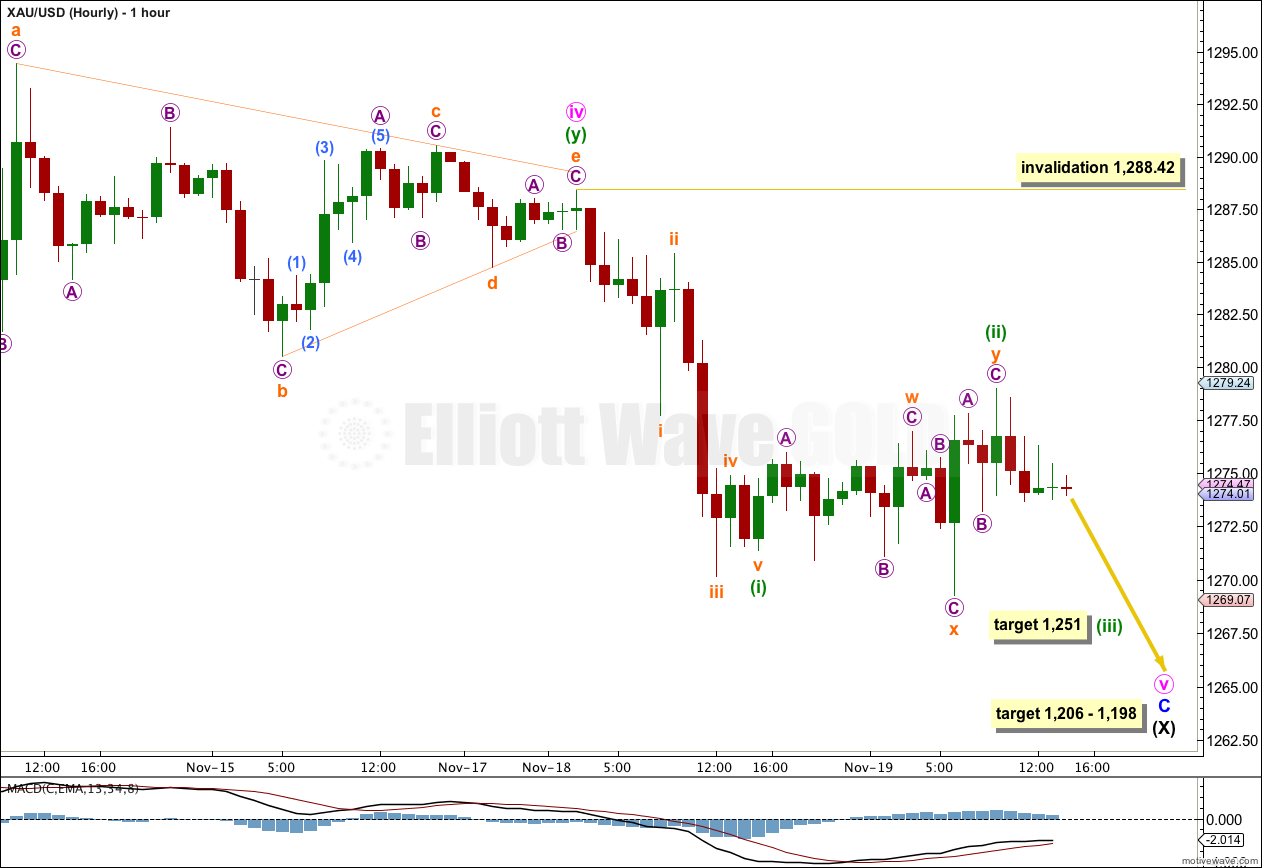

Yesterday’s analysis expected more downwards movement to a short term target at 1,264 to be followed by upwards movement for a second wave correction.

Price did move a little lower but only reached down to 1,269.27. Sideways movement over the last several hours looks typically corrective.

Click on the charts below to enlarge.

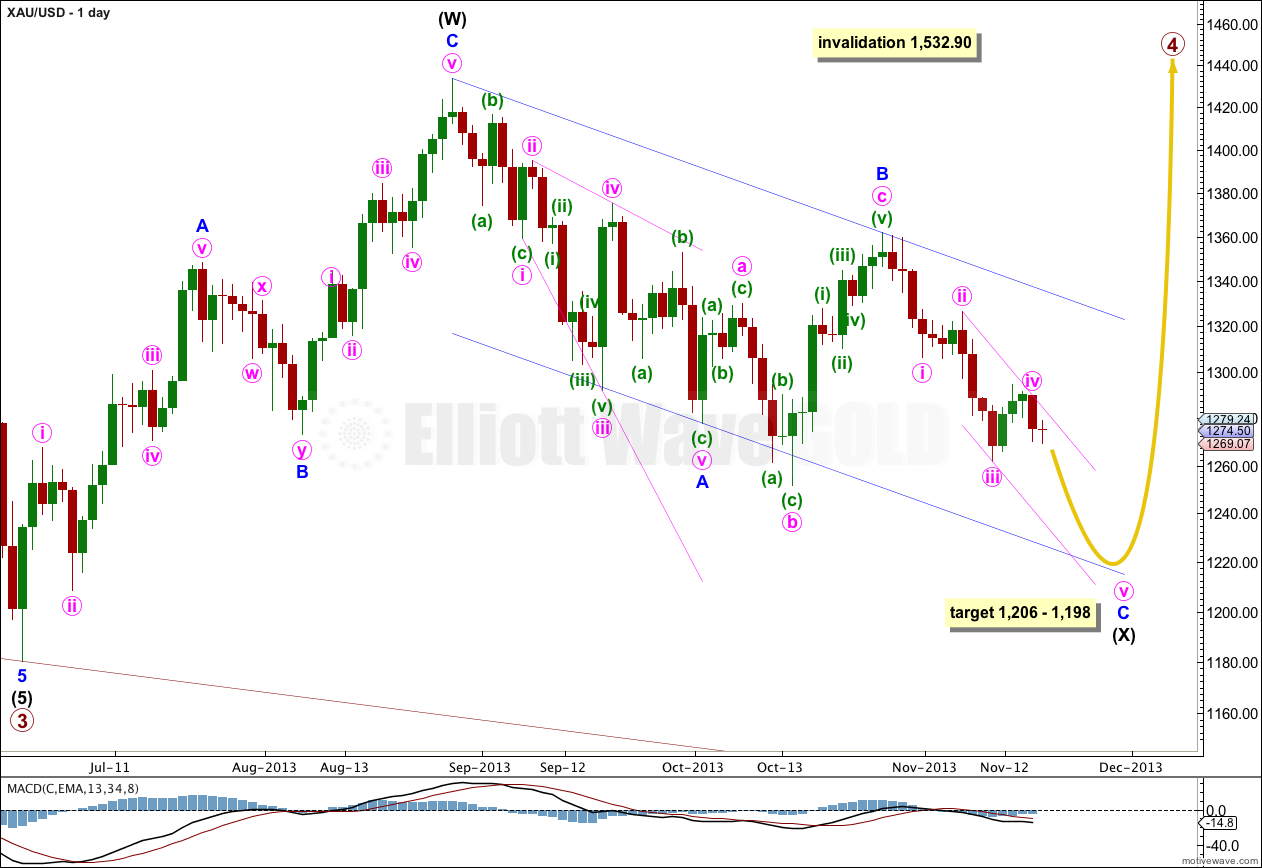

Gold is still within a large fourth wave correction at primary wave degree which is incomplete. It is now more likely to continue as a double combination because within it intermediate wave (X) should be deep.

The purpose of double combinations is to take up time and move price sideways, so I would now expect intermediate wave (Y) to end about the same level as intermediate wave (W) at 1,433.83. Double combinations in fourth wave positions are quite common.

If downwards movement reaches 1,205.74 or below then it would be 90% of the prior upwards movement labeled intermediate wave (W). At that stage I would relabel primary wave 4 as a flat correction, A-B-C rather than a combination W-X-Y.

Within the combination intermediate wave (X) is unfolding as a zigzag. Minor wave C downwards must complete as a five wave structure. At 1,206 minor wave C would reach equality in length with minor wave A. Within minor wave C at 1,198 minute wave v would reach 1.618 the length of minute wave i. This gives an $8 target zone for downwards movement to end. I will try to narrow this zone as the structure gets closer to the end.

There is no lower invalidation point for intermediate wave (X); X waves may make new price extremes beyond the start of W waves, and they may behave like B waves within flat corrections. For combinations X waves often end close to the start of W waves.

I have drawn a parallel channel about the zigzag of intermediate wave (X) using Elliott’s technique for a correction. Draw the first trend line from the start of minor wave A to the end of minor wave B. Place a parallel copy upon the end of minor wave A. I will expect minor wave C to find support at the lower end of this channel, and it may end there.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

The small parallel channel drawn on yesterday’s hourly chart about the downwards wave of minuette wave (i) is very clearly breached by sideways movement. Minuette wave (i) looks like it is over, and minuette wave (ii) is underway.

Minuette wave (i) may have ended with a truncated fifth wave. Ratios within minuette wave (i) are: there is no Fibonacci ratio between subminuette waves iii and i, and subminuette wave v is just 0.11 short of 0.236 the length of subminuette wave iii.

Minuette wave (ii) may now be a completed double combination: flat – X – zigzag. Minuette wave (i) lasted a Fibonacci 13 hours, and minuette wave (ii) is in proportion lasting 17 hours. I would expect minuette wave (iii) to most likely begin from here, and to see an increase in downwards momentum over the next one to two days.

At 1,251 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

If the labeling within minuette wave (ii) is moved down one degree then it is possible that only subminuette wave a within it is complete. Only a clear five down on the hourly chart would invalidate this possibility. Until we have that then the invalidation point must remain at 1,288.42. Minuette wave (ii) may not move beyond the start of minuette wave (i).