Downwards movement was expected for Monday, but this is not what happened.

Price moved mostly sideways, and a small inside day closed green.

Summary: A small consolidation is completing, which may be an Elliott wave triangle or a multiple. The classic pattern equivalent may be a pennant. When the consolidation is done, the breakout is expected to be downwards but may not be very long in length or duration. The expected length may be about $28. RSI may be too close to oversold to allow a larger amount of downwards movement after the pattern is complete.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

The last published monthly chart may be seen here.

To fit daily charts into the bigger picture see last analysis of weekly charts here.

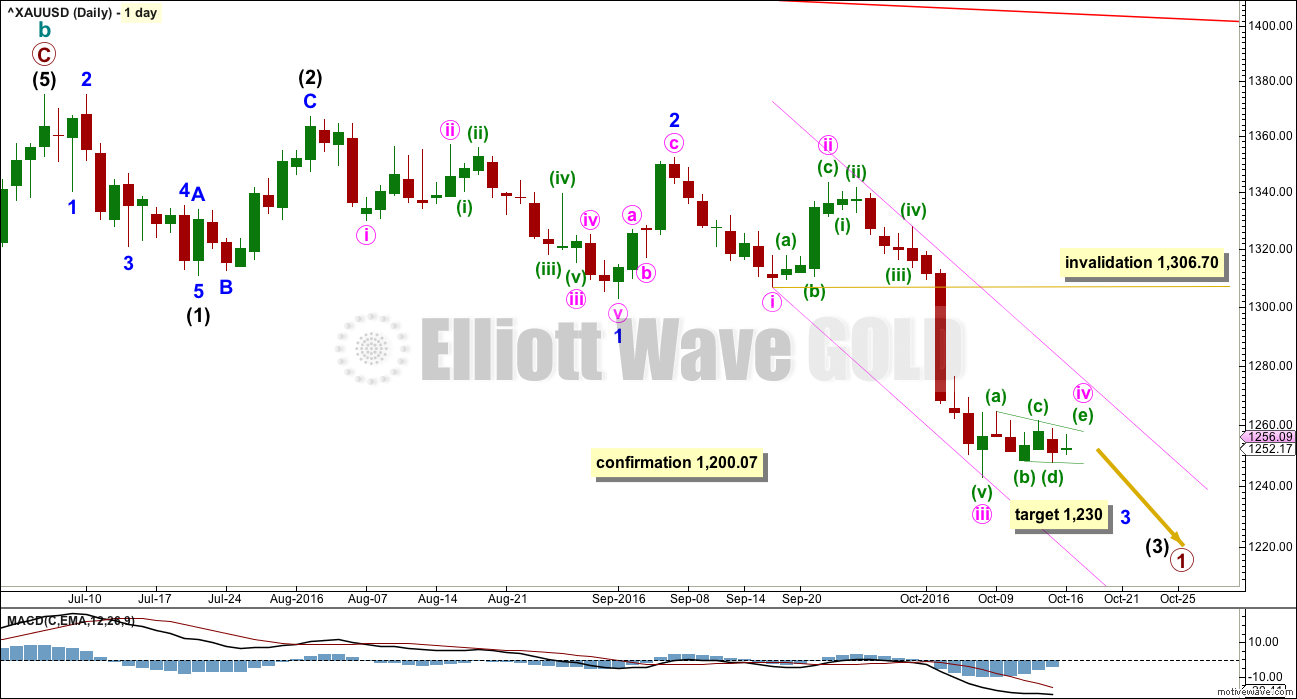

DAILY ELLIOTT WAVE COUNT

The movement up from the low of 1,046 on the 3rd of December, 2015, subdivides 5-3-5. Current downwards movement is too deep to reasonably be considered a second wave correction (that idea has been discarded based upon an exceptionally low probability), so the movement up from 1,046 is seen as a complete zigzag. This may be either the entirety of a correction, or it may be the first zigzag in a double zigzag. This main wave count looks at it as an entire correction.

If there has been a trend change at a large degree at the last high, then what looks like a rather obvious triangle must be ignored. It is possible that a series of three overlapping first and second wave corrections has unfolded, but this does look less likely than a triangle.

The triangle may not be labelled as a second wave because second waves do not take the form of triangles.

This wave count is reverted to see minor wave 3 incomplete and minute wave iv within it now unfolding. There is no Fibonacci ratio between minute waves i and iii.

Minute wave iv may not move into minute wave i price territory above 1,306.70.

Minute wave ii was a deep 0.81 zigzag lasting four days. Minute wave iv is least likely to be a zigzag to exhibit alternation and most likely to be a sideways flat, combination or triangle. It may last a bit longer than minute wave ii as sideways structures tend to be longer lasting than zigzags. It may last a Fibonacci five or eight days.

At this stage, at the hourly chart level, minute wave iv fits as a completed regular barrier triangle lasting a Fibonacci five days. If minute wave iv is a triangle, then the target for minute wave v needs to be recalculated. Gold’s fifth waves out of its fourth wave triangles are often surprisingly short and brief. At 1,230 minute wave v would reach 0.618 the length of minute wave i.

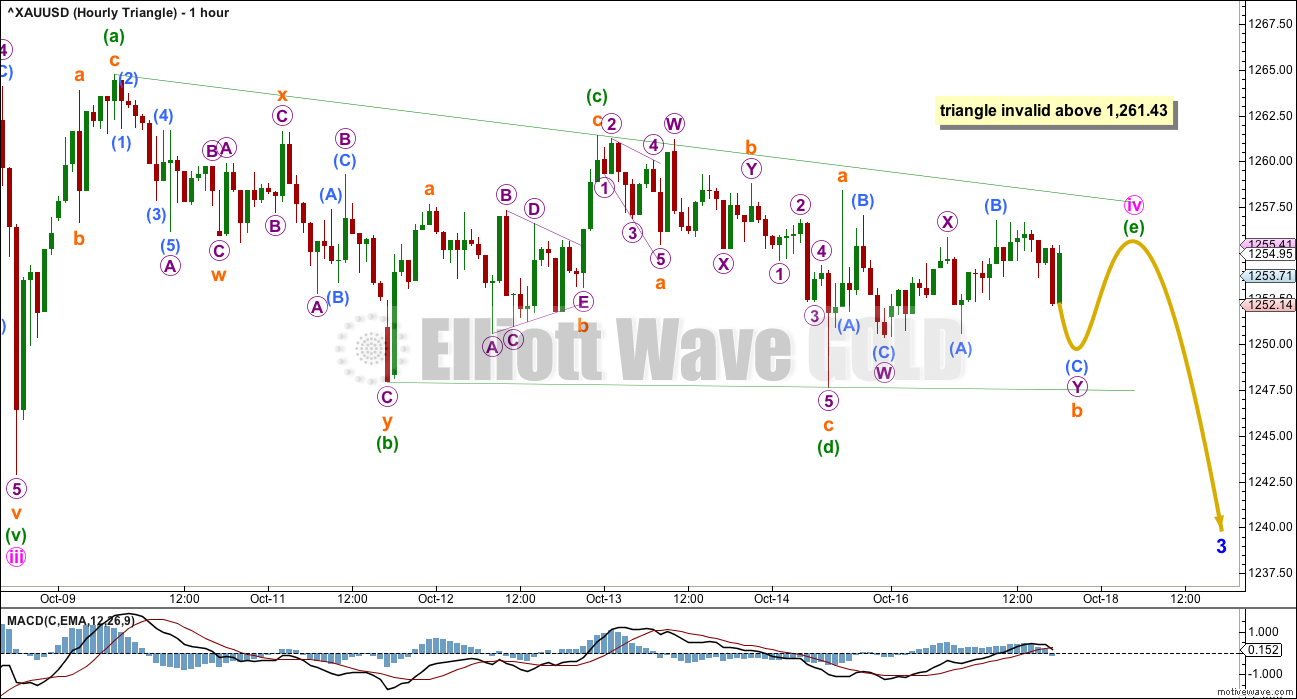

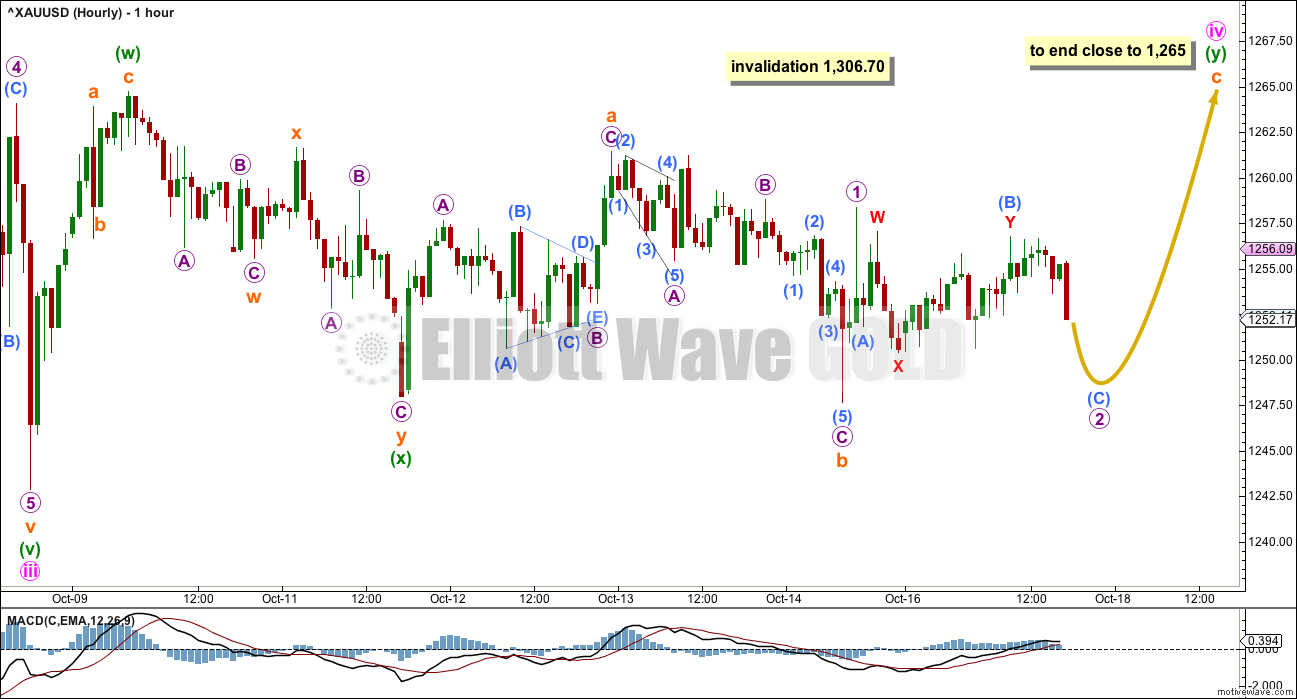

HOURLY ELLIOTT WAVE COUNT – TRIANGLE

Sideways movement for Monday’s session does not look like a short sharp downward thrust out of a triangle. If a triangle is forming, then it may still be incomplete.

The triangle is not supported by MACD hovering about zero; MACD is fluctuating too far above and below the zero line. MACD should sit very close to the zero line for it to support a triangle. This does not mean a triangle is not forming. It only means that the probability that a triangle is forming is slightly reduced.

This triangle may be a regular barrier triangle. Minuette wave (d) should end about the same level as minuette wave (b) within a barrier triangle, so that the (b)-(d) trend line is essentially flat. In practice this means that minuette wave (d) may end slightly below the end of minuette wave (b). This is the only Elliott wave rule which is not black and white.

The rule for the end of minuette wave (e) is black and white. Minuette wave (e) may not move beyond the end of minuette wave (c) above 1,261.43. The most common point for minuette wave (e) to end is a little short of the (a)-(c) trend line.

This wave count now expects a little more sideways movement to complete minuette wave (e) of the triangle. Thereafter, it still expects a short, sharp downwards thrust to last about one or two days and to be about $28 in length. This length would see minute wave v reach 0.618 the length of minute wave i.

If the triangle is invalidated with a new high above 1,261.43, then minute wave iv may be completing as a combination. A separate chart is provided for this possibility today.

HOURLY ELLIOTT WAVE COUNT – COMBINATION

If minute wave iv is unfolding as a combination, then the first structure in the double combination may have been a quick zigzag labelled minuette wave (w).

The double may be joined by a three in the opposite direction labelled minuette wave (x).

X waves within multiples may subdivide as any corrective structure, including a multiple. The rule stating the maximum number of corrective structures in a multiple refers to W, Y and Z. It does not include the X waves which move in the opposite direction and join the structures in the multiple (otherwise the maximum would not be three and would be five).

Within corrective structures of multiples labelled W, Y and Z, they may only be simple corrective structures labelled A-B-C (or A-B-C-D-E in the case of triangles). They may not be labelled themselves as multiples W-X-Y (X-Z) because to do so would increase the maximum beyond three and violate the rule.

The second structure in this possible double combination is labelled minuette wave (y) and may be unfolding as a regular flat correction. Within minuette wave (y), subminuette wave a is a three wave structure and subminuette wave b is also a three wave structure, at 1.02 length of subminuette wave a, indicating a regular flat.

Subminuette wave c would be very likely to move at least slightly above the end of subminuette wave a at 1,261.43 to avoid a truncation.

Minuette wave (y) would be likely to end about the same level as minuette wave (w) at 1,265 to achieve the purpose of a double combination, which is to take up time and move price sideways.

If the triangle is invalidated, then only a little more upwards movement would be expected to end this correction for minute wave iv.

If minute wave iv does not complete as a triangle, then minute wave v downwards after it may not be short and brief. It may more likely be equal in length with minute wave i, which was 45.49 in length.

Minute wave iv may not move into minute wave i price territory above 1,306.70.

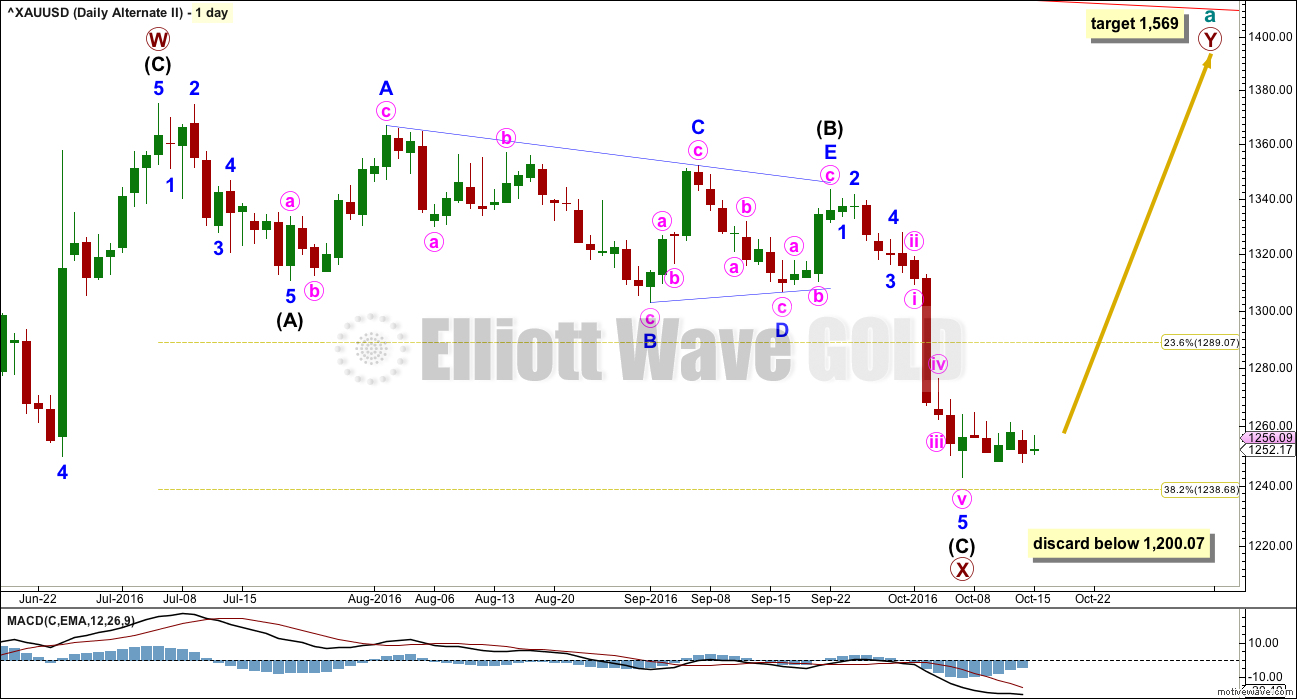

ALTERNATE II DAILY ELLIOTT WAVE COUNT

What if the zigzag upwards from the low of 1,046 on the 3rd of December, 2015, is only the first zigzag in a double?

There is no rule stating a limit for X waves within double zigzags or double combinations. To achieve the purpose of a double zigzag, which is to deepen a correction, their X waves should be relatively brief and shallow. It would be highly unusual and defeat the purpose if primary wave X moved beyond the start of intermediate wave (C) of primary wave W below 1,200.07. This wave count should be discarded below that point.

Primary wave X is seen as a zigzag. Within primary wave X, intermediate wave (B) fits neatly as a triangle. This is supported by MACD hovering about zero as it unfolded. Any wave count which sees a triangle in this position should have a higher probability than a wave count which does not.

The zigzag downwards for primary wave X may again be complete, at all time frames. A target for primary wave Y upwards would be about 1,569 where primary wave Y would be about even in length with primary wave W.

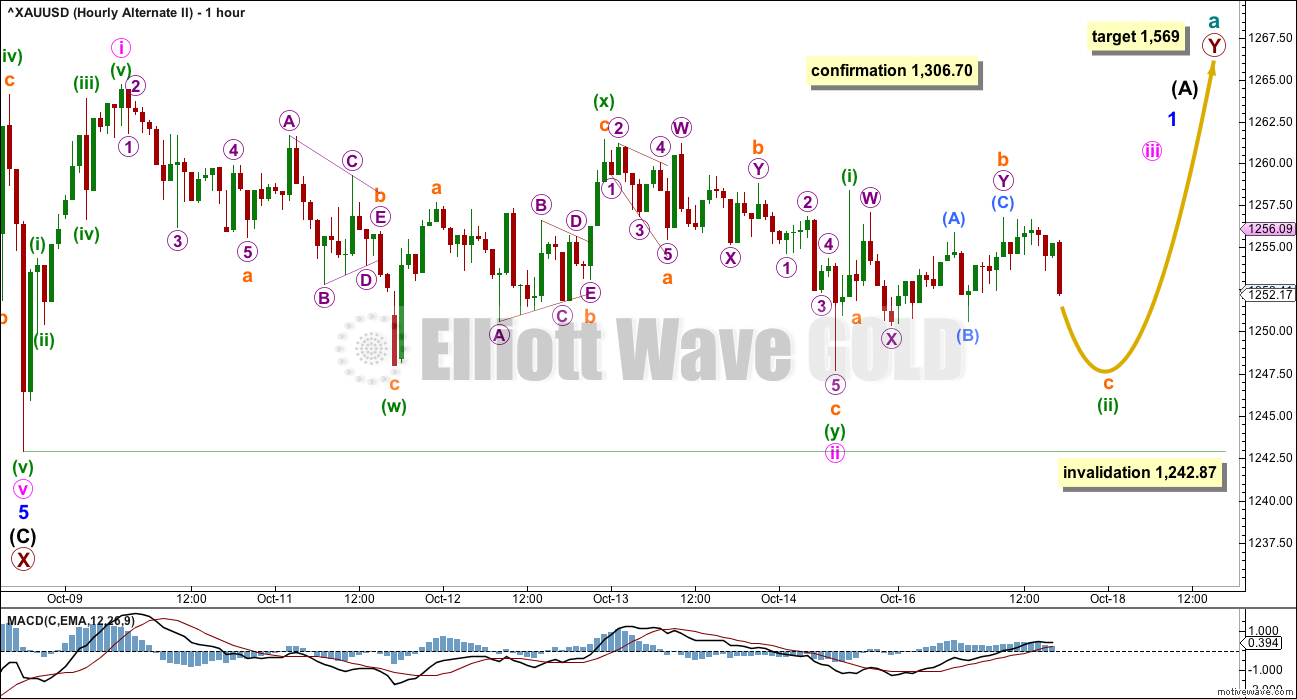

ALTERNATE II HOURLY ELLIOTT WAVE COUNT

With price moving sideways for a few days now, in a small range, it does not look like a new upwards trend is beginning. If a new upwards trend had begun, price should be moving clearly higher with five wave structures upwards and three wave structures downwards.

Minute wave i does subdivide best as a five wave structure. This does slightly increase the probability of this wave count.

Minute wave ii fits as a double zigzag, but the second zigzag in the double labelled minuette wave (y) has barely deepened the correction. The double zigzag has not achieved its purpose thus far, so minute wave ii does not have a clear slope (moved sideways) and does not look like a double zigzag.

At 1,569 primary wave Y would reach equality in length with primary wave W.

If minute wave ii continues any lower, it may not move beyond the start of minute wave i below 1,242.87. This wave count may be discarded below this point.

TECHNICAL ANALYSIS

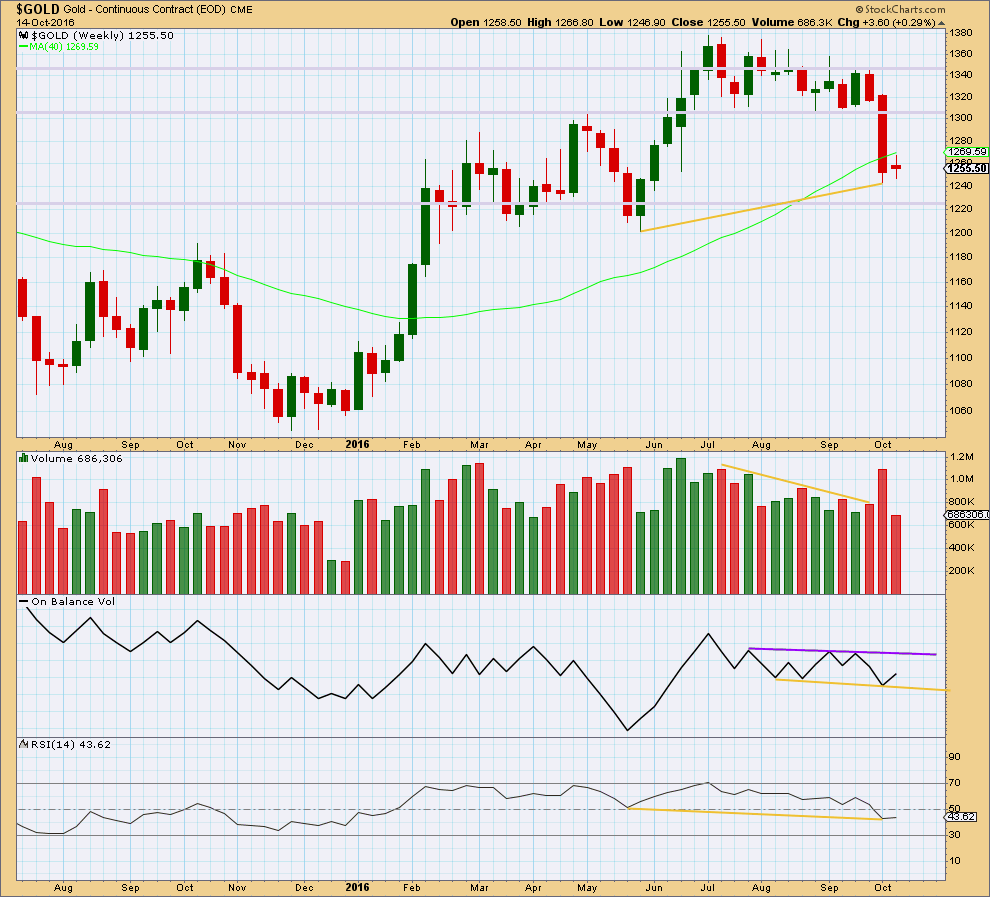

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A small range week with light volume indicates a pause within a new downwards trend.

On Balance Volume remains constrained within support and resistance lines. These lines are slightly redrawn this week.

There is still mid term divergence between price and RSI: price has made a higher low, but RSI has made a lower low (yellow lines).

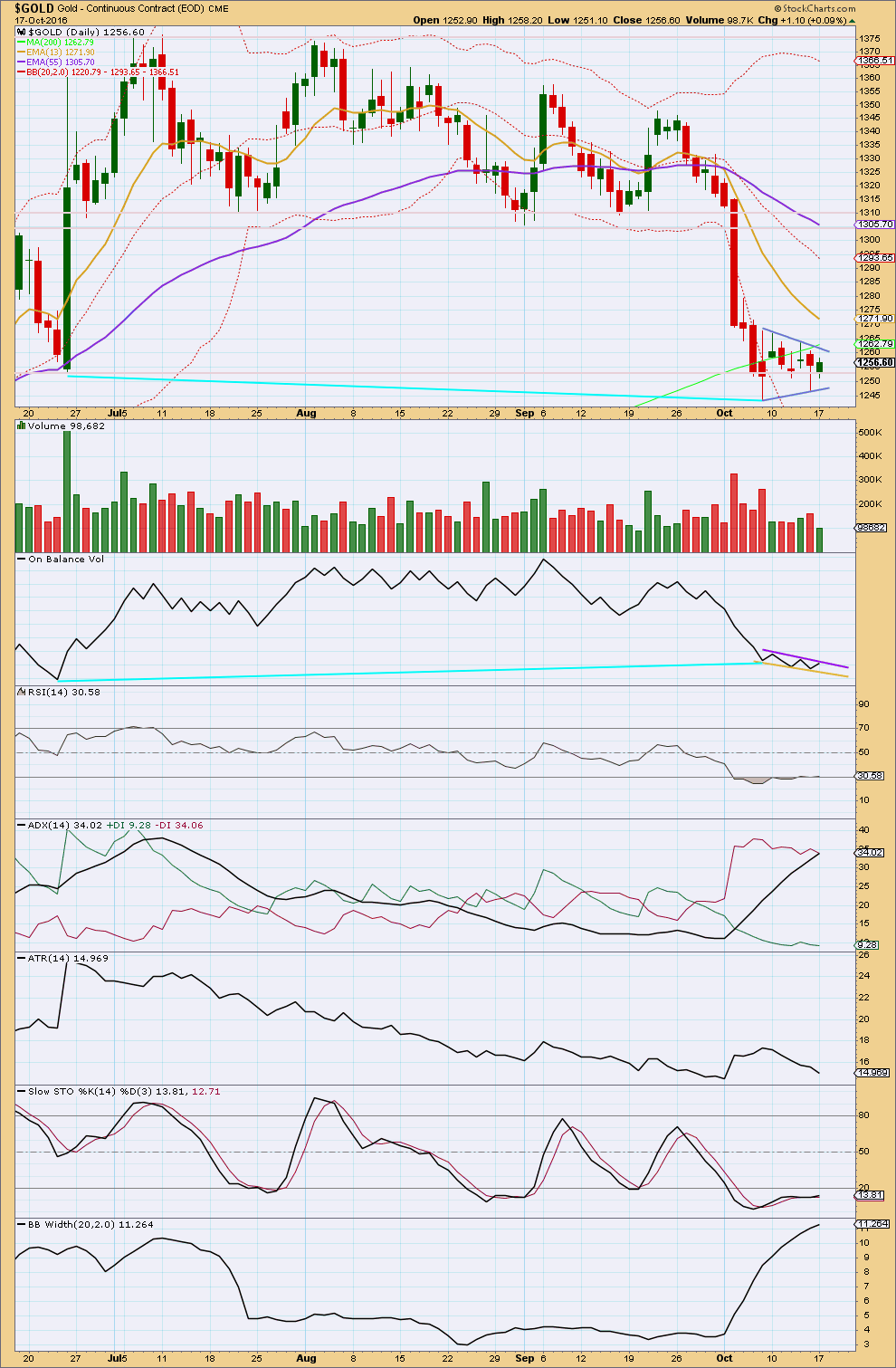

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A small pennant pattern may be forming, but it still needs one more point for the lower trend line to be drawn across before it would look like a typical pennant. This point may come if a little downwards movement comes to touch the lower blue trend line.

Pennants are the most reliable of all consolidation patterns, particularly if they form within 15 days. They should be short term and are almost always characterised by a decline in volume.

Volume today is much lighter, so this may support the idea of a small pennant forming.

During this small consolidation, it is a downwards day which has strongest volume suggesting a downwards breakout may be more likely than upwards when the pattern is complete.

Using the measured rule, the movement out of the pattern may be expected to be about $105 in length. This would give a target much lower then the Elliott wave count. Extreme oversold conditions may not allow for a movement of this length to be achieved.

Trend lines on On Balance Volume are redrawn today as there are now two points for a resistance line and two for a support line. If OBV breaks out of this small range, it may precede a breakout from price.

The small consolidation of the last six days has returned RSI to normal but only just. There is very little room for downwards movement.

ADX continues to increase signalling a downwards trend is in place. Bollinger Bands continue to widen in agreement that the market is trending.

ATR disagrees. This may be due to the small consolidation within the trend, which is currently completing.

This consolidation has not managed to return Stochastics from oversold.

This analysis is published @ 07:26 p.m. EST.

This is what i have so far. Micro 4 may not overlap micro 1 price territory below 1,258.38.

After one more high this could be done.

So it is not a triangle, it’s morphed into a combination.

My problem this morning is the structure of subminuette c complete. I can’t.

The high of micro 1 has been overlapped by the last low during this session. So that can’t be micro 4.

It won’t fit as a diagonal because the third wave would be too long.

So the conclusion must be this structure is incomplete and will need one more high at least before it’s done.

Gold futures climb toward a two-week high

Oct 18, 2016 11:28 a.m. ET

http://www.marketwatch.com/story/gold-tries-for-back-to-back-gain-as-dollar-pulls-off-multimonth-high-2016-10-18

Looking good for the bulls. GDX cup and handle bottom pattern projects to about 25.5 where the gap is. Also could be an inverted H&S

Wall Street marks biggest rush to cash since Brexit, 9/11

Oct 18, 2016 11:04 a.m. ET

http://www.marketwatch.com/story/rush-to-cash-at-highest-since-brexit-911-2016-10-18

Flight to cash may be a contrarian bullish signal, says BAML

The other Main Hourly takes over to end close to 1,265.

Gold at Barchart has already hit a morning high of 1,263.48 at 8:37 am.

Gold dropped to 1256.56 at 9:39 am then back up to 1262.89 at 11:43 am.

Gold may be about to begin today it’s decent down about $45.49.

Or else Alan gave “Once price rises above 1264.72, the bull move ought to be underway.”

Main hourly Triangle has been invalidated above 1261.43 so now the other Main Hourly takes over to end close to 1,265.

Gold at Barchart has already hit a morning high of 1,263.48 at 8:37 am

However Lara mentioned with this count then there may be a drop of $45.49 in length to end minute v.

The bearish count is not invalidated until above 1306.70.

“If the triangle is invalidated, then only a little more upwards movement would be expected to end this correction for minute wave iv.

If minute wave iv does not complete as a triangle, then minute wave v downwards after it may not be short and brief. It may more likely be equal in length with minute wave i, which was 45.49 in length.”

With the rise above 1261.43, the triangle is invalidated. The combination is in play, just as I proposed last week.

With the triangle out of the way, let’s see if the Alternate 2, or some other bullish scenario, may be in play in the future. I just can’t reconcile with the bearish scenario.

I agree. I though we might get one more quick move down, but with the consolidation lasting many days, and now with an upwards break, I think another multi month bull move may be in it’s infancy.

Once price rises above 1264.72, the bull move ought to be underway. This is because that was where Minute 1 reached.

The only proviso is that Minute 2, if it continues, is not an expanded flat.

Triangle hourly invalidated. Hourly combination could be in play -or- the bottom could be in and up we go.

While I’m still cautious, I think the bottom may be in. There’s not much resistance until above 1,300. We could move up quickly.

I love the bottomed scenario. I’m just trying to find a wave profile that fits it.

Lara I just spotted an unusual TYPO.

The DAILY ELLIOTT WAVE COUNT in today’s analysis is actually yesterday’s however when you click on it, when it enlarges it magically turns into today’s Daily wave count. Strange but true, I already checked it many times.

Oops! Sorry Richard. There are two bits of code. One bit for how it shows in the body of the text, and another for how it shows when you click on it. Will fix.

Thank you.