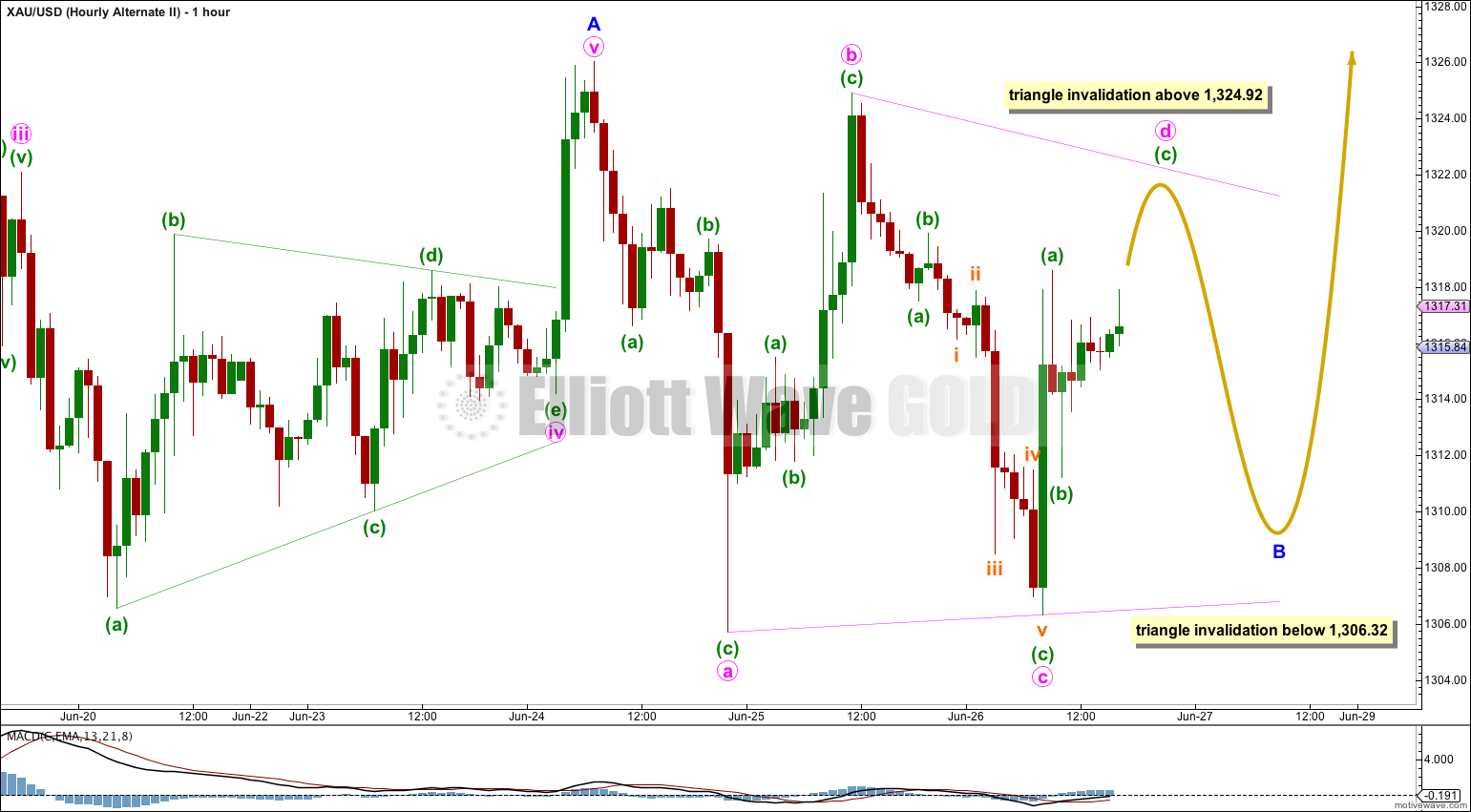

Movement below 1,315.48 invalidated yesterday’s alternate Elliott wave count and confirmed the main wave count. I have more confidence today that a B wave has begun. So far it looks like it may be very shallow and it may also be brief. I have two wave counts for you today.

Summary: Minor wave B is underway. It should continue for another couple of days with choppy overlapping movement. The range may remain small, or it could expand.

Click on charts to enlarge.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

This wave count expects primary wave 4 is a huge triangle. The triangle is now within the final wave of intermediate wave (E) which should subdivide as a zigzag.

Intermediate wave (E) is most likely to fall short of the (A) – (C) trend line. It may also overshoot this trend line, but that is less common.

Within the zigzag of intermediate wave (E) minor wave B may not move beyond the start of minor wave A at 1,240.51.

So far within primary wave 4 intermediate wave (A) lasted 43 days (no Fibonacci relationship), intermediate wave (B) lasted 88 days (just one day short of a Fibonacci 89), intermediate wave (C) lasted 53 days (just two days short of a Fibonacci 55) and intermediate wave (D) lasted 56 days (just one day more than a Fibonacci 55). So far intermediate wave (E) has lasted 17 days and is about halfway through. It may complete in a total Fibonacci 21 or 34 days, give or take one day either side of this expectation.

Main Hourly Wave Count.

Sideways movement over the last 24 hours looks like an unfolding double combination or double flat correction. Within the possible double minute wave x has no invalidation point, and may make a new high beyond the start of minute wave w at 1,326.02.

At 1,323 minuette wave (c) within minute wave x would reach equality in length with minuette wave (a).

Thereafter, this wave count expects more choppy overlapping movement for another couple of days for minute wave y. Minute wave y may be a flat, zigzag or triangle. If it is a triangle then it would be more time consuming, and if it is a zigzag it could be quick.

Overall the purpose of combinations and double flats is the same, to take up time and move price sideways. The second structure in the double would most likely end close to the same level as the first, so minute wave y would be very likely to end about 1,306.32.

First Alternate Hourly Wave Count.

Instead of a combination minor wave B may be unfolding as a flat correction. Within a flat correction minute wave a must subdivide as a three wave structure, and this one is a regular flat correction.

Within a flat correction minute wave b must reach a minimum of 90% the length of minute wave a. This would be achieved at 1,324.05.

Within a flat correction the most common length of minute wave b is between 100% to 138% the length of minute wave a, between 1,326.02 to 1,333.51.

Minute wave b must subdivide as a three wave structure.

Thereafter, minute wave c downwards would be extremely likely to make at least a slight new low below the end of minute wave a at 1,306.32 to avoid a truncation and a very rare running flat. When minute wave b is complete then it would be known what type of flat is unfolding, and a target for minute wave c may be calculated.

Second Alternate Hourly Wave Count.

The other possibility at this stage for minor wave B is a small regular contracting triangle.

The only problem with this wave count, and the reason why it is an alternate, is the shallow slope of the a-c trend line. Normally a-c trend lines of contracting triangles have a steeper slope than this. If one of the triangle trend lines is close to flat it is normally the b-d trend line for a barrier triangle.

If minor wave B is unfolding as a contracting triangle then within it minute wave d may not move beyond the end of minute wave b at 1,324.92.

If minor wave B is unfolding as a barrier triangle then within it minute wave d may end about the same level as minute wave b at 1,324.92, and in practice may move slightly beyond this point as long as the b-d trend line remains essentially flat. However, with the a-c trend line not exhibiting much of a slope at this stage if the b-d trend line was flat the whole structure would not have a look of a triangle; triangle trend lines should slope together more than this.

Minute wave e of the triangle may not move beyond the end of minute wave c below 1,306.32. This invalidation point is black and white.

If minor wave B continues as a triangle it may take another couple of days to unfold. Triangles have the same purpose as combinations, to take up time and move price sideways.

This analysis is published about 05:30 p.m. EST.