Last analysis had a main wave count which was preferred, and expected more upwards movement. Price has moved higher.

I have only one wave count for you now; the alternate was invalidated.

Click on the charts below to enlarge.

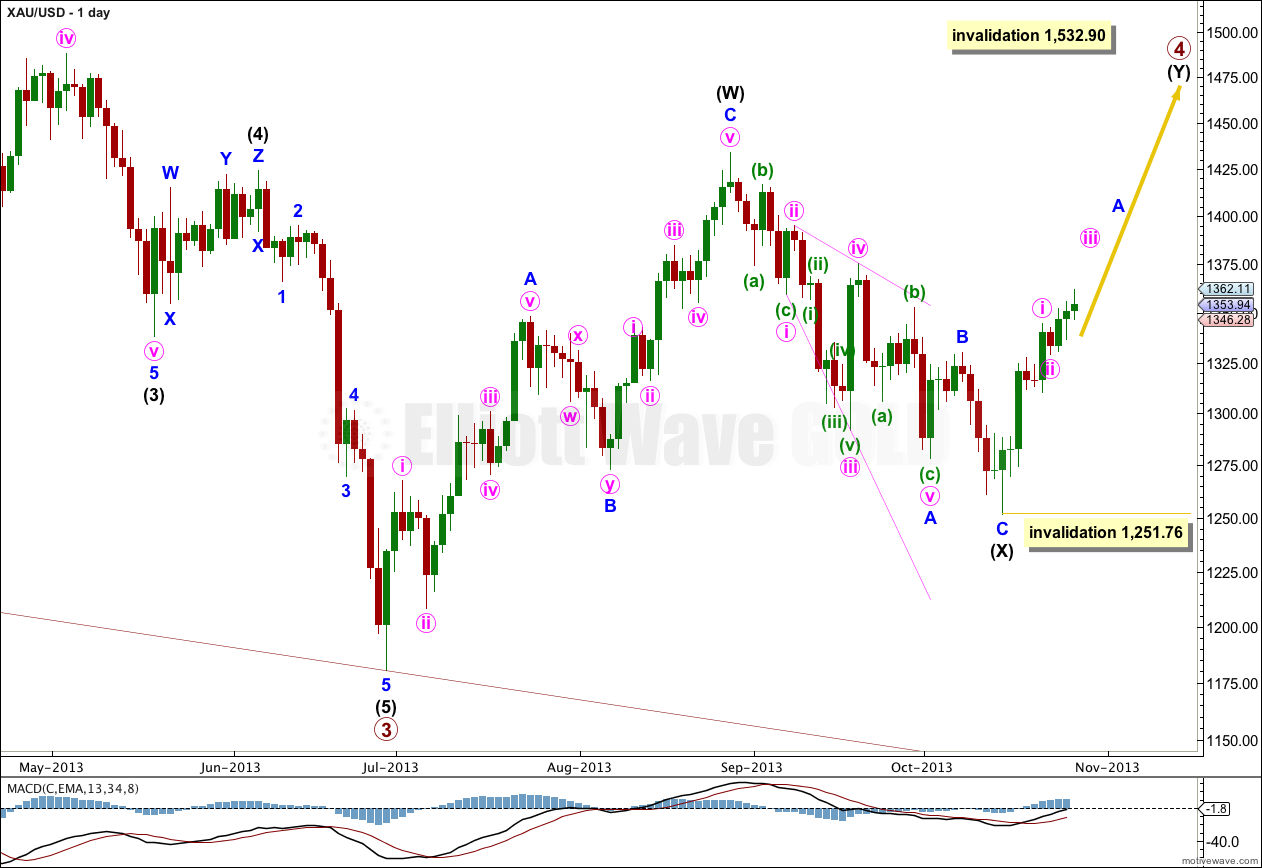

Gold has completed its downwards wave and is in the early stages of the next wave up which should last at least a month.

The structure for primary wave 4 cannot be a flat correction, because what would be the B wave is well less than 90% of what would be the A wave. That is why I have labeled it as a double.

Because intermediate wave (X) is quite shallow I would expect primary wave 4 is most likely a double zigzag rather than a double combination. Double combinations move price sideways and their X waves are usually deeper than this one is. Double zigzags trend against the main direction, and their purpose is to deepen a correction when the first zigzag did not take price deep enough. So I will be expecting intermediate wave (Y) to subdivide as a zigzag and to take price comfortably above 1,433.83. It should last about 35 to 45 days or sessions in total.

Within intermediate wave (Y) no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,251.76.

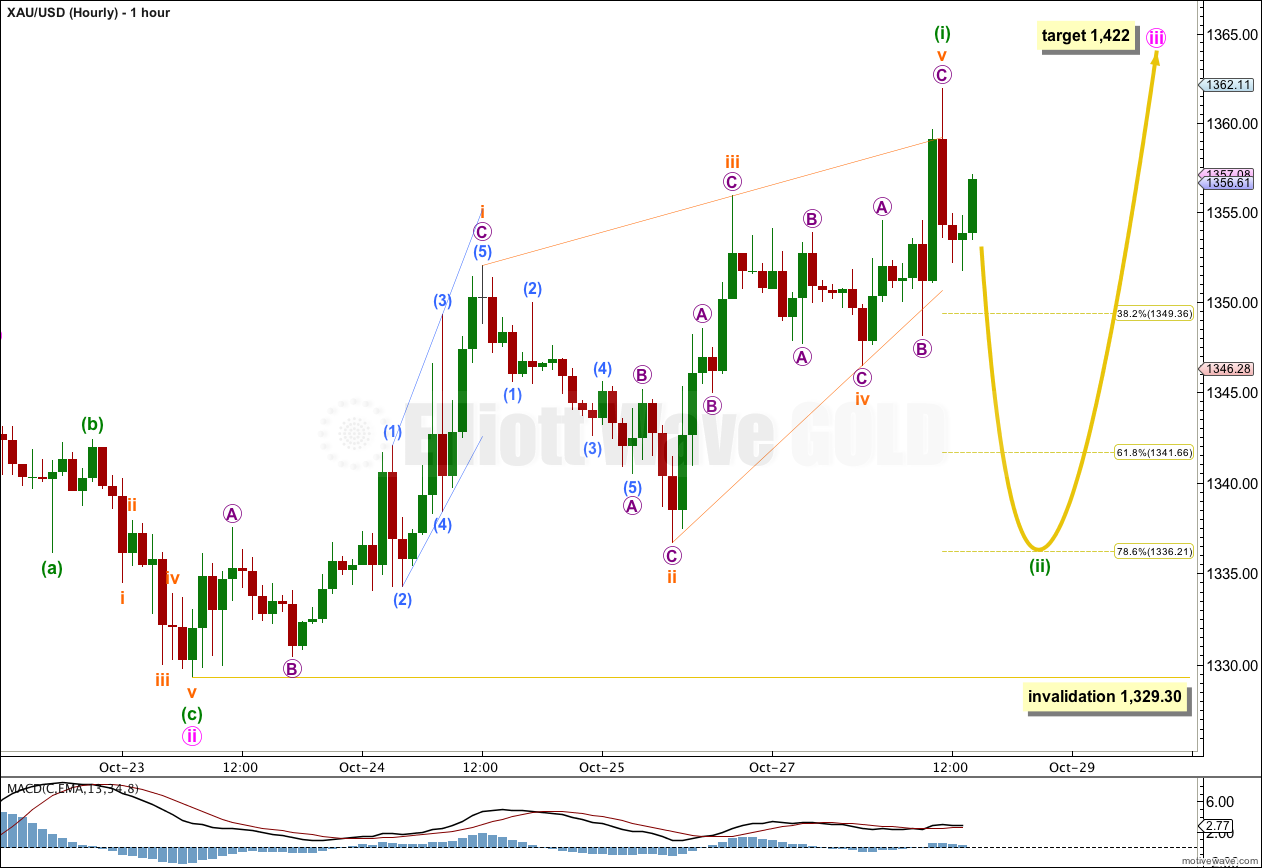

Upwards movement invalidated the alternate hourly wave count and confirmed this main wave count. Minute wave ii must be over and minute wave iii must be underway.

From the end of minute wave ii the upwards movement to follow subdivides best as a series of zigzags. This fits as a leading diagonal.

An ending diagonal must have all its sub waves as zigzags. A leading diagonal must have its second and fourth wave as zigzags, and the first, third and fifth waves are most commonly zigzags but may also be impulses. For this example all the sub waves subdivide best as zigzags. Within a diagonal the fourth wave must overlap into first wave price territory.

Following a leading diagonal in a first wave position a deep second wave is common. I would expect minuette wave (ii) to reach down to the 0.618 Fibonacci ratio, or the 0.786 ratio, with the 0.786 ratio slightly more likely.

Minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated with movement below 1,329.30.

When minuette wave (ii) is completed then I would expect strong upwards movement for the middle of a third wave.