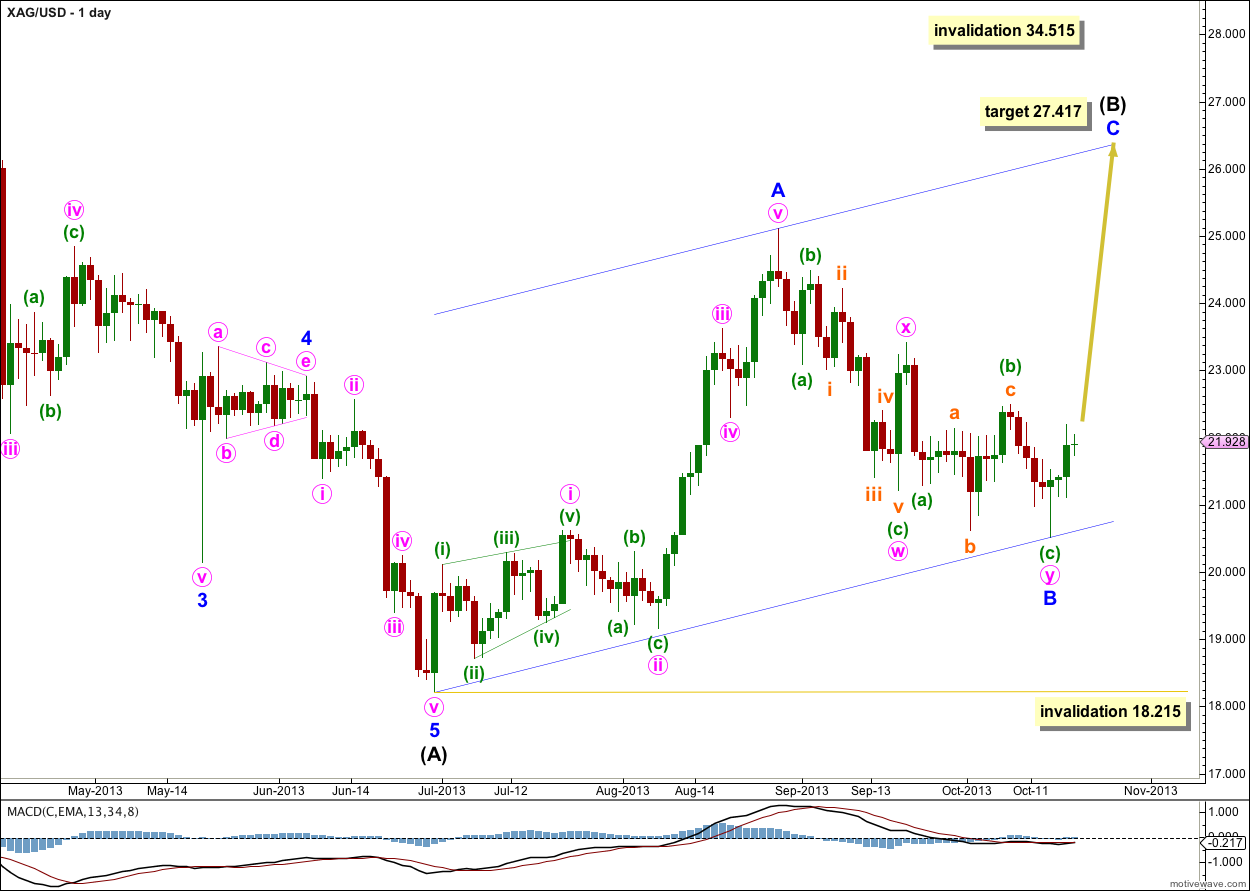

Silver Daily Wave Count.

For silver the recent downwards movement labeled here minor wave B is a completed double zigzag.

Because minor wave A subdivides as a five wave structure this wave count for silver would be invalidated with movement below 18.215. Within a zigzag wave B may not move beyond the start of wave A.

At 27.417 minor wave C would reach equality in length with minor wave A.

I have tried to see an alternate for silver which requires more downwards movement, but I cannot at this stage.

Hi Lara,

I see that PUG is a “friend”. I don’t subscribe to him, but I noticed that he has a weekly GLD chart on stock charts.com. His LT view appears to differ from yours regarding the 2011 high. If I’m stating this correct, he shows it as a P3 and you show it as a P5. As detailed as you are, I’m sure yours is based on being the higher probability. I’m thinking that his count would only prove to be correct if we break 1532 on the upside. Can you comment? Thanks! Bob

Hi Lara.

Just wondering if this downward scenario can be valid.

Relabel Minor B as Minuette A. Those waves from Minute X onwards will be relabelled one degree lower.

In this case, the retracement high at 22.20 (unless it rises slightly higher next week to 22.32, Fib 0.618) can be Minuette B. With a 3-wave structure, Minor B (Minuette C) may terminate at 19.26 (equality with Minuette A) or 19.55 (equality with X).

Thank you for your consideration.

Alan, a chart would be enormously helpful here. Please post a link. Then I know exactly what you mean at a glance.

Hi Lara. Sorry for the delay. Was held up this morning. I agree with you that it is easier to visualise with a chart.

I have thought about it when making the suggestion but I realise that it is not possible to attach a file in this box. I have made a minor edit to your wonderful chart, and would like to send it to you. Perhap you could send me your e-mail address to my gmail at thamkwokliang@gmail.com and I will immediately send it to you.

Thank you.