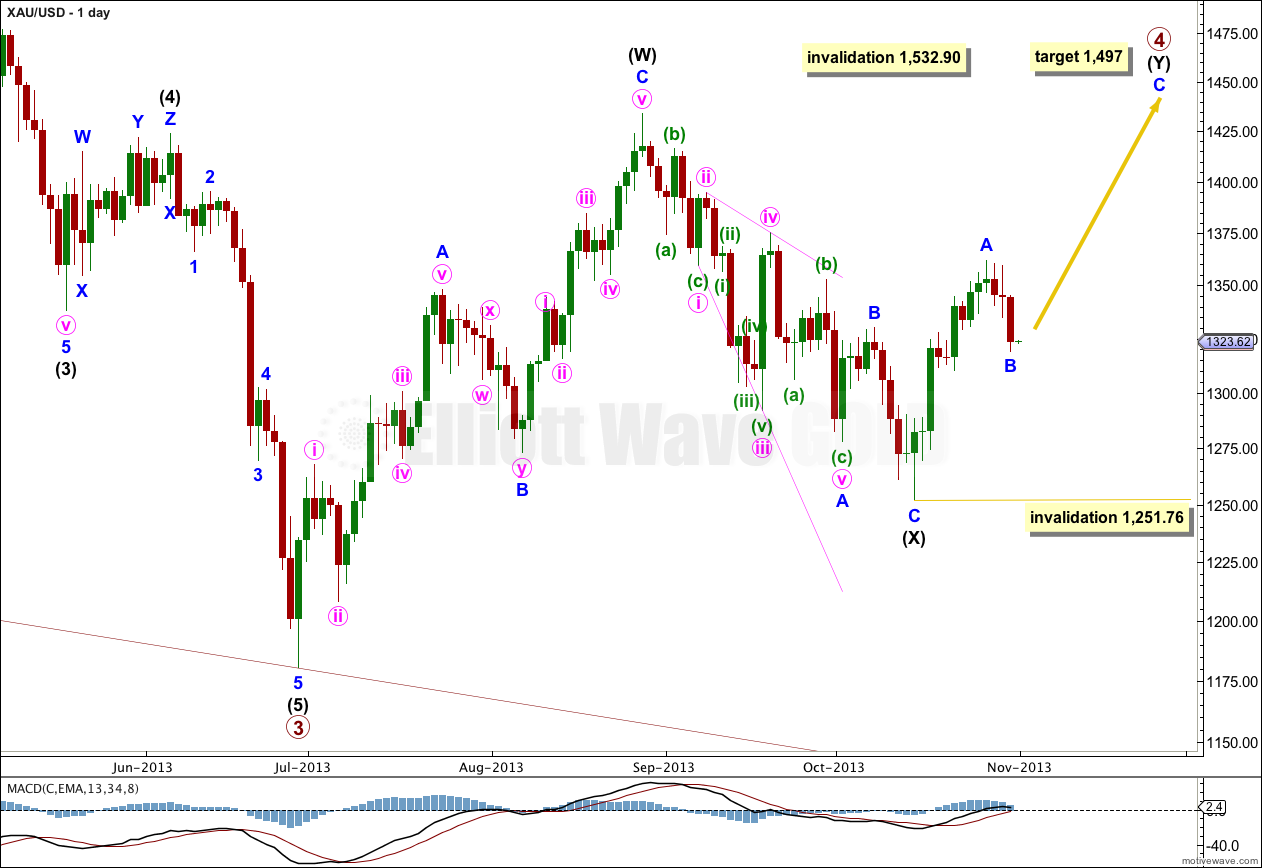

Yesterday’s analysis expected more downwards movement towards a target about 1,325. Price has moved lower, so far down to 1,319.22, 5.78 below the target and extremely close to the 0.382 Fibonacci ratio on the main hourly wave count at 1,318.73.

The wave counts remain the same.

Click on the charts below to enlarge.

The structure for primary wave 4 cannot be a flat correction, because what would be the B wave is well less than 90% of what would be the A wave. That is why I have labeled it as a double.

Because intermediate wave (X) is quite shallow I would expect primary wave 4 is most likely a double zigzag rather than a double combination. Double combinations move price sideways and their X waves are usually deeper than this one is. Double zigzags trend against the main direction, and their purpose is to deepen a correction when the first zigzag did not take price deep enough. So I will be expecting intermediate wave (Y) to subdivide as a zigzag and to take price comfortably above 1,433.83. It should last about 35 to 45 days or sessions in total.

Within the zigzag of intermediate wave (Y) minor wave B may not move beyond the start of minor wave A. This wave count is invalidated with movement below 1,251.76.

If minor wave B is over (if the main hourly wave count below is correct) then at 1,497 minor wave C would reach 1.618 the length of minor wave A.

Main Hourly Wave Count.

This wave count agrees with MACD. Within minor wave A the strongest upwards momentum is within the third wave, and the second and fourth waves correspond to MACD coming very close to, or touching, the zero line. The depth and duration downwards for minor wave B gives this wave count a good look.

Minor wave B may be over now as a zigzag. Within it minute waves a and c have no Fibonacci ratio to each other.

Ratios within minute wave c are: minuette wave (iii) is 1.85 longer than 2.618 the length of minuette wave (i), and minuette wave (v) has no Fibonacci ratio to either of minuette waves (i) or (iii).

Ratios within minuette wave (v) are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is just 0.05 short of 0.618 the length of subminuette wave i. There is perfect alternation between subminuette wave ii as a zigzag and subminuette wave iv as a triangle.

Within the zigzag of minor wave B minuette wave (c) has overshot the parallel channel. A conservative best fit channel drawn about minuette wave (c) is not yet breached by any upwards movement. When it is clearly breached I would expect that for now the downwards wave is over and the next wave upwards is underway.

Movement above 1,335.45 could not be a fourth wave correction within minuette wave (v), so at that stage minuette wave (v) would have to be over. At that stage I would have more confidence that the next upwards wave is underway.

If the next upwards wave subdivides clearly as a five wave structure (a leading diagonal or an impulse) then this main hourly wave count would be confirmed. At that stage I would have confidence in the target on the daily chart.

If the next upwards wave unfolds as a three wave structure then the alternate wave count below would be confirmed.

Movement below 1,319.22 would most likely be a continuation of minuette wave (v) within minute wave c. However, at this stage the structure for minute wave c is complete.

Alternate Hourly Wave Count.

I will not publish yesterday’s alternate hourly wave count again today for the because it no longer has the “right look”.

This alternate however is one I must seriously consider today. So far minor wave B is only three days in duration. It could continue further to take up more time as a sideways moving double combination, or it could continue further to move deeper as a double zigzag.

Careful analysis of the next wave upwards is necessary to determine if this wave count could be correct. Minute wave X must subdivide as a three wave structure (or a triangle). There is no upper limit for minute wave X, it may make a new high above 1,361.91.

This alternate wave count would expect another three to five days of choppy, overlapping sideways or lower movement.

Minor wave B may not move beyond the start of minor wave A. This wave count is invalidated with movement below 1,251.76.