The target at 1,297 was expected to be met within 24 hours. Price has moved higher as expected to 1,296.38, just 0.62 below the target.

The wave count remains the same.

Summary: In the short term upwards movement is not over. The short term target is now widened to 1,297 to 1,303 and I favour the upper end of this zone. A fourth wave correction is coming up, and it should last up to 24 hours. Look for a channel breach on the hourly chart to indicate the fourth wave correction has arrived. When it is complete upwards movement to 1,330 should resume.

Click on the charts below to enlarge.

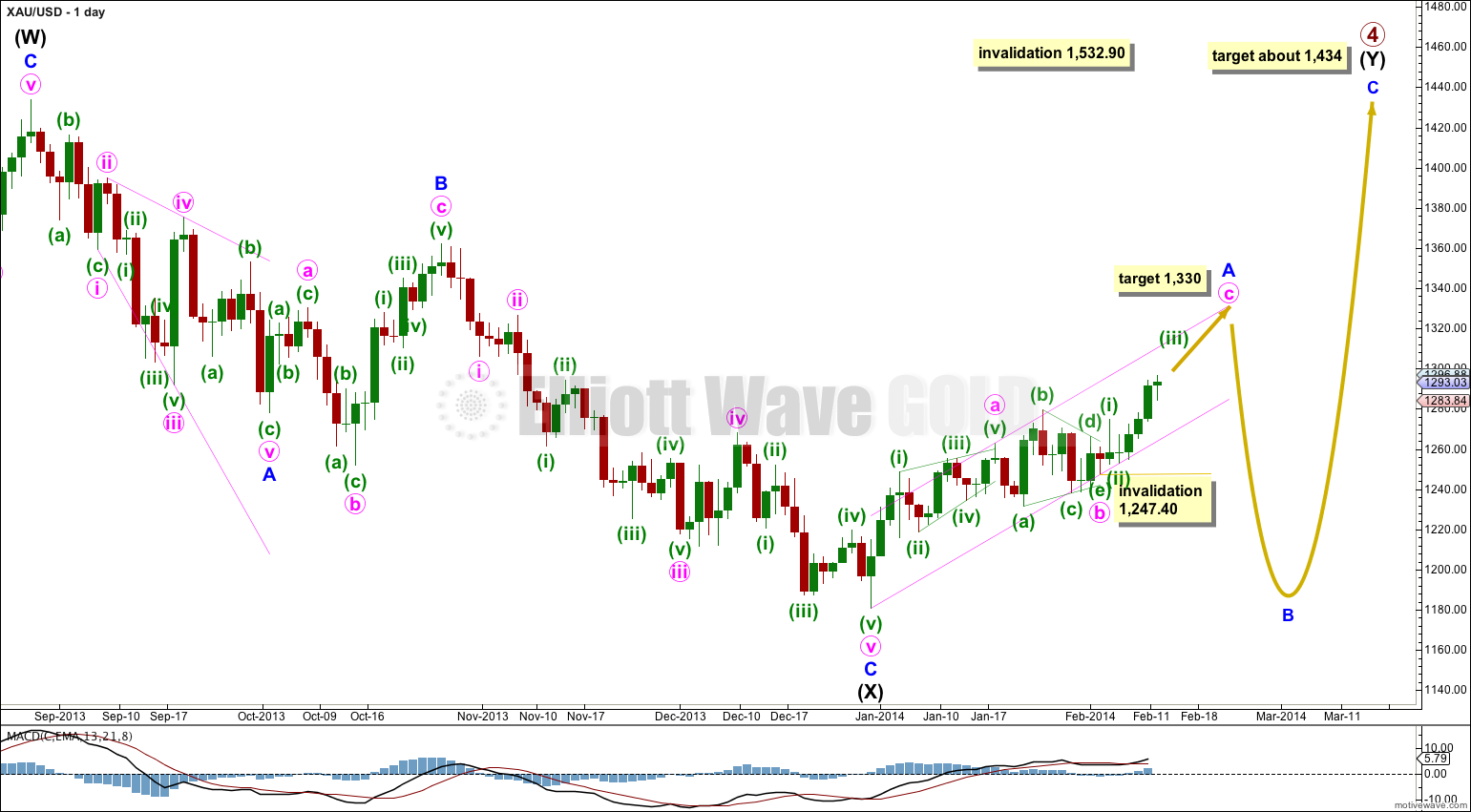

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

To determine what structure the current upwards movement is most likely to take it is necessary to determine what structure primary wave 4 is most likely to take.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

The first upwards wave within primary wave 4 labeled here intermediate wave (W) subdivides as a three wave zigzag. Primary wave 4 cannot be an unfolding zigzag because the first wave within a zigzag, wave A, must subdivide as a five.

Primary wave 4 is unlikely to be completing as a double zigzag because intermediate wave (X) is a deep 99% correction of intermediate wave (W). Double zigzags commonly have shallow X waves because their purpose it to deepen a correction when the first zigzag does not move price deep enough.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) may be either a flat or a triangle. For both these structures minor wave A must be a three, and is most likely to be a zigzag.

Minor wave A is unfolding as a zigzag: minute wave a is a five wave structure, minute wave b is a running contracting triangle and minute wave c is a simple impulse. At 1,330 minute wave c would reach equality in length with minute wave a. Minute wave a lasted a Fibonacci 13 days. Minute wave c may end in another two days, totaling a Fibonacci eight, or another seven days totaling a Fibonacci 13.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Draw a channel about the zigzag of minor wave A: draw the first trend line from the start of minute wave a to the end of minute wave b, then place a parallel copy upon the end of minute wave a. Downwards corrections along the way up should continue to find support at the lower edge of the channel, and upwards movement may end at the upper edge of the channel.

Upwards movement continues as minute wave c unfolds as a simple impulse, the easiest and clearest of all Elliott wave structures to analyse.

Within minute wave c minuette wave (iii) is still incomplete. At 1,297 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

Within minuette wave (iii) there is no Fibonacci ratio between subminuette waves i and iii. This makes it more likely we shall see a Fibonacci ratio between subminuette wave v and either i or iii. Now that subminuette wave iv is complete I can add to the short term target calculation at a second wave degree. The most common ratio for subminuette wave v would be equality with subminuette wave i at 1,303.

I favour the upper end of the short term target zone of 1,297 to 1,303 because it is calculated at a lower wave degree.

When minuette wave (iii) is complete then I would expect minuette wave (iv) downwards to clearly breach the parallel channel containing minuette wave (iii). Minuette wave (iv) may not move into minuette wave (i) price territory. This wave count is invalidated with movement below 1,274.53.

I would expect minuette wave (iv) to last up to 24 hours. It may show slightly on the daily chart. It is most likely to end about the end of the fourth wave of one lesser degree at 1,284.08.

Minuette wave (v) should be the final upwards wave towards 1,330. When minuette wave (iv) is complete I will add to this target calculation at a second wave degree, so it may widen to a small zone or it may change.

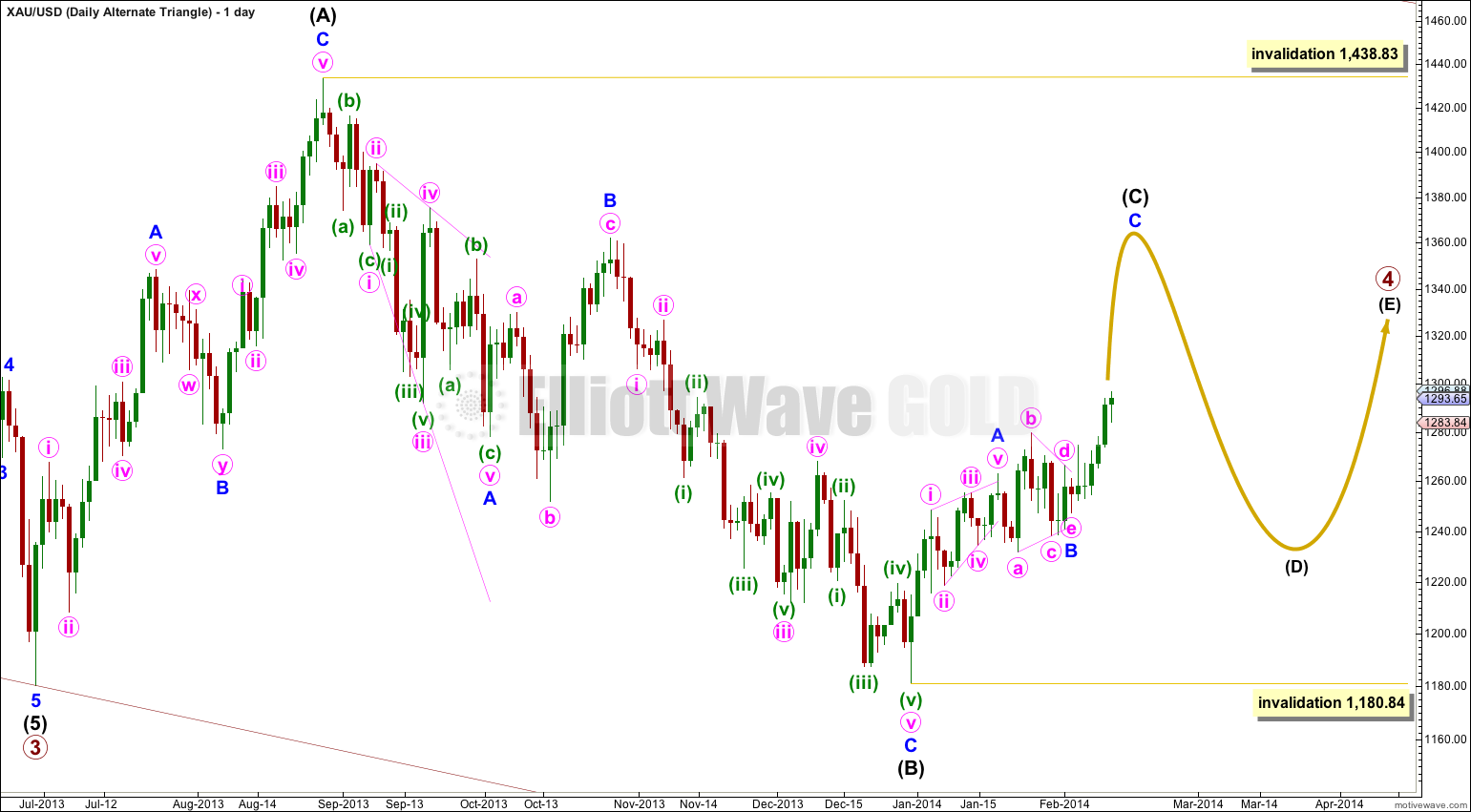

Alternate Daily Wave Count – Triangle.

It is also possible that primary wave 4 may continue as a regular contracting (or barrier) triangle.

The expected direction of this next upwards wave is the same, but for this alternate intermediate wave (C) of the triangle may not move beyond the end of intermediate wave (A). The triangle is invalidated with movement above 1,438.83.

Intermediate wave (C) must unfold as either a single or double zigzag. Within it no second wave correction, nor wave B of the zigzag, may move beyond the start of the first wave or A wave. This wave count is invalidated with movement below 1,180.84.

The final intermediate wave (E) upwards may not move above the end of intermediate wave (C) for both a contracting and barrier triangle. E waves most commonly end short of the A-C trend line.

All five subwaves of a triangle must divide into corrective structures. If this next upwards movement subdivides as a zigzag which does not make a new high above 1,438.83 then this alternate would be correct.

Triangles take up time and move price sideways. If primary wave 4 unfolds as a triangle then I would expect it to last months rather than weeks.

It’s over already. No estimate required. It lasted 14 hours.

Hi Lara, thanks for your great analysis! From a trading perspective, it would not surprise me if c=.618*A which is approx 1307. I noticed that’s right where the pink trendline is thurs or Fri. It looks to me as if minuette iv is already underway with a target of $1280-$1285.

You were right. Minuette wave (iv) was already underway. Your target was pretty spot on too! Nicely done.

“I would expect minuette wave (iv) to last up to 24 hours.”

“Minuette wave (v) should be the final upwards wave towards 1,330. ”

Lara, do you have an estimate on how long minuette wave (v) will last ?