The short term target was about 1,236. Downwards movement continued for the session as expected to reach 1,236.54.

Members are today offered very specific trading advice on how to manage existing short positions and on how to join the trend.

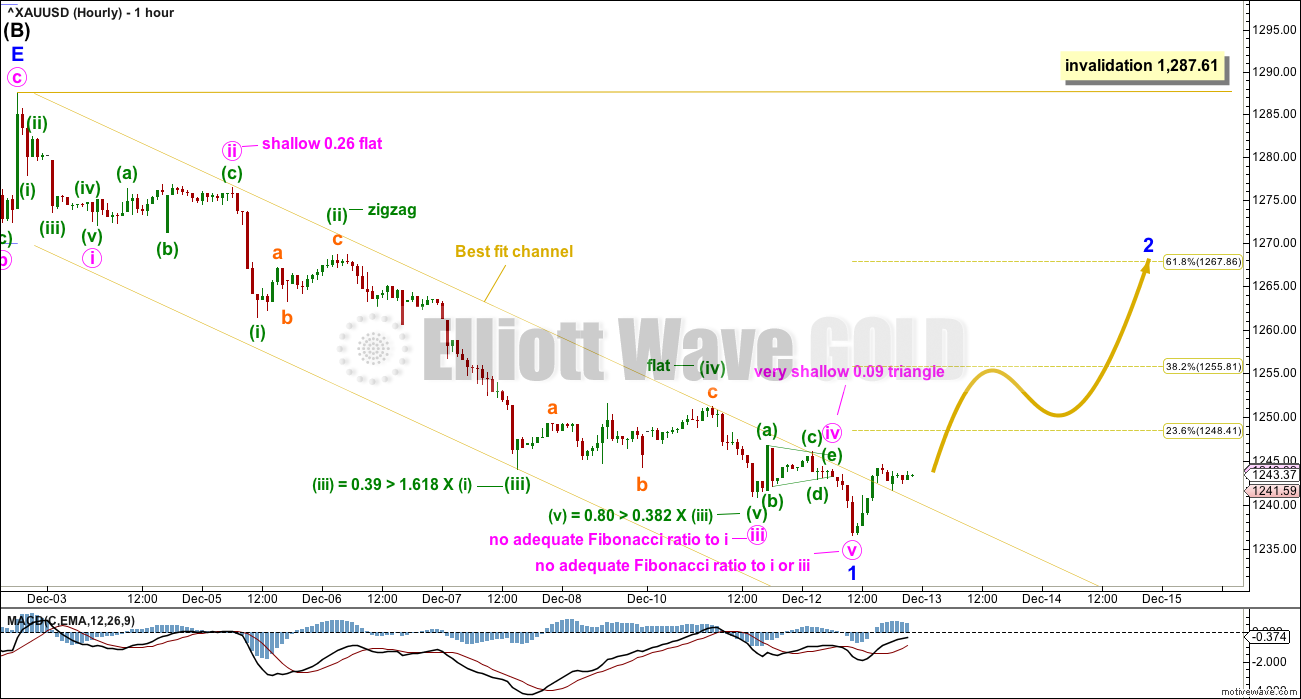

Summary: The small channel on the hourly chart is breached, and this indicates now that minor wave 1 should be over and a multi day bounce for minor wave 2 should have arrived.

The target for minor wave 2 is either 1,256 or 1,268, which may be met in about three or five days.

Short positions opened on or before 1st of December, and particularly any short positions opened above 1,287.61, may still be held for traders with a longer term horizon. Positions opened within the very last few days, and particularly any below 1,267, should now be closed.

The trend for now is down. Bounces are opportunities to enter the trend. All trades should remain with the trend.

Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

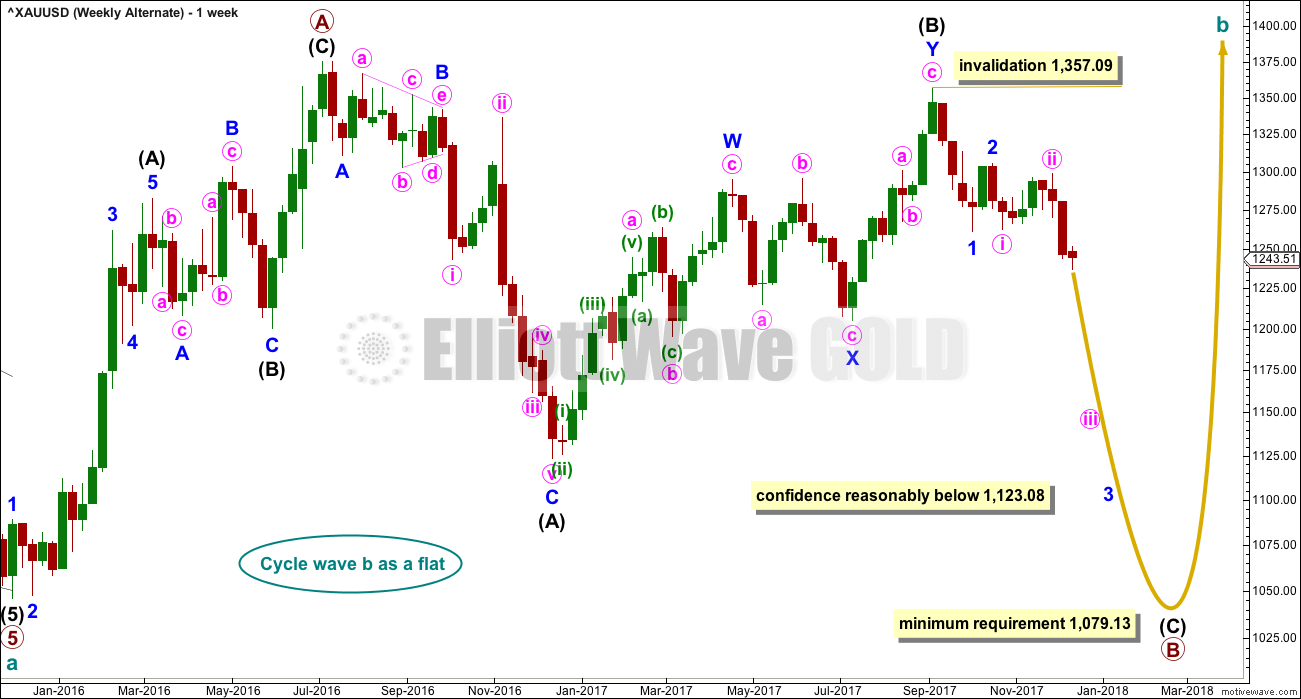

All wave counts expect that Gold completed a large five down from the all time high in November 2011 to the low of December 2015, which is seen on the left hand side of both weekly charts.

If this analysis is correct, then the five down may not be the completion of the correction. Corrective waves do not subdivide as fives; they subdivide as threes. The five down is seen as cycle wave a within Super Cycle wave (a).

All wave counts then expect cycle wave b began in December 2015.

There are more than 23 possible corrective structures that B waves may take. It is important to always have multiple wave counts when B waves are expected.

It looks unlikely that cycle wave b may have been over at the high labelled primary wave A. Primary wave A lasted less than one year at only 31 weeks. Cycle waves should last one to several years and B waves tend to be more time consuming than other Elliott waves, so this movement would be too brief for cycle wave b.

This wave count looks at cycle wave b to be most likely a regular contracting triangle.

The B-D trend line should have a reasonable slope for this triangle to have the right look, because the A-C trend line does not have a strong slope. A barrier triangle has a B-D trend line that is essentially flat; if that happened here, then the triangle trend lines would not converge with a normal look and that looks unlikely.

Primary wave D should be a single zigzag. Only one triangle sub-wave may be a more complicated multiple, and here primary wave C has completed as a double zigzag; this is the most common triangle sub-wave to subdivide as a multiple.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08.

At its completion, primary wave D should be an obvious three wave structure at the weekly chart level.

For this one weekly chart, two daily charts are presented below. They look at intermediate wave (B) in two different ways, and are presented now in order of probability.

DAILY CHART

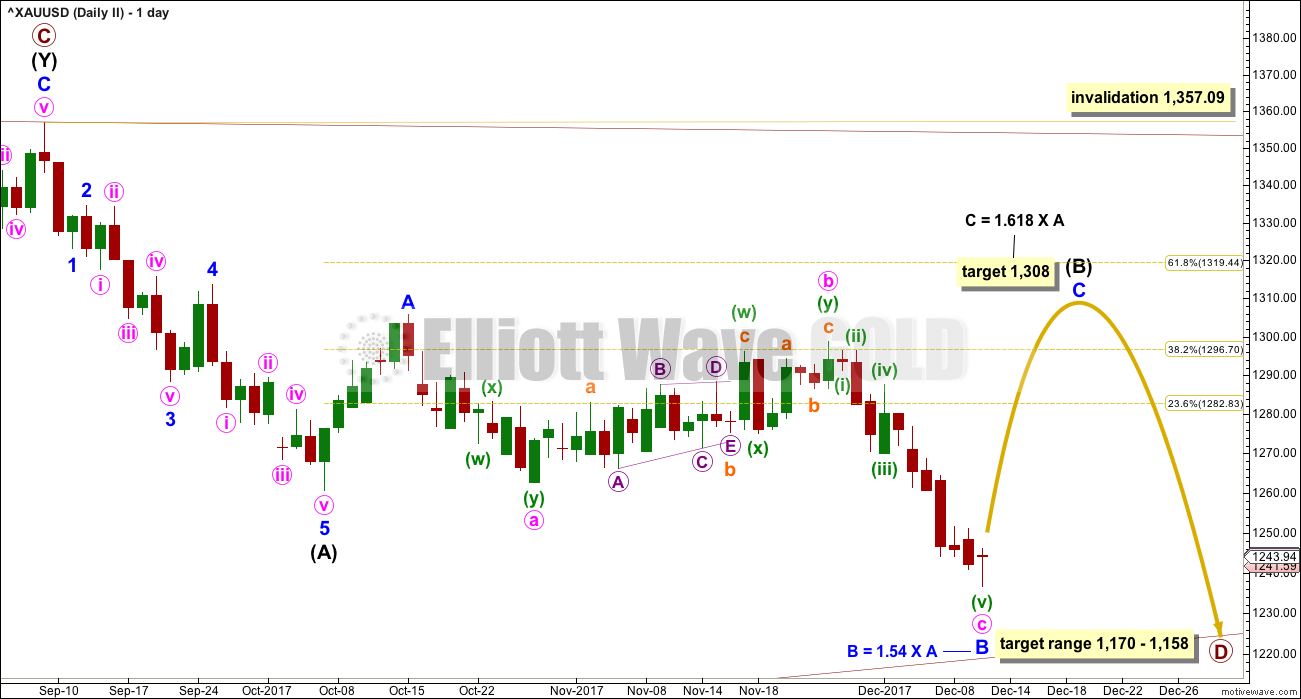

Both daily charts are identical up to the low labelled intermediate wave (A).

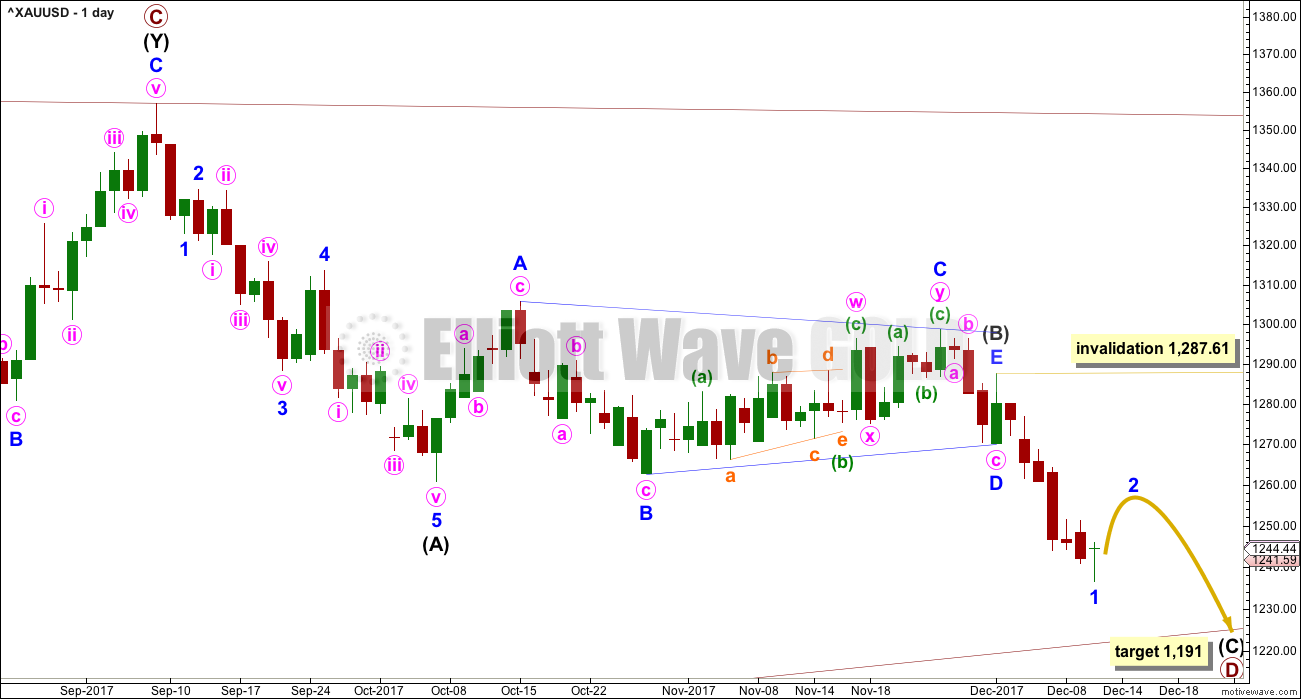

This first daily chart shows intermediate wave (B) as a now complete regular contracting Elliott wave triangle. This has support from what looks like a classic downwards breakout from the symmetrical triangle identified on the technical analysis chart below.

The target assumes that intermediate wave (C) may exhibit the most common Fibonacci ratio to intermediate wave (A).

Intermediate wave (C) must subdivide as a five wave structure. Within intermediate wave (C), minor wave 1 may now be complete and minor wave 2 may now have just begun. Minor wave 2 may not move beyond the start of minor wave 1 above 1,287.61.

Intermediate wave (A) lasted twenty sessions. Intermediate wave (C) may be about even in duration as well as length, so twenty or twenty-one sessions looks likely.

Minor wave 1 may have lasted seven sessions. For the wave count to have the right look, as Gold almost always does, minor wave 2 may be expected to last a Fibonacci three, five or eight sessions. It may be any corrective structure except a triangle, and it is most likely to be a zigzag.

HOURLY CHART

After some consideration of this downwards movement, it is reanalysed.

Within the impulse downwards, this labelling now has perfect alternation at minute and minuette degrees. Although there are no adequate Fibonacci ratios between minute waves i, iii and v, they are not too far off some reasonable ratios. My judgement is that if the variation from a perfect ratio is more than 10% of the length of the wave being considered, then it is not an adequate ratio. These waves are just beyond that decision point.

Within minute wave iii, there are excellent Fibonacci ratios between all three actionary waves.

This movement fits well into a channel. That channel is now breached by some upwards movement. This is an indication that the wave down may now be over.

At its end, minor wave 1 has exhibited some divergence with MACD.

Minor wave 2 may be any one of several corrective structures. For reasonable proportion, it would most likely show up on the daily chart and last a few days.

SECOND DAILY CHART

It is very important to always consider an alternate when a triangle may be unfolding. Triangles are very tricky structures, and may even be invalidated after one thinks they are complete.

It is still possible that intermediate wave (B) may be completing as a flat correction.

Within the flat correction, both minor waves A and B are threes. Minor wave B has retraced more than the minimum 0.9 length of minor wave A.

With minor wave B now a 1.54 length to minor wave A, an expanded flat is now indicated. Minor wave C of an expanded flat would most commonly be about 1.618 the length of minor wave A.

Now minor wave C may be required to move price upwards to end at least above the end of minor wave A at 1,305.72 to avoid a truncation.

A new high above 1,298.70 is required now for confidence in this wave count.

There should be something wrong or “off” about B waves. In this instance, the downwards wave of the last two weeks has some strength. While the market is falling of its own weight, On Balance Volume is very bearish. Classic technical analysis does not support this wave count, so it looks unlikely now.

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

All wave counts are identical to the low labelled cycle wave a. Thereafter, they look at different possible structures for cycle wave b.

Cycle wave b may be a flat correction. Within a flat primary, wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below.

TECHNICAL ANALYSIS

WEEKLY CHART

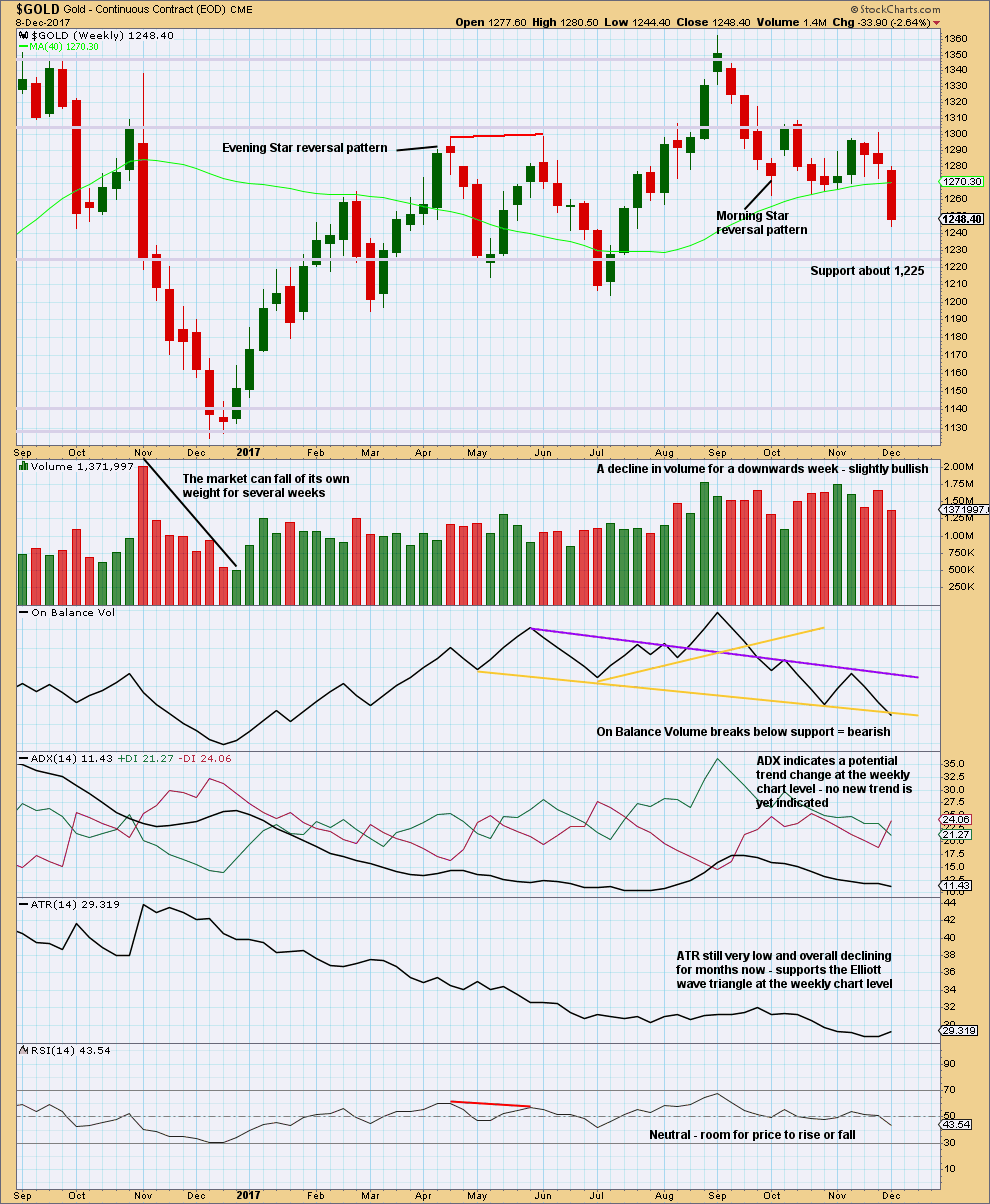

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price has broken below support this week, which was about 1,262. The market this week fell of its own weight, but this can continue for several weeks as recent evidence noted on this chart for November 2016 shows.

The last signal given from On Balance Volume was bearish. Now On Balance Volume gives another clear bearish signal this week. With On Balance Volume now fairly bearish, this offers support to the main Elliott wave count.

DAILY CHART

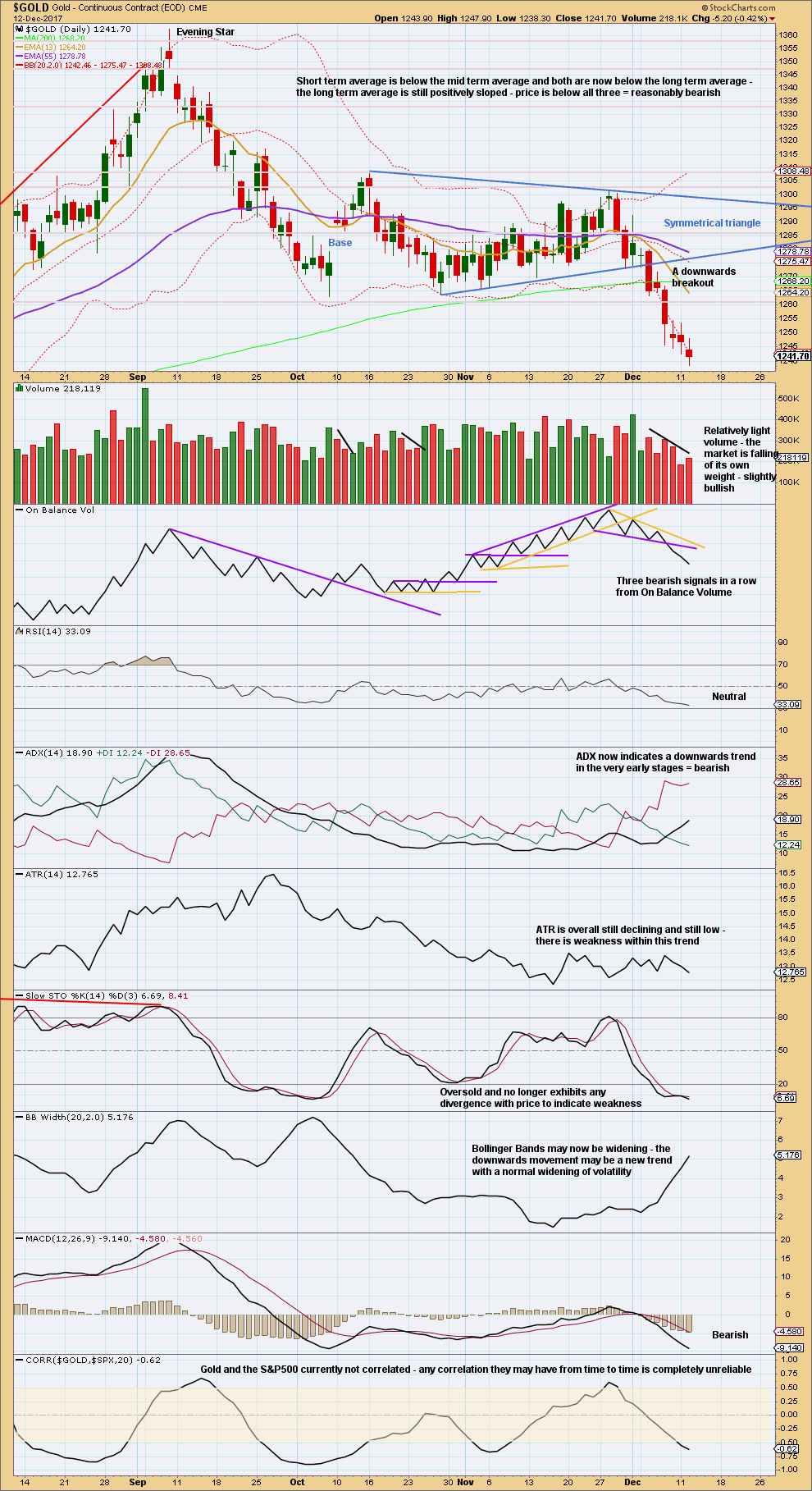

Click chart to enlarge. Chart courtesy of StockCharts.com.

A target calculated using the symmetrical triangle is about 1,228. That target has not yet been met.

This chart remains very bearish. There will be bounces along the way in a downwards trend. With Stochastics oversold, a small bounce may now arrive. But with no weakness yet evident (apart from light volume), do not expect the bounce to be very high or time consuming.

At this time, this chart does not offer support to the idea that a bounce should begin here. That judgement is based upon the Elliott wave structure and the trend channel on the hourly chart.

GDX DAILY CHART

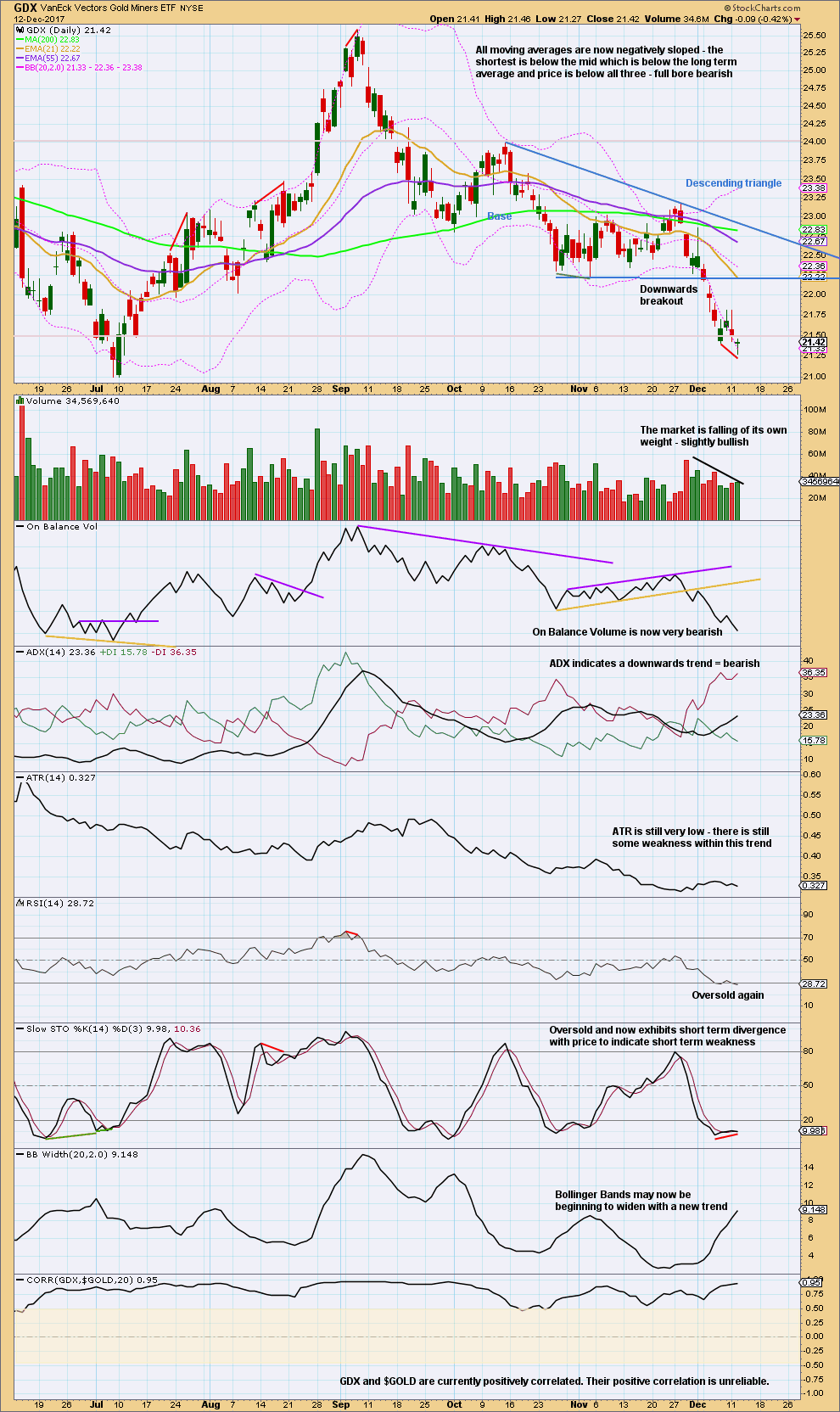

Click chart to enlarge. Chart courtesy of StockCharts.com.

A target calculated from the width of the triangle and applied to the breakout point is at 20.43.

There is a next area of support about 21.00.

For the very short term, look out for a small bounce for GDX. This is indicated now by Stochastics and a doji candlestick today.

Published @ 11:33 p.m. EST.

Outstanding calls as of late Lara!!! Your service and analysis are greatly appreciated.

Rob

…. really, Lara deserves a standing ovation for having so superbly guided and shepherded us all through the triangle with such clarity (the patience of many was tested though during the triangle period), the eventual breakout, the downside target and now the reversal up…. Thank you Lara. Simply brilliant. Lets see if Gold price does get rejected from under 1257-58 or breaks above there for the 1270s. Happy surfing to all the wave riders lol 🙂

🙂 🙂 🙂

Thank you Syed.

Now… I will wish and dream that it could be that easy and that good all the time….

Nailed it. Doing my Super Happy Morning Dance again this morning. Maybe one day I’ll get Cesar to video it so you can all have a good laugh 🙂

So far minor 2 has reached only 0.236 of minor 1. That’s too shallow.

Because minor 1 lasted several days let us expect minor 2 to more likely be deep, 0.618 is the preferred target. But 0.382 is also possible, so when price gets up there I’ll be analysing the structure to see if it’s complete… or not.

Focus now turns to the structure of minor wave 2. Let’s use this as an entry opportunity to join a downwards trend, and catch a third wave.

And before that, right now, while I wait for NY to close and data to be finalised I’m going to go catch some of those wet wobbly waves in that big blue thing I see out my window….

A study on Fed rate hikes for Gold and GDX.

Gold bottomed 9 days before the 1st hike, then bottomed close to the 2nd and 3rd hike dates. Then on the 4th hike date, gold continued down and bottomed 18 days later.

If gold takes another 3-4 weeks to bottom as Lara’s count suggests, that seems to fit with the gold price action after the last rate hike. Will history repeat?

https://www.tradingview.com/x/oM25YM6P/

Dreamer, good stats. Thx for sharing it!

I second that. Thank you very much Dreamer for sharing this research. Love your work 🙂