A correction is expected to be unfolding. A red doji candlestick fits this idea well.

Summary: The trend may still be down although classic technical analysis indicates a low may be in place, and for that I have a new alternate today. A final fourth wave correction may last another one to two sessions and may end about 1,222 or 1,236. When the correction is complete, a final fifth wave down to a target at 1,183 would complete the Elliott wave structure.

New updates to this analysis are in bold.

To see last weekly charts click here.

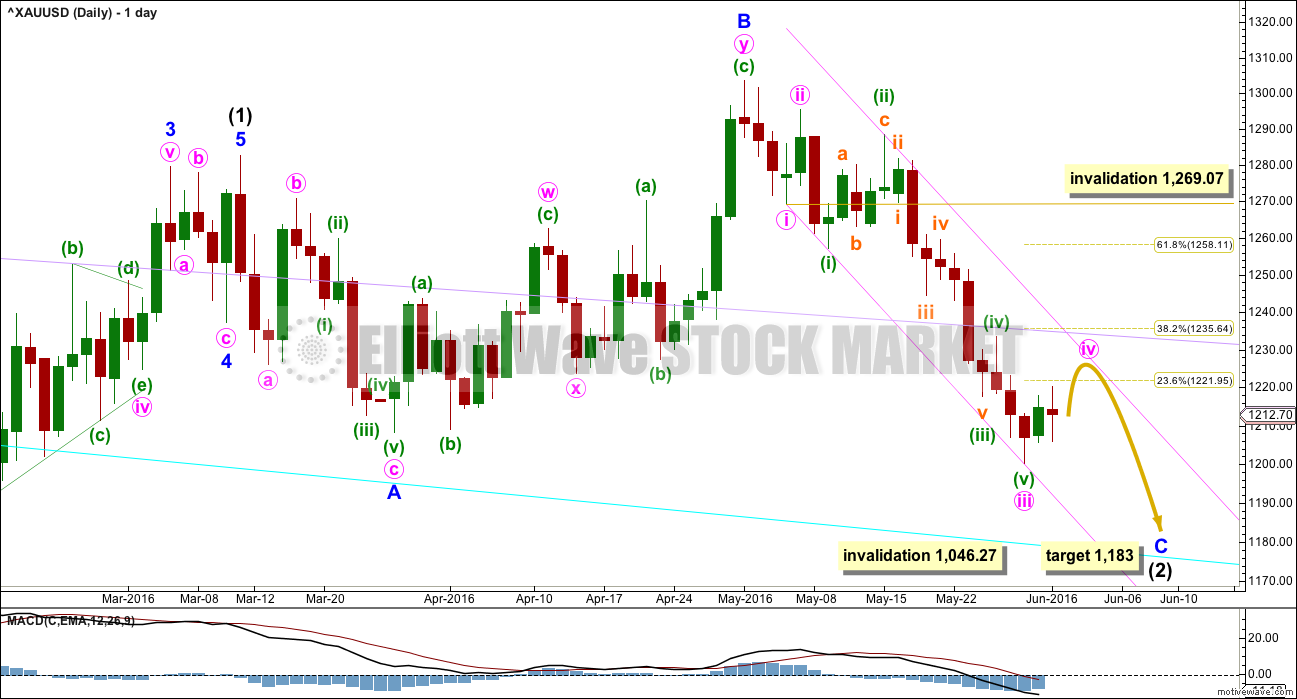

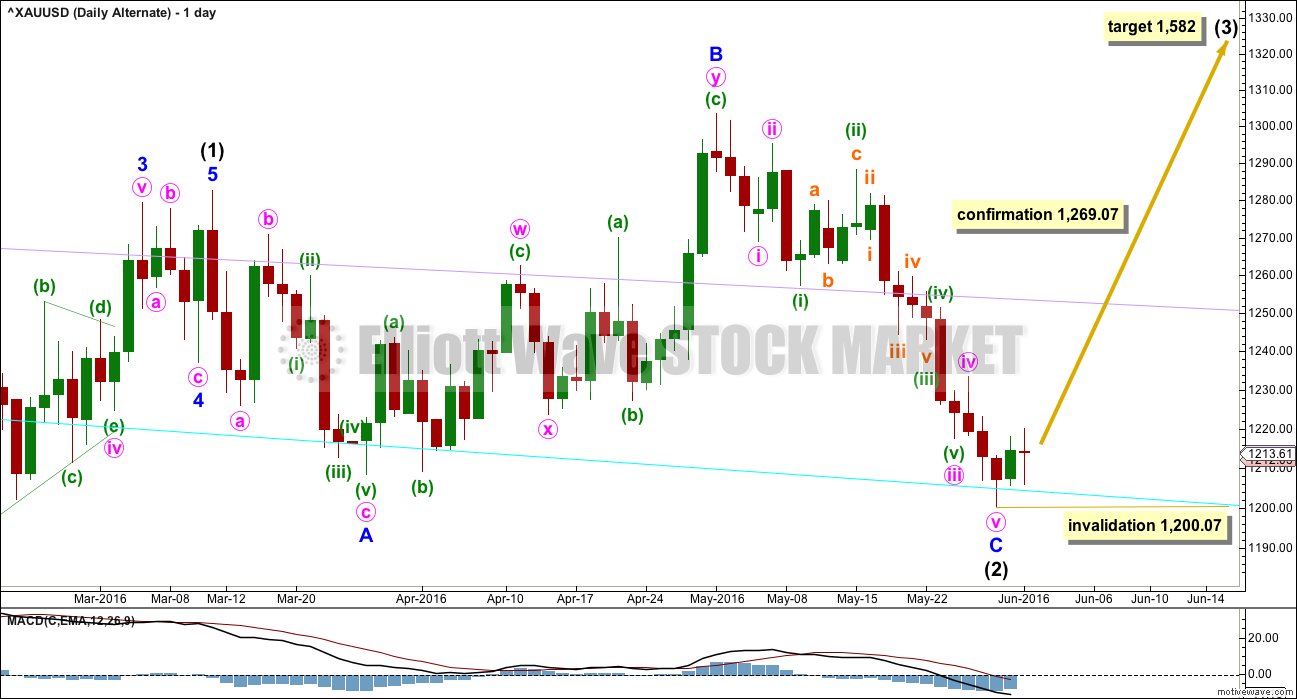

DAILY ELLIOTT WAVE COUNT

Intermediate wave (2) is not over.

Normally, the first large second wave correction within a new trend is very deep, often deeper than the 0.618 Fibonacci ratio.

Intermediate wave (2) may be an expanded flat correction. Minor wave A is a three, minor wave B is a three and a 1.28 length of minor wave A. This is within the normal range of 1 to 1.38.

At 1,183 minor wave C would reach 1.618 the length of minor wave A. This would be the most likely target. If price keeps falling through this first target, then the second target would be at 1,108 where minor wave C would reach 2.618 the length of minor wave A.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 1,046.27.

There are two structural options for minor wave C: either an impulse or an ending diagonal. Minor wave C does not look at this stage like an ending diagonal. It looks like the more common impulse.

Minute wave iv has begun and so far shows up on the daily chart with one green candlestick and one red doji. It is likely to be longer lasting than this; the structure on the hourly chart is most likely incomplete.

Minute wave iv may not move into minute wave i price territory above 1,269.07.

Draw a channel about minor wave C as shown in pink: the first trend line from the ends of minute waves i to iii, then a parallel copy on the high labelled minuette wave (ii) so that all downwards movement is contained.

Minute wave iv may find resistance at the upper edge of the pink channel. It may also find resistance at the lilac trend line copied over from the weekly chart, if it gets that high.

For this main wave count, minute wave iii is 5.05 short of 2.618 the length of minute wave i.

There are no adequate Fibonacci ratios between minuette waves (i), (iii), and (v) within minute wave iii.

Ratios within minuette wave (iii) are: there is no Fibonacci ratio between subminuette waves i and iii, and subminuette wave v is 2.64 short of 2.618 the length of subminuette wave i. Subminuette wave ii is an expanded flat and subminuette wave iv is a zigzag.

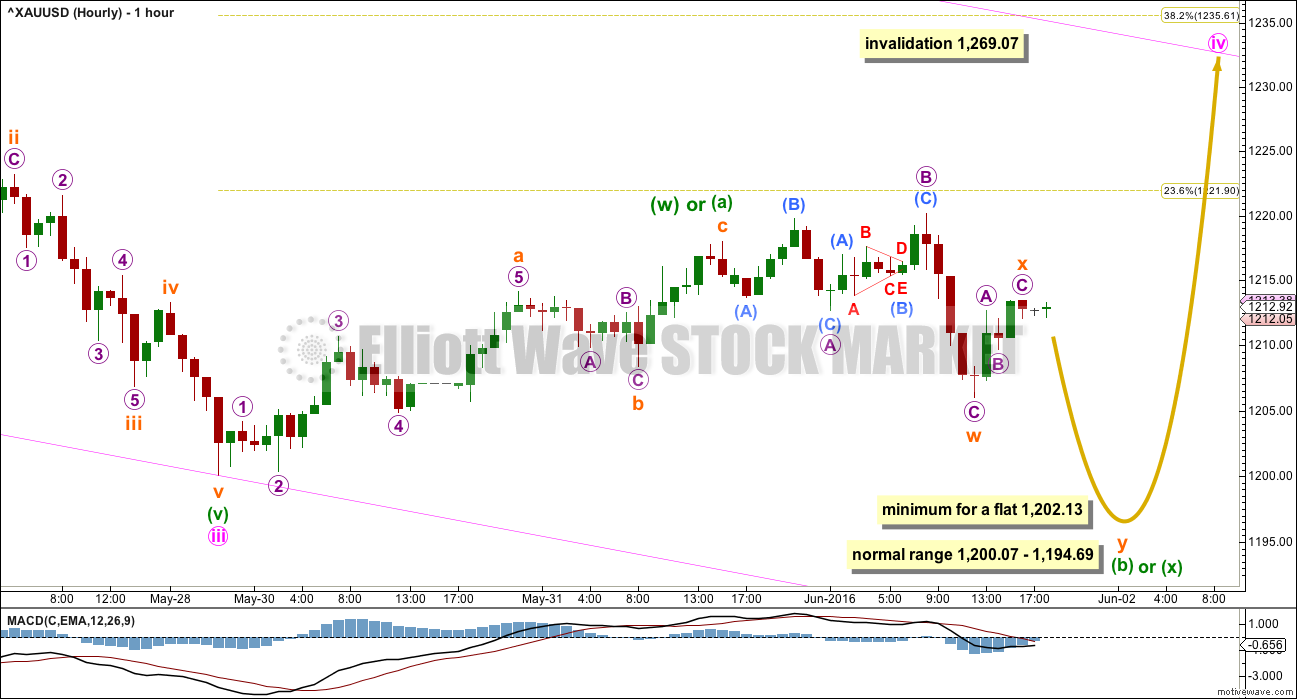

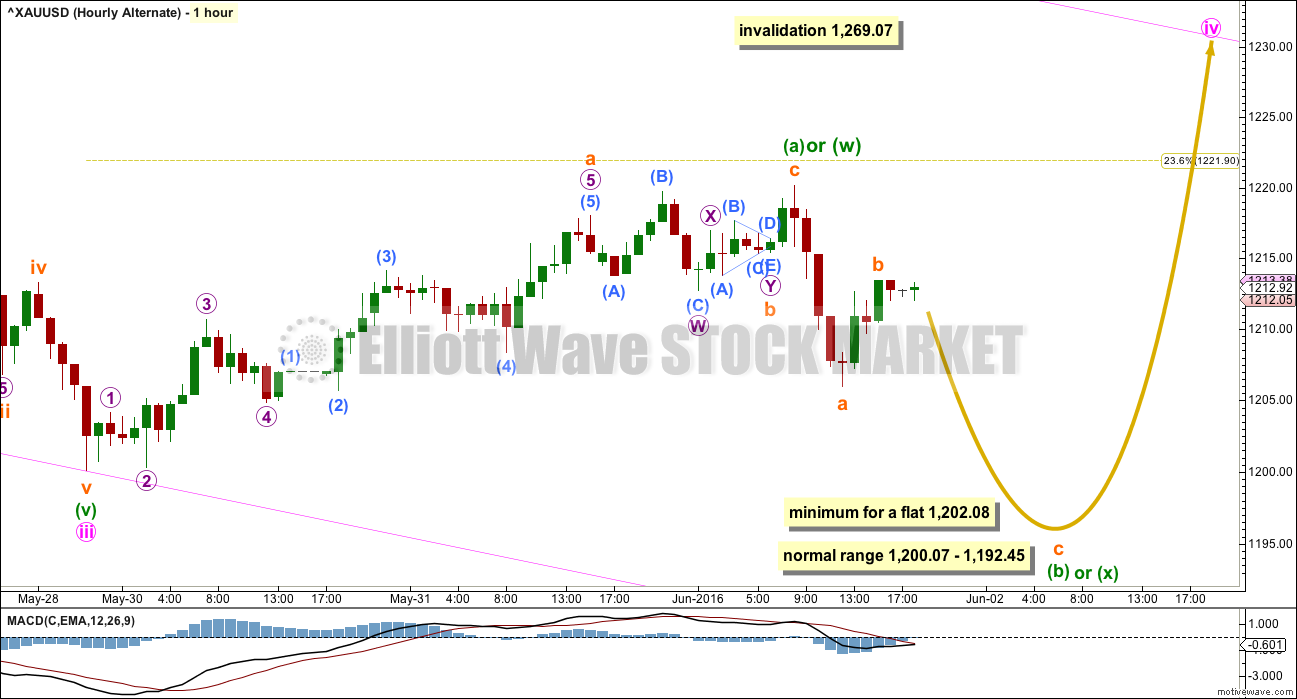

MAIN HOURLY ELLIOTT WAVE COUNT

Minute wave ii was a quick deep 0.76 zigzag lasting 23 hours. Given the guideline of alternation, minute wave iv is most likely to be a shallow sideways structure and may be more time consuming than 23 hours. Minute wave iv is most likely to be a flat, combination or triangle. It is most likely to end about either the 0.236 or 0.382 Fibonacci ratios, so targets at 1,222 and 1,236 are reasonable.

If minute wave iv unfolds as an expanded flat (which is a very common structure), running triangle or combination, then it may include a new low below its start at 1,200.07. A new low below this point in the next one or two sessions does not mean minute wave iv is over; it would more likely be a part of minute wave iv.

At this stage, there are still multiple structural possibilities for minute wave iv. Alternate wave counts and flexibility while this correction unfolds will be essential. It is impossible to tell with certainty which structure will unfold, so it is impossible for me to give you an accurate road map for how price will move during this correction. Small corrections do not present good trading opportunities; they should be avoided. They present an opportunity to join the trend at their completion, so analysis over the next few days will focus on identifying if minute wave iv could be complete and what price points will confirm its completion.

So far a zigzag upwards may be complete. This is most likely minuette wave (a) of a flat or triangle, or minuette wave (w) of a double combination.

If minute wave iv is a flat correction, then the minimum requirement for minuette wave (b) is to retrace 0.9 the length of minuette wave (a) at 1,202.13. If price reaches down to this point, then the minimum requirement will be met; the rule that minuette wave (b) must be at least 0.9 the length of minuette wave (a) will be met. This is not the same as the normal range for minuette wave (b).

If minute wave iv is a flat correction, then the normal length of minuette wave (b) is 1 to 1.38 the length of minuette wave (a). This gives a normal range of 1,200.07 to 1,194.69.

If minute wave iv is a triangle, there is no minimum nor maximum for minuette wave (b); it must only be a three wave structure. It may make a new low below the start of minuette wave (a) at 1,200.07 as in a running triangle.

If minute wave iv is a double combination, then the first structure in the double may be a complete zigzag. Minuette wave (x) has no minimum nor maximum requirement; it must only be a corrective structure and would most likely be deep. It is possible today that minuette wave (x) could be complete at today’s low labelled subminuette wave w.

I do hope that the various possibilities outlined in this text for this first chart make it clear that the pathway price may take over the next one to two days cannot be predicted with any accuracy. There are too many structural possibilities for this correction. Choppy overlapping sideways movement with an upward bias should be expected.

ALTERNATE HOURLY ELLIOTT WAVE COUNT

It is also possible to see a zigzag upwards complete at the last high. This may be a zigzag for minuette wave (a) of a flat correction, or minuette wave (a) of a triangle. It may also be a zigzag for minuette wave (w) of a double combination.

If minute wave iv is to be a flat correction, then minuette wave (b) within it must retrace a minimum 0.9 length of minuette wave (a) at 1,202.08.

If minute wave iv is to be a flat correction, then the normal range for minuette wave (b) is from 1 to 1.38 the length of minuette wave (a) giving a range of 1,200.07 to 1,192.45.

If minute wave iv is to be a triangle, there is no minimum nor maximum requirement for minuette wave (b). It may make a new low below the start of minuette wave (a) at 1,200.07 as in a running triangle.

If minute wave iv is to be a combination, there is no minimum nor maximum requirement for minuette wave (x). It must only subdivide as a correct structure which may be unfolding as a zigzag. X waves within combinations are normally quite deep and may make a new price extreme beyond the start of minuette wave (w) below 1,200.07.

ALTERNATE DAILY ELLIOTT WAVE COUNT

It is possible that intermediate wave (2) is over as a completed expanded flat. It would be a shallow 0.350 correction of intermediate wave (1) lasting 56 days, just one more than a Fibonacci 55. There would be no Fibonacci ratio between minor waves A and C.

For this alternate wave count, ratios within minor wave C are: there is no Fibonacci ratio between minute waves i and iii, and minute wave v is just 1.13 short of equality in length with minute wave i.

Within minute wave iii, there are no adequate Fibonacci ratios between minuette waves (i), (iii) and (v).

Ratios within minuette wave (iii) are: there is no Fibonacci ratio between subminuette waves i and iii, and subminuette wave v is 0.70 short of 0.618 the length of subminuett wave i. Subminuette wave ii is an expanded flat and subminuette wave iv is a regular contracting triangle.

On balance, there is no advantage for either wave count, this alternate or the main, in terms of Fibonacci ratios or alternation which would indicate one is more likely than the other.

What is problematic for this alternate is the structure of minuette wave (v): the fit on the hourly chart is not as neat for this alternate as it is for the main wave count. For this reason, in terms of Elliott wave, this alternate must be judged to have a lower probability. It requires confirmation with a new high above 1,269.07 before it may be used.

At 1,582 intermediate wave (3) would reach 1.618 the length of intermediate wave (1). No second wave correction may move beyond the start of its first wave below 1,200.07 within intermediate wave (3).

TECHNICAL ANALYSIS

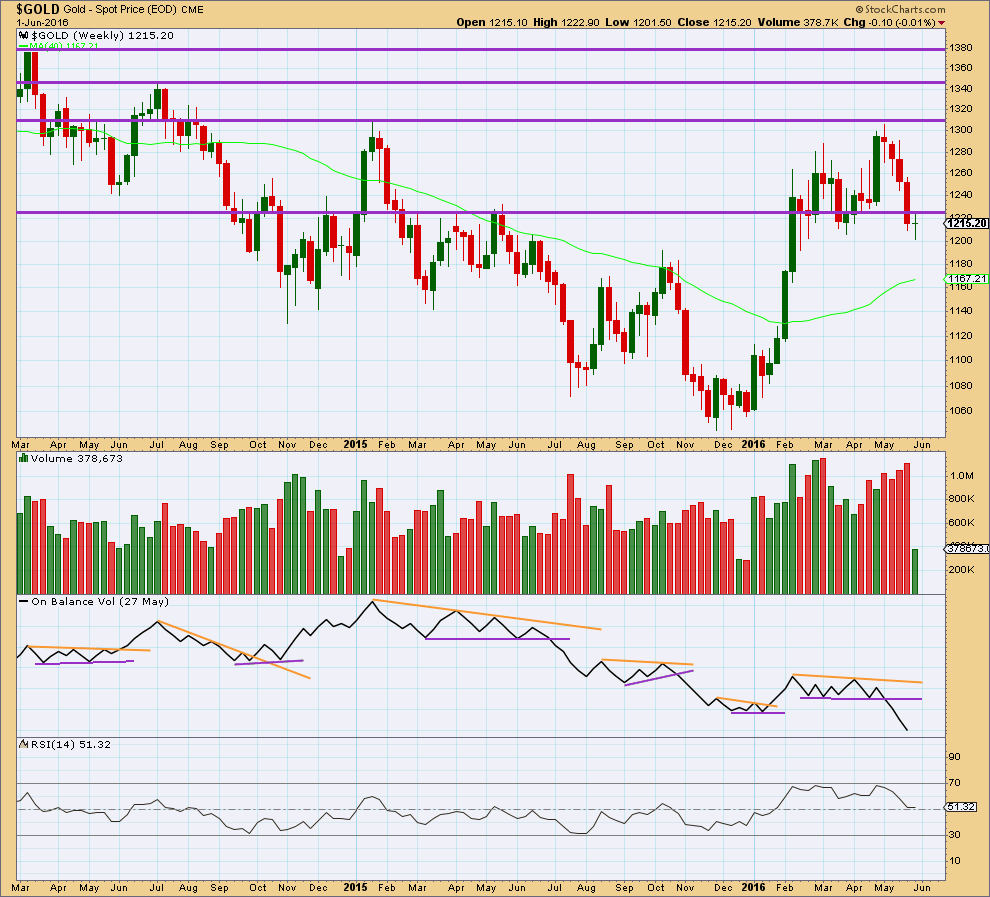

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On Balance Volume is breaking below a reasonably long held and clearly defined consolidation zone. It would be entirely reasonable to expect price to follow by continuing lower for a few weeks. This piece of evidence strongly supports the Elliott wave count.

Price has broken below and closed below support about 1,225. Price has fallen on increasing volume for four weeks in a row. This supports a downwards trend.

RSI is neutral. There is plenty of room for price to fall.

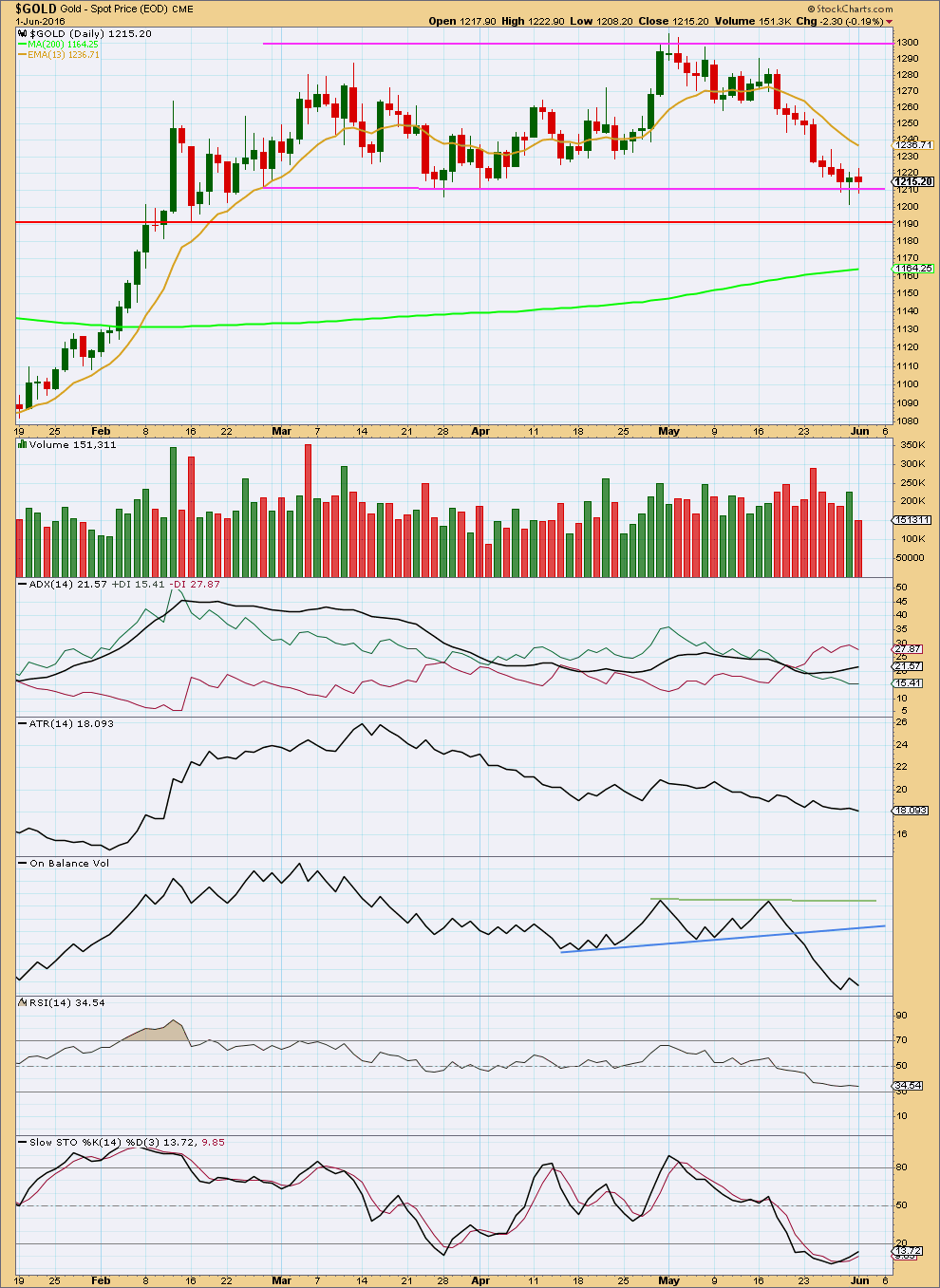

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

At this stage, classic technical analysis still looks like there may be a low in place. Yesterday’s green candlestick completed a hammer pattern at support. Today’s downwards movement is not supported by volume, so it looks to be corrective. This supports the alternate daily Elliott wave count.

It is entirely possible though that after the low of 31st May price could turn down to make one more final low as the main Elliott wave count expects. If that happens, then the next support line is about 1,190.

ADX still indicates a downwards trend is in place. ATR still disagrees which indicates this downwards movement from price over the last couple of weeks is more likely to be a counter trend movement than the start or continuation of a bear market.

On Balance Volume still has no useful nearby trend lines. Trend lines may be drawn and used after some more sideways movement from OBV. For now no divergence is noted between OBV and price.

RSI is not yet extreme and also exhibits no divergence with price. There is room for price to fall and RSI is not indicating a reversal here.

Stochastics has reached oversold and may be expected to return to neutral about here.

This analysis is published @ 08:53 p.m. EST.

Gold just dropped down to 1,206.97 at 6:38 pm.

Glad I didn’t buy today and hold any miners overnight.

Hopefully gold will drop overnight below the invalidation point of $1,200.07 of the alternate daily bullish wave count. Thanks to Janet Yellen and her Fed’s treat of raising US interest rates.

Perhaps this news Friday morning may pressure gold solidly below support at $1,200.

FRIDAY, JUNE 3 US News

8:30 am Nonfarm payrolls

This will be my preferred hourly wave count for todays analysis.

More choppy overlapping movement to complete minute wave iv.

This movement does not look impulsive so far, so at the hourly chart level price behaviour does not support the daily alternate wave count.

Despite some technical analysis looking like a low is in place, I think we will see one final low before the turn.

Another small range day, another small red candlestick within the price range of yesterday fits as part of a corrective movement.

I’ll be expecting more choppy overlapping sideways movement for at least one more day, and now it looks likely to be more protracted than originally expected.

FRIDAY, JUNE 3 US News

8:30 am Nonfarm payrolls

8:30 am Unemployment rate

8:30 am Average hourly earnings

8:30 am Trade deficit

9:45 am Markit services PMI

10 am ISM non-manufacturing

If you look at the hourly time frame on pmbull.com there is a triangle that’s been forming since May 25th.

Perhaps it may hopefully breakout down destroying miners values in an all day miners down 20% and gold crash down 5% to $1,183 for a miners discount heavenly shopping spree, where Cash is King. I may be dreaming about the discount.

If the triangle began at 1,217.67 then the final wave, E of the triangle, has to end above that point to effect a net retracement.

The high today was 1,217.39, slightly below the start of the triangle, so that can’t be the final wave E.

I don’t think that’s a triangle there.

Gold settles at more than 3-month low as Fed official reiterates hawkish view

– June 2, 2016 3:04 p.m. ET

Yellow metal slated to take its cue from U.S. dollar for now

http://www.marketwatch.com/story/gold-pressured-by-fed-rate-hike-expectations-2016-06-02

It looks like subminuette wave x and subminuette wave b may have continued higher overnight and ended up at $1,217.78 at 8:04 am high.

Perhaps gold may have ended a 5th wave down at 1,209.88 at 11:13 am to complete an A wave of an A-B-C down much lower today or Friday to 1202.08 or lower to maybe 1192.45 the lower normal range of the two hourly waves?

The miners quickly turning back up in about 30 minutes of start of a stall in the descent.

Any wave counts or comments?

Agree with your first part. Subminuette b / x ended at 1217.78.

Subminuette c / y has to be 5 waves. I counted 1209.88 as the third wave. Target should be around 1206-1205. Which begs the question: does this end Minuette B or is Minuette B continuing as a combination?

The 1205-1206 region is very important. If breached to the downside, it opens up the floodgate to 1183 or lower.

If respected, price could rise to test 1243.17 resistance levels. In that eventuality, first resistance could be the intraday EMA 50 at 1224.65. I am tempted to do a scalp if 1205-1206 holds.

Alan thanks for clarifying things. Good to know it’s a 5 wave count down to a possible 1206 – 1205 region. That’s the same as Wednesdays’ low of 1,206.02 at 12:05 pm.

If that region holds I’ll do a quick bullish trade on NUGT, but no overnighter $1,243 is quite high lately and different than Lara’s target for days.

NUGT is bullish now from 1 minute to 195 minute on MACD-SMA/EMA but gold is bearish from 1 to 195 minutes MACD-SMA/EMA.

I guess investors look at GDX and NUGT prices as bargains and still bullish gold so buying the dips.

It appears SM will break out to upside launching a new bull market to 2500.

NYA is showing a break above the handle of huge cup and handle is bullish.

This doesn’t appear relevant to gold but I would also dispute the technical analysis here even though I do not claim to be an expert!

The cup and handle formation mooted (which I don’t believe is actually a cup and handle) is not complete and has not been broken above. The volume is too low in the cup and the slow stochastics certainly do not suggest a break out.

In fact, you only have to look earlier in the chart (August to December last year) to see a chart set up almost identical to the current one, if somewhat shallower. In that case the result was a 15% drop.

If someone much better than me at technical analysis could confirm one way or the other!

It’s a slight variation on a rounded bottom. For that pattern (and so I’m assuming for a cup and handle also) volume should mirror price:

as price moves slowly lower it should come on declining volume, volume should be very light at the lows, then slowly increase as price slowly rises

this pattern should be identified at a larger time frame; daily at least, weekly or monthly more common

I wouldn’t label this particular example a cup and handle, it doesn’t have the slow curved bottom and volume doesn’t support it

my two cents worth anyway

I checked a lot of time frames on many indicators for Gold from 15 minutes up to a month and nothing really bullish right now that I feel would put more weight on the Bullish Daily alternate wave count.

Agreed. But most wouldn’t show until after it was well underway. That’s why I like Elliott.

I agree with both comments. Trend indicators maybe slow to react and EW is definitely amazing when it gets it right so I use both and more for confluence.

Hi Lara

I refer to your comment on the alternate daily having a problematic minuette v.

On my feed there was a slight lower low 5 hours after the first low. (see chart) Hypothetically, would that resolve your problem with minuette v?

Thanks

No.

The problem is further up.

This is how I’ve counted that movement for the alternate daily

And this is how I’ve counted the same movement for the main wave count

As you can see, the difference mainly is in how what is here subminuette v is counted

I’d much rather see it like this chart does; a long extension

I see. Thanks