More sideways movement is overall expected for this week.

Price is behaving as expected, and the breakout is still expected to be in the same direction.

Summary: Members please note: the second wave count is strongly preferred. Intermediate wave (B) may continue for another month if it is to exhibit a Fibonacci duration of fifty-five sessions.

Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

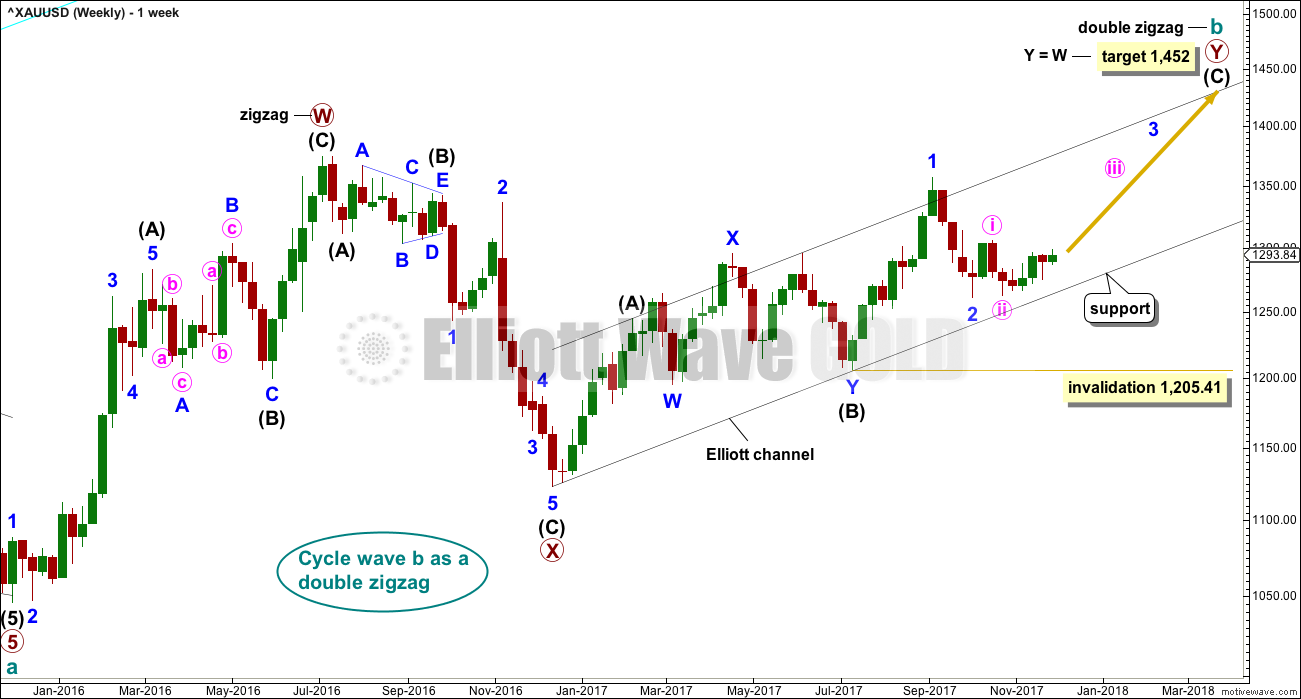

To avoid swapping wave counts over while cycle wave b continues, they will be labelled in the order they were developed: first, second and third. At this time, the second wave count is preferred because its Elliott wave structure has a better fit and has more support from classic technical analysis.

FIRST ELLIOTT WAVE COUNT

WEEKLY CHART

Both wave counts expect that Gold completed a large five down from the all time high in November 2011 to the low of December 2015, which is seen on the left hand side of both weekly charts.

If this analysis is correct, then the five down may not be the completion of the correction. Corrective waves do not subdivide as fives; they subdivide as threes. The five down is seen as cycle wave a within Super Cycle wave (a).

Both wave counts then expect cycle wave b began in December 2015.

There are more than 23 possible corrective structures that B waves may take. It is important to always have multiple wave counts when B waves are expected.

It looks unlikely that cycle wave b may have been over at the high labelled primary wave W. Primary wave W lasted less than one year at only 31 weeks. Cycle waves should last one to several years and B waves tend to be more time consuming than other Elliott waves, so this movement would be too brief for cycle wave b.

This first wave count expects that cycle wave b may be an incomplete double zigzag.

While this first wave count is entirely possible, there are three problems now which reduce its probability.

1. Cycle wave b is a double zigzag, but primary wave X within the double is deep and time consuming. While this is possible, it is much more common for X waves within double zigzags to be brief and shallow.

2. Intermediate wave (B) within the zigzag of primary wave Y is a double flat correction. These are extremely rare, even rarer than running flats. The rarity of this structure must further reduce the probability of this wave count.

3. Although intermediate wave (C) should be continuing so that primary wave Y ends substantially above the end of primary wave W, the duration of minor wave 2 within it now looks to be too large at the weekly time frame.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41. However, prior to invalidation, this wave count may be discarded if price breaks below the lower edge of the black Elliott channel. If this wave count is correct, then intermediate wave (C) should not break below the Elliott channel which contains the zigzag of primary wave Y upwards.

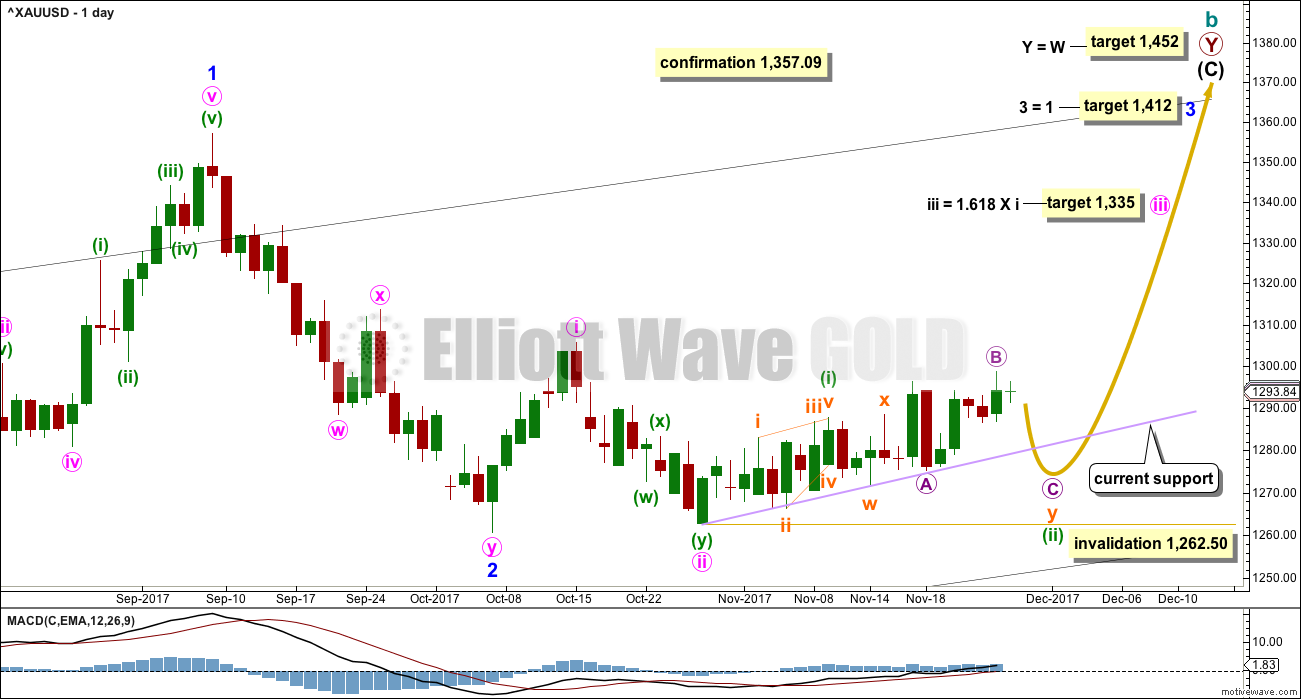

DAILY CHART

The analysis will focus on the structure of intermediate wave (C). To see details of all the bull movement for this year see daily charts here.

Intermediate wave (C) must be a five wave structure, either an impulse or an ending diagonal. It is unfolding as the more common impulse.

Minor wave 1 was a long extension. The target for minor wave 3 expects that too may be a long extension. If this is the case, then minor wave 5 may be shorter (only two actionary waves in an impulse may be extended).

The target for minute wave iii fits with higher targets and expects it to exhibit the most common Fibonacci ratio to minute wave i.

If price makes a new high above 1,357.09, then the second wave count below would be discarded and more confidence may be had in this first wave count.

This first wave count now expects there should be a series of three overlapping first and second waves: minor, minute, and minuette. A support line is added in lilac to show where price has found support for the last few weeks.

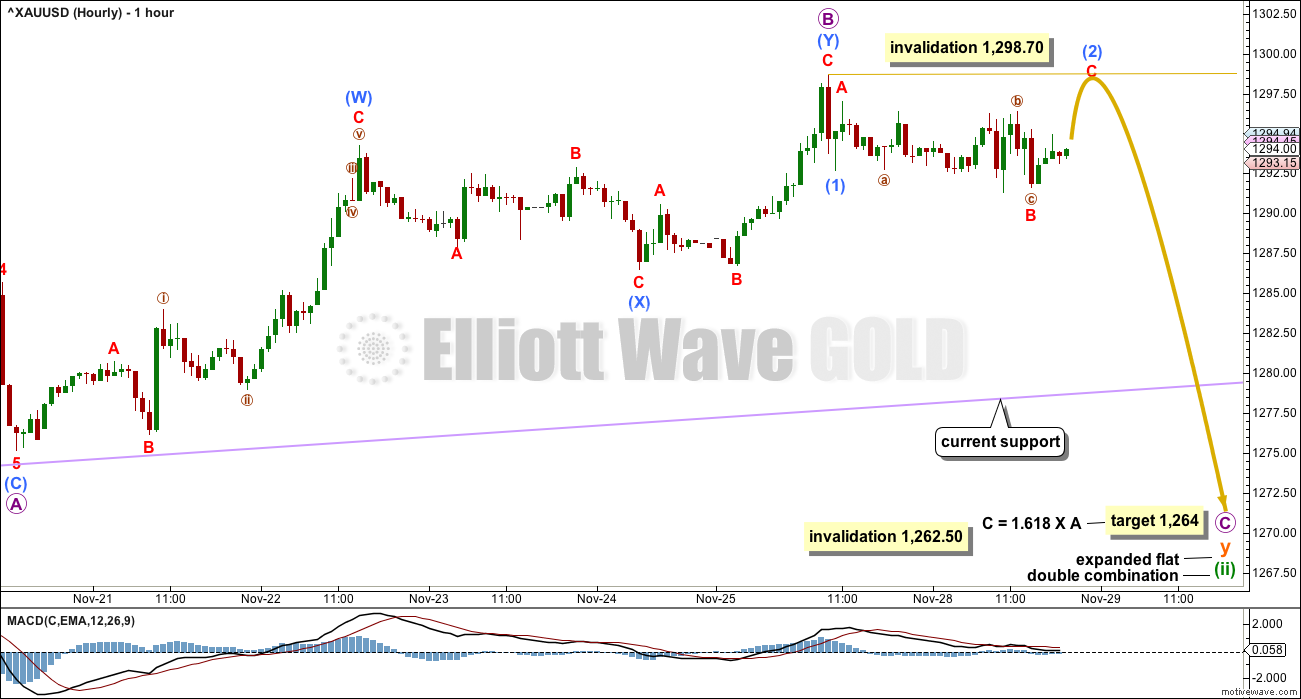

HOURLY CHART

This hourly chart shows the latter half of a possible double combination, labelled minuette wave (ii).

The first structure in a double combination may have been a zigzag labelled subminuette wave w. This is now seen only on the daily chart.

The double is joined by a three in the opposite direction, a zigzag labelled subminuette wave x, also visible now only on the daily chart.

The second structure in the double may be an expanded flat correction labelled subminuette wave y. Within this expanded flat, only the structures of micro waves B and C are now shown on the hourly chart.

Within the expanded flat of subminuette wave y, micro wave B is now a 1.79 length to micro wave A. While there is no Elliott wave rule stating a limit to B waves within flats, there is a convention which states that the idea of an expanded flat should be discarded when a B wave reaches twice the length of the A wave.

Micro wave B is now seen as a double zigzag ending at Monday’s high. This does not have as good fit as last analysis.

Micro wave C now needs to be a five wave structure downwards. Sub-micro wave (1) may have been a very quick short impulse, and now sub-micro wave (2) may be completing as an expanded flat. Sub-micro wave (2) may not move beyond the start of sub-micro wave (1) above 1,298.70.

SECOND ELLIOTT WAVE COUNT

WEEKLY CHART

Both wave counts are identical to the low labelled cycle wave a. Thereafter, they look at different possible structures for cycle wave b.

This wave count looks at cycle wave b to be most likely a regular contracting triangle.

The B-D trend line should have a reasonable slope for this triangle to have the right look, because the A-C trend line does not have a strong slope. A barrier triangle has a B-D trend line that is essentially flat; if that happened here, then the triangle trend lines would not converge with a normal look and that looks unlikely.

Primary wave D should be a single zigzag. Only one triangle sub-wave may be a more complicated multiple, and here primary wave C has completed as a double zigzag. This is the most common triangle sub-wave to subdivide as a multiple.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08.

At its completion, primary wave D should be an obvious three wave structure at the weekly chart level. Within primary wave D, intermediate wave (B) is incomplete. At this stage, it looks like intermediate wave (B) may be unfolding as a triangle. This now has a better fit at the daily and hourly chart level. At its conclusion, intermediate wave (B) should look like a corrective structure at the weekly chart level.

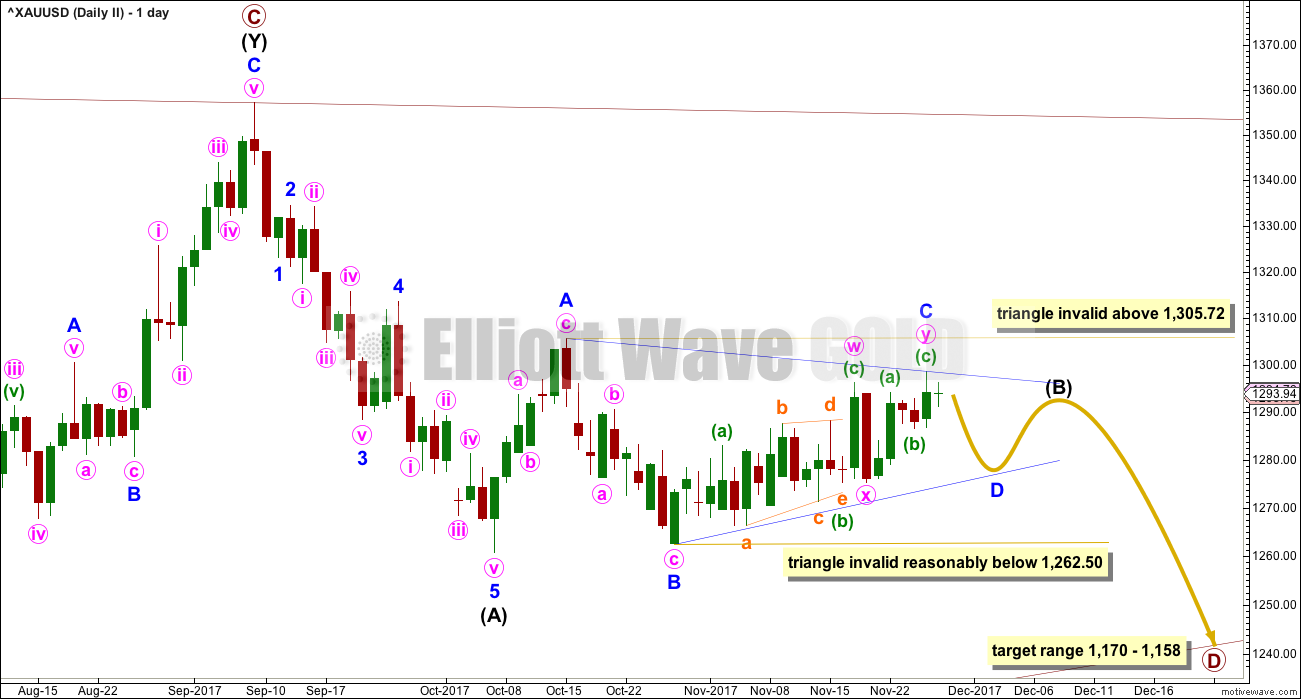

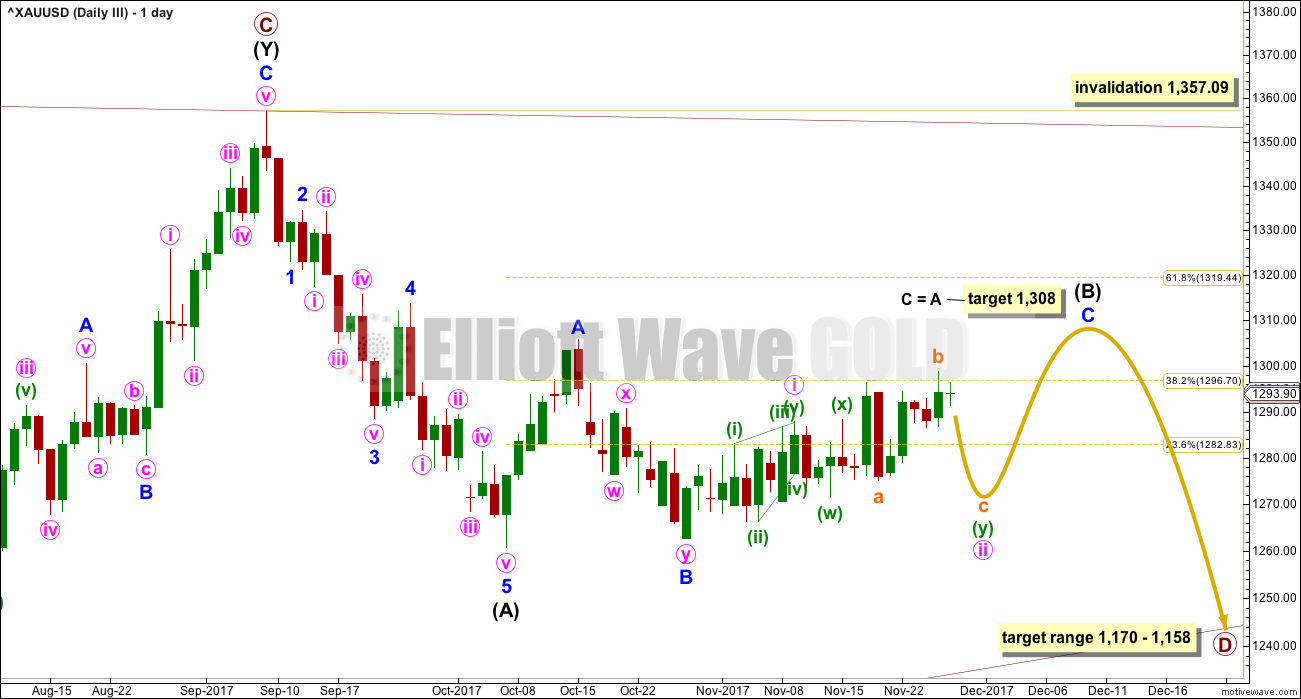

DAILY CHART

This is the preferred wave count.

A common length for triangle sub-waves is from 0.8 to 0.85 the length of the prior wave. Primary wave D would reach this range from 1,170 to 1,158.

Primary wave D should subdivide as a zigzag, and within it intermediate wave (B) looks incomplete.

So far intermediate wave (B) has lasted thirty-seven sessions; it is incomplete and needs several more sessions now to complete. If intermediate wave (B) completes as a triangle, then it may either not exhibit a Fibonacci duration, or it may last a total Fibonacci fifty-five sessions. If it were to last a total Fibonacci fifty-five sessions, it wold continue for another month.

At this stage, intermediate wave (B) will be labelled as a triangle.

Within the triangle of intermediate wave (B), it may be minor wave C which is subdividing as a multiple zigzag. This is the most common triangle sub-wave to subdivide as a multiple.

For both a contracting and barrier triangle, minor wave C may not move beyond the end of minor wave A above 1,305.72.

For a contracting triangle, minor wave D may not move beyond the end of minor wave B below 1,262.50. For a barrier triangle, minor wave D may end about the same level as minor wave B at 1,262.50. The triangle for intermediate wave (B) will remain valid as long as the lower B-D trend line remains essentially flat. Unfortunately, this is the only Elliott wave rule which is not black and white; it involves a subjective grey area.

When minor wave D is complete, then a final zigzag upwards for minor wave E should unfold. Minor wave E would most likely fall short of the A-C trend line. If it does not end there, it may overshoot the trend line slightly. Minor wave E may not move beyond the end of minor wave C.

Triangles normally adhere very well to their trend lines and fairly often the trend lines are tested within the triangle sub-waves.

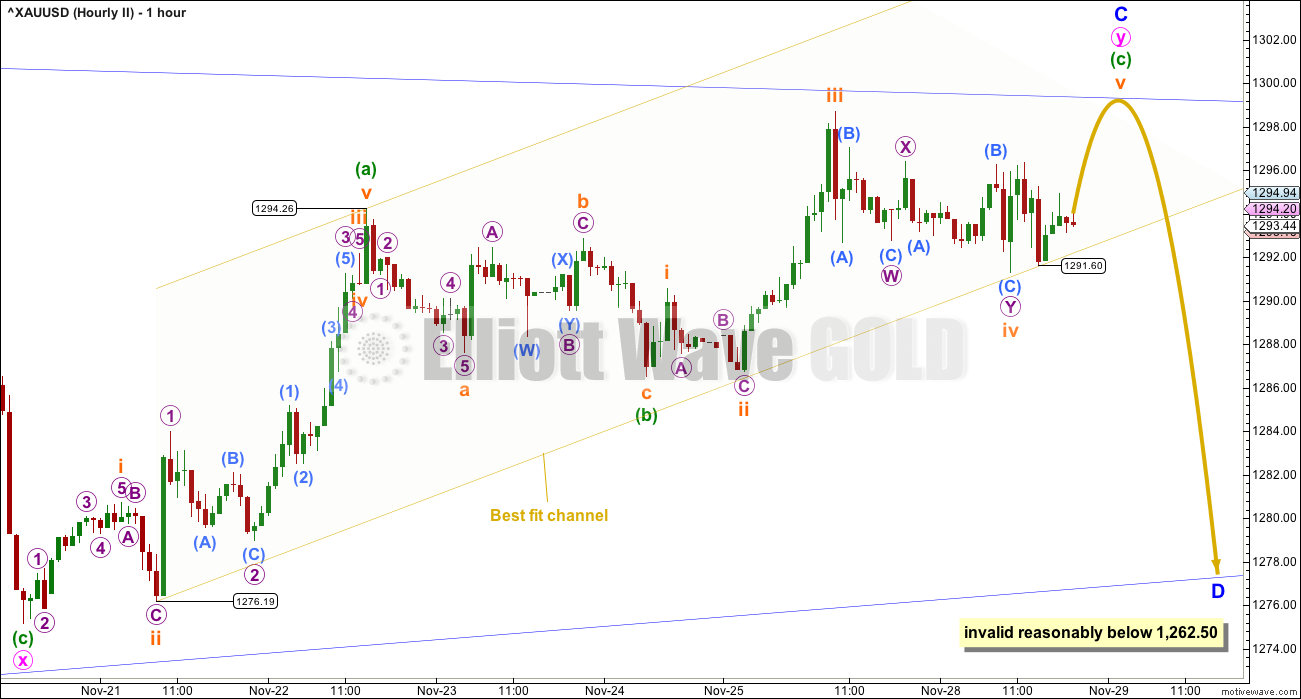

HOURLY CHART

While minor wave C is incomplete, price should remain within the yellow best fit channel. Note: this channel is adjusted very slightly today. Anchor points are shown so members may duplicate it. A breach of this channel to the downside would indicate minor wave C should be over and minor wave D should have begun.

Within the second zigzag labelled minute wave y, the five wave structure of minuette wave (c) still looks incomplete. If subminuette wave v makes only a very slight new high above the end of subminuette wave iii at 1,298.70, then a truncation would be avoided and minuette wave (c) would exhibit a Fibonacci ratio of 0.618 the length of minuette wave (a).

Because price remains within the best fit channel and continues to find support at the lower edge, it should be assumed that minuette wave (c) is continuing. If price breaks below the lower edge of this channel and begins to move lower, then minor wave C should be considered as complete.

THIRD ELLIOTT WAVE COUNT

DAILY CHART

This third wave count looks at intermediate wave (B) as a flat correction. Within a zigzag, minor wave C would need further upwards movement for the structure to complete. The target at 1,308 remains the same.

Minor wave C must subdivide as a five wave structure. So far within it, minute waves i and ii, and minuette waves (i) and (ii), may be complete.

Analysis of most recent movement is seen in the same way as for the first wave count.

This wave count would now expect a breach of the upper edge of the pink base channel. Third waves should have the power to break through base channels in the direction of the trend.

At the hourly chart level, this third wave count sees subdivisions for most recent movement of the last few weeks in the same way as the first wave count. The degree of labelling would be one degree higher.

Because this third and the first wave count are the same at the hourly chart level, only one will be published at this time.

TECHNICAL ANALYSIS

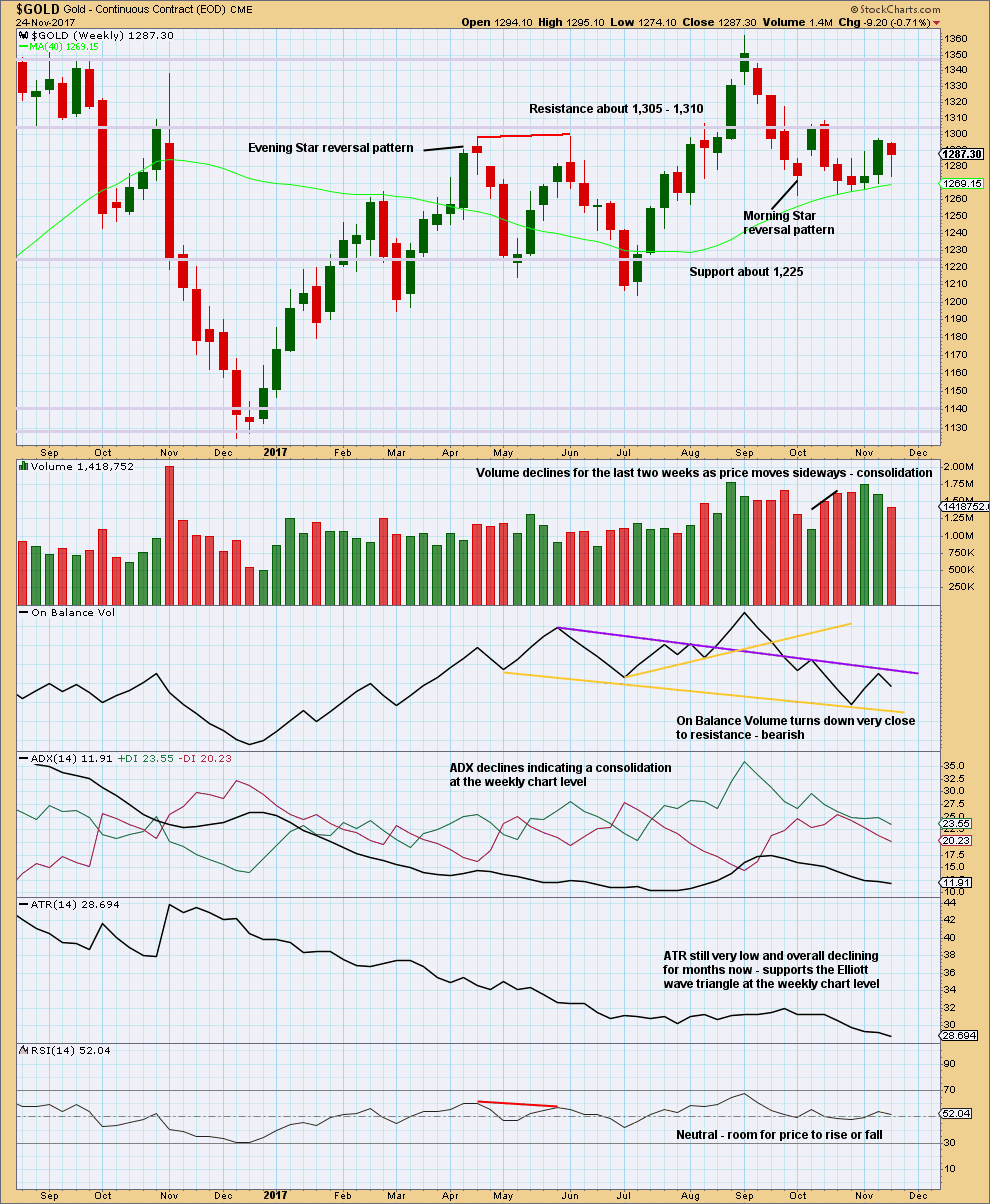

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On Balance Volume is constrained. The last signal given was bearish.

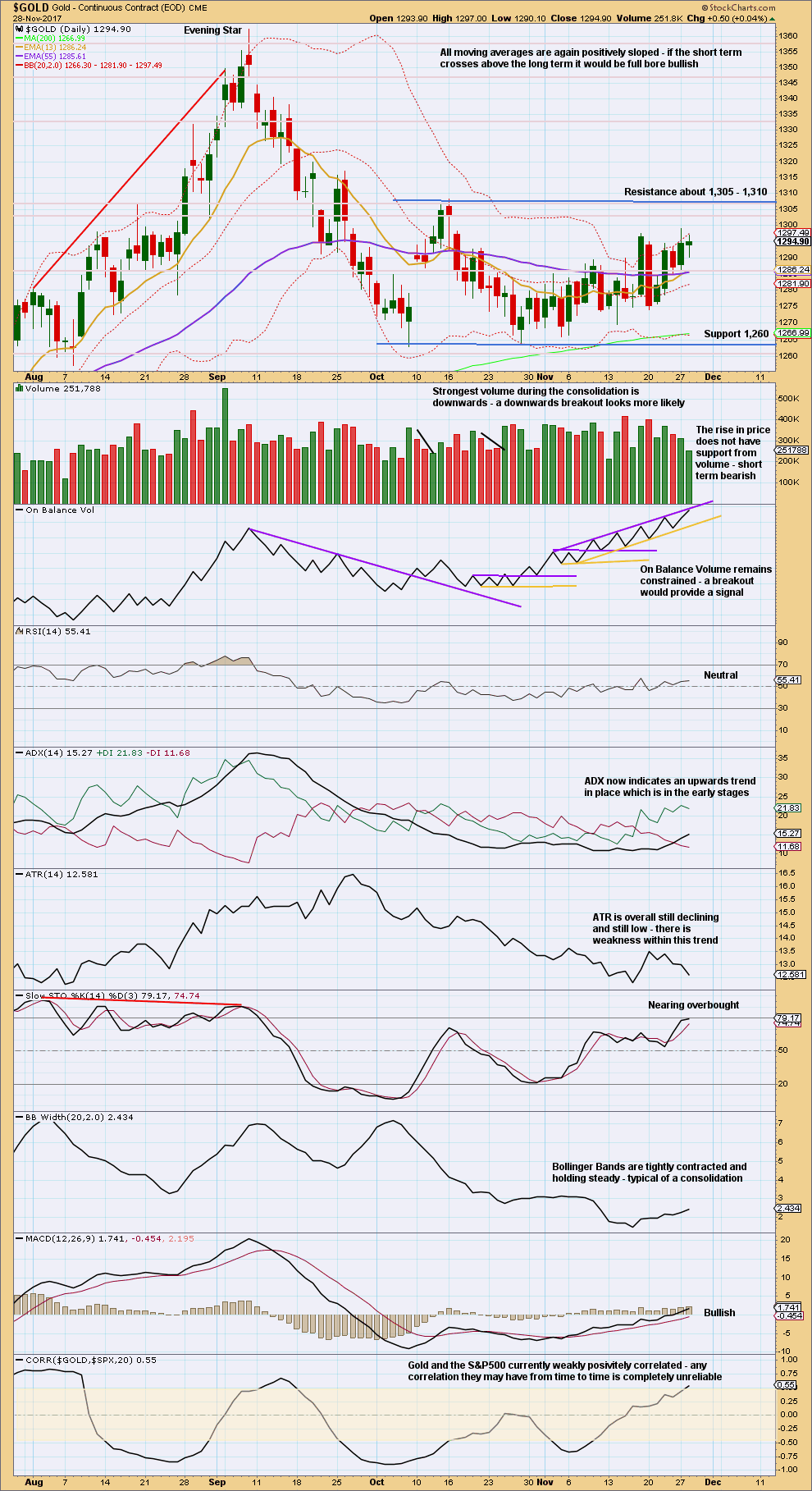

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Gold is still constrained with resistance about 1,305 to 1,310, and support about 1,260. It is a downwards day during this consolidation which has strongest volume, suggesting a downwards breakout may be more likely than an upwards breakout.

One system to use during a consolidation is Stochastics in conjunction with support and resistance. Here, Stochastics is nearing overbought and price is nearing resistance. Expect an end to this upwards swing here or fairly soon, and then another downwards swing.

With volume declining as price moves higher, Stochastics almost overbought and On Balance Volume at resistance, a downwards day may follow for tomorrow’s session.

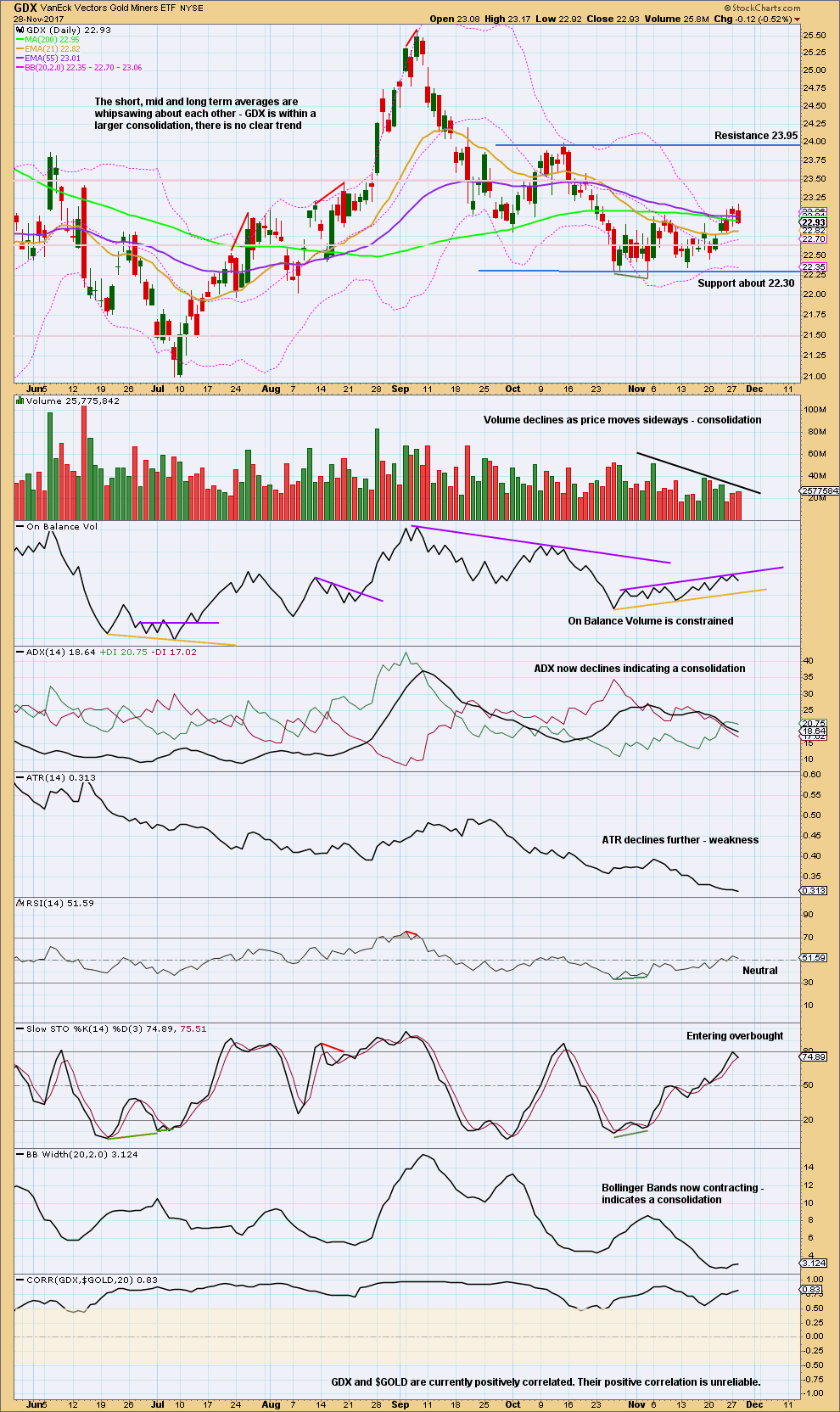

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An upwards swing may be expected to continue to resistance about 23.95.

Price does not move in straight lines within consolidations, making them poor trading opportunities. If trading this upwards swing, then reduce risk to only 1-3% of equity to acknowledge higher risk.

Published @ 08:08 p.m. EST.

Hourly chart updated (second preferred count):

Minor D should now be underway, actually nearly complete. My labelling within it may have to change in the next one to three days. It could be that minute a isn’t done, and minute b may take some time to move sideways.

Target looks about right for the look of the triangle on the daily chart.

Hi Lara

None of the wave counts has a direct rally up towards 1310 and above i am looking at similar price patterns on eurusd and gbpusd which were behaving similar to gold but surged up, if gold does go straight up from here to 1310 that still does not agree with your very first wave count as that still needs a retracement back below prior to moving up how does the wave count play out if prices keep rallying past 1310 without any pullback below 1290?

I did try to see a wave count which would expect upwards movement, and I couldn’t find a solution which met all EW rules. Not to say one did not exist, but I couldn’t find it.

I also had some confidence price would likely go down from classic TA.

And it is, so it’s all okay now.

News flash 📰. DPRK launches another missile 😱. Gold yawns 😴, then moves slowly up following the EWG path…

Wow, Bitcoin finally hit $10,000. Amazing!

It’s amazing if you own some.