More downwards movement for Friday was expected.

Summary: A low may now be in place. Some confidence may be had in this view if price breaks above the yellow channel on the hourly chart. A target would then be at 3,020.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here. Video is here.

An historic example of a cycle degree fifth wave is given at the end of the analysis here.

MAIN ELLIOTT WAVE COUNT

MONTHLY CHART

The large expanded flat labelled Super Cycle wave (IV) completed a 8.5 year correction. Thereafter, the bull market continues for Super Cycle wave (V). The structure of Super Cycle wave (V) is incomplete. At this stage, it is subdividing as an impulse.

There is no Fibonacci ratio between cycle waves I and III within Super Cycle wave (V). This makes it more likely that cycle wave V will exhibit a Fibonacci ratio to either of cycle waves I or III. Cycle wave V has passed equality in length with cycle wave I. The next two Fibonacci ratios in the sequence are used for two possible targets for it to end.

The teal channel is drawn using Elliott’s first technique about an impulse. Draw the first trend line from the ends of cycle waves I to III (from the months of July 2011 to December 2014), then place a parallel copy on the low of cycle wave II. Cycle wave IV has found support very close to the lower edge of this channel, so the channel looks about right. The lower edge should continue to provide support, and the upper edge may provide resistance if price gets up that high.

Copy this large channel over to weekly and daily charts, all on a semi log scale. The lower edge will be important.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV is now seen as a more shallow 0.28 double combination lasting 14 months. With cycle wave IV nearly five times the duration of cycle wave II, it should be over there.

Cycle wave I lasted 28 months (not a Fibonacci number), cycle wave II lasted a Fibonacci 3 months, cycle wave III lasted 38 months (not a Fibonacci number), and cycle wave IV lasted 14 months (one more than a Fibonacci 13).

Cycle wave V has begun its 24th month. The structure needs several more months to complete. It may last another 10 months to total a Fibonacci 34, which now looks reasonable.

It is also possible that cycle wave V may not exhibit a Fibonacci duration.

Within cycle wave V, the correction for intermediate wave (4) may not move back down into intermediate wave (1) price territory below 2,193.81.

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Due to its size intermediate wave (4) looks proportional to intermediate wave (2), even though their durations so far are quite different.

Intermediate wave (4) has breached the Elliott channel drawn using Elliott’s first technique. The channel may be redrawn when it is confirmed as complete using Elliott’s second technique. A best fit channel is used while it may still be incomplete to show where it may find support. Price points are given for this channel, so that members may replicate it on a semi-log scale.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81.

DAILY CHART

The S&P has behaved like a commodity to end intermediate wave (3): a relatively strong fifth wave with a steep slope. The high looks a little like a blow off top. This is being followed by a sharp decline, which is typical behaviour for a commodity and not common for the S&P.

There are adequate Fibonacci ratios within this wave count. It is common for the S&P to exhibit a Fibonacci ratio between two of the three actionary waves within an impulse, and uncommon for it to exhibit Fibonacci ratios between all three actionary waves. This means that the lack of Fibonacci ratios for intermediate wave (3), minor wave 3, and minute wave v is not a concern. This is normal.

Friday’s low is only a little above the lower edge of the best fit channel. The very long lower wick on Friday’s candlestick is bullish. It looks like intermediate wave (4) may now have found its low.

ALTERNATE WAVE COUNT

WEEKLY CHART

This alternate wave count is published with the caveat that at this stage it must be judged to have an extremely low probability for the following reasons:

1. There is no divergence between price and the AD line at the all time high. All bear markets within the last (almost) 100 years began after a minimum of 4 months divergence with the AD line. If this wave count is correct, then this is the first time in almost 100 years when divergence did not occur.

2. There is no divergence between price and RSI on the monthly chart at the last all time high. This is again highly unusual prior to a bear market.

3. The bear market may have begun suddenly without a normal prior increase in market volatility. Normally, corrections unfold prior to the end of a bull market that increase by degree prior to the bull market ending.

However, low probability (even as low as I judge this to be) does not mean no probability. I would rather members are aware of this risk and manage this risk accordingly.

This wave count absolutely requires a clear breach of the teal channel on the weekly chart before any confidence at all may be had in it. A breach would be a full weekly candlestick (not just daily) below and not touching the lower teal trend line. This channel is copied over from the monthly chart.

Thereafter, a new low by any amount at any time frame below 2,111.05 would add substantial confidence to this wave count. At that stage, downwards movement could not be a fourth wave correction within an ongoing impulse as it would be back in first wave price territory of primary wave 1.

If this wave count is correct, then a once in multi-generations trend change may have occurred. Grand Super Cycle wave II would be expected to last at least 20 years, and possibly a generation. It would be very likely to end substantially below the end of Super Cycle wave (IV) at 666.79.

I judge the probability of this alternate wave count to have such a low probability that I was hesitant in publishing it. But I am also aware that just because this kind of end to a bull market has not been seen in almost 100 years does not mean it cannot happen.

TECHNICAL ANALYSIS

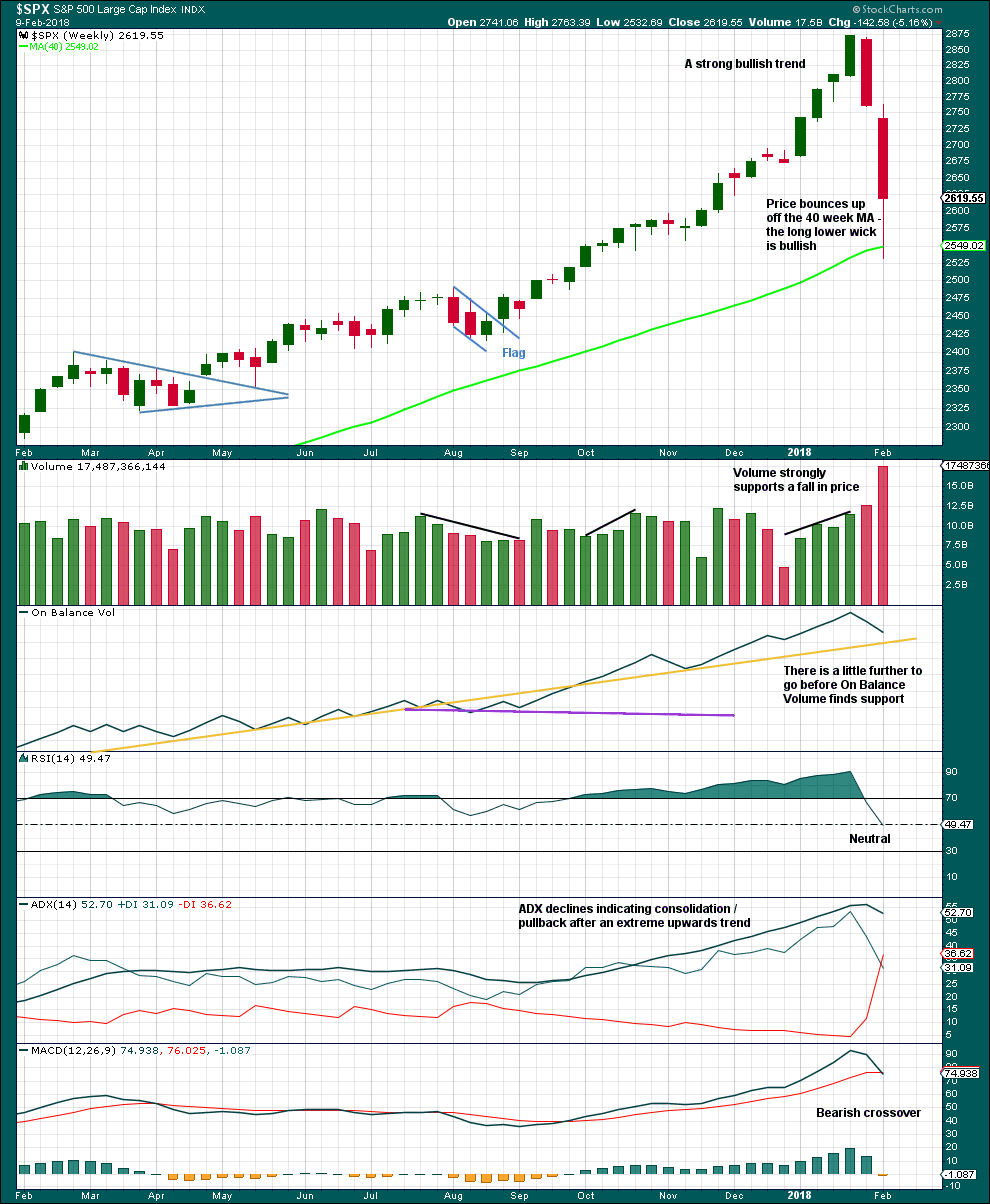

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This pullback has now brought RSI well back down into neutral territory. ADX is declining from very extreme. A possible trend change to down is indicated, but as yet no new downwards trend at this time frame.

In the first instance, support should be expected for On Balance Volume at the yellow trend line. A breach below this line by On Balance Volume would be a very strong bearish signal. A bounce up off the line would be a strong bullish signal.

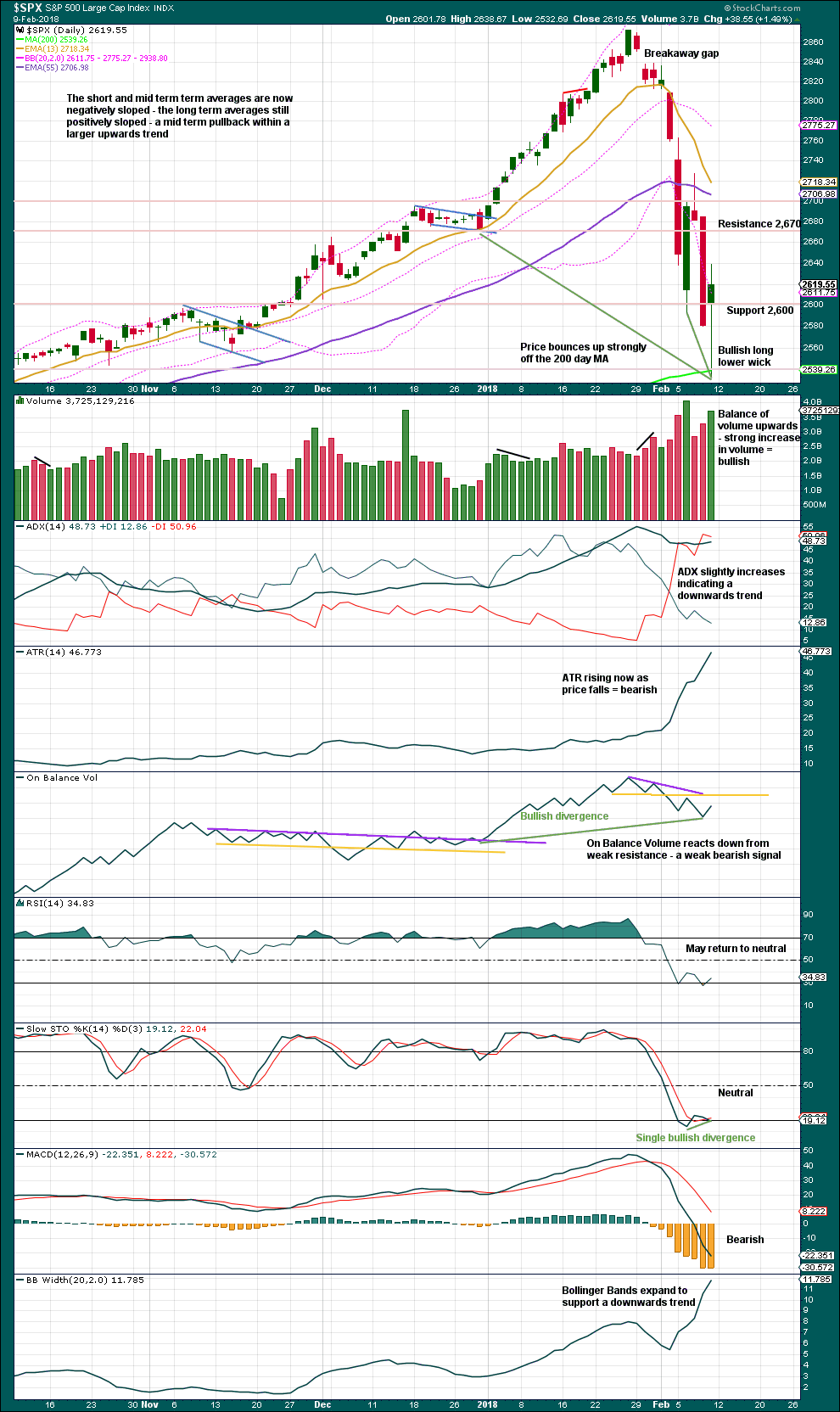

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Friday’s daily candlestick is not properly a hammer reversal pattern because it has too long an upper wick. However, the lower wick is very long and this is very bullish. Particularly as the low was very close to the 200 day SMA.

This pullback has brought RSI down from very overbought to just oversold. RSI can move back into oversold and remain there for a few days, or it can move back now further into neutral territory.

Overall, it looks like a low may now be in pace.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Price moved lower with a lower low and lower high for Friday, but inverted VIX moved higher. This single day divergence is bullish.

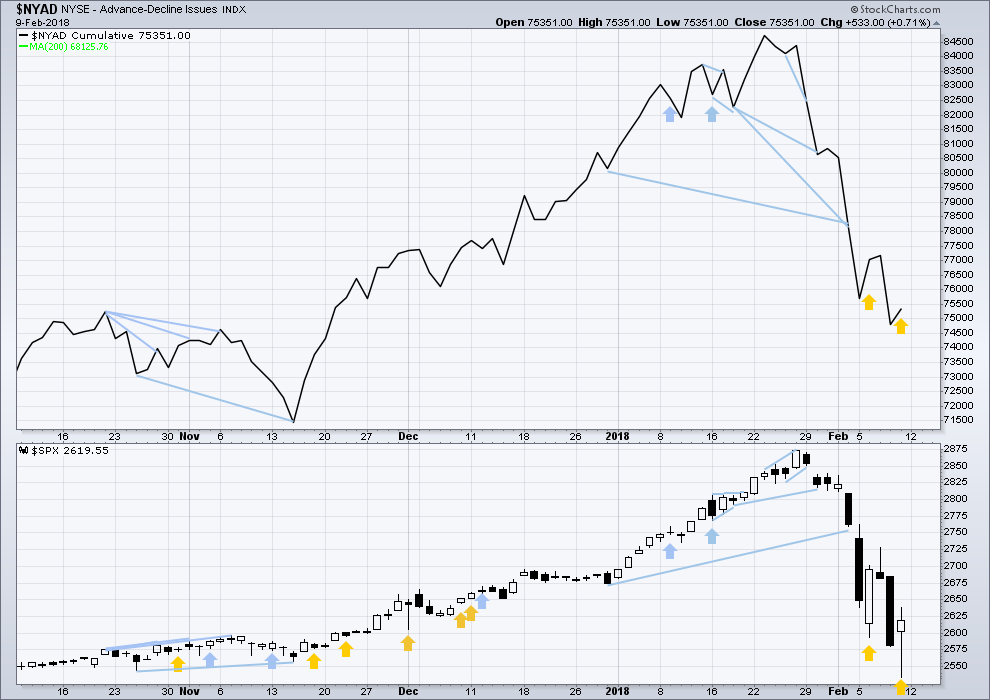

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

All of small, mid and large caps this week moved lower. The decline has support from wide breadth.

Breadth should be read as a leading indicator.

Price moved lower with a lower low and lower high for Friday, but the AD line moved higher. This single day divergence is bullish.

DOW THEORY

All indices have made new all time highs as recently as three weeks ago, confirming the ongoing bull market.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Published @ 06:09 p.m. EST on 10th February, 2018.