Upwards movement continues exactly as expected. The target remains the same.

Summary: The trend is upwards. All trades always should be with the trend. Be prepared to exit long positions soon, either at the target or if price moves strongly down back into the base channel or below 1,325.67. The target is now just below 1,375.

Corrections are an opportunity to join the trend. Stops should always be used; set now just below 1,325.67. Manage risk by investing only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

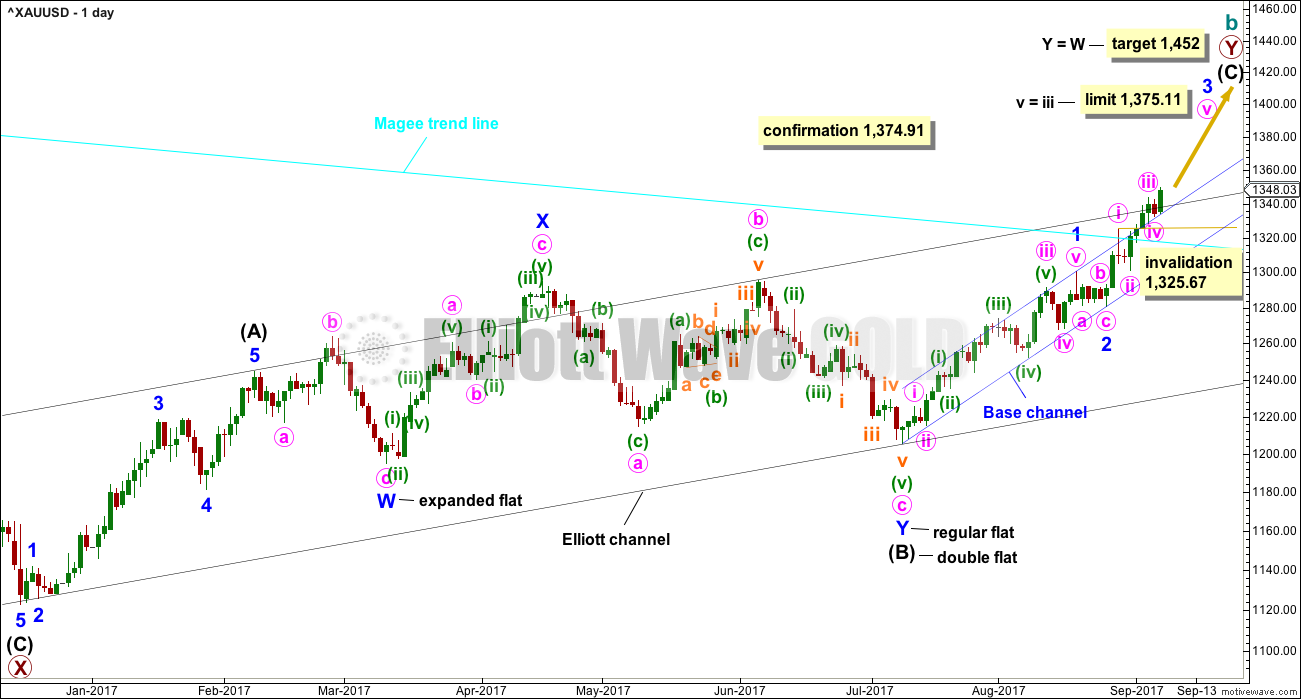

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

There is strong support from classic technical analysis for this wave count. Now that price has fully broken above the Magee trend line and has broken out above a consolidation zone, with support from volume, this wave count will now be the main wave count.

There are more than 23 possible corrective structures that B waves may take, and although cycle wave b still fits best at this stage as a triangle, it may still be another structure. This wave count looks at the possibility that it may be a double zigzag.

If cycle wave b is a double zigzag, then current upwards movement may be part of the second zigzag in the double, labelled primary wave Y.

The target remains the same.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41.

There are two problems with this wave count which reduce its probability in terms of Elliott wave:

1. Cycle wave b is a double zigzag, but primary wave X within the double is deep and time consuming. While this is possible, it is much more common for X waves within double zigzags to be brief and shallow.

2. Intermediate wave (B) within the zigzag of primary wave Y is a double flat correction. These are extremely rare, even rarer than running flats. The rarity of this structure must further reduce the probability of this wave count.

Although this wave count still has these problems, technical analysis now points to it being more likely. The alternate will continue to be considered until price invalidates it.

DAILY CHART

As requested by member Papudi, the daily charts are zoomed out today to show all structure within primary wave Y. This structure subdivides 5-3-5 as a zigzag.

Intermediate wave (C) may be unfolding as an impulse.

Within the impulse, minor waves 1 and 2 would now be complete.

Minor wave 2 may have ended as a relatively brief shallow second wave. It is unusual for second wave corrections to be this shallow. If my analysis of intermediate wave (C) is wrong, it may be in labelling minor waves 1 and 2 already over. It is possible that only minor wave 1 was over at yesterday’s high. If price moves below 1,325.67 at this stage, then I would expect a deeper more time consuming correction which would be labeled minor wave 2.

Minor wave 3 may only subdivide as an impulse. So far the corrections of minute waves ii and iv show up evenly on the daily chart giving this portion of the wave count the right look.

With minor wave 1 a very long extension, the Fibonacci ratio of equality is used for a target for minor wave 3 now.

Price has been doing some work here to overcome resistance. First resistance at the cyan Magee trend line, then resistance at the upper edge of the dark blue base channel, and resistance again now about the upper edge of the black Elliott channel copied over from the weekly chart. It may be that once this resistance is overcome the end of this third wave may proceed with strength.

The last three daily candlesticks now perfectly find support at the upper edge of the blue base channel, which is drawn about minor waves 1 and 2. This is exactly how a third wave should behave with a base channel.

Price is now closing above the wider black Elliott channel about the zigzag of primary wave C.

Minute wave iv may not move into minute wave i price territory below 1,325.67. It is still possible that minute wave iv may not be over. It may continue further as an expanded flat correction. The invalidation point today must remain the same for this reason.

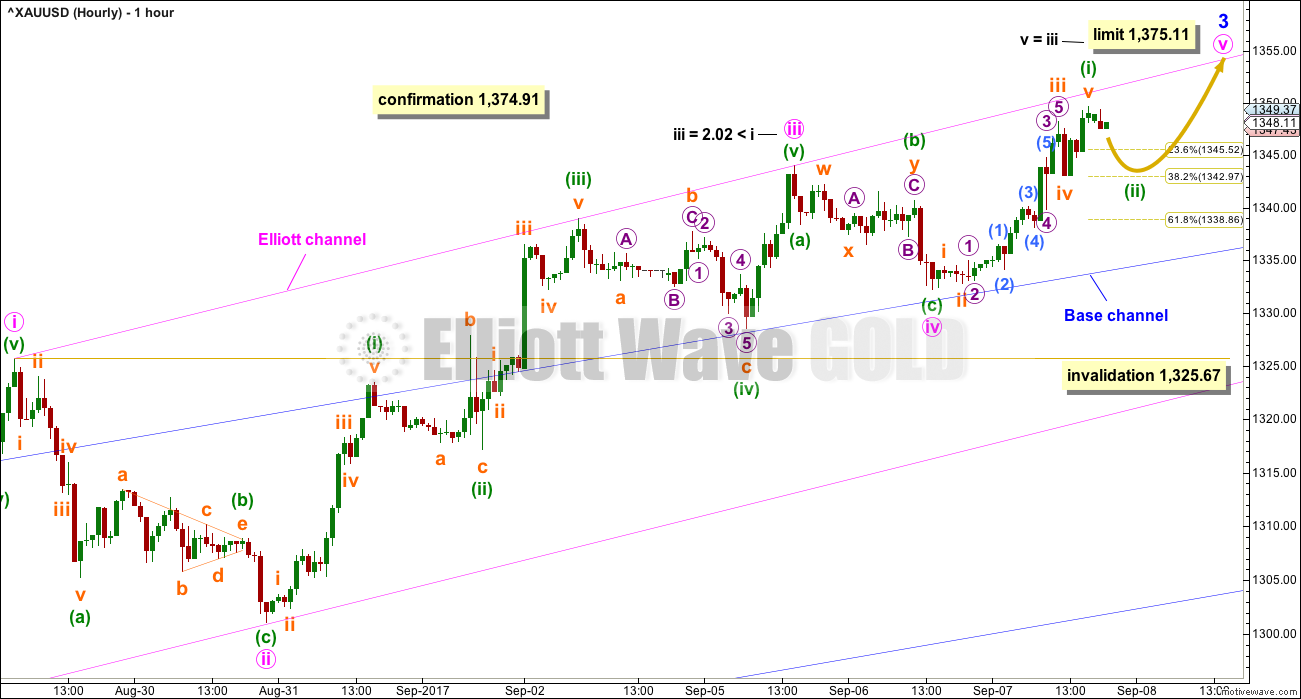

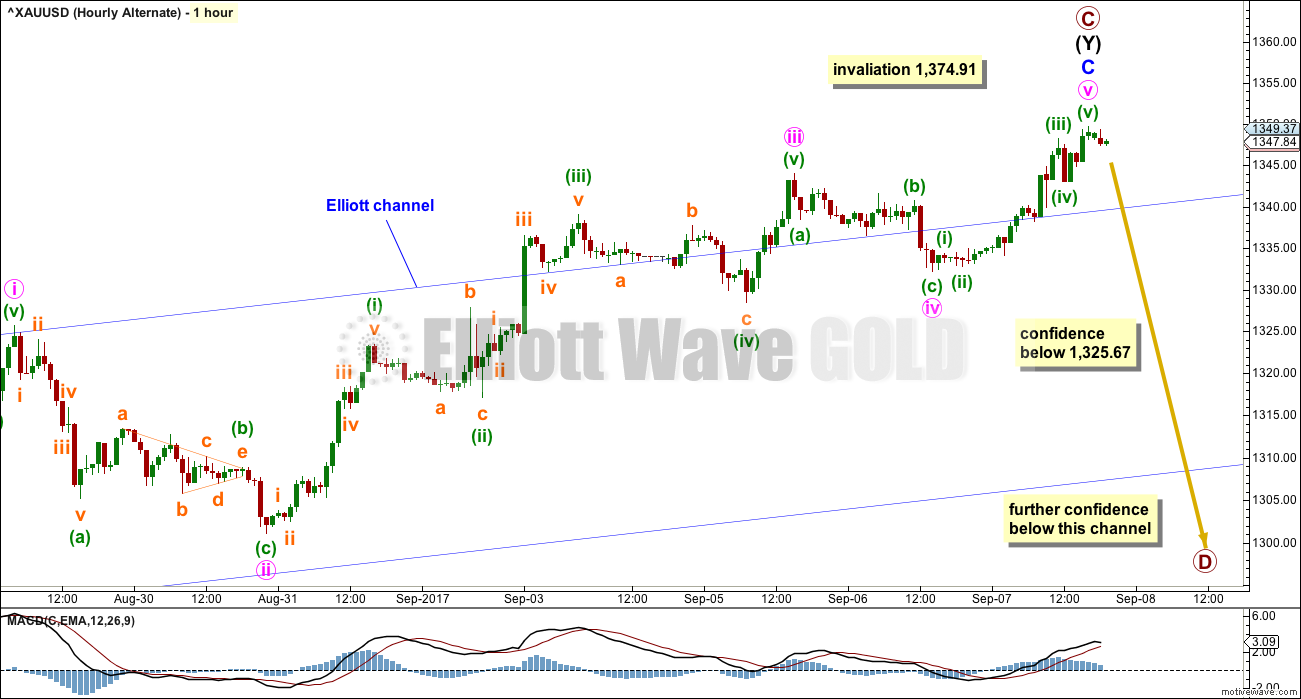

HOURLY CHART

Minute wave iii has strong support from volume and ended with a blow off top (if volume data from StockCharts is to be believed). This is typical for the end of Gold’s third waves.

The correction for minute wave iv now shows up on the daily chart as one red candlestick. Minute wave ii also shows up on the daily chart. At the daily chart level, this wave count has the right look.

Now that price has breached the upper edge of the base channel and is finding support there, it should continue to do so while minor wave 3 is still continuing.

At this stage, within minor wave 3 as it nears its end, corrections may begin to be more brief and shallow. Minuette wave (ii) may end close to the 0.382 Fibonacci ratio of minuette wave (i) above 1,343. If it is deeper, then it should find very strong support about the blue trend line, the upper edge of the base channel. If price again comes down to touch that line and bounces up from there, it would offer another entry opportunity to join an established upwards trend.

Minute wave v may exhibit stronger momentum. It may reach close to equality with minute wave iii at 1,375.11, but it may not be longer. Minute wave iii may not be the shortest actionary wave within the impulse of minor wave 3. About 1,375 minor wave 3 would also reach equality with minor wave 1.

Use the pink Elliott channel to indicate where minute wave v may end. It may find resistance at the upper edge.

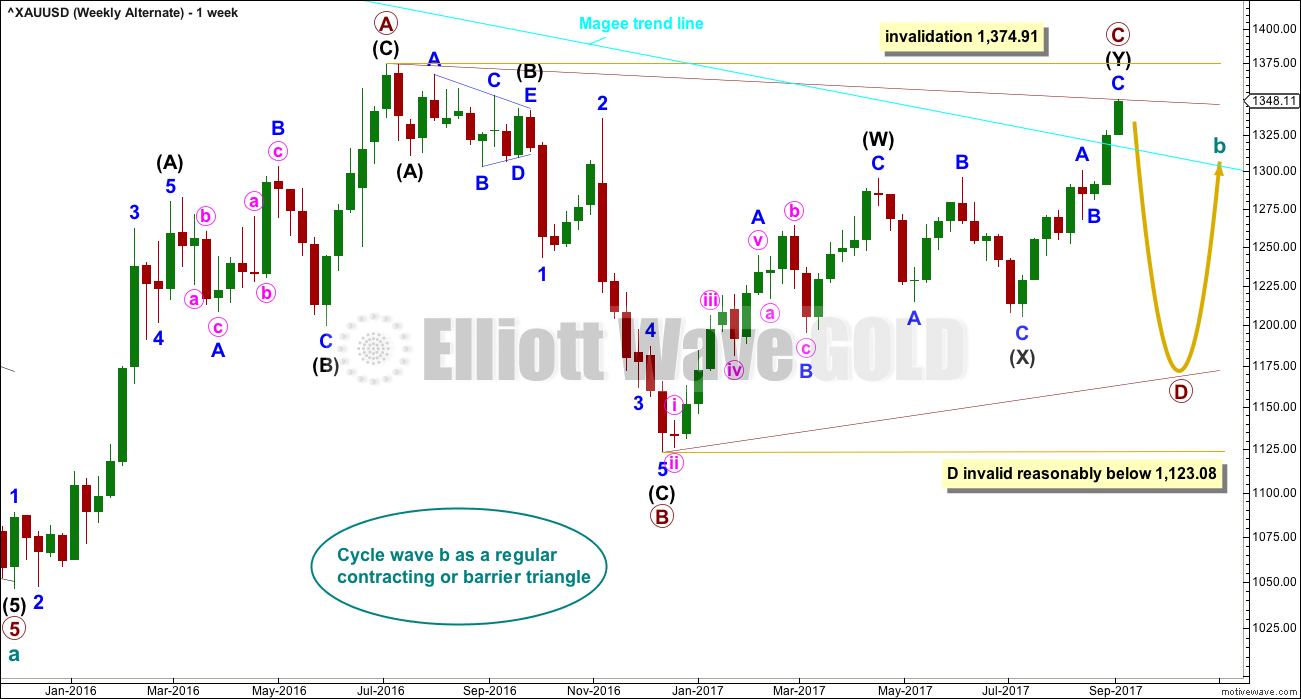

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

Price has breached the Magee trend line. This is now an alternate wave count. It remains valid, but classic technical analysis points to it now having a lower probability.

The Magee bear market trend line is drawn from the all time high for Gold on the 6th of September, 2011, to the first major swing high within the following bear market on the 5th of October, 2012.

To use this trend line in the way Magee describes, we should assume that price will find resistance at the line if it gets back up there. Now that the line is breached (by at least one or two full daily candlesticks above it), it is signalling a major trend change from bear to bull.

Within a triangle, one sub-wave should be a more complicated multiple, which may be primary wave C. This is the most common sub-wave of the triangle to subdivide into a multiple.

Intermediate wave (Y) now looks like a developing zigzag at the weekly chart level, and minor wave B within it shows up with one red weekly candlestick.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08. Contracting triangles are the most common variety.

Primary wave D of a barrier triangle should end about the same level as primary wave B at 1,123.08, so that the B-D trend line remains essentially flat. This involves some subjectivity; price may move slightly below 1,123.08 and the triangle wave count may remain valid. This is the only Elliott wave rule which is not black and white.

Finally, primary wave E of a contracting or barrier triangle may not move beyond the end of primary wave C above 1,295.65. Primary wave E would most likely fall short of the A-C trend line. But if it does not end there, then it can slightly overshoot that trend line.

Primary wave A lasted 31 weeks, primary wave B lasted 23 weeks, and primary wave C started its 38th week. A double zigzag may be expected to be longer lasting than single zigzags within a triangle, and so this continuation of primary wave C is entirely acceptable and leaves the wave count with the right look at this time frame.

With upwards movement continuing, the A-C trend line no longer has an adequate slope. At this stage, this wave count today now looks less likely.

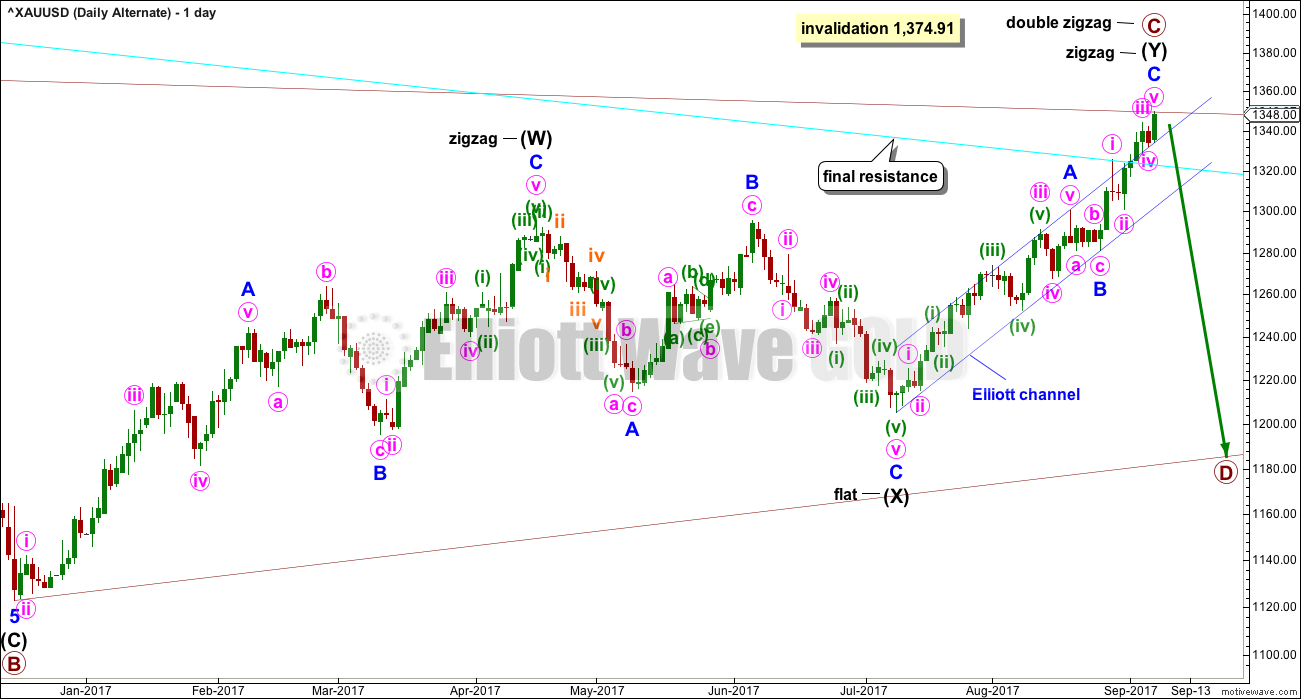

DAILY CHART

The cyan Magee trend line has now been breached. This must reduce the probability of this wave count.

A breach of the blue Elliott channel by downwards movement would indicate a trend change.

The structure of minor wave C may now be complete. It may also continue a little higher.

HOURLY CHART

This hourly chart shows the same piece of movement as the hourly chart for the main wave count.

It is again possible today that primary wave C could be over here or very soon.

For the short term, this wave count fits reasonably well with MACD. Minute wave iii is weaker than minute wave i, and minute wave v is the weakest. The strongest portion of the histogram is within the third wave.

If price moves lower and breaks back into the blue Elliott channel (which is exactly the same as the base channel on the main hourly chart), then this wave count should be considered. It would be possible a high is in place.

TECHNICAL ANALYSIS

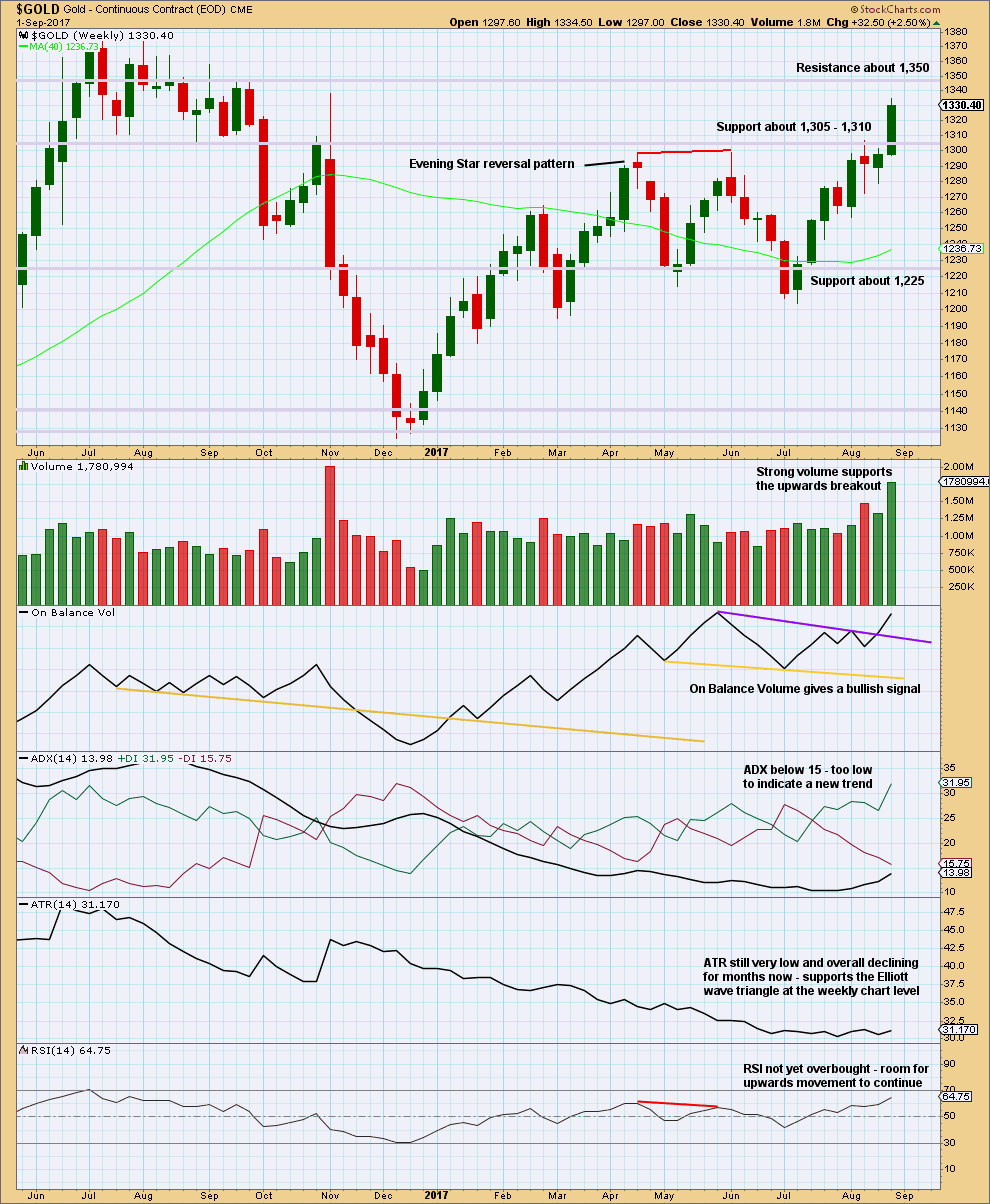

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price has closed last week above the consolidation zone, which began back in February this year. The close above resistance comes with a week of strong volume. This is a classic upwards breakout supported by volume.

It is very common after an upwards breakout to see price curve down to test support which was prior resistance. Look out for a pullback to find support now about 1,305 to 1,310. Thereafter, price should turn up and move strongly higher.

If price behaves like this, it would offer a good opportunity to join the trend at a good price. This does not always happen, but it happens much more often than it does not.

On Balance Volume gives a weak bullish signal. ADX continues to rise, but is not high enough yet to indicate an upwards trend. RSI indicates there is room still for price to rise.

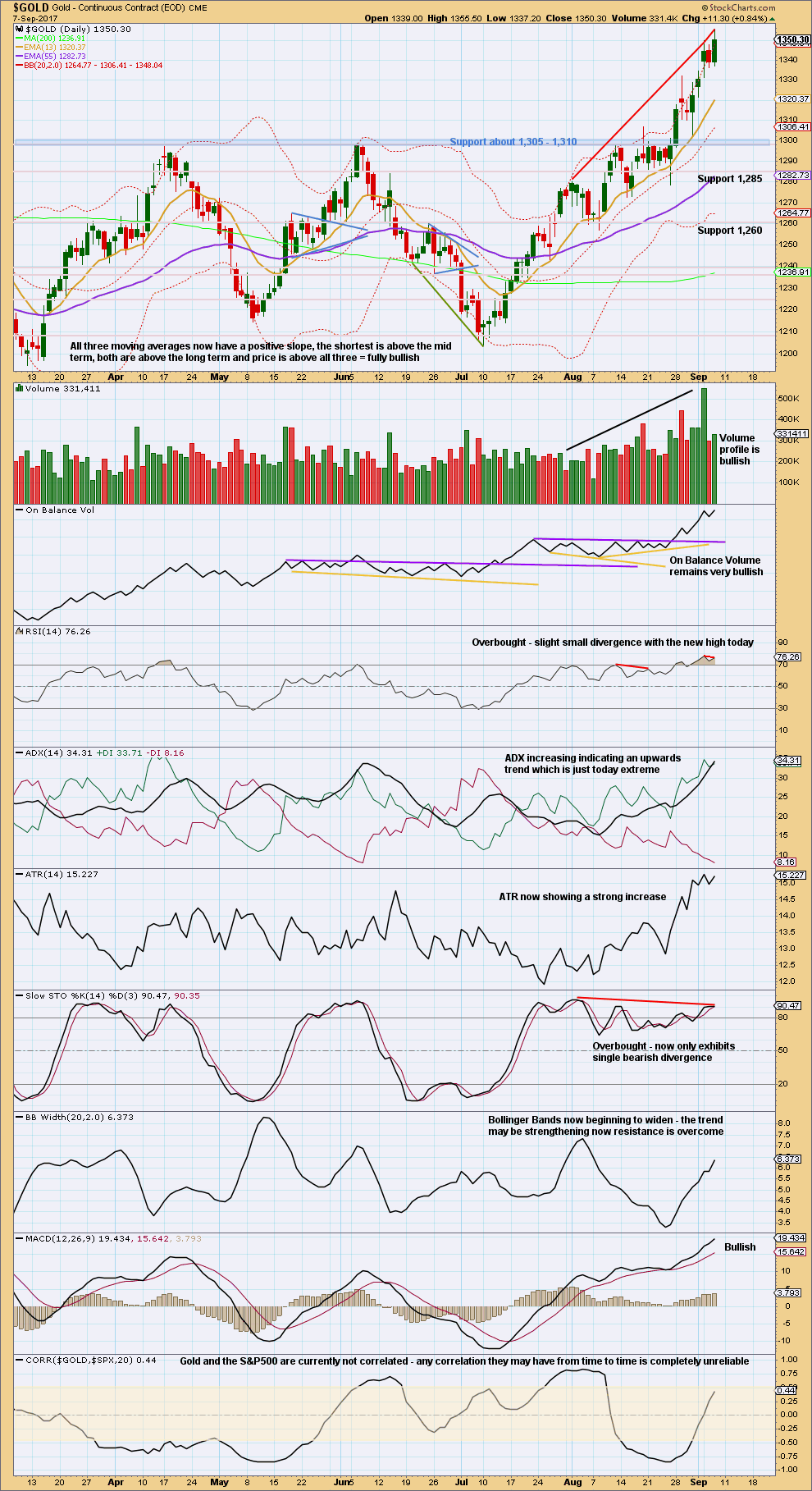

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This chart remains overall bullish. A little weakness is now beginning to show but not yet enough to expect an end to this upwards trend.

If RSI develops stronger divergence, ADX reaches above 35, and On Balance Volume exhibits a bearish signal, then an end to this trend should be expected.

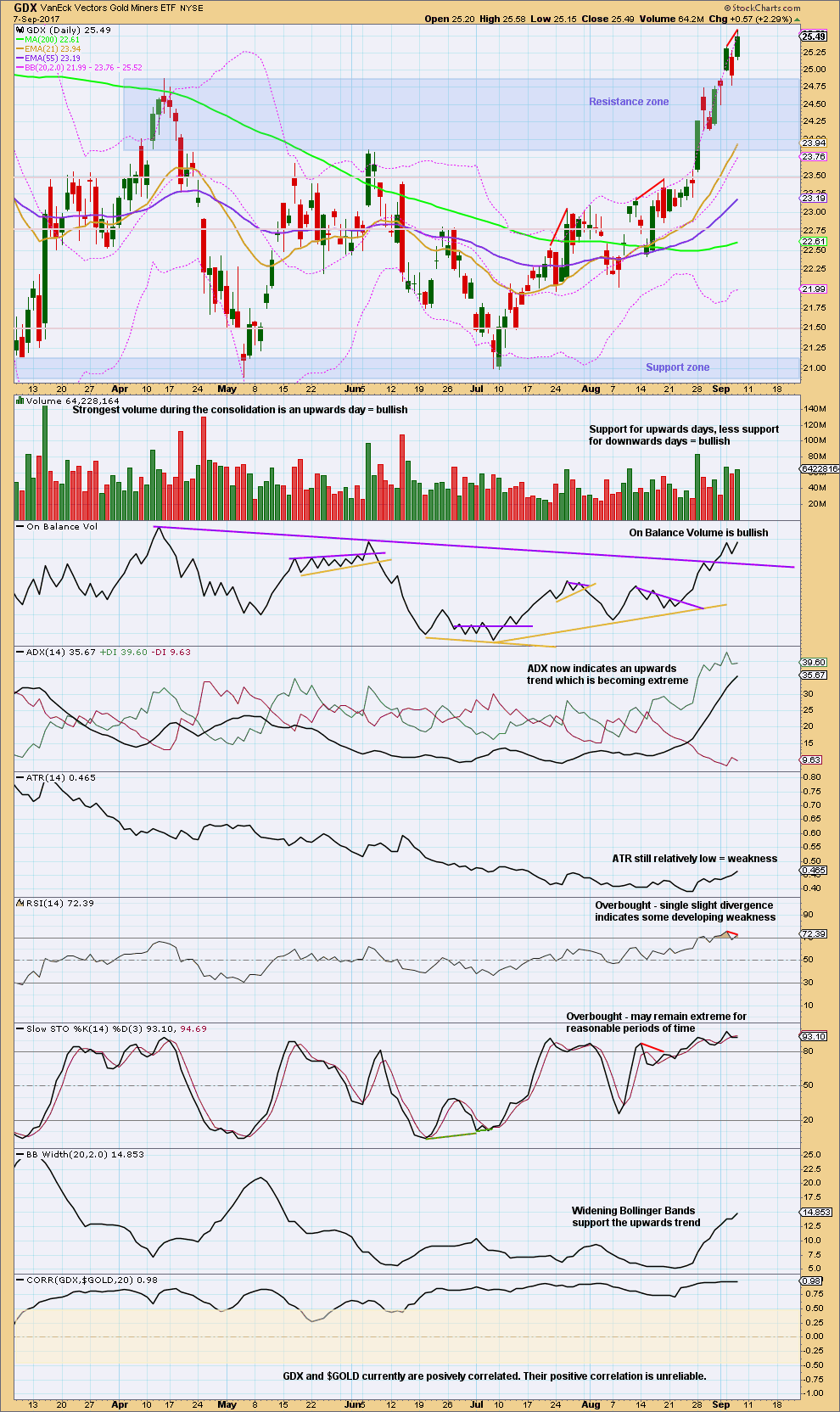

GDX

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Some weakness is now also beginning to show for GDX.

Volume remains bullish, but it is starting overall to decline. ADX is now above 35, extreme. RSI exhibits slight divergence.

Look out for an end to this trend soon, but not quite yet. Be prepared to exit long positions quickly.

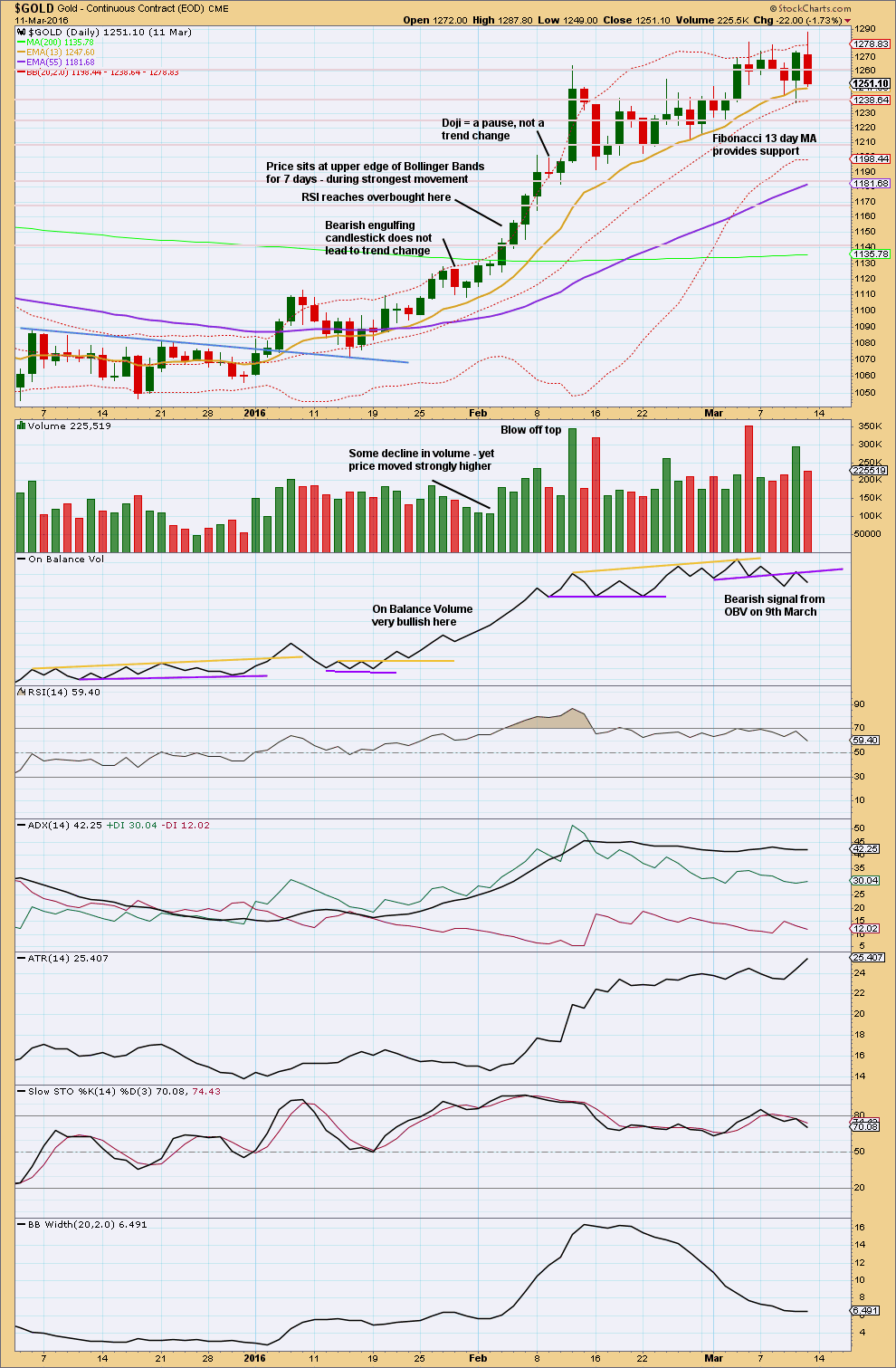

GOLD THIRD WAVE EXAMPLE – DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This section will be left at the end of analysis until either the current wave count is proven wrong, or the third wave we are expecting has completed.

This chart has been published before. It shows the most recent example of a strong third wave in Gold from December 2015 to March 2016.

Note that during this strong upwards trend:

– RSI first reached overbought on the 4th of February and price then continued strongly higher for five more days culminating in a blowoff top on the 11th of February.

– RSI and Stochastics remained extreme for most of the second half of the trend. At the final high, they both exhibited strong divergence with price.

– Price found support at the short term Fibonacci 13 day moving average during the entire trend.

– All signals from On Balance Volume were bullish right up to the end of the trend. The 9th of March shows the first bearish signal, which was an important warning of a trend change.

– The trend begins with choppy overlapping and some hesitancy.

– The 6th of January was an important upwards breakout from resistance, with support from volume. Thereafter, price moved more strongly.

– While overall volume supported the upwards movement in price, this was not linear. Some weaker days occurred yet price continued higher. It is the overall trend of volume which is more important than any one or two days. On Balance Volume remaining bullish was an important guide.

No two waves are the same. So if the current wave count is correct, it may be different from this example. However, there are some important lessons to be learned here:

1. On Balance Volume is an important guide. Bullish signals should be taken seriously, particularly early on in the trend. Later in the trend, with RSI and Stochastics overbought, any bearish signal from On Balance Volume should see long positions closed.

2. RSI and Stochastics can reach extreme overbought. Only when they have been extreme for some time and then exhibit strong divergence should it be taken as a warning of a trend change.

Published @ 09:40 p.m. EST.

after september 19 the gold strongly comes down because this is wave fourth runing

wave four means its down the market so be careful in the marjet

Lara is a great he gives gud advise i like it lara

First idea here on updated hourly chart:

The last wave up may only be minuette (i) of minute v.

This leaves the target for minor 3 the same, just below 1,375.

OR

second idea which I’ll chart and publish in end of week analysis: move the degree of labelling within minuette (i) up one degree, it could be minute v complete in its entirety and so minor 3 may be over at todays high.

We shall know if the second idea is correct if price moves below 1,332.22.

But for now, expect the upwards trend to continue. Indicators can get more extreme. There will be still short pauses and pullbacks along the way, but the trend remains up.

Stockcharts data is now available.

I’ll be moving the degree of labelling within minute v up one degree to see minor 3 over at todays high. I’ll be expecting a shallow sideways chop for all of next week now for minor 4. It may include a new high if it’s an expanded flat or running triangle.

I’m doing this because:

– Friday’s candlestick closes red

– a long upper wick is bearish

– ADX is extreme

– RSI is extreme and exhibits divergence

The upwards trend remains, but right now I’m expecting a consolidation within it to last about a week.

gold started wave 1st 1080 ounce

now this is fourth wave

Gold price possibly made a 23.6% retrace of 1298/1357? Can it drop deeper? Probably may with daily RSI still hanging around at 70+ and will require a break below 1342…. Lets see. Good weekend all.

Short term looking kinda dicey, with signals that usually make me start to short. Daily still looking okay but could change pretty quickly. I could be wrong but maybe market is waiting to see what happens with the hurricane this weekend before any further movement

Hi! Considering Gold price is still bullish and ADX on the daily at 41.xx still has some more room for 45; a risk Buy with a stop (and reverse?) at 1342 for a takeout of 1356 may just work! lol… Probably best to wait this out and see how Gold price closes and wait for Lara’s update.

interesting COT report just out now as well. Commercials added shorts AND longs. Open interest up pretty big. hedge fund longs getting very high, not totally extreme but getting there…

Expecting a pullback (snap drop) on Monday to possible 38.2% retrace of 1298/1357 at about 1335 and a sharp rebound from there. Price could go deeper to about 50% retrace (1328) as it did for the 1275/1326 leg up. We will never know until the Big Boys put up their show. GL.

Hello Lara,

Yesterday I asked about possibility of 1st wave to develop as an expanding diagonal.

Please, check my the attached image, it is weekly chart. I am asking about the wave in the blue rectangle.

I presume it is primary or intermediate degree.

It could be primary A within cycle b. Cycle b could be a zigzag: 5-3-5.

It looks way too big though for primary degree. Primary degree waves normally last months. So far this has been going on now for close to 2 years. Too big.

I’m confused about the upper target of 1374. It sounds like most people will sell there postions there. However, there is a higher target of 1452. What are the chances that gold will push on to that without a major correction?

Lara: Now that wave count is fixed as dz what is the estimated target for wave Y?

Thanks.

Great works.

Oh thanks for the zoom out view of the current daily ciunt.

It will remain the same until minor 3 and 4 are both complete.

The target calculation is at primary degree. I could add a target at intermediate degree, but it would not be anywhere close to 1,452.

At intermediate degree (C) = 1.618 X (A) at 1,402. That should be the first target actually. It does allow for primary Y to deepen the correction, but not by so much.

I can only add to the calculation at the next degree down when minor 3 and 4 are complete. At that point the target can then be calculated at three degrees so it’ll probably change or widen to a zone.

Hi Lara : board

This was my preferred count. Why exactly can this not work?

Thx

It is getting too stretched now.

If the high at 1,343.98 of the 5th of September is only minuette (i) within minute iii, now todays low is overlapping back down into that point. Todays low is 1,343.48.

So for the idea to work we would now have four first and second waves complete: minor 1 and 2, minute i and ii, minuette (i) and (ii), and today subminuette i and ii. The middle of the third wave would not have passed.

But volume and extreme indicators strongly suggest the middle of the third wave has indeed passed. It could even be over.

The idea works in terms of EW, it’s my other technical analysis that I’m using to discard it.

Corrections are more brief and shallow than expected.

The trend is still up. Look out for another blow off top possibly. Good luck everybody!

And safe harbour wished for those in Bangladesh and India, may you all be okay! And the Caribbean in the pathway of Irma, now also Hose and Katia too… may you all be safe.

GDX has walked right up the Bollinger Bands for the last 8 days, closing above the bands for 4 out of the 8 days. This classic 3rd wave behavior has undoubtedly left many looking for an entry point that never came. Divergence as noted by Lara warrants caution short term for longs.

Looks like Minuette 4 completed in one day. Minute 3 could already be complete or we may get a pop up on Friday before Minute wave 4 starts.

Good luck all!

https://www.tradingview.com/x/ouajoWtB/

boss

Dreamer,

This would coincide with your thoughts yesterday of that resistance for GDX at 25.7 level. We have already hit 25.65 premarket so would be reasonable for minute 4 pullback to begin after early pop in am.

A little bit similar to Daniel’s thoughts below, it’s now possible that Minuette 1 is complete with Subminuette wave 5 within it extending. The issue with this idea is that now there may not be enough room for Minute wave 5 to complete before hitting Lara’s invalidation point of 1,375.11.

Therefore, the alternate idea is that Minor 3 could already be complete if you move the count up one degree for all labels since the Minute 4 low.

Let’s see what happens.

https://www.tradingview.com/x/N74nfQUs/

Excellent thought Dreamer. Would explain minor 3 breaking above pink channel on hourly chart. Minor 4 would then likely find support at upper trendline of base blue channel which would be in range of minute 4 of minor 3, a good target.

Exactly. This will be my alternate too for end of week analysis.

Always the best and easiest alternate idea is to simply move the degree of labelling within a wave either up or down.

Minor 4 should last only a very few days.

Daniel hoffman how u know now gold is running fourthwave

Minuette wave 2 of minute 5 of minor 3 as per Lara’s hourly count. Dreamer above gave alternative idea that by moving count up this is end of minor 3. It does look either way we are now having a pullback to be able to join trend.

elliotwave lara super

Working well ATM…

Take profits and book them when you can. I’m not always right Viky. When I’m wrong, exit the position and please manage the loss.

For now… up up and away!

With minuette 1 continuing higher subminuette 5 may therefore be extended ending contracting diagonal to hit top of trendline.

Minuette 2 tomorrow may therefore last most of a slow Friday. With extended minute 5, it would not be unexpected for minuette 2/4 to show up on daily. JMO.

Alternatively what was labelled as end of minuette 1 was end subminuette 3 and now we are finishing a short impulse for subminuette 5. Either way upward movement should be over shortly. Can you tell I am looking forward to a little pullback. Lol 😊

Can’t say how the wave count/s work; as a novice imo at cmp 1352-53 difficult to see gold price drop to or below 1350 for 1348-47 (wish it does) with upside 1359+ to look out for. Let’s see how this plays out. GL for a profitable trade!

Thanks. Hoping for 1245 target on downside. Expecting one new high before minuette 2 begins.

Typo: 1345