Yesterday’s main wave count expected more downwards movement towards a short term target at 1,215.4 before a trend change. Price moved only slightly lower, reaching 1,218.60, before turning slowly upwards.

Click on the charts below to enlarge.

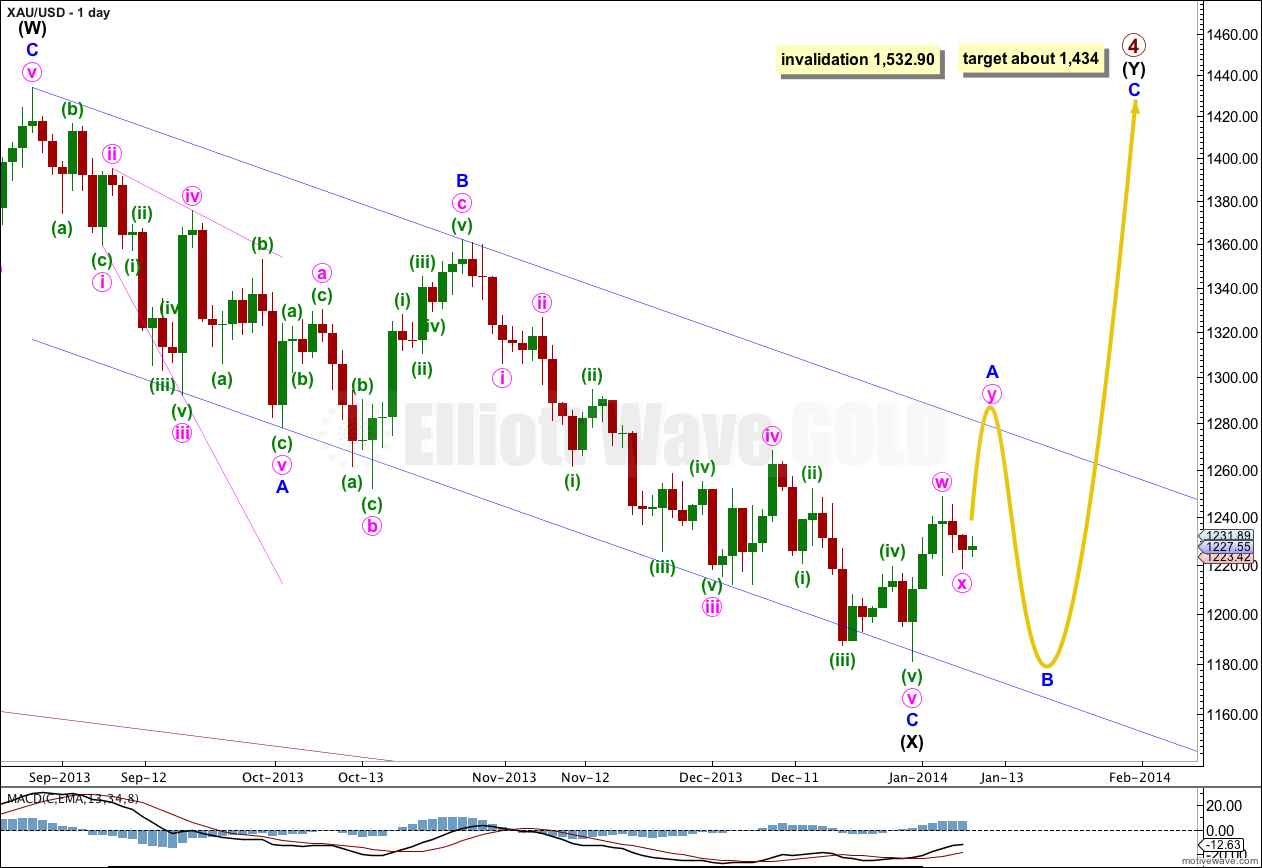

Gold is still within a large fourth wave correction at primary wave degree which is incomplete. To see a full explanation of my reasoning for expecting that primary wave 4 is not over and is continuing see this.

Movement above 1,277.97 would provide confirmation that primary wave 4 is not over. At that stage upwards movement could not be a fourth wave correction within primary wave 5 because it would be in its first wave price territory, and the downwards movement labeled intermediate wave (X) would be confirmed as a completed three wave structure.

When the channel about intermediate wave (X) is finally breached by upwards movement then I would consider that final confirmation that intermediate wave (Y) is underway.

Primary wave 2 was a rare running flat correction, and was a deep 68% correction of primary wave 1. In order to show alternation in structure primary wave 4 may be a zigzag, double zigzag, combination, triangle or even an expanded or regular flat. We can rule out a zigzag because the first wave subdivides as a three. This still leaves several structural possibilities.

The downwards wave labeled intermediate wave (X) is now 99% the length of the upwards wave labeled intermediate wave (W). Primary wave 4 is most likely to be a combination or triangle in order to show structural alternation with the running flat of primary wave 2.

Primary wave 4 is less likely to be a flat correction because if it were it would be a regular flat. These have similar behaviour and a similar look to running flats, and so there would be little structural alternation between primary waves 2 and 4.

Primary wave 4 is most likely to be a combination rather than a double zigzag because of the depth of intermediate wave (X). Double combinations take up time and move price sideways, and their X waves can be very deep. Double zigzags are different because their purpose is to deepen a correction when the first zigzag does not move price deep enough, so their X waves are not normally very deep. Thus intermediate wave (Y) is most likely to be a flat correction, and less likely a triangle and least likely a zigzag. It is most likely to end about the same level as intermediate wave (W) at 1,434 so that the whole structure moves sideways. It may last about 43 to 89 days, depending upon what structure it takes.

If intermediate wave (Y) is a flat correction then within it minor wave B must retrace a minimum of 90% the length of minor wave A, and it may make a new low below 1,180.84.

If intermediate wave (Y) is a flat correction then within it minor wave A must subdivide as a three wave structure. At this stage it looks like minor wave A may be unfolding as a double zigzag, or possibly a very rare triple. The main hourly wave count follows this possibility, while the alternate follows the possibility it may be a flat correction.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Main Hourly Wave Count.

A slight new low to 1,218.60 completed the ending diagonal structure for subminuette wave v, and so the whole structure for the zigzag of minute wave x. Minuette wave (c) failed to move beyond the end of minuette wave (a) and is truncated.

Thereafter, upwards movement is slow and overlapping. It subdivides as a series of zigzags and it may be a leading diagonal unfolding in a first wave position.

Movement above 1,231.64 would invalidate the alternate below and provide confidence for this main wave count.

If minute wave y is about equal in length with minute wave w then it may end about 1,286. However, please note, this is a rough target only and will be revised. Within double zigzags there in not usually a ratio between the two structures in the double, but sometimes they are about even in length. The best way to calculate a target is to use the lengths of minuette waves (a) and (c) within this second zigzag. When minuette wave (b) is completed then the target will change.

When the leading diagonal structure is completed for subminuette wave i then I would expect to see a deep second wave correction. Subminuette wave ii may not move beyond the start of subminuette wave i. This wave count is invalidated with movement below 1,218.60.

Alternate Hourly Wave Count.

Sideways movement over the last 35 hours gives a disproportionate look to subminuette wave ii; it is now much longer in duration than minuette wave (b) one degree higher. This further reduces the probability of this wave count.

If minor wave A is unfolding as a flat correction then within it minute wave b must move lower to reach a minimum of 90% the length of minute wave a at 1,187.61.

If minor wave A is an expanded flat then minute wave b must be a minimum of 105% the length of minute wave a at 1,177.46 or below.

There is no lower invalidation point for this wave count.

Within subminuette wave iii no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 1,231.64.

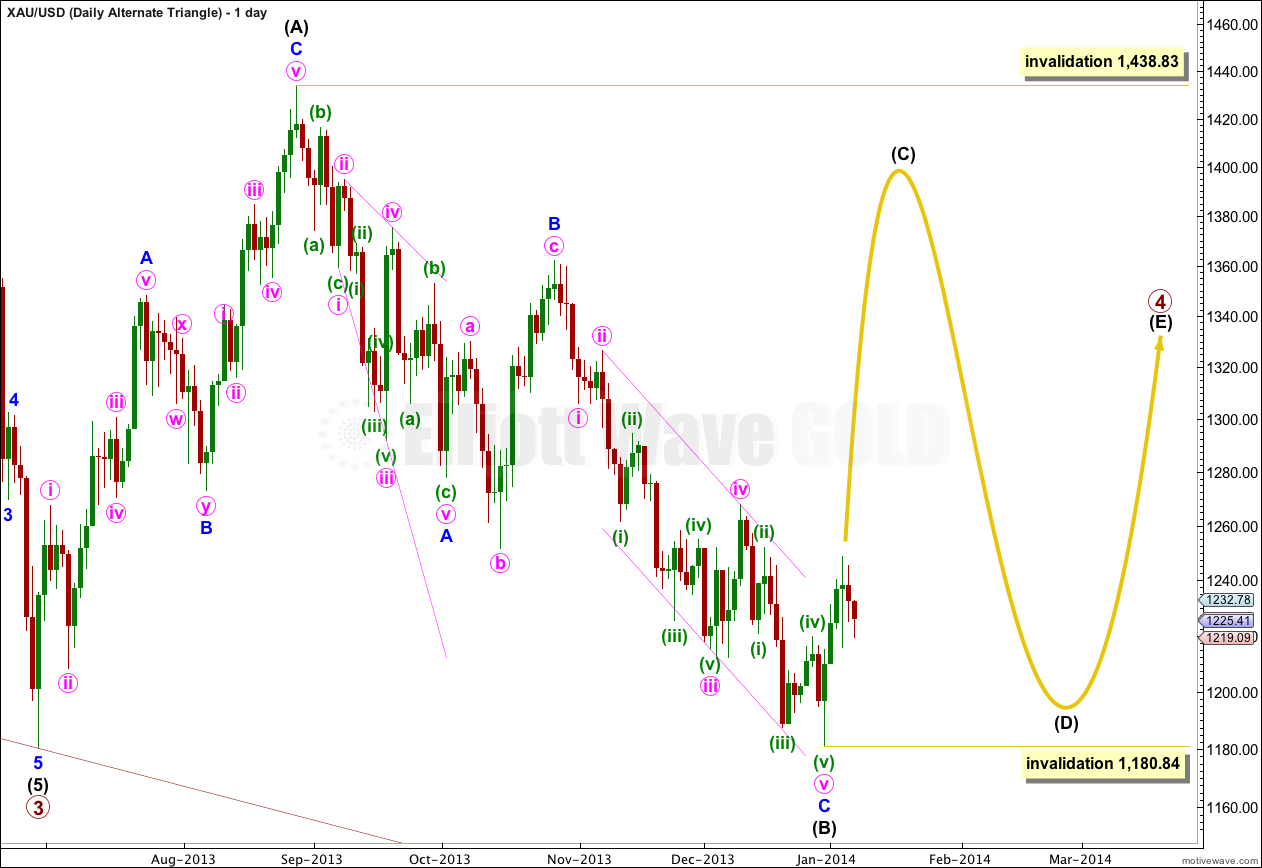

Alternate Daily Wave Count – Triangle.

It is also possible that primary wave 4 may continue as a regular contracting (or barrier) triangle.

The expected direction of this next upwards wave is the same, but for this alternate intermediate wave (C) of the triangle may not move beyond the end of intermediate wave (A). The triangle is invalidated with movement above 1,438.83.

Intermediate wave (C) must unfold as either a single or double zigzag. Within it no second wave correction, nor wave B of the zigzag, may move beyond the start of the first wave or A wave. This wave count is invalidated with movement below 1,180.84.

The final intermediate wave (E) upwards may not move above the end of intermediate wave (C) for both a contracting and barrier triangle. E waves most commonly end short of the A-C trend line.

All five subwaves of a triangle must divide into corrective structures. If this next upwards movement subdivides as a zigzag which does not make a new high above 1,438.83 then this alternate would be correct.

Triangles take up time and move price sideways. If primary wave 4 unfolds as a triangle then I would expect it to last months rather than weeks.

“When the leading diagonal structure is completed for subminuette wave i then I would expect to see a deep second wave correction. ”

Lara, any more detail on this movement? Possible target for wave i ? How long to get there? Then possible target for wave ii and how long to get there?

Reason for question–looking for lowest entry point, now or possibly wait for end of wave ii.

all the detail I can give you is in the analysis.

trying to predict exactly when a movement will end, as well as a price point, is close to impossible.