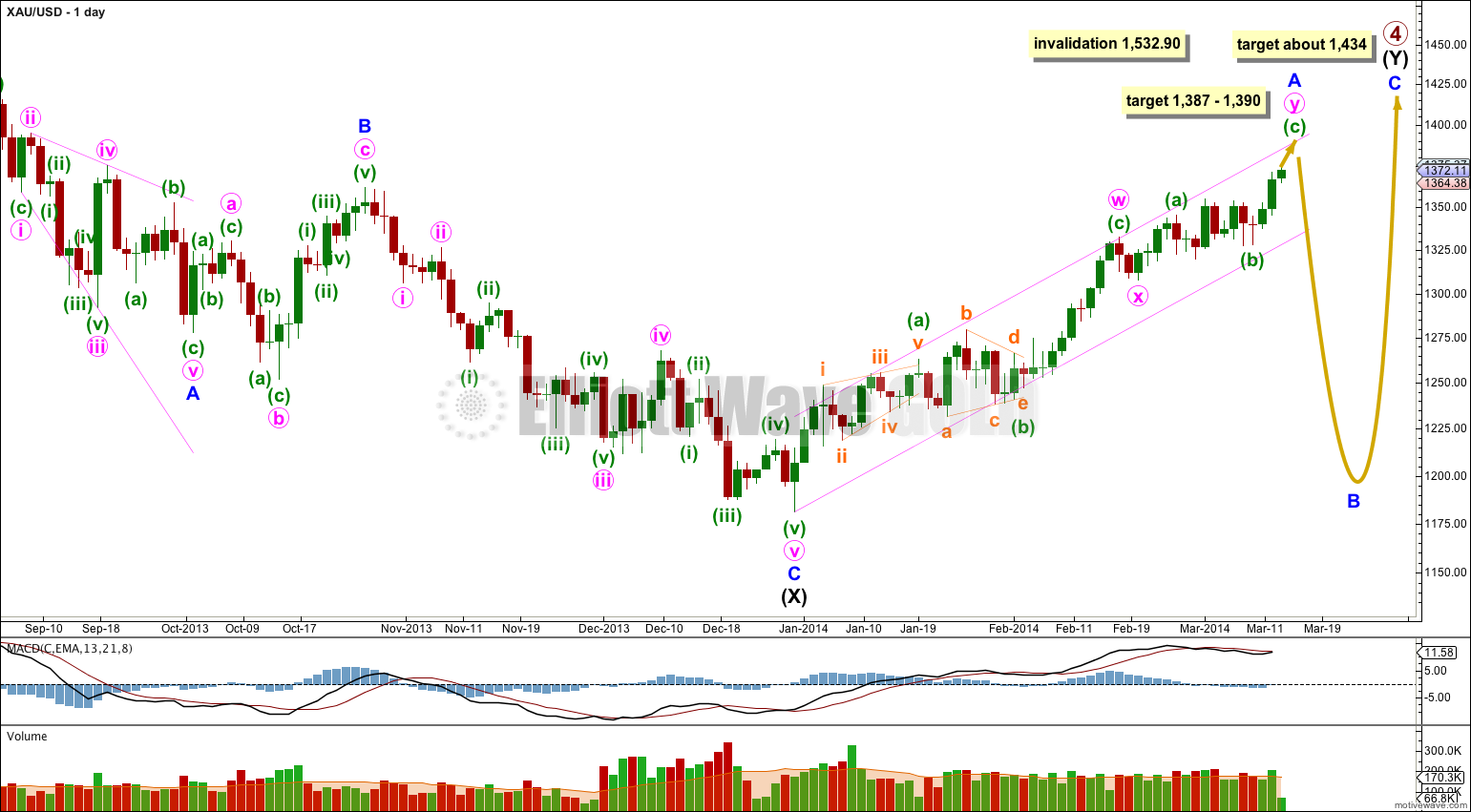

The short term target at 1,381 has not yet been met, but price has moved higher as expected.

Summary: The trend is up. The target for it to end is now calculated at two degrees and so widens to a small zone at 1,387 to 1,390. This target may be met in two days.

This analysis is published about 05:00 p.m. EST. Click on charts to enlarge.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

The first upwards wave within primary wave 4 labeled intermediate wave (W) subdivides as a three wave zigzag. Primary wave 4 cannot be an unfolding zigzag because the first wave within a zigzag, wave A, must subdivide as a five.

Primary wave 4 is unlikely to be completing as a double zigzag because intermediate wave (X) is a deep 99% correction of intermediate wave (W). Double zigzags commonly have shallow X waves because their purpose it to deepen a correction when the first zigzag does not move price deep enough.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) may be either a flat or a triangle. For both these structures minor wave A must be a three.

Minor wave A is an incomplete double zigzag. The second zigzag in the double is incomplete. There is a morning doji star candlestick pattern at the bottom of minuette wave (b) within minute wave y. A morning star pattern is one of the more reliable candlestick patterns. This provides some confirmation for the upwards trend.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Subminuette wave iii is complete and did not reach the target. There is no Fibonacci ratio between subminuette waves i and iii. This makes it more likely we shall see a ratio between subminuette wave v and either of i or iii.

At 1,387 subminuette wave v would reach 0.618 the length of subminuette wave iii. This target is just $3 short of 1,390 where minuette wave (c) would reach 1.618 the length of minuette wave (a). If this target is met in two more days then minuette wave (c) would last a Fibonacci five days.

I have redrawn the channel about minuette wave (c) using Elliott’s first technique: draw the first trend line from the ends of the first to third waves, then place a parallel copy on the end of the second wave. Subminuette wave iv remains within this channel. Subminuette wave v may end about the upper edge of the channel, or it may overshoot it.

When this channel is breached by subsequent downwards movement (after subminuette wave v could be considered complete) that shall be our first indication that minor wave A may be over.

Within subminuette wave v no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 1,364.60.

If this wave count is invalidated with downwards movement then it may be that subminuette wave iv is continuing further as a double combination or double flat correction. The invalidation point would move back to 1,344.77.

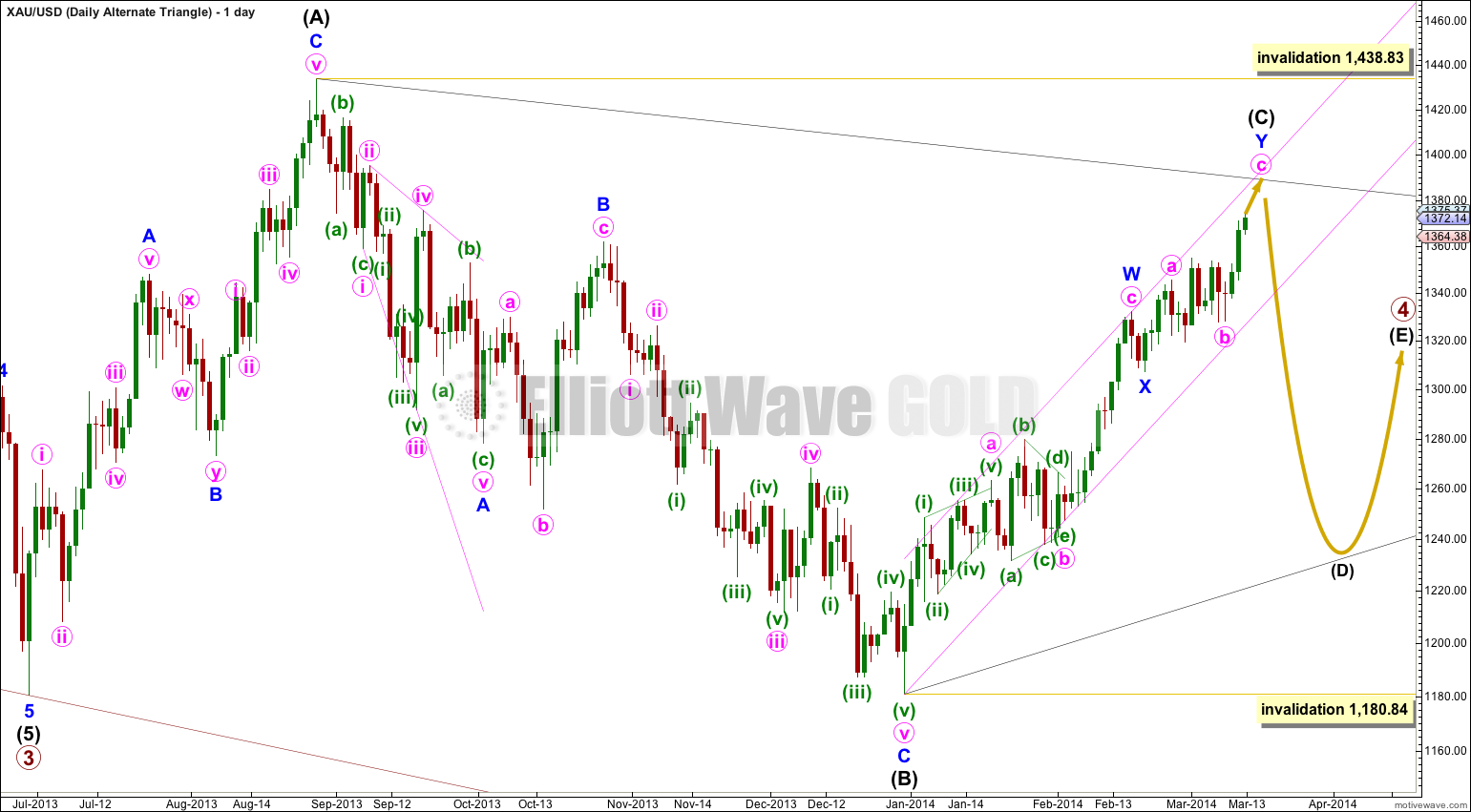

Alternate Daily Wave Count – Triangle.

It is also possible that primary wave 4 may continue as a regular contracting (or barrier) triangle.

This wave count has a good probability. It does not diverge from the main wave count and it will not diverge for several weeks yet.

Triangles take up time and move price sideways. If primary wave 4 unfolds as a triangle then I would expect it to last months rather than weeks.

Congratulations Richard. That’s some good trading you’ve done there.

Hello Lara, thanks for your precise Gold target of $1,387 to 1,390.

When the NYSE market opened at 9:30 am EST today Gold was at 1,387.

So I watched Gold and Silver a few minutes and the prices of my Gold mining ETF and Silver mining ETF and sold both of them at 9:45 am when the miners peaked and I made thousands in profits from buying and selling both of them this week.

Now I will wait until Gold bottoms out in the $1,200 area and do it again only for lots more profits. Thanks Lara you give great forecasts.

I’ll be in the Saloon celebrating until the next Gold Rush!!!