GDX has not made a new high, so it too remains range bound. The situation for all three markets, gold, silver, and GDX remains unclear.

Click charts to enlarge.

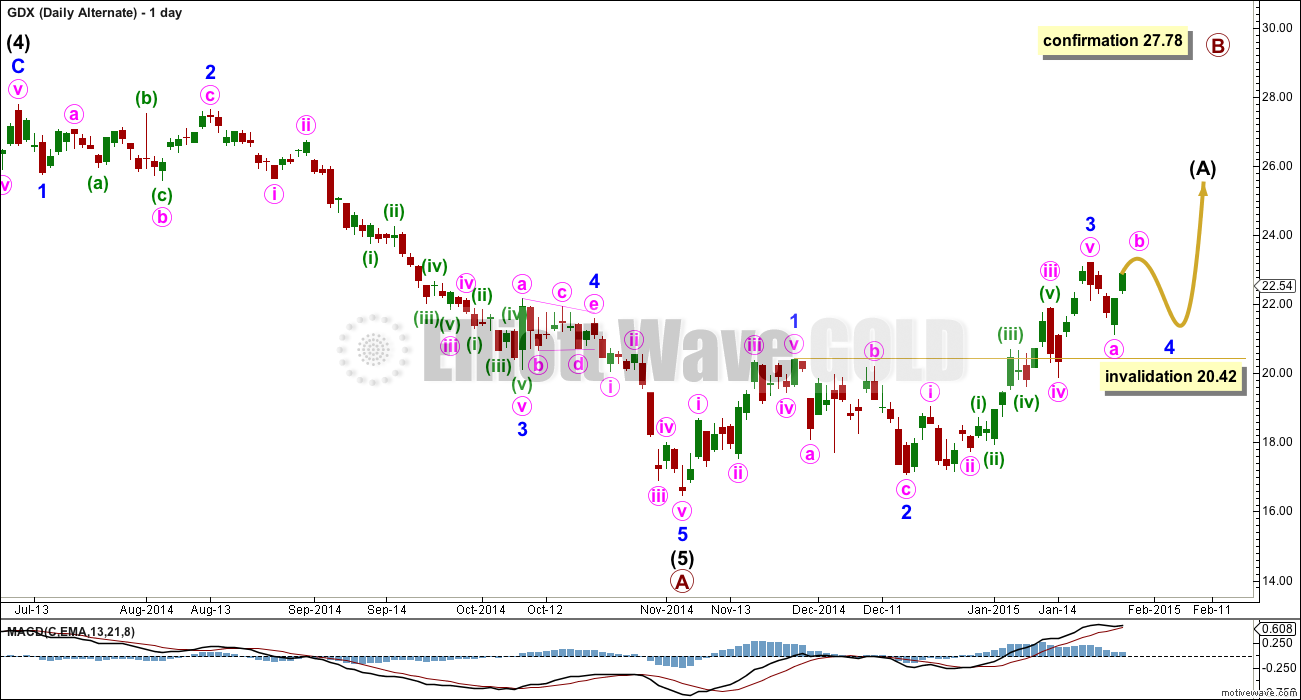

For GDX the main and alternate wave counts have exactly the same subdivisions, only the degree of labelling differs. This means it is impossible at this stage to determine which is correct, and they have a completely even probability in my judgement.

A-B-C and 1-2-3 have exactly the same subdivisions as they both subdivide 5-3-5. This main wave count requires a new low below 20.42 for confirmation.

At this stage a new high above 23.22 would substantially reduce the probability (but not finally invalidate) of this wave count. If this happens the alternate will be strongly preferred.

Alternatively, if this main wave count is correct then downwards movement should begin to build momentum as a third wave begins.

This wave count moves everything within intermediate wave (5) up one degree to see it as a complete impulse.

Within the new upwards trend a clear five up should develop on the daily chart. Within that minor wave 4 may not move into minor wave 1 price territory below 20.42.

Minor wave 2 looks like a zigzag. Minor wave 4 is probably incomplete, and may continue sideways to be better in proportion to minor wave 2 (although GDX does not always have nicely proportioned waves). If minor wave 4 is a flat correction it would exhibit alternation with minor wave 2. This may include a new high above 23.22 for minute wave b, because within a flat the B wave may move beyond the start of its A wave. If this happens this alternate would be strongly favoured.

I do not look at GDX data daily because I must import it manually. If members note a new high above 23.22 or a new low below 20.42, please let me know and I will update charts immediately. This could have a big impact on Gold analysis at this stage.

Lara, how do you get a target of 14.13? You have wave 1 going from 27.60-16.34=11.26. From wave 2 high of 23.22-11.26 minimum drop is to 11.94.

Any idea how high GDX will correct up from over night low Thursday AM?

Gold broke below 1272.34 at 4:46 am and hit 1,272.01 providing confidence in both Lara’s Daily Alternates and confirmation of the last two hourly charts and likely the top GDX chart. Price is clarifying the wave counts..