The data for this market has many gaps, and the structures are not entirely typical looking Elliott wave structures. Although there are some Fibonacci ratios, they are not as prevalent as ratios within Gold. I am only able to import daily data, and I cannot check subdivisions on lower time frames.

While I expect my analysis of GDX will be useful to you, please note that it may not have as good an accuracy rate as what I can achieve for Gold.

Overall the structures and the wave count will be quite different from Gold. Although it looks these two markets have major turns together, the subdivisions within each are quite different.

Click on the charts below to enlarge.

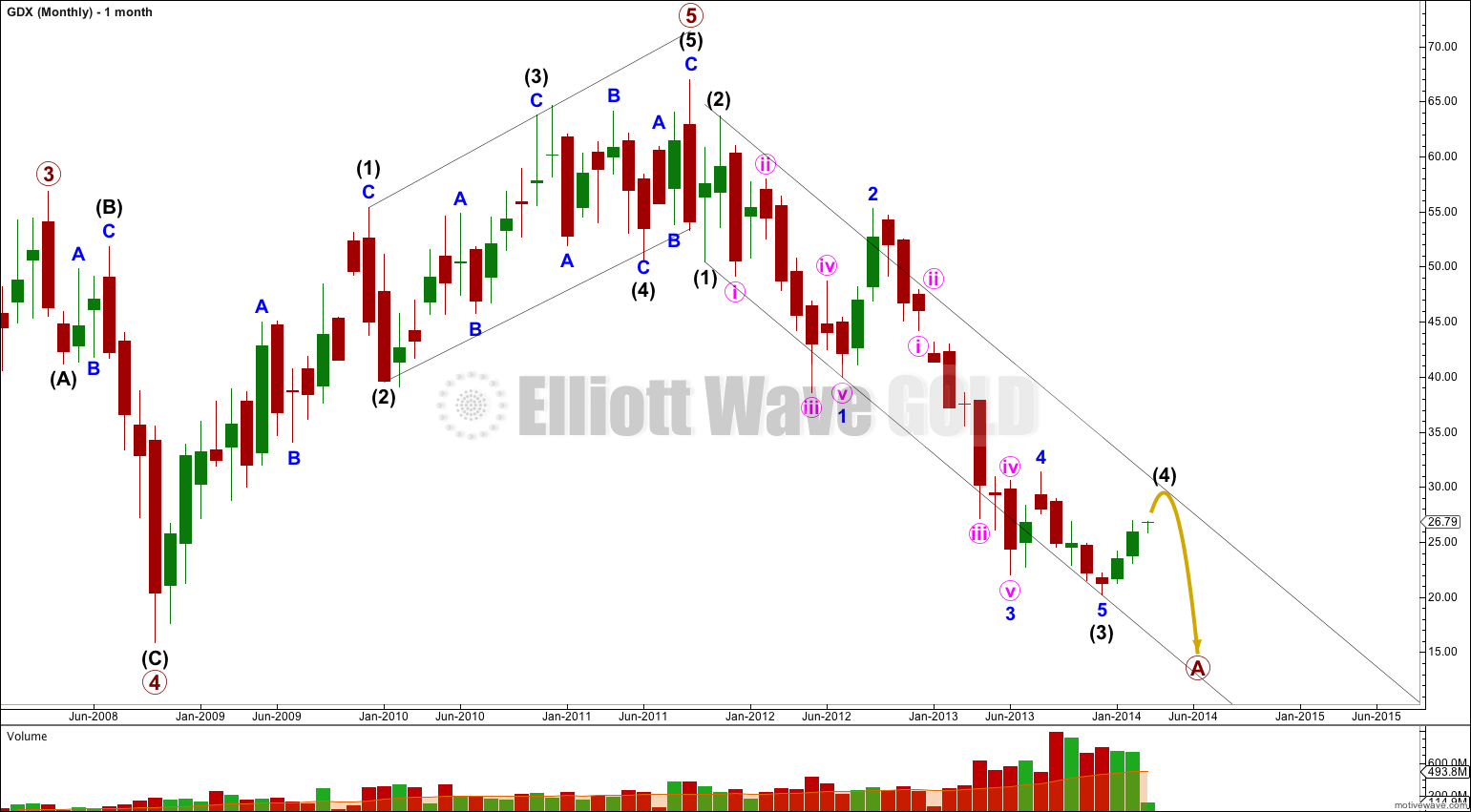

The clearest piece of movement is the downwards movement from the high. This looks most like a first, second and third wave. This may be the start of a larger correction.

Intermediate wave (3) is 10.59 points longer than 2.618 the length of intermediate wave (1).

Within intermediate wave (3) there are no Fibonacci ratios between minor waves 1, 3 and 5.

Ratios within minor wave 1 of intermediate wave (3) are: minute wave iii has no Fibonacci ratio to minute wave i, and minute wave v is 21.90 longer than 0.618 the length of minute wave i.

Ratios within minor wave 3 of intermediate wave (3) are: minute wave iii has no Fibonacci ratio to minute wave i, and minute wave v is 68.72 longer than 0.382 the length of minute wave iii.

Draw a parallel channel about this downwards movement. Draw the first trend line from the lows of intermediate waves (1) to (3), then place a parallel copy upon the high of intermediate wave (2). I would expect intermediate wave (4) to find resistance at the upper edge of the channel, and it may end there.

Intermediate wave (4) should last one to a few months. It may end about the terminus of the fourth wave of one lesser degree at 31.35.

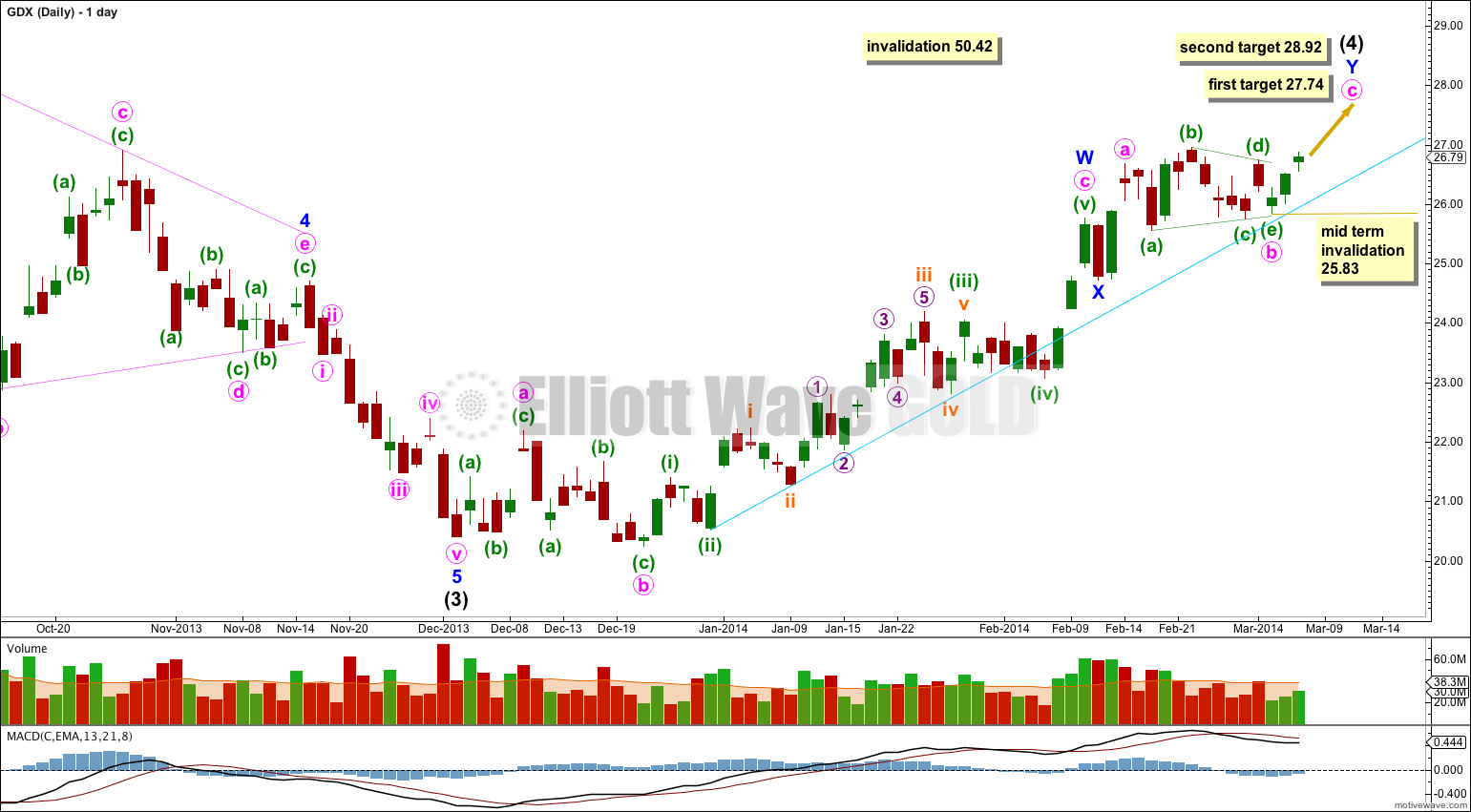

The target for upwards movement for minute wave c (within minor wave W) to end given in last analysis was 24.76. It has ended at 25.76.

This structure for intermediate wave (4) is so far looking like an atypical double combination. It cannot be a double zigzag because the first structure subdivides 3-3-5, and so minor wave W is a flat. Intermediate wave (4) may be a double combination: flat – X – zigzag.

Double combinations normally move price sideways. This one is trending upwards in a corrective direction.

The three in the opposite direction labeled minor wave X is remarkably shallow for an X wave within a combination and it is more like an X wave within a double zigzag.

Within minor wave Y minute wave b subdivides nicely as a running contracting triangle. The trend lines of the triangle fit perfectly.

Within minor wave Y at 27.74 minute wave c would reach equality with minute wave a. If upwards movement does not stop there then the next possible target is at 28.92 where minute wave c would reach 1.618 the length of minute wave a.

The lower aqua blue trend line may show where downwards corrections find support.

Within minute wave c no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 25.83 while minute wave c is unfolding.

Thank you for the GDX update. Really appreciate seeing GDX updates as your time permits.