A small correction finds support exactly where expected, at the upper edge of the base channel.

Summary: Each time support is found is another opportunity to join the upwards trend. The low today was a perfect opportunity. The target is now about 1,375, or just below.

Corrections are an opportunity to join the trend. Stops should always be used; set now just below 1,325.67. Manage risk by investing only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

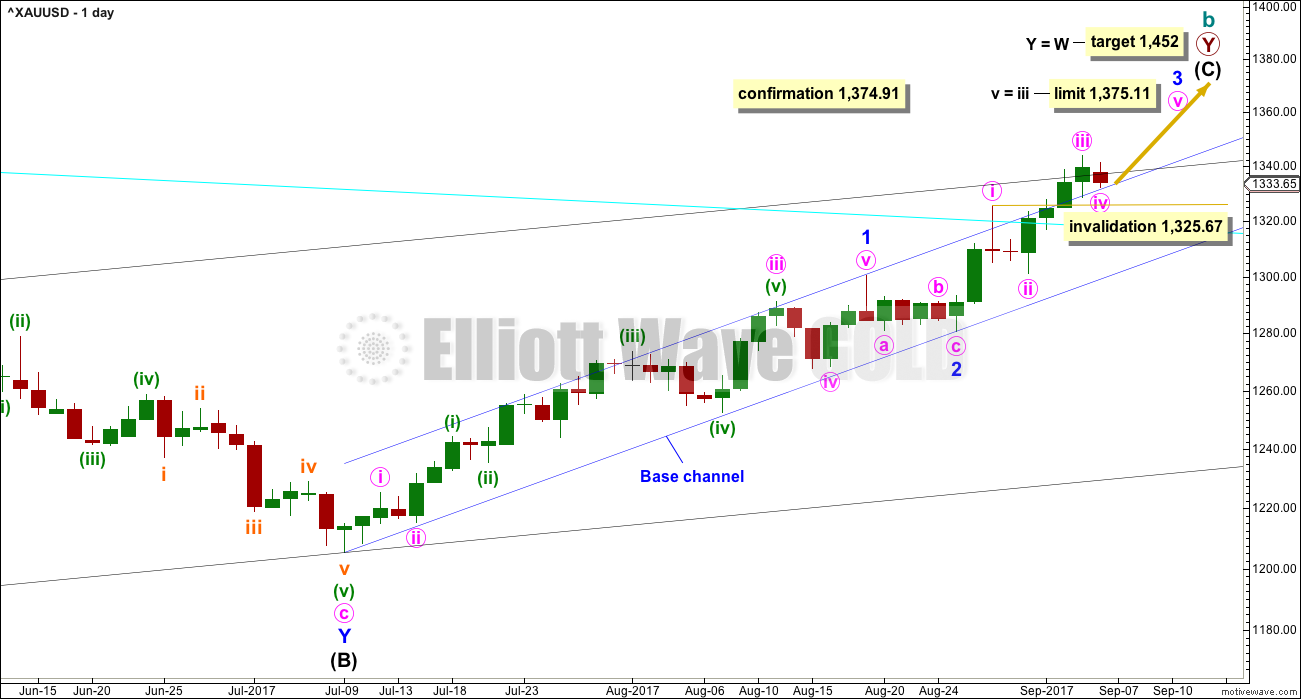

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

There is strong support from classic technical analysis for this wave count. Now that price has fully broken above the Magee trend line and has broken out above a consolidation zone, with support from volume, this wave count will now be the main wave count.

There are more than 23 possible corrective structures that B waves may take, and although cycle wave b still fits best at this stage as a triangle, it may still be another structure. This wave count looks at the possibility that it may be a double zigzag.

If cycle wave b is a double zigzag, then current upwards movement may be part of the second zigzag in the double, labelled primary wave Y.

The target remains the same.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41.

There are two problems with this wave count which reduce its probability in terms of Elliott wave:

1. Cycle wave b is a double zigzag, but primary wave X within the double is deep and time consuming. While this is possible, it is much more common for X waves within double zigzags to be brief and shallow.

2. Intermediate wave (B) within the zigzag of primary wave Y is a double flat correction. These are extremely rare, even rarer than running flats. The rarity of this structure must further reduce the probability of this wave count.

Although this wave count still has these problems, technical analysis now points to it being more likely. The alternate will continue to be considered until price invalidates it.

DAILY CHART

Intermediate wave (C) may be unfolding as an impulse.

Within the impulse, minor waves 1 and 2 would now be complete.

Minor wave 2 may have ended as a relatively brief shallow second wave. It is unusual for second wave corrections to be this shallow. If my analysis of intermediate wave (C) is wrong, it may be in labelling minor waves 1 and 2 already over. It is possible that only minor wave 1 was over at yesterday’s high. If price moves below 1,325.67 at this stage, then I would expect a deeper more time consuming correction which would be labeled minor wave 2.

With minor wave 1 a very long extension, the Fibonacci ratio of equality is used for a target for minor wave 3 now.

Price has been doing some work here to overcome resistance. First resistance at the cyan Magee trend line, then resistance at the upper edge of the dark blue base channel, and resistance again now about the upper edge of the black Elliott channel copied over from the weekly chart. It may be that once this resistance is overcome the end of this third wave may proceed with strength.

There are now two daily candlesticks above the base channel and touching the upper edge. This is exactly how a third wave should behave and adds a little confidence to this wave count.

Minute wave iii may be over. Today’s correction may be minute wave iv. Minute wave iv may not move into minute wave i price territory below 1,325.67.

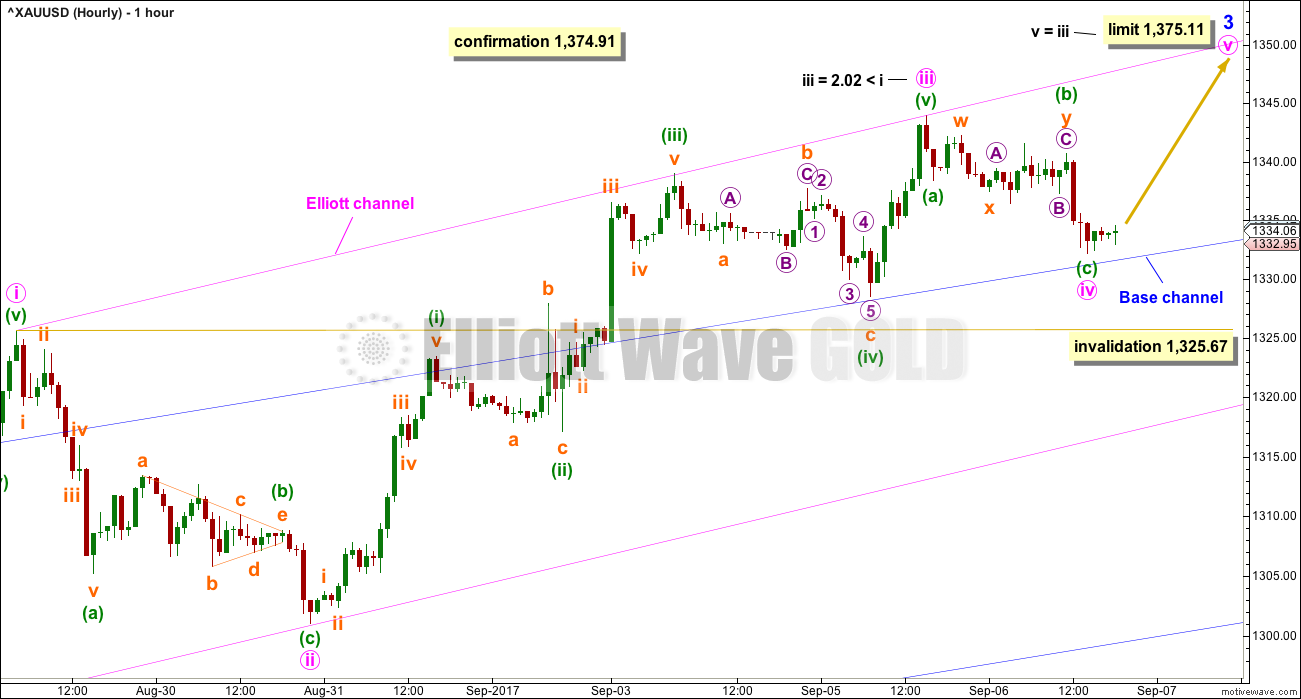

HOURLY CHART

The degree of labelling within the last upwards wave is moved up one degree today to see minute wave iii complete. Minute wave iii has strong support from volume and ended with a blow off top (if volume data for yesterday’s session from StockCharts is to be believed). This is typical for the end of Gold’s third waves.

The correction for minute wave iv now shows up on the daily chart as one red candlestick. Minute wave ii also shows up on the daily chart. At the daily chart level, this wave count has the right look.

Now that price has breached the upper edge of the base channel and is finding support there, it should continue to do so while minor wave 3 is still continuing.

Minute wave v may exhibit stronger momentum. It may reach close to equality with minute wave iii at 1,375.11, but it may not be longer. Minute wave iii may not be the shortest actionary wave within the impulse of minor wave 3. About 1,375 minor wave 3 would also reach equality with minor wave 1.

Use the pink Elliott channel to indicate where minute wave v may end. It may find resistance at the upper edge.

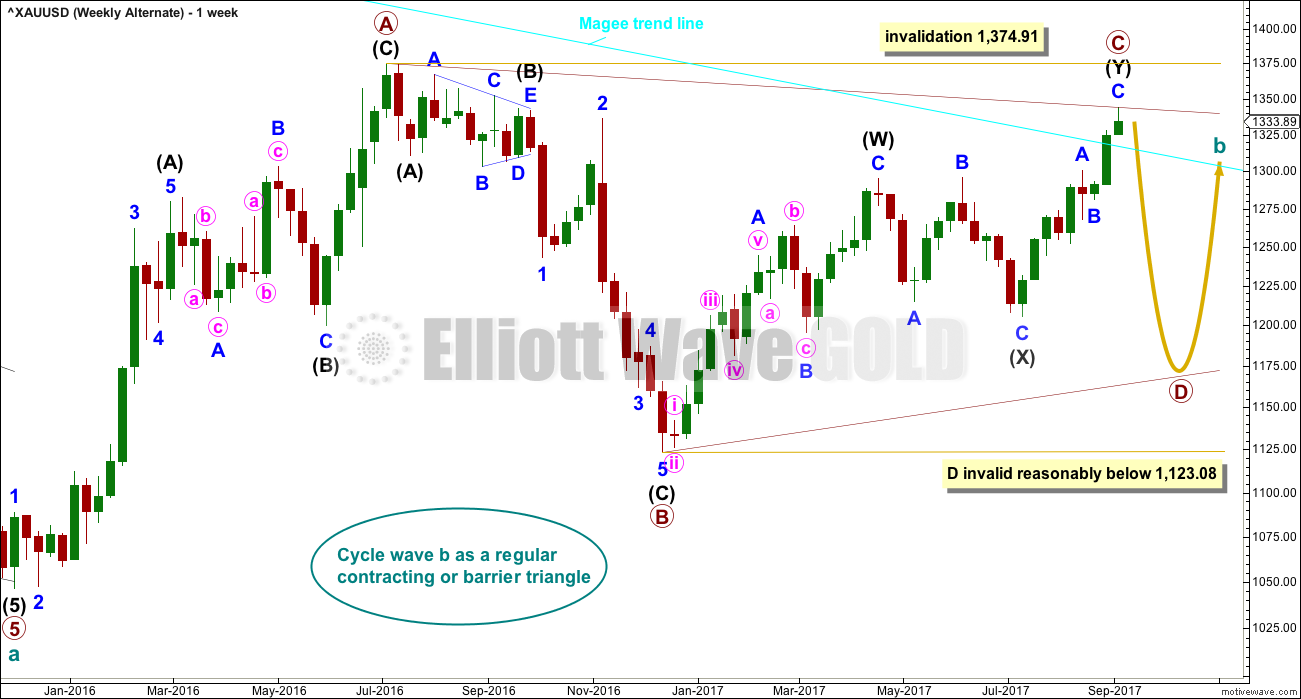

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

Price has breached the Magee trend line. This is now an alternate wave count. It remains valid, but classic technical analysis points to it now having a lower probability.

The Magee bear market trend line is drawn from the all time high for Gold on the 6th of September, 2011, to the first major swing high within the following bear market on the 5th of October, 2012.

To use this trend line in the way Magee describes, we should assume that price will find resistance at the line if it gets back up there. Now that the line is breached (by at least one or two full daily candlesticks above it), it is signalling a major trend change from bear to bull.

At this stage, a triangle still looks possible and has the best fit for cycle wave b. It has strong support from declining ATR and MACD hovering about zero at the weekly chart level.

Within a triangle, one sub-wave should be a more complicated multiple, which may be primary wave C. This is the most common sub-wave of the triangle to subdivide into a multiple.

Intermediate wave (Y) now looks like a developing zigzag at the weekly chart level, and minor wave B within it shows up with one red weekly candlestick.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08. Contracting triangles are the most common variety.

Primary wave D of a barrier triangle should end about the same level as primary wave B at 1,123.08, so that the B-D trend line remains essentially flat. This involves some subjectivity; price may move slightly below 1,123.08 and the triangle wave count may remain valid. This is the only Elliott wave rule which is not black and white.

Finally, primary wave E of a contracting or barrier triangle may not move beyond the end of primary wave C above 1,295.65. Primary wave E would most likely fall short of the A-C trend line. But if it does not end there, then it can slightly overshoot that trend line.

Primary wave A lasted 31 weeks, primary wave B lasted 23 weeks, and primary wave C started its 38th week. A double zigzag may be expected to be longer lasting than single zigzags within a triangle, and so this continuation of primary wave C is entirely acceptable and leaves the wave count with the right look at this time frame.

DAILY CHART

The cyan Magee trend line has now been breached. This must reduce the probability of this wave count.

A breach of the blue Elliott channel by downwards movement would indicate a trend change.

The structure of minor wave C may now be complete. It may also continue a little higher.

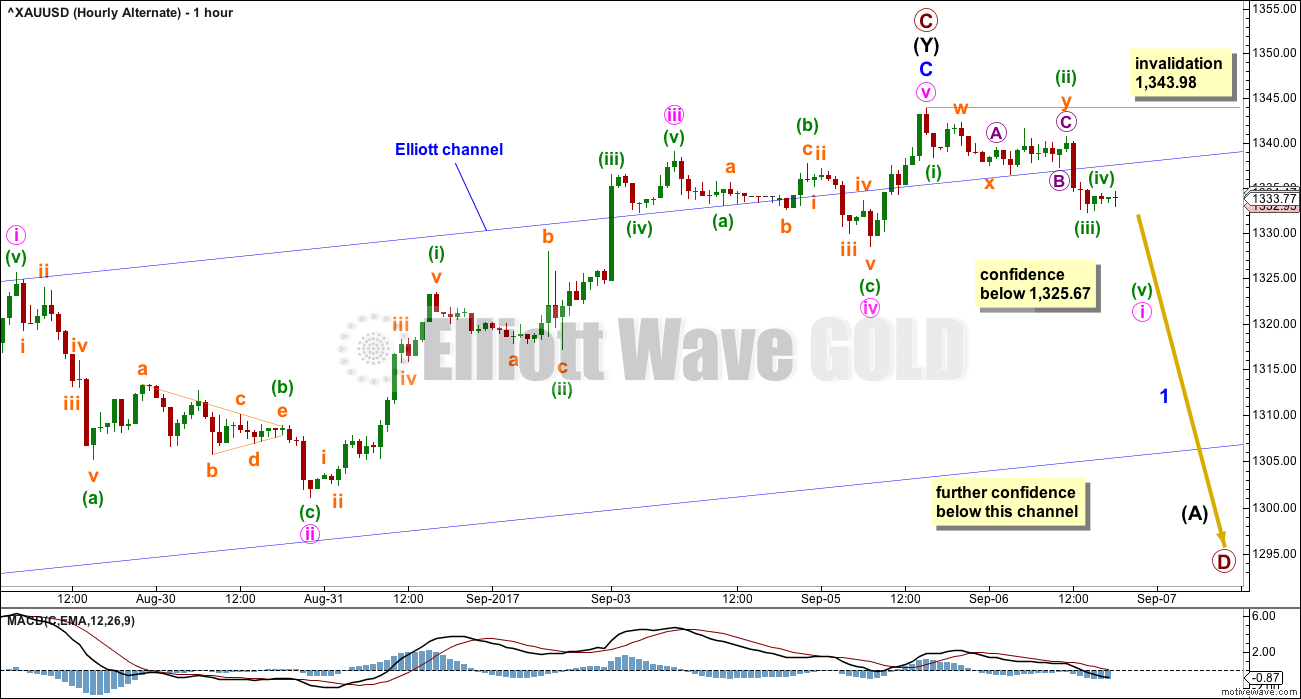

HOURLY CHART

This hourly chart shows the same piece of movement as the hourly chart for the main wave count.

It is now possible today that primary wave C could be over here or very soon.

For the short term, this wave count fits reasonably well with MACD. Minute wave iii is weaker than minute wave i, and minute wave v is the weakest. The strongest portion of the histogram is within the third wave.

If price moves lower and breaks back into the blue Elliott channel (which is exactly the same as the base channel on the main hourly chart), then this wave count should be considered. It would be possible a high is in place.

TECHNICAL ANALYSIS

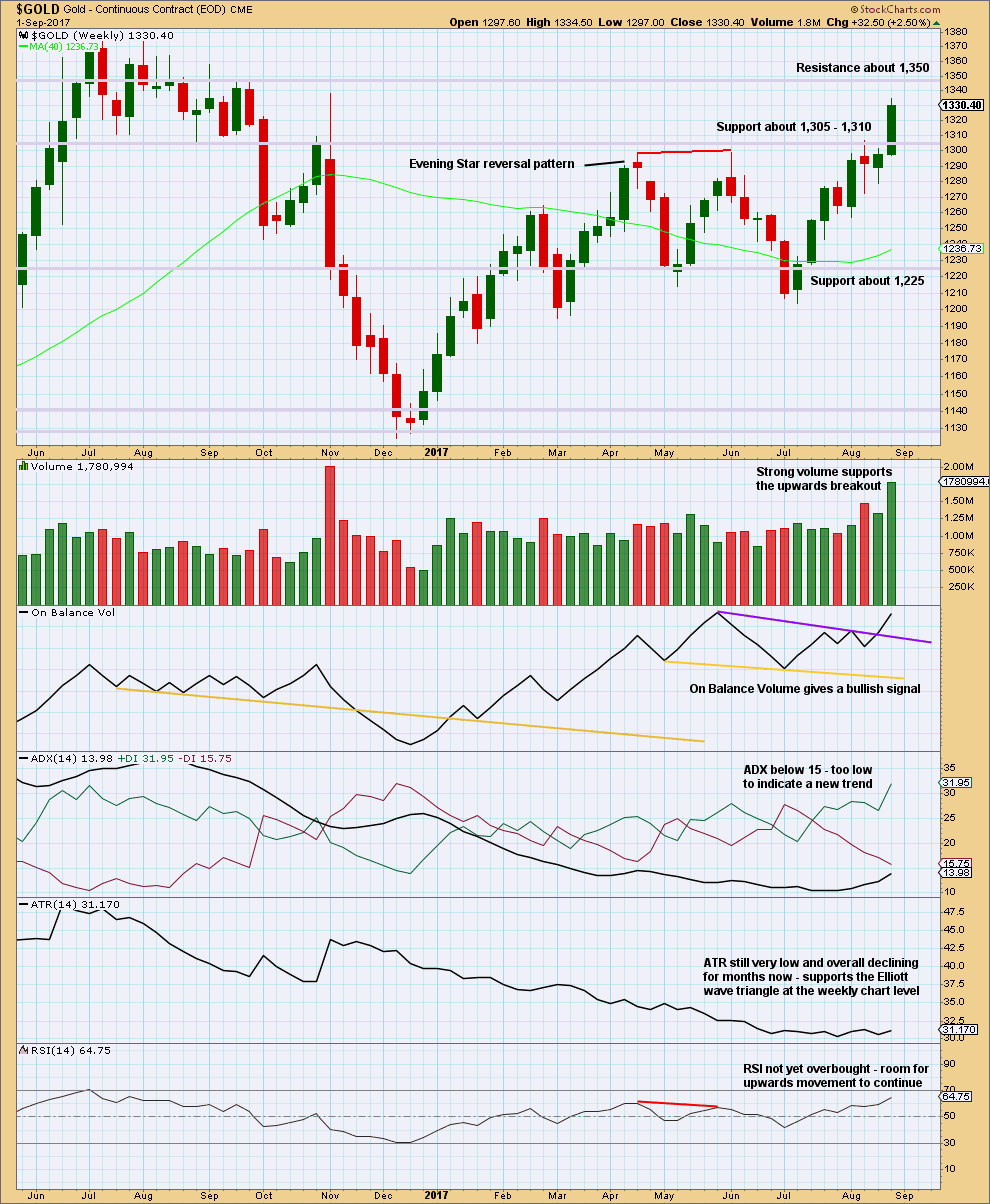

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price has closed last week above the consolidation zone, which began back in February this year. The close above resistance comes with a week of strong volume. This is a classic upwards breakout supported by volume.

It is very common after an upwards breakout to see price curve down to test support which was prior resistance. Look out for a pullback to find support now about 1,305 to 1,310. Thereafter, price should turn up and move strongly higher.

If price behaves like this, it would offer a good opportunity to join the trend at a good price. This does not always happen, but it happens much more often than it does not.

On Balance Volume gives a weak bullish signal. ADX continues to rise, but is not high enough yet to indicate an upwards trend. RSI indicates there is room still for price to rise.

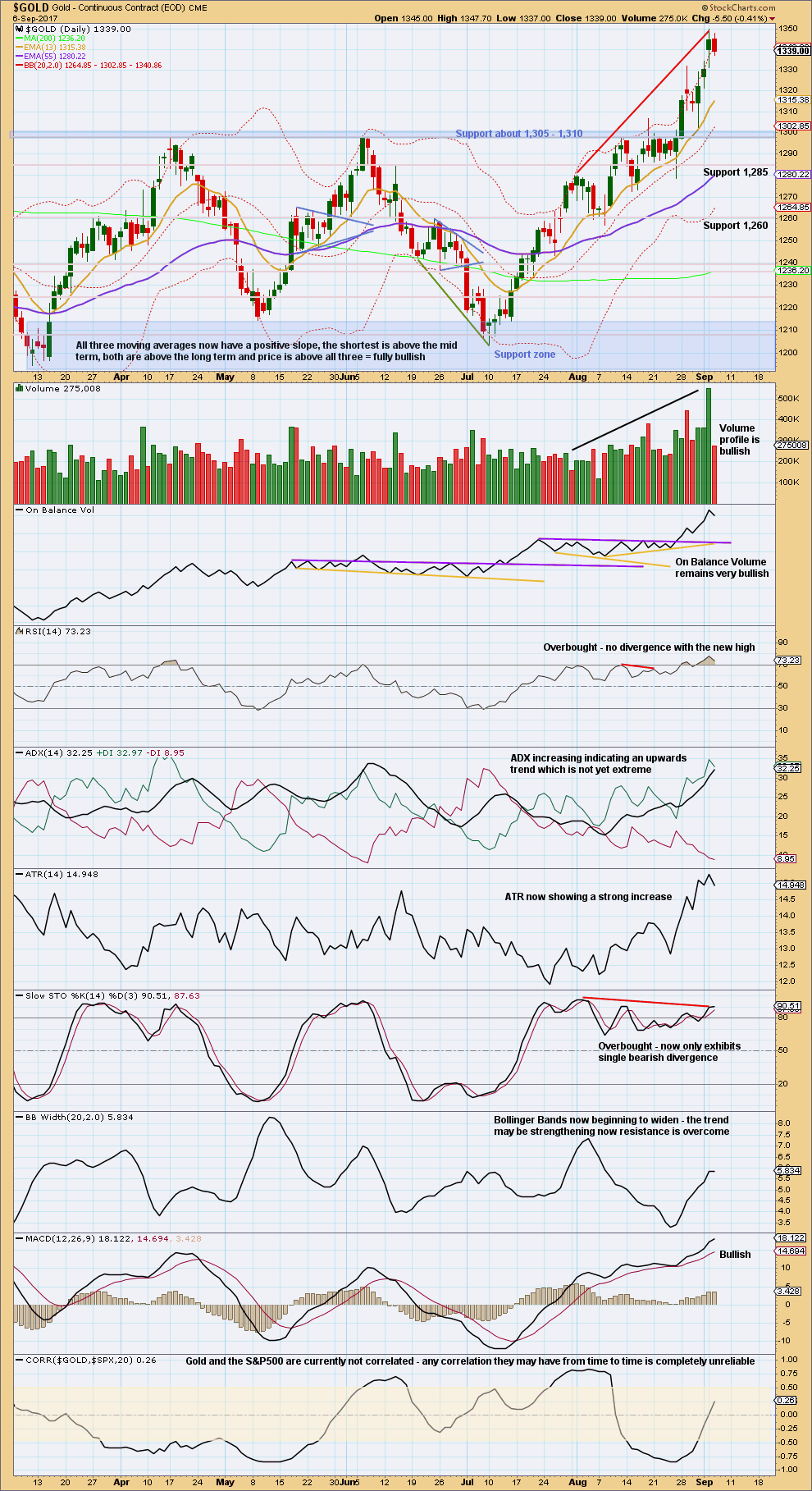

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Yesterday’s session looks like a blow off top now followed by a small downwards correction. Blow off tops are usually followed by a consolidation and then the trend continues and begins to exhibit weakness.

So far the only weakness in this trend is single divergence with Stochastics.

To expect this trend is over we should see divergence between price and RSI, and / or a bearish signal from On Balance Volume.

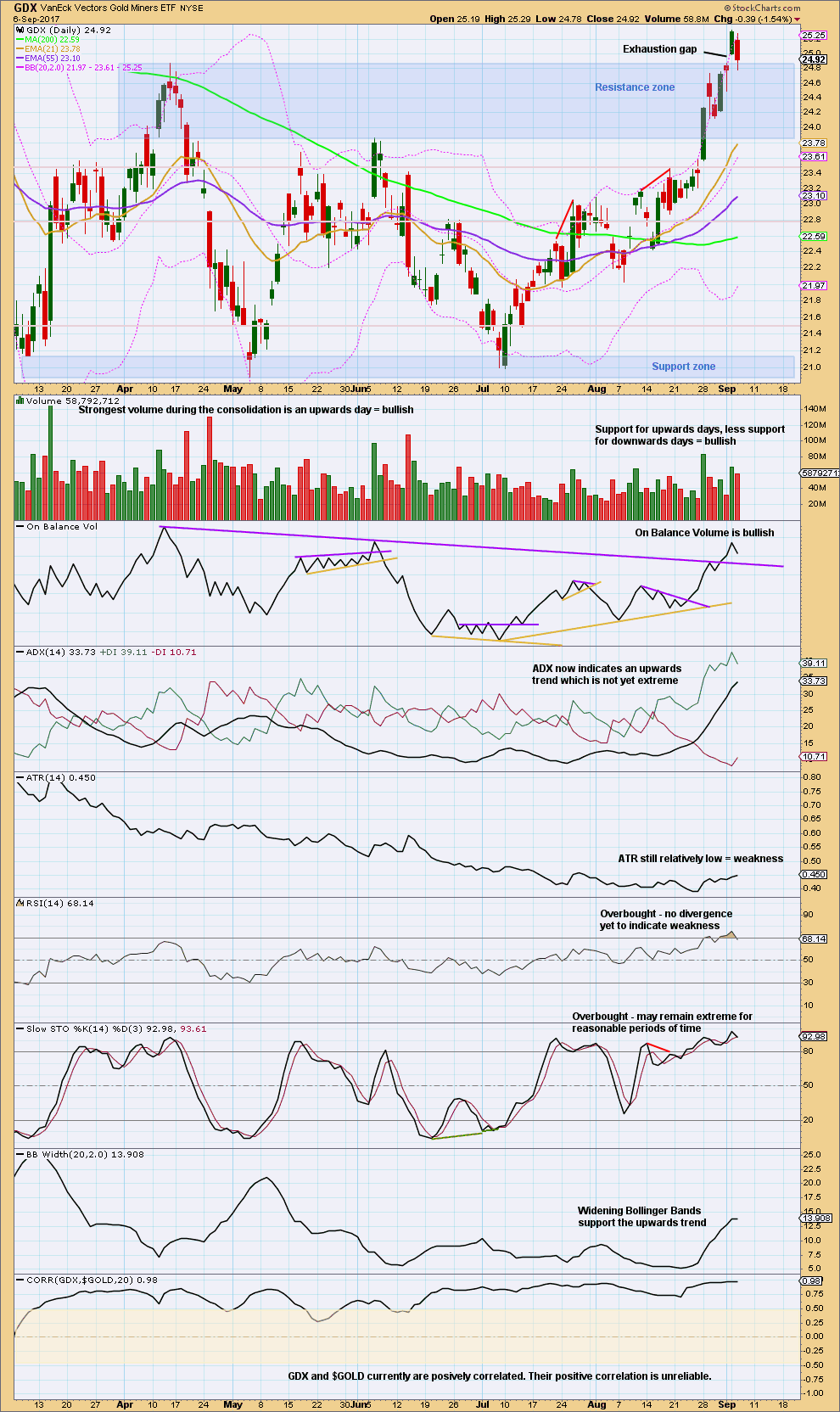

GDX

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last gap is now closed; the gap was not a breakaway gap and now looks like an exhaustion gap. The trend may be changing for GDX, or a small consolidation may unfold here before the trend continues.

There is no weakness yet in this trend. There is no divergence between price and RSI or Stochastics. On Balance Volume remains very bullish.

This trend is not extreme. It should be expected to continue higher.

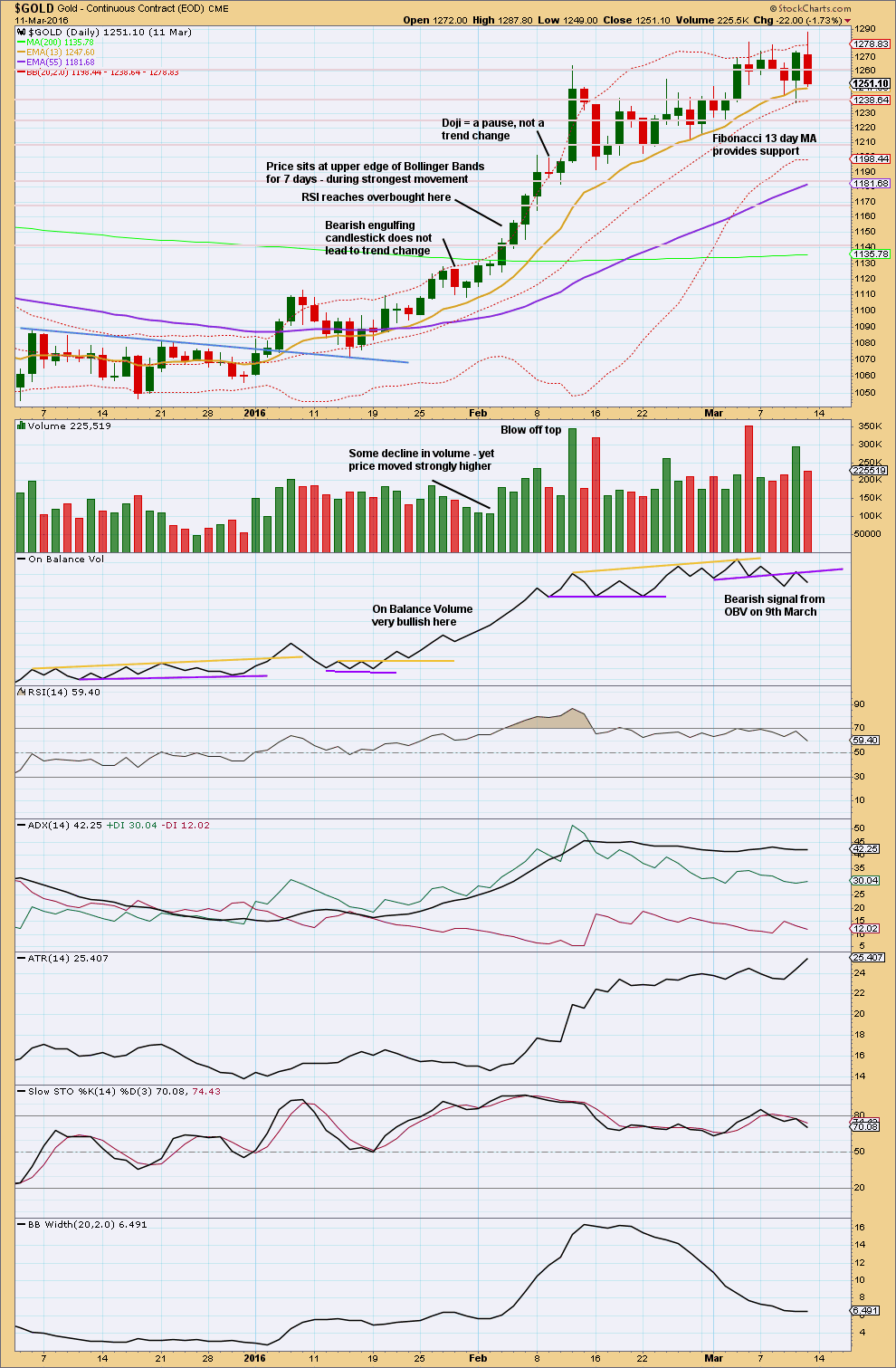

GOLD THIRD WAVE EXAMPLE – DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This section will be left at the end of analysis until either the current wave count is proven wrong, or the third wave we are expecting has completed.

This chart has been published before. It shows the most recent example of a strong third wave in Gold from December 2015 to March 2016.

Note that during this strong upwards trend:

– RSI first reached overbought on the 4th of February and price then continued strongly higher for five more days culminating in a blowoff top on the 11th of February.

– RSI and Stochastics remained extreme for most of the second half of the trend. At the final high, they both exhibited strong divergence with price.

– Price found support at the short term Fibonacci 13 day moving average during the entire trend.

– All signals from On Balance Volume were bullish right up to the end of the trend. The 9th of March shows the first bearish signal, which was an important warning of a trend change.

– The trend begins with choppy overlapping and some hesitancy.

– The 6th of January was an important upwards breakout from resistance, with support from volume. Thereafter, price moved more strongly.

– While overall volume supported the upwards movement in price, this was not linear. Some weaker days occurred yet price continued higher. It is the overall trend of volume which is more important than any one or two days. On Balance Volume remaining bullish was an important guide.

No two waves are the same. So if the current wave count is correct, it may be different from this example. However, there are some important lessons to be learned here:

1. On Balance Volume is an important guide. Bullish signals should be taken seriously, particularly early on in the trend. Later in the trend, with RSI and Stochastics overbought, any bearish signal from On Balance Volume should see long positions closed.

2. RSI and Stochastics can reach extreme overbought. Only when they have been extreme for some time and then exhibit strong divergence should it be taken as a warning of a trend change.

Published @ 07:17 p.m. EST.

A cautionary tale:

I received a sad notice from a leaving member today telling me their account is now wiped out.

This happens from time to time. Some members have been here for many years, most members come and go. A core stay.

It is the less experienced members who will have their accounts wiped out at least once. And the sole reason for that is poor risk management.

I cannot stress strongly enough how important risk management is. My two Golden Rules should always be applied rigorously. Along with other good techniques.

There is one thing I can be 100% certain of. Failure to manage risk will see your account wiped out sooner or later.

I suspect this member may have been trading with positions too large. Then when I get it wrong (and I will get it wrong from time to time) and the member had losses, the losses were too large. A few of them in a row and the account is toast.

Theory of Runs, math, allows that if you position trade size to 1-5% of equity your account can withstand a series of worst case scenario 10 losses in a row, and still have enough equity to continue trading.

Increasing position size above 5% means you are letting greed make your money management decisions for you. Fear and greed are the emotions we must be aware of and manage with strong will.

Less experienced members should reduce position size to no more than 3%. And if your response on reading this is “no way, too small, I’d never make enough money” then you shouldn’t be here. Or fund your account better.

Hourly chart updated:

I can count a nice impulse up complete at todays high. A small correction should unfold about now. If it is deep enough to come back down to the base channel upper trend line then expect it to stop there, that line is providing support.

If that happens then enter long. Stops just below the line or the invalidation point. Manage risk by investing only 1-5% of equity on any one trade.

Thanks Lara

What do you make of the action btw 1 and 2 pm

Seems like it overlaps quite a bit

difficult to see as the beginning of v (orange) to = 1?

this?

one more question

If this is a 3 up (blue) is it normal that both

pink i & iv and green (i) & (iv) come so close to invalidation.

thx

yes. perfectly normal, perfectly acceptable

we have one awesome member here at both EWG and EWSM who uses the “4 kissing 1” as her favourite trade set up. I suspect she manages it because her EW skills are extremely good.

Everybody should have profits today.

Back in the black after today’s move, after getting off balance trying to be cute looking to short against the trend. That was a mistake because not only was that a loss but kept me from getting a great entry to go long again, and needed this nice move just to recover from that! But I took your advice and hopped back on and cost averaged a bit with the theory that this move would forgive imperfect entries. So far so good!

That’s fabulous 🙂

Yep, sticking with the trend and as you say trying to not be “cute” and get the little corrections within it, is generally a better route to profits.

Hello Lara,

what chances of the 1st wave to be an expanding diagonal?

Thanks in advance

in order to answer your question I need to know which degree of first wave you are referring to?

Lucky if we get a back test of 1342-1338 and will look to add longs there for 1350-59 range. Lets see.

I agree Syed. At this stage I’m expecting corrections to be relatively brief and shallow. That range looks about right for an imminent second wave correction.

Thank you Lara. Gold price is on a tare! 1348-47 appears to be holding for Friday’s session with risk 1344. GL to all members.

Rambus on miners

https://rambus1.com/2017/09/06/wednesday-report-177/

“In the very short term they have had a good run and are getting overbought and need to work off some of the bullishness. This is perfectly normal and should be expected. What we need to focus in on now is where we should look for support to keep the uptrend intact.”

Looking at today’s new high in gold, could be part of expanded flat of fourth wave correction after blow off top Sept 5 of third wave. Will see if there is any follow through or whether it makes a turn down now.

Could be the same for GDX. Strong resistance @ 25.71 February high.

now the uptrend over in two weeks after that gold still again once come gud down after september 19 wave 4 is running

Absolutely correct. It could be. B so far would be 1.41 X A. So within allowable limits, and fairly normal.

But…

For an expanded flat to unfold C would need to move back below the upper edge of the base channel. That line is now providing support and has been tested at least three times. Support would have to be broken. Possible, not not looking likely at this stage IMO

Great report Lara. Thanks.

Time for zoom out of daily wave count beginning from start of bull trend in 2016.

Sorry i like to see the full picture.

You’re welcome, and no worries. Will do today.

Looks like Minuette 3 is complete. Minuette 4 may be over, but I think its more likely to move lower for another 1-2 days.

Look for channel support around 24.50. If that fails, look for base channel support around 24.00. Invalidation is at 23.20, which does allow for a deep correction although a shallow correction is more likely.

Good Luck

https://www.tradingview.com/x/ARok1GwQ/

Thanks for the chart. Should stay in that steep channel hopefully. Your right to possibly expect another day of weakness.

Excellent chart, Dreamer.

Thanks for posting it here.

You’re welcome 😊