Upwards movement reached 1,314.48, just 1.48 above the short term target of 1,313 for the main hourly wave count.

Summary: The structure of this upwards movement is clearer: it is an unfolding zigzag. This expects overall a clearer upwards trend. This should continue for about two more weeks. In the very short term I am expecting downwards movement for a small correction which may last about three to five days. This is a correction against the trend as the trend at minute degree is up.

This analysis is published about 04:45 p.m. EST. Click on charts to enlarge.

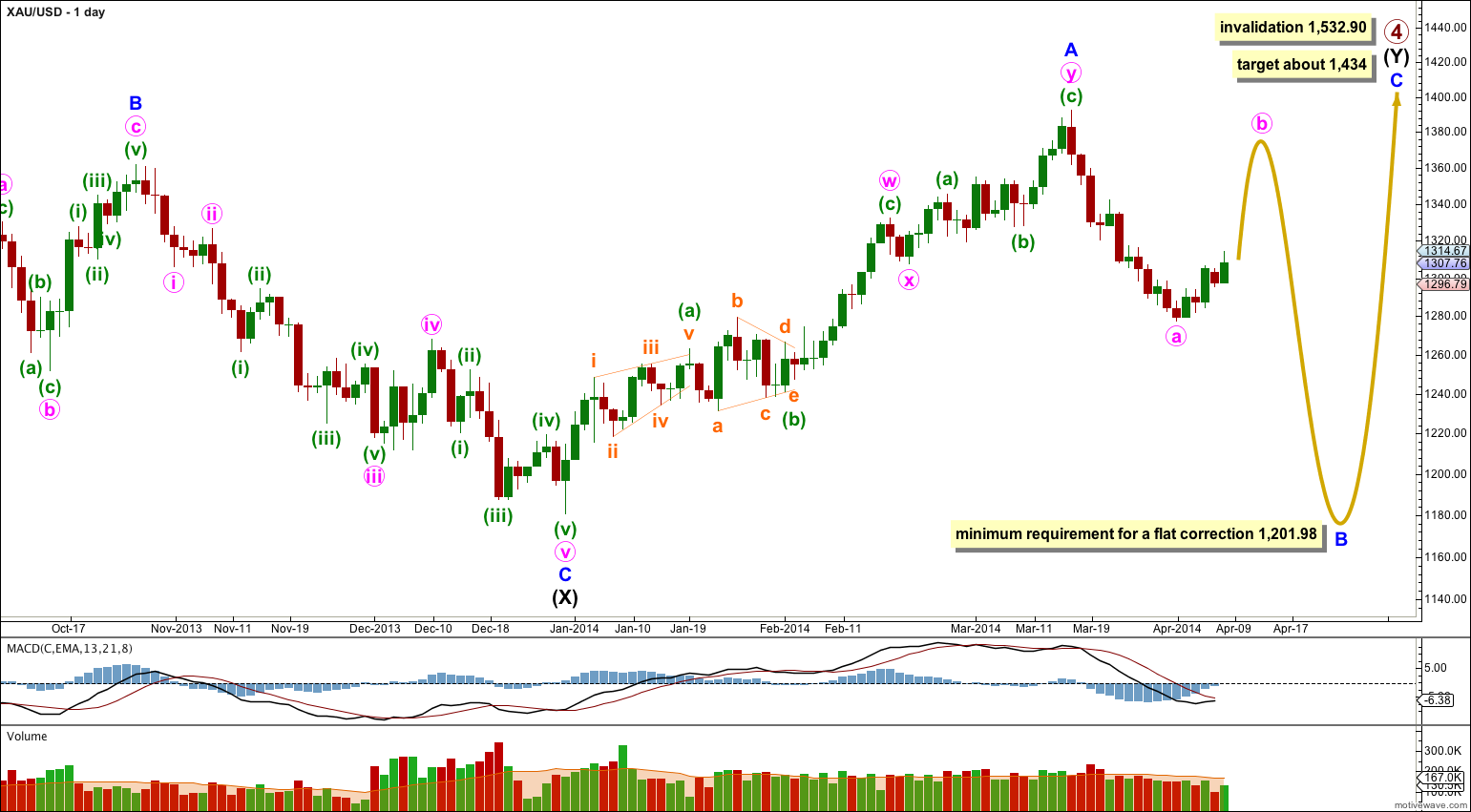

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Primary wave 4 may also be a large contracting triangle, but at this stage this idea does not have the “right look” and so I will not publish a chart for it. I will continue to follow this idea and will publish a chart in coming weeks for it if it shows itself to be correct. At this stage there is no divergence between wave counts for a triangle or a double combination.

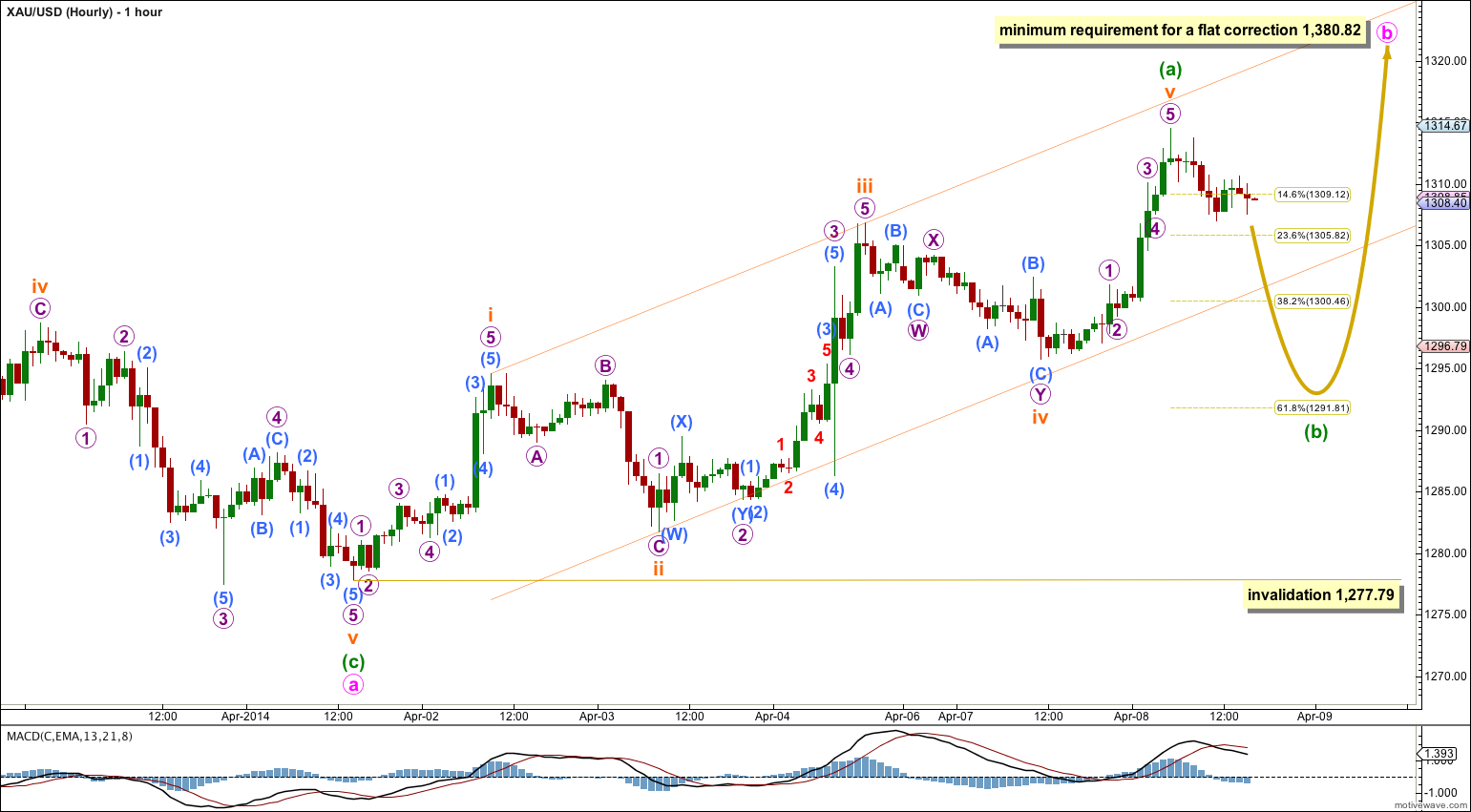

This main wave count follows the idea that minor wave B may be unfolding as a flat correction. Within the flat correction minute wave a subdivides as a single zigzag. Minute wave b within the flat must reach a minimum of 90% the length of minute wave a at 1,380.82.

Minute wave b is most likely to subdivide as a single or double zigzag in order to reach 1,380.82. The first wave up should subdivide as a five and it is now complete.

Ratios within minuette wave (a) are: subminuette wave iii is 2.07 short of 1.618 the length of subminuette wave i, and subminuette wave v has no adequate Fibonacci ratio to either of subminuette waves iii or i.

Use Elliott’s first technique to draw a channel about minuette wave (a): draw the first trend line from the highs of subminuette waves i to iii, then place a parallel copy upon the low of subminuette wave ii. When this channel is clearly breached by downwards movement we shall have confirmation that minuette wave (a) is over and minuette wave (b) is underway.

Because subminuette waves ii and iv show on the daily chart as red candlesticks I would expect minuette wave (b) one degree higher to also clearly show on the daily chart. Minuette wave (a) lasted five days. Minuette wave (b) may last about three to five days to be in proportion.

I will use the Fibonacci ratios of minuette wave (a) as a guideline to where minuette wave (b) may end, favouring the 0.618 Fibonacci ratio at 1,291.81.

There are more than thirteen corrective structures that minuette wave (b) may unfold as. It may be a clear downwards zigzag, or it may be a very choppy overlapping flat, triangle or combination. It may include a new high above its start at 1,314.48.

This downwards B wave is a low degree correction against the current short term upwards trend.

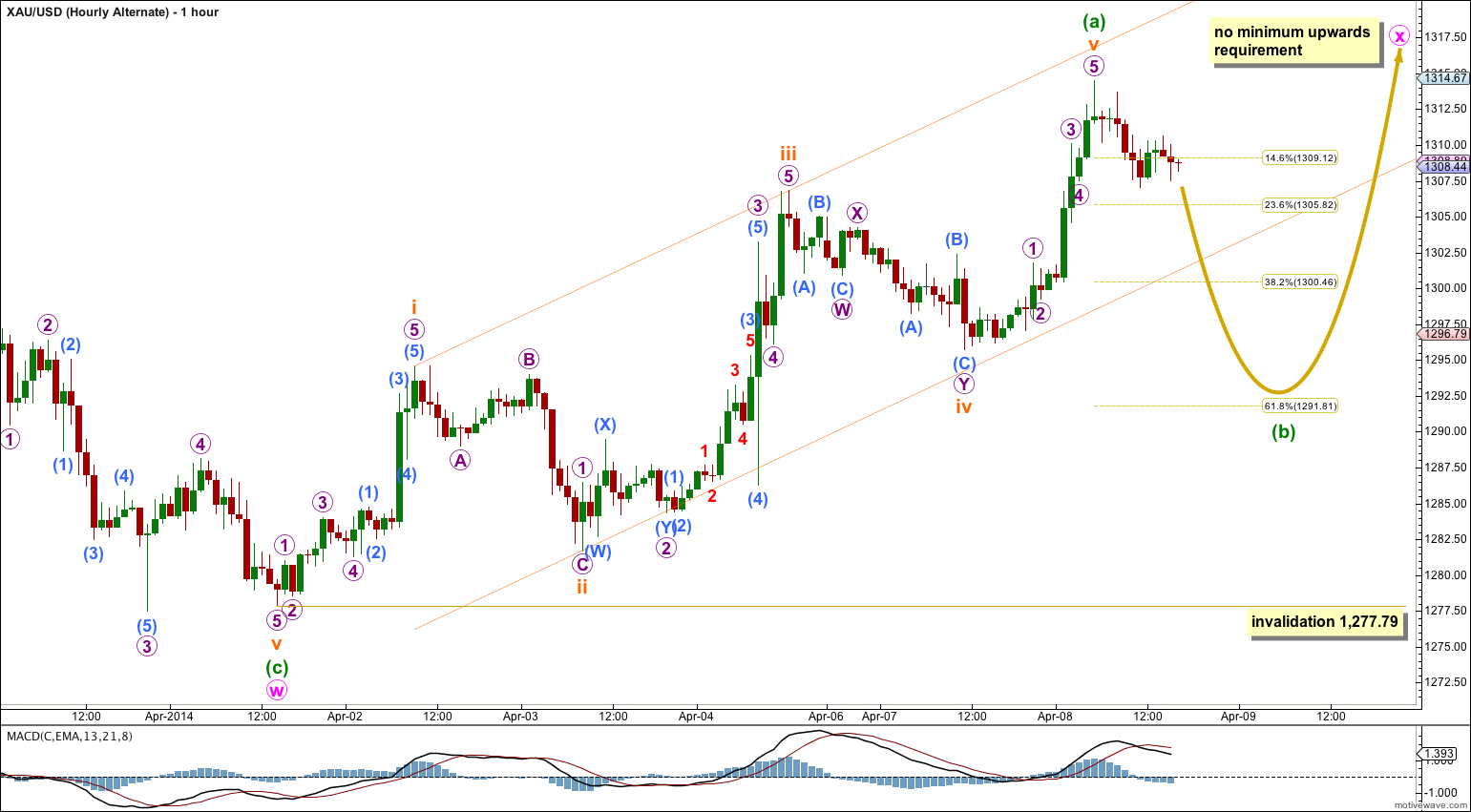

Alternate Hourly Wave Count.

This alternate wave count follows the idea that minor wave B may be unfolding as a double zigzag. The first zigzag downwards is labeled minute wave w. The double should be joined by a “three” in the opposite direction which may subdivide as any corrective structure labeled minute wave x.

Minute wave x may be unfolding as a zigzag. At this stage the only difference between the two hourly wave counts is the expectation of where this current short term upwards trend may end; there is no minimum requirement for X waves so this alternate does not require movement to 1,380.82.

If a zigzag completes upwards which falls short of 1,380.82 then this alternate wave count would be correct.

Attached chart is my question talking about. Thanks Lara

I see. Thanks for the chart, that makes it SO much easier for me to understand your question. I’m very visual.

Yes, that’s possible but I expect it has an extremely low probability.

Look at minuette wave (a) on the daily chart. There you can see red candlesticks for the second and fourth waves within it at subminuette degree.

This means that you should expect to see minuette wave (b) show up clearly on the daily chart. This would give the wave count the “right look” at the daily chart level. And I have learned that Gold almost always has that typical look. We should expect it.

Thanks Lara, thanks for your experience sharing, I would also take into account of the “right look” on the daily chart as one of important factor to consider later on.

Lara, are you mean that wave (b) could be exceeding the start of wave (a) without any bounded area? On today 9th report, you mentioned that 100%-138% of wave a amplitude would be a reference upper limited area for wave b, could we say that if over this reference limit point, we should not consider that wave not as wave b any more, sorry for my detailed question as I want to set my stop loss order in more appropriate.

The common length of a B wave within a flat is 100% to 138%, but 138% is not a maximum.

I have seen plenty of B waves within flats which are more than 138%.

There is no rule which states a maximum limit for a B wave within a flat. Once the B wave is twice the length of the A wave then the wave count has an extremely low probability and should be discarded or relegated to an unlikely alternate.

This is one area where Elliott wave unfortunately does not offer a firm rule to use for placing stop losses. In these instances trend channels may be more useful.

Hi, Lara, yesterday the price of already breached through the yellow once before on hourly chart and then bounced back up to 1315 which is higher than the previous high of the subminuette wave v of minuette (a), is it minuette wave (b) has finished its subminuette abc already and already on the way of minuette wave (c)

I think your question has been answered by today’s analysis.

As I stated in yesterday’s analysis of 8th April, this B wave could include a new high. There are more than 13 possible corrective structures a B wave may take, and some of those include new price extremes beyond the start of it: expanded flats, running flats, running triangles, or combinations including any of those or just regular combinations where the X wave makes a new price extreme.

That’s why there was no upper invalidation point. And that’s a huge reason why low degree B waves are horribly difficult to analyse and predict. They’re so variable!

Hello Lara,

Just a possible typo.

Your text says 0.618 Fibonacci ratio at 1,294.81.

Your chart shows 1,291.81.

Thanks Richard. Typo has been corrected.