A consolidation or pullback continues as expected.

Two ideas for the short term are now considered at the hourly chart level.

Summary: A consolidation looks likely to have begun, and it may be as time consuming as a Fibonacci 13 or even 21 weeks. It is also possible it may be a quicker sharper pullback. When it is complete, the upwards trend may resume.

A new low below 1,236.54 would indicate Gold remains within a huge bear market. At that stage, new lows would be expected below 1,046.27.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last in-depth historic analysis with monthly and several weekly charts is here, video is here.

There are multiple wave counts at this time at the weekly and monthly chart levels. In order to make this analysis manageable and accessible only two will be published on a daily basis, one bullish and one bearish. This does not mean the other possibilities may not be correct, only that publication of them all each day is too much to digest. At this stage, they do not diverge from the two possibilities below.

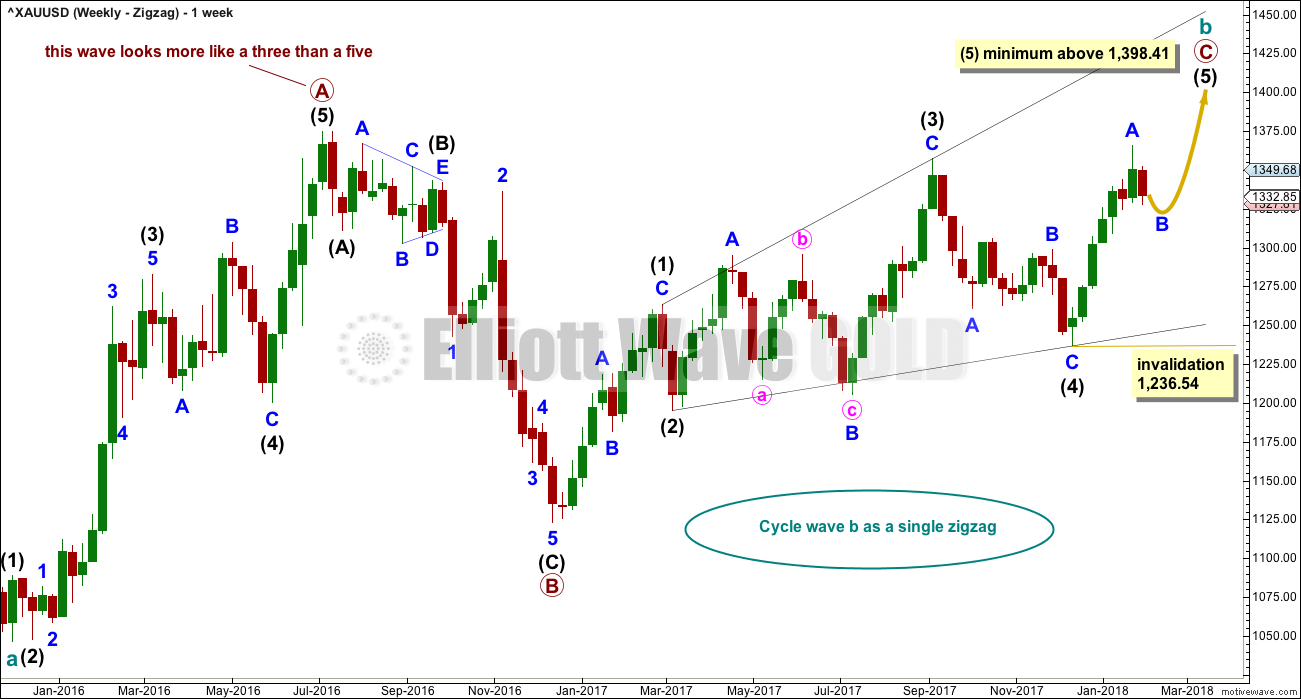

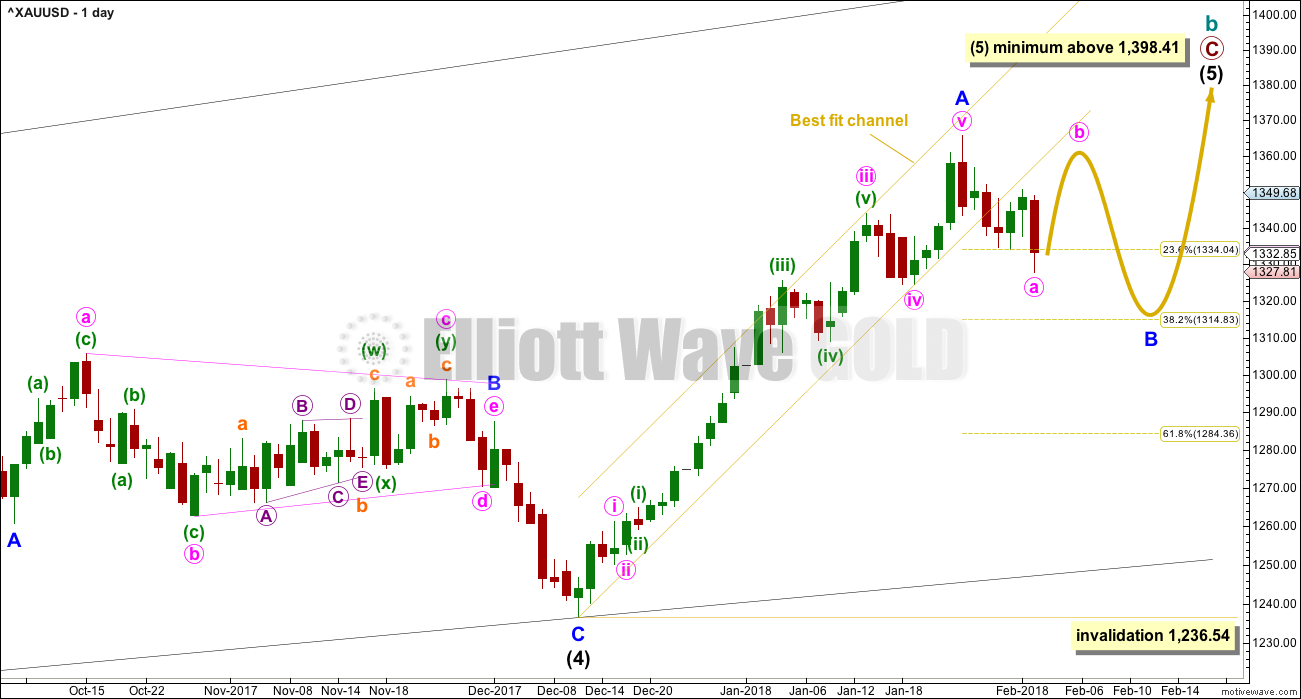

BULLISH ELLIOTT WAVE COUNT

FIRST WEEKLY CHART

Cycle wave b may be a single zigzag. Zigzags subdivide 5-3-5. Primary wave C must subdivide as a five structure and may be either an impulse or an ending diagonal. Overlapping at this stage indicates an ending diagonal.

Within an ending diagonal, all sub-waves must subdivide as zigzags. Intermediate wave (4) must overlap into intermediate wave (1) price territory. This diagonal is expanding: intermediate wave (3) is longer than intermediate wave (1) and intermediate wave (4) is longer than intermediate wave (2). Intermediate wave (5) must be longer than intermediate wave (3), so it must end above 1,398.41 where it would reach equality in length with intermediate wave (3).

Within the final zigzag of intermediate wave (5), minor wave B may not move beyond the start of minor wave A below 1,236.54.

Within intermediate wave (1), the correction labelled minor wave B was over within one week. Within intermediate wave (2), the correction labelled minor wave B was too quick to be seen on the weekly chart. Within intermediate wave (3), the correction labelled minor wave B was over in 12 weeks, one short of a Fibonacci 13. Within intermediate wave (4), the correction labelled minor wave B was over in a Fibonacci 8 weeks. As each actionary wave is extending in time as well as price, the correction of minor wave B within intermediate wave (5) may be longer than that within intermediate wave (3). At this early stage, a Fibonacci 13 or possibly even 21 weeks may be expected. This expectation is a rough guideline; flexibility is essential when B waves unfold.

This first weekly chart sees the upwards wave labelled primary wave A as a five wave structure. It must be acknowledged that this upwards wave looks better as a three than it does as a five. The fifth weekly chart below will consider the possibility that it was a three.

FIRST DAILY CHART

Within the ending diagonal, intermediate wave (5) must sub-divide as a zigzag.

Downwards movement has clearly broken below the yellow best fit channel. This indicates that the upwards wave labelled minor wave A should now be over and the next wave labelled minor wave B may now have begun. Price turned upwards after the breakout to find resistance at the lower edge of the channel, and is now this week moving down and away. This looks like typical behaviour after a breakout.

Minor wave B may be a reasonably time consuming consolidation or a quicker sharper pullback within the upwards trend, and it may end about either of the 0.382 or 0.618 Fibonacci ratios (neither may be favoured).

There are more than 23 possible structures that minor wave B may take, and it is impossible until close to or at the end to have confidence which possibility has unfolded. When B waves unfold, it is essential that analysis is flexible. B waves are analogous to either range bound consolidations or sharp corrections. As minor wave B unfolds, the labelling on the hourly chart for its sub-waves will change and alternates will be required from time to time.

The yellow arrow today outlines one possibility for minor wave B, an expanded flat correction. Members are strongly advised that this outline is only one possibility of many. Expanded flats are very common structures. If minor wave B unfolds as an expanded flat, then minute wave b would make a new high above the start of minute wave a at 1,365.68. Minute wave c downwards may then take price down to about the 0.382 Fibonacci ratio of minor wave A at 1,315.

Minor wave B may also be a triangle, an overlapping sideways movement in an ever decreasing range. At this stage, it may also be a zigzag, a relatively quick and sharp pullback that may end closer to the 0.618 Fibonacci ratio then the 0.382 Fibonacci ratio.

Minor wave B may not move beyond the start of minor wave A below 1,236.54.

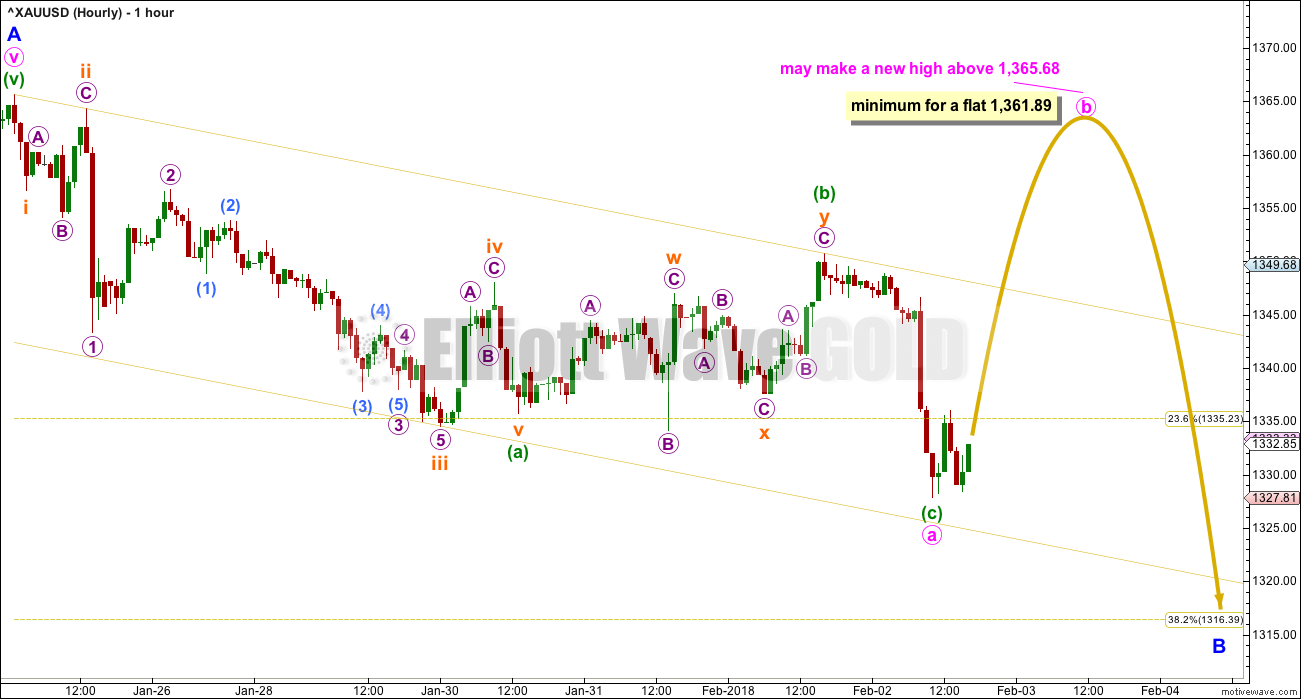

HOURLY CHART

The strongest piece of analysis on both hourly charts is the yellow best fit channel. The bottom line is that we should assume price may continue lower while price remains within this channel. If price breaks above the upper edge of this channel on Monday, then use this first hourly chart and look out for a strong bounce within minor wave B.

Minute wave a at this stage may be either a three wave zigzag or a five wave impulse. This first hourly chart looks at the possibility of a zigzag, which overall does have a better look (the proportions are a better fit).

If minute wave a is a three wave structure, then minute wave b would likely be a strong upwards bounce, and may make a new high above the start of minute wave a as in an expanded flat or running triangle. The minimum requirement for a flat is 0.9 the length of minute wave a at 1,361.89. There is no minimum requirement for minute wave b if minor wave B is a triangle.

Minute wave b may be a very time consuming and complicated movement. It may last a few weeks.

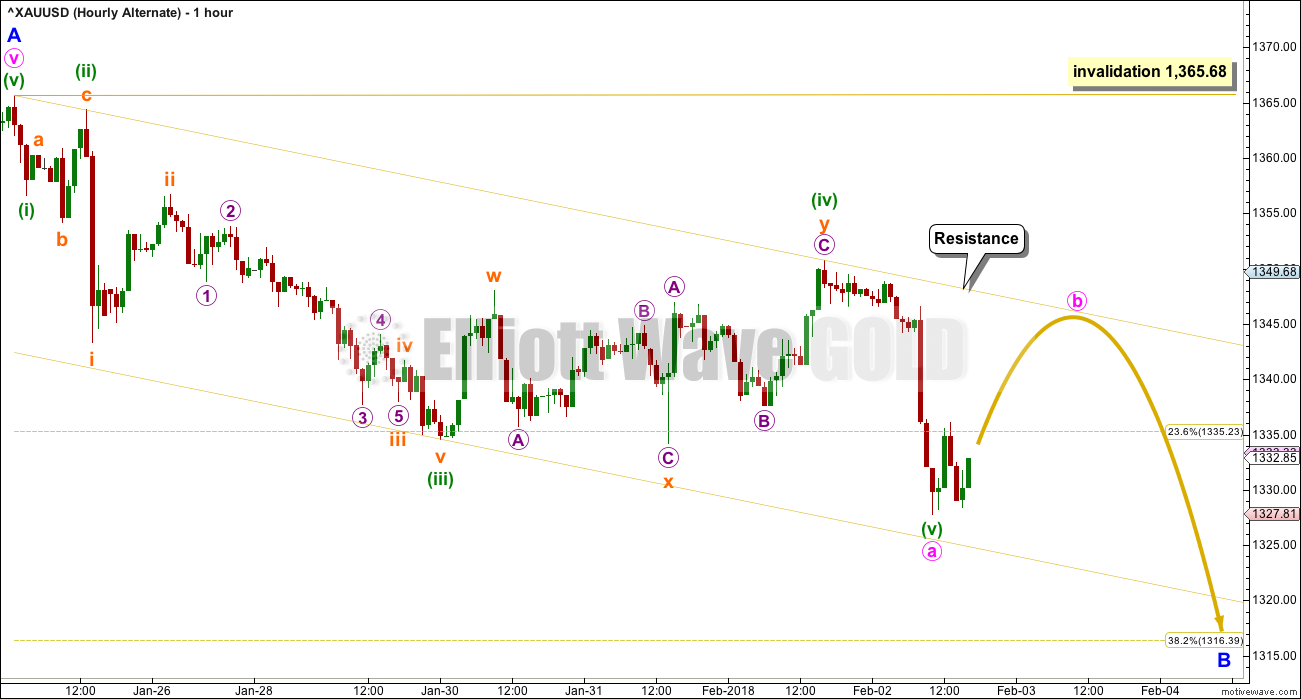

ALTERNATE HOURLY CHART

It is also possible that minute wave a was a five wave impulse. Both possibilities must be considered.

If minute wave a was an impulse, then minute wave b within it may not make a new high above the start of minute wave a at 1,365.68. Minute wave b may be relatively shallow, and it may find resistance about the upper edge of the yellow best fit channel.

There is a gross disproportion between subminuette waves (ii) and (iv) within minute wave a. This wave count does not have the right look for this reason. However, proportions within time consuming consolidations are not always very good, so this wave count is a valid possibility.

If a zigzag downwards does complete as this wave count expects for minor wave B, then another possibility must also be considered: the degree of labelling within the zigzag may be moved down one degree; it may be only minute wave a of a flat or triangle, or minute wave w of a double zigzag or combination.

Multiple structural possibilities would still remain for minor wave B.

BEARISH ELLIOTT WAVE COUNT

FIFTH WEEKLY CHART

There were five weekly charts published in the last historic analysis. This fifth weekly chart is the most immediately bearish wave count, so this is published as a bearish possibility.

This fifth weekly chart sees cycle wave b as a flat correction, and within it intermediate wave (B) may be a complete triple zigzag. This would indicate a regular flat as intermediate wave (B) is less than 1.05 the length of intermediate wave (A).

If cycle wave b is a flat correction, then within it primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. The most common length of B waves within flats is from 1 to 1.38 times the length of the A wave. The target calculated would see primary wave B end within this range.

I have only seen two triple zigzags before during my 10 years of daily Elliott wave analysis. If this wave count turns out to be correct, this would be the third. The rarity of this structure is identified on the chart.

TECHNICAL ANALYSIS

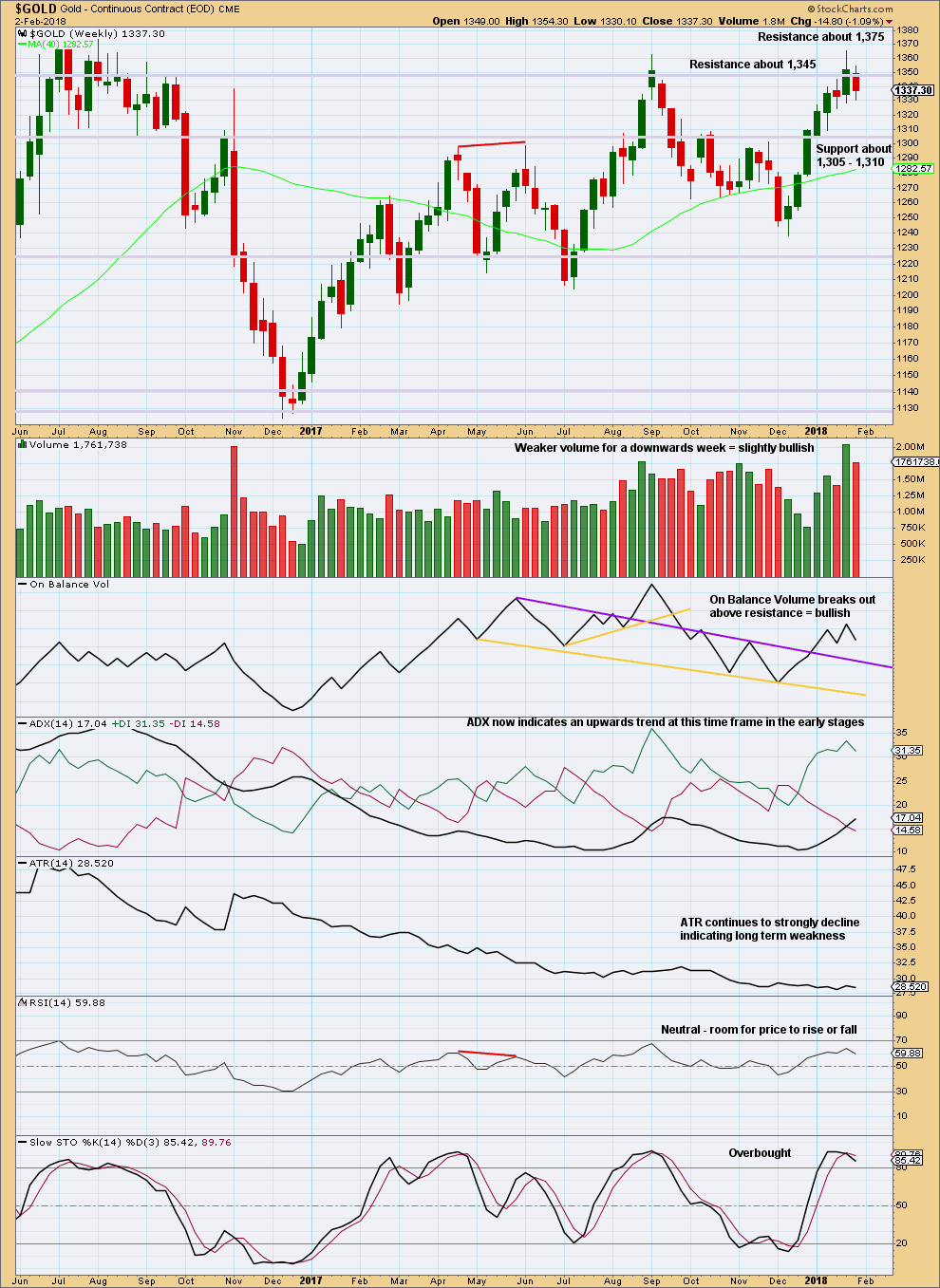

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Again, price could not remain above resistance at 1,345 and has closed back below this point. Price remains range bound at this time frame with resistance about 1,378 and support about 1,225. During this consolidation, it is now an upwards week that has strongest volume suggesting an upwards breakout may be more likely than downwards.

Last week’s upwards movement had strong support from volume. This week’s downwards movement does not. The short term volume profile remains bullish.

However, with price at resistance and Stochastics overbought, it would be reasonable to expect an end to the upwards swing here and a downwards swing to support.

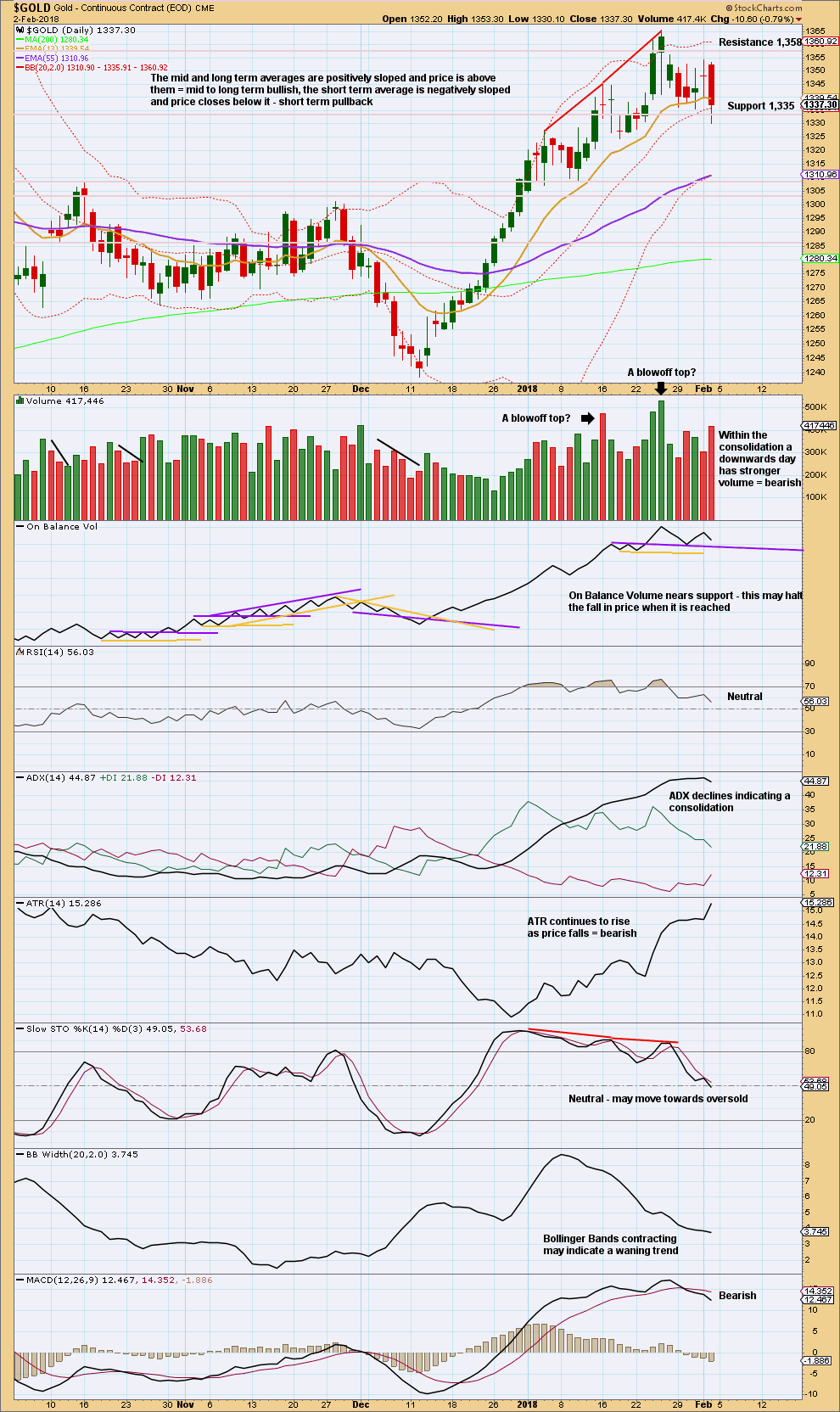

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

It still looks like price so far may be in a consolidation within an upwards trend. The volume profile for this smaller consolidation suggests a downwards breakout.

Look for next support about 1,310 – 1,305.

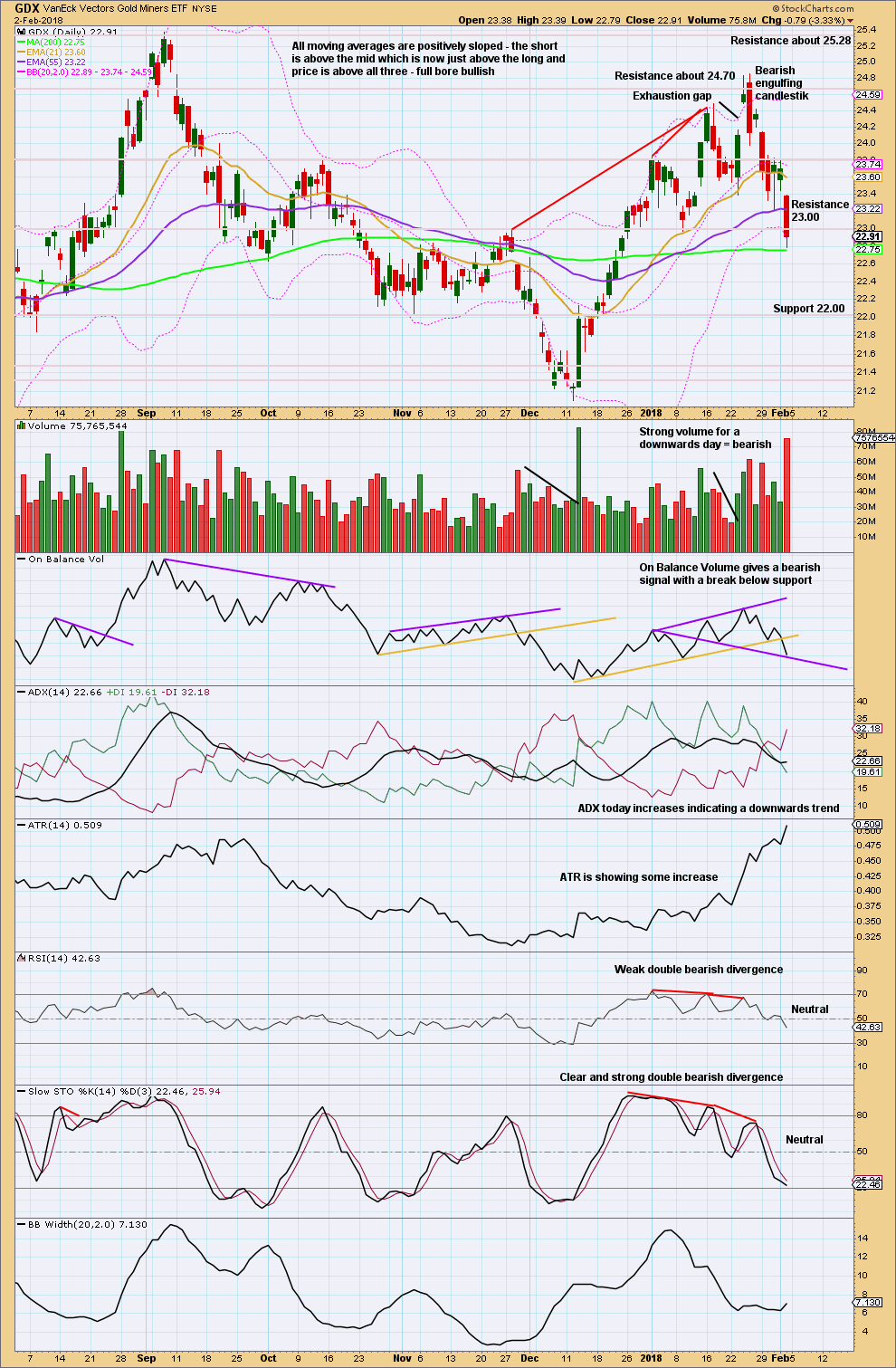

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The long term 200 day moving average may provide support.

ADX is now bearish, On Balance Volume gives a bearish signal, volume is bearish, ATR supports downwards movement and neither Stochastics nor RSI are oversold yet. There is a downwards trend at this time, and there is room for price to continue lower. Next strong support is about 22.00.

Published @ 06:25 p.m. EST on 3rd February, 2018.

First / main hourly count updated:

If a deep bounce is beginning then it looks like it may be a zigzag. That certainly could change. It could be an expanded flat, their C waves can be long and strong and that could have the power and reach to end at or above the minimum 1,361.89.

But remember also that this chart encompasses not only the idea of a flat correction for minor B, but also a triangle. Where minute b does not have to reach that minimum, it only needs to be a three upwards. Which is usually fairly deep.

Second / alternate hourly chart updated:

The idea of a zigzag unfolding lower, which could be minor B in its entirety.

OR

move the degree of labelling down one and it could be only minute a within minor B.

If a zigzag is unfolding lower then it would be extremely likely for wave B to find resistance at the upper edge of the yellow channel.

I also have a question on the look of triangle in the main Weekly.

The minor 1 of Primary 4 seems very close to the minor E of the end of the triangle?

On the US Oil chart, main weekly, yes, minor 1 of intermediate (C) of primary 4 ends very close to the upper B-D trend line of the triangle for intermediate (B).

That’s okay. It looks like there may have been some resistance still about there. The breakout came at the start of minor 3.

The subdivisions all fit, all rules are met, and the triangle ended with a common undershoot of the A-C trend line.

But yeah, that doesn’t mean that the main count must be the correct one. Hence the alternate which sees that whole movement differently.

Lara, thanks again for sharing the S&P analysis with us!

One question from the US Oil Alt count: Is it normal for Extended Triangles to have Waves F to I end so short of the overall triangle trendlines? Thanks,

Well, I’ve never actually seen a nine wave triangle before so I can’t tell you how normal this one is.

It would be very rare.

My theory would be that because it is so common for E waves of five wave triangles to fall short of the trend line, it follows that for a nine wave triangle the last waves may fall short of the trend lines, and more than one of those last waves may do that.

However, the rarity of a nine wave triangle must reduce the probability of that count. It does also suffer from a bit of a problem with primary C not ending beyond the extremes of primary B. It’s not technically a truncation, but it is still a slight problem.

That wave count was developed to see a bullish case. It’s a “what if?” What if my main count is just plain wrong? What else could be happening? Is it possible that the bear market for Oil could be over? If it’s possible, how can the subdivisions fit and all EW rules be met? And that’s the best I’ve come up with.

Sounds good. Thanks,