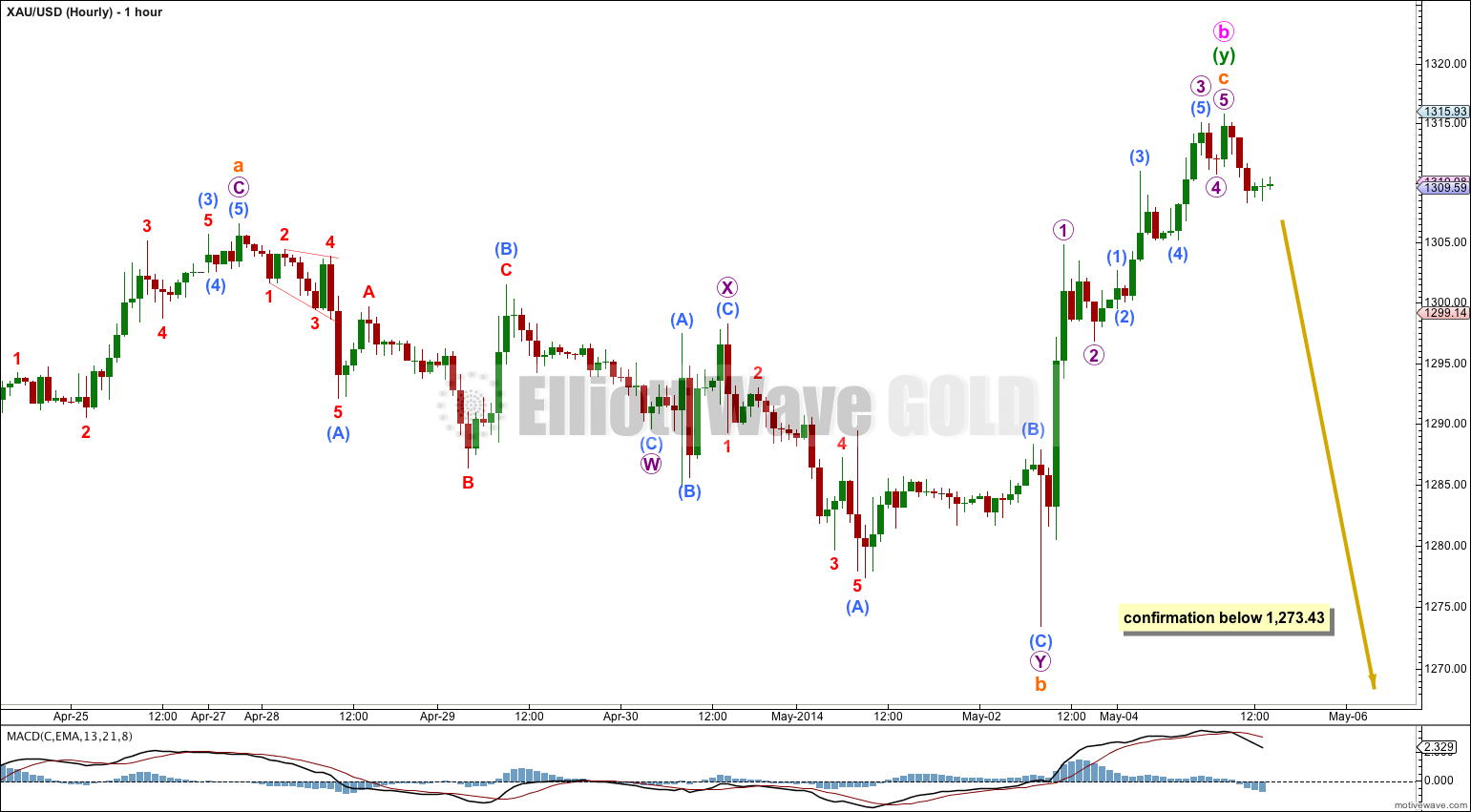

Upwards movement invalidated the triangle for minute wave b. The structure is more likely a combination. Upwards movement is either over here or should be over soon. Overall I expect to see the downwards trend resume this week.

Summary: I want to see movement below 1,273.43 before I have confidence that the downwards trend has resumed. Once I have this confirmation I will calculate a target for it to end. Downwards movement should reach 1,201.98 or below.

This analysis is published about 03:33 p.m. EST. Click on charts to enlarge.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure, and at this stage the structure may be either a single zigzag (as labeled here) or a double zigzag (relabel A-B-C to W-X-Y). When minute wave b is finally confirmed as complete then I will have two hourly wave counts for the two possibilities of the next downwards wave: either an impulse for a C wave or a zigzag for a W wave.

Although the triangle for last analysis had the best overall look, movement above 1,306.58 invalidated it. Unfortunately, this is often the case with triangles. They look good right until they are almost complete then unexpected movement invalidates the structure and it turns out to be a combination instead. This is why I considered alternates, however unlikely, in last analysis.

This wave count is slightly different from prior alternates, but it has a reasonable fit. If minute wave b is a combination then within it minuette wave (w) was a zigzag and minuette wave (y) is a flat correction.

Within minuette wave (y) subminuette wave a subdivides as a rare running flat, with a deep B wave and a slightly truncated C wave. In this instance the C wave is truncated by 0.61.

Within minuette wave (y) it is not clear that subminuette wave c is complete. If it is over here then it would be 3.49 longer than 1.618 the length of subminuette wave a. This is a likely place for it to end.

If we see movement below 1,273.43 in the next day or two then downwards movement cannot be a second wave correction within subminuette wave c, and so at that stage subminuette wave c would have to be complete. At that stage I would have confidence that Gold has broken out of its sideways range and the next wave is underway.

While price remains above 1,273.43 we must accept the possibility that subminuette wave c could be incomplete and could move price higher. There is not enough downwards movement at this stage for the structure to look like it may be complete.