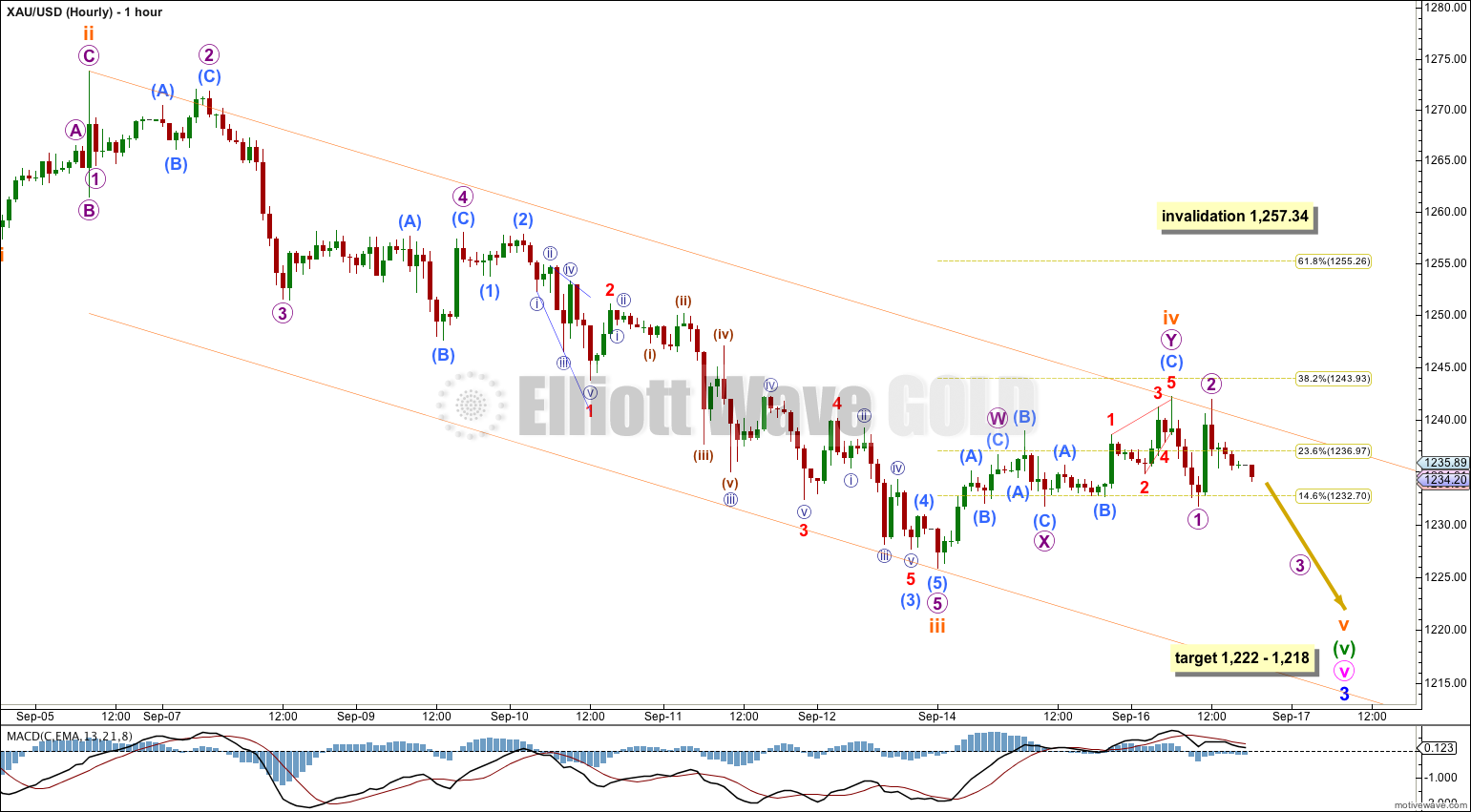

Another green candlestick was allowed for in the wave count, and upwards movement remains just below the 0.382 Fibonacci ratio on the main hourly Elliott wave chart.

Summary: The target for this last wave down to end is now 1,222 to 1,218. I favour the upper edge of this target zone because it is calculated at a lower wave degree. I expect Wednesday to complete a red candlestick and see a new low. This will end minor wave 3.

Click on charts to enlarge.

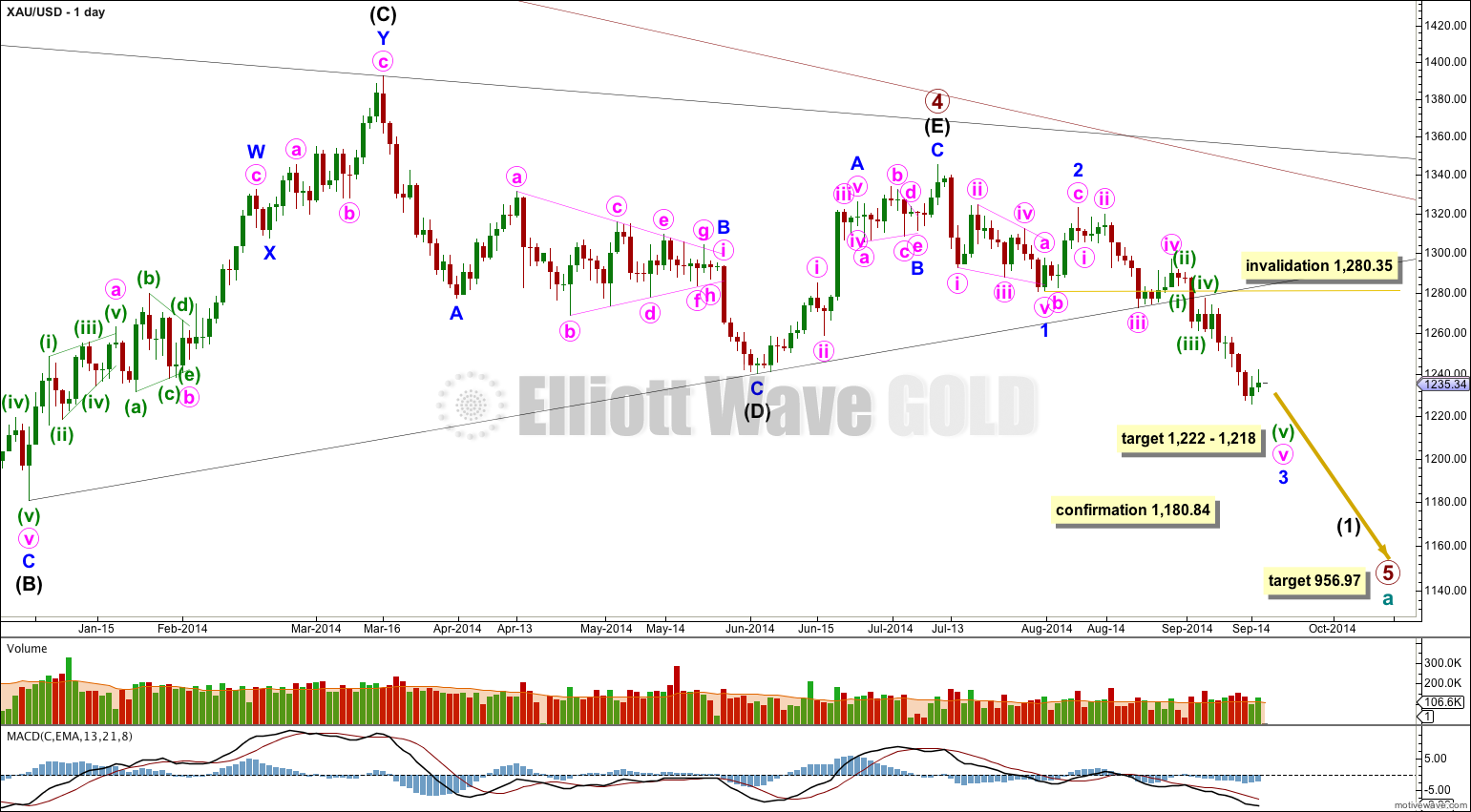

Main Wave Count

Extend the triangle trend lines of primary wave 4 outwards. The point in time at which they cross over may be the point in time at which primary wave 5 ends. This does not always work, but it works often enough to look out for. It is a rough guideline only and not definitive. A trend line placed from the end of primary wave 4 to the target of primary wave 5 at this point in time shows primary wave 5 would take a total 26 weeks to reach that point, and that is what I will expect. Primary wave 4 has just begun its 10th week.

The black (B)-(D) trend line is clearly breached. I have confidence that primary wave 5 has begun. The black (B)-(D) trend line is now also clearly breached on the weekly chart. This is significant.

In the last few trading days it is downwards days which have mostly higher volume. From a traditional technical analysis point of view this indicates the main trend is most likely down.

At 956.97 primary wave 5 would reach equality in length with primary wave 1. Primary wave 3 is $12.54 short of 1.618 the length of primary wave 1, and equality between primary waves 5 and 1 would give a perfect Elliott relationship for this downwards movement.

However, when triangles take their time and move close to the apex of the triangle, as primary wave 4 has (looking at this on a weekly chart is clearer) the movement following the triangle is often shorter and weaker than expected. If the target at 956.97 is wrong it may be too low. In the first instance I expect it is extremely likely that primary wave 5 will move at least below the end of primary wave 3 at 1,180.40 to avoid a truncation. When intermediate waves (1) through to (4) within primary wave 5 are complete I will recalculate the target at intermediate degree because this would have a higher accuracy. I cannot do that yet; I can only calculate it at primary degree.

At 1,218 minor wave 3 would reach 1.618 the length of minor wave 1.

Movement comfortably below 1,180.84 would invalidate the new alternate daily wave count below and provide further confidence in this main wave count.

Upwards movement is a fourth wave correction, and this wave count expects it is subminuette wave iv. Subminuette wave ii was a deep zigzag and subminuette wave iv may be expected to be shallow. So far it subdivides best as a double zigzag, which is a little alternation with the single zigzag of subminuette wave ii. That these structures are so similar does slightly reduce the probability of this wave count.

Subminuette wave iv has breached the channel drawn about minuette wave (v) using Elliott’s first technique, so I have redrawn the channel using his second technique: draw the first trend line from the highs labeled subminuette waves ii to iv, then place a parallel copy on the low labeled subminuette wave iii. I would expect subminuette wave v to remain within this channel, and if it meets the target it may end mid way within the channel.

At 1,222 subminuette wave v would reach equality in length with subminuette wave i.

Subminuette wave iv may not move into subminuette wave i price territory. This wave count is invalidated with movement above 1,257.34.

Note: I have considered and charted the possibility that minor wave 3 is over, but I am deciding to not publish this chart because its wave count also requires downwards movement (which would probably make a new low) so there is no divergence with the main wave count in the expected direction. If minor wave 3 is over then there are no Fibonacci ratios within minute wave v and within minuette wave (v), this is extremely unusual for Gold and this idea has an extremely low probability.

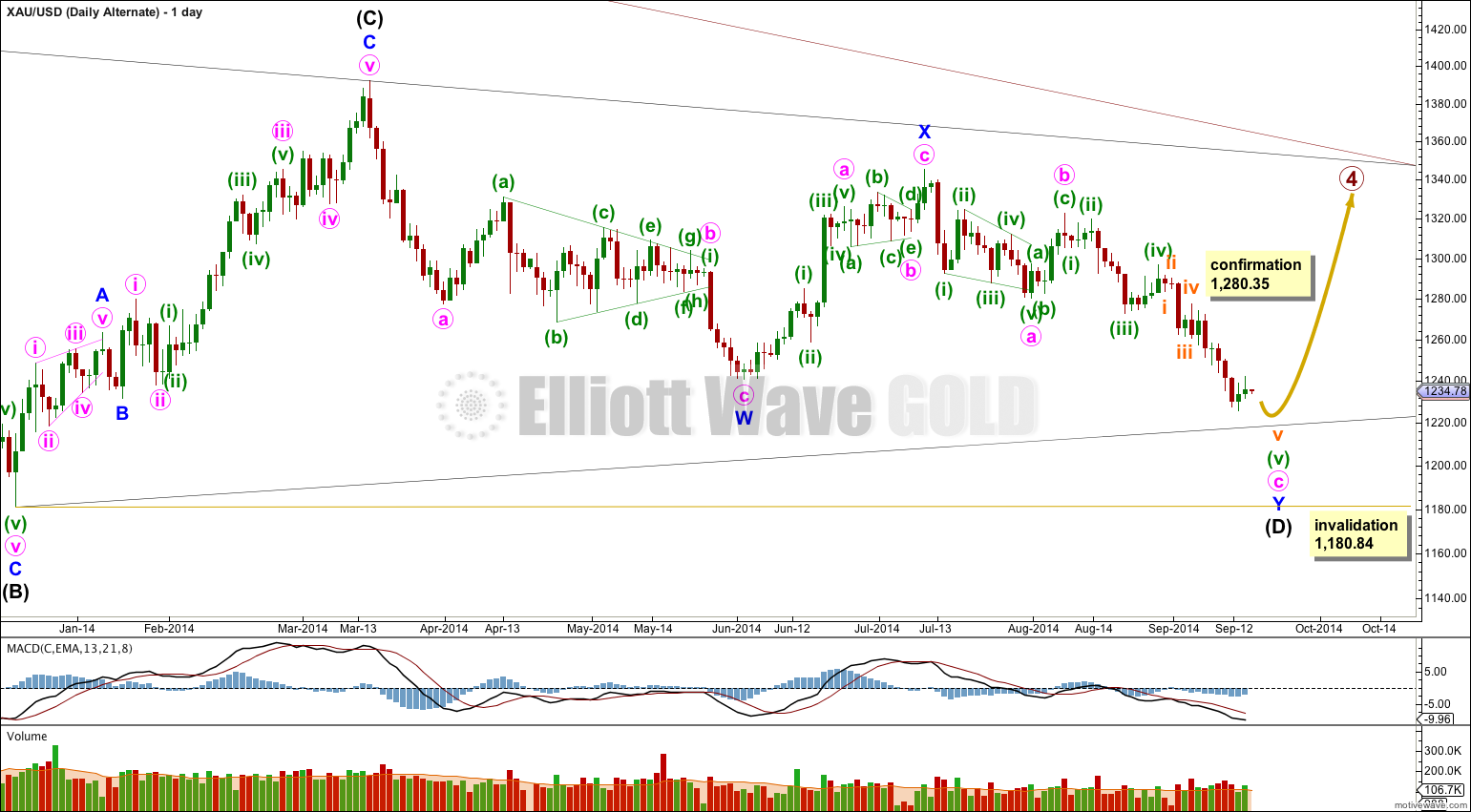

Alternate Wave Count

I would judge this wave count to have a very low probability only because of proportion between primary waves 2 and 4. The main wave count sees them almost exactly of the same duration, with primary wave 2 lasting 53 weeks and primary wave 4 lasting 54 weeks. This alternate would see primary wave 4 as much longer in duration than primary wave 2. It is the proportion between second and fourth waves within an impulse which gives the wave count what is called the “right look”. This alternate would still have the right look, but it would not look as good as the main wave count.

If intermediate wave (D) is continuing it can only be as a double zigzag. For a contracting triangle intermediate wave (D) may not move beyond the end of intermediate wave (B) below 1,180.84. For a barrier triangle intermediate wave (D) should end about the same level as intermediate wave (B), as long as the (B)-(D) trend line is essentially flat. In practice this means that intermediate wave (D) could end slightly below 1,180.84 and the wave count would remain valid. Unfortunately, this invalidation point is not black and white.

If intermediate wave (D) is a double zigzag, then intermediate wave (C) must be seen as a single zigzag because only one of the five subwaves of a triangle may be a double.

It is possible to see intermediate wave (C) as a zigzag, but to do so a rather obvious triangle must be ignored after the end of minor wave A. The main wave count sees a triangle in that position. I think this reduces the probability of this alternate.

Within intermediate wave (C) the subdivision within minuette wave (i) of minute wave iii of minor wave C is problematic. On the hourly chart this upwards wave subdivides as a double zigzag and does not fit well at all as a five wave structure. This is another reason why I would prefer a wave count which sees a triangle in that position because the subdivisions of those waves fit a triangle perfectly. This further reduces the probability of this alternate.

This alternate wave count does not diverge from the main wave count at this stage, and will not diverge for another one or two weeks. The main wave count expects downwards movement to complete minor wave 3 and this alternate expects downwards movement to complete minute wave c. Thereafter, the main wave count would expect upwards movement for minor wave 4 and this alternate wave count would expect upwards movement for intermediate wave (E). If at that stage price moves above 1,280.35 for that upwards movement then the main wave count would be invalidated and this alternate confirmed.

This analysis is published about 07:15 p.m. EST.

Hi Lara,

I would be interested in seeing your post for primary 3 of intermediate 1 being over– as I would have thought primary 2 correction was deep and therefore 4 should be shallow (??)

Sorry, your comment doesn’t make sense.

Primary degree is higher than intermediate, so there is no primary 3 OF intermediate (1).

So… I will assume you mean minor 3 within intermediate (1) and answer accordingly:

Yes. Minor 2 was deep so the upcoming minor 4 should be shallow. But… remember minor wave 4 will be shallow in relation to minor wave 3. I will draw a Fibonacci retracement along the entire length of minor 3 when it is done and expect minor 4 to reach back up to the 0.236 or 0.382 Fibonacci ratios. But the invalidation point is 1,280.35.

I’m not sure why that looks like… something you are concerned can’t happen? I don’t really understand your question.

Thanks Lara, and yes, oh jeepers! I wrote primary instead of minor — you knew what I meant – that little blue three we are all waiting on. :):)