Downwards movement today breached a trend line on one of the daily Elliott wave counts, and because of the breach it has now been discarded.

Volume analysis today is used to indicate the most likely direction for tomorrow.

Summary: With volume now supporting downwards movement, it looks like the bounce was very brief and shallow. The short term target is at 1,226 for a multi day to multi week consolidation.

The mid term target is 1,216 – 1,211. Downwards movement may be limited to no lower than 1,123.08.

Always trade with stops to protect your account. Risk only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with several monthly and weekly charts is here, video is here.

The last bullish wave count (the zigzag) is today discarded because the lower (2)-(4) trend line was breached by a full daily candlestick.

At this time, only three wave counts remain for cycle wave b: a triangle, a flat and a combination. All three wave counts expect downwards movement to continue from here. While this direction does not diverge between them, only one wave count shall be published daily.

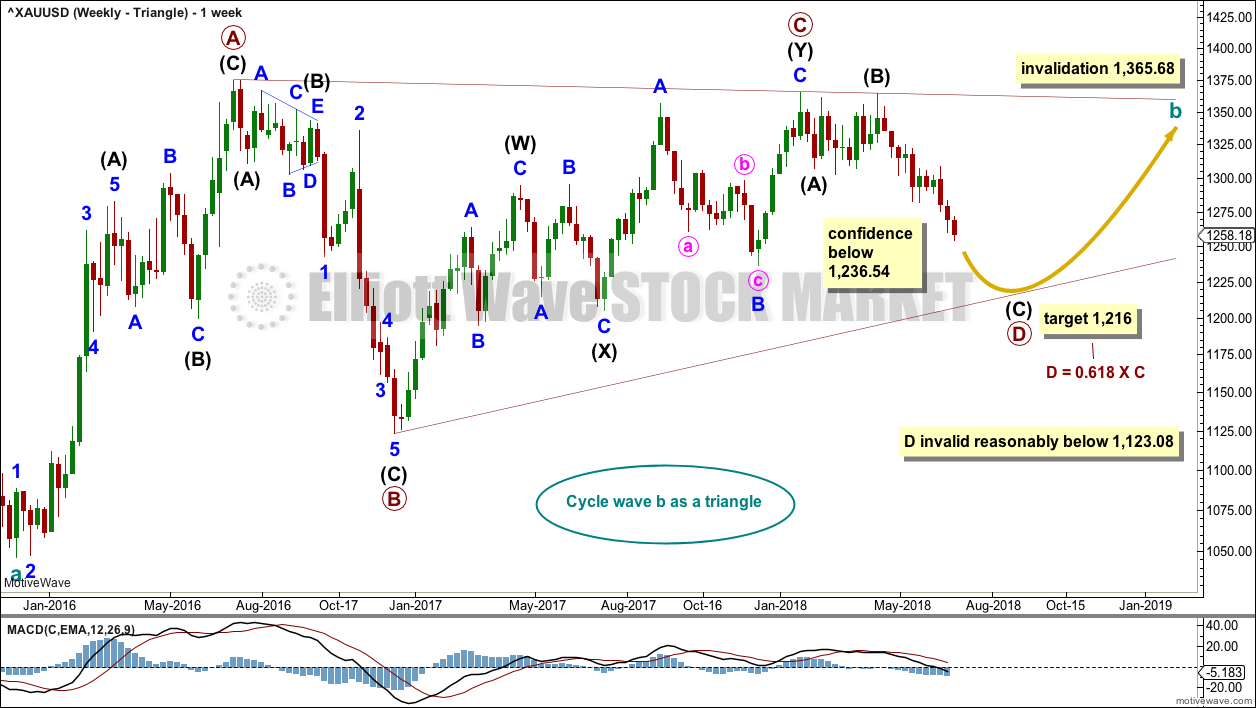

WEEKLY CHART – TRIANGLE

The triangle so far has the best fit and look. If price shows a combination or flat may be more likely, then those ideas may be published on a daily basis. The flat and combination ideas expect movement reasonably below 1,123.08, or perhaps a new low below 1,046.27.

Cycle wave b may be an incomplete triangle. The triangle may be a contracting or barrier triangle, with a contracting triangle looking much more likely because the A-C trend line does not have a strong slope. A contracting triangle could see the B-D trend line have a stronger slope, so that the triangle trend lines converge at a reasonable rate. A barrier triangle would have a B-D trend line that would be essentially flat, and the triangle trend lines would barely converge.

Within a contracting triangle, primary wave D may not move beyond the end of primary wave B below 1,123.08. Within a barrier triangle, primary wave D may end about the same level as primary wave B at 1,123.08, so that the B-D trend line is essentially flat. Only a new low reasonably below 1,123.08 would invalidate the triangle.

Within both a contracting and barrier triangle, primary wave E may not move beyond the end of primary wave C above 1,365.68.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Primary wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best.

Primary wave D must be a single structure, most likely a zigzag.

One triangle sub-wave tends to be close to 0.618 the length of its predecessor; this gives a target for primary wave D.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

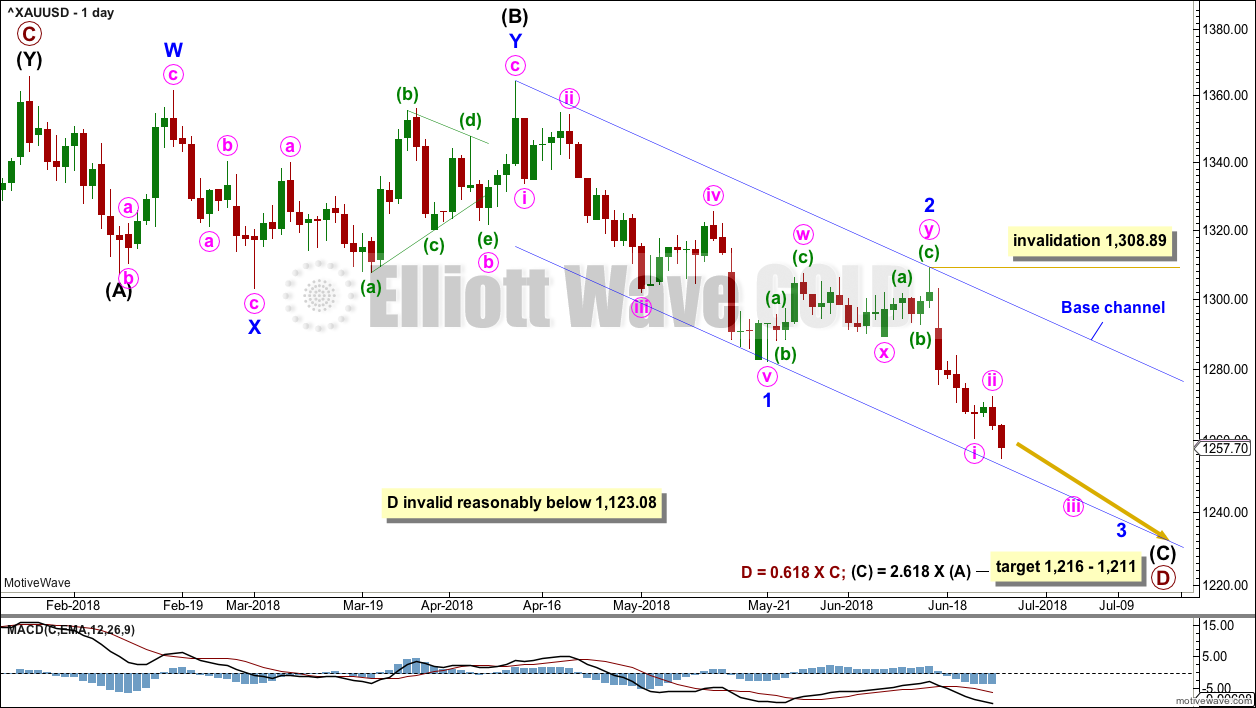

DAILY CHART – TRIANGLE

Primary wave D may be unfolding lower as a single zigzag, and within it intermediate waves (A) and (B) may be complete.

The target is widened to a $5 zone calculated at two degrees. This should have a reasonable probability.

Within intermediate wave (C), it looks likely that minor wave 2 may now be over. Within minor wave 3, no second wave correction may move beyond the start of its first wave above 1,308.89.

This wave count now expects to see an increase in downwards momentum as a third wave unfolds.

Add a base channel about minor waves 1 and 2. Along the way down, bounces for lower degree second wave corrections may be expected to find resistance at the upper edge of the base channel. The middle to end of minor wave 3 may have the power to break below support at the lower edge of the base channel.

Gold, typical of commodities, often exhibits very swift and strong fifth waves. This tendency is particularly prevalent for its fifth waves to end third wave impulses. Look out for a possible selling climax to end one or both of minute wave iii and minor wave 3.

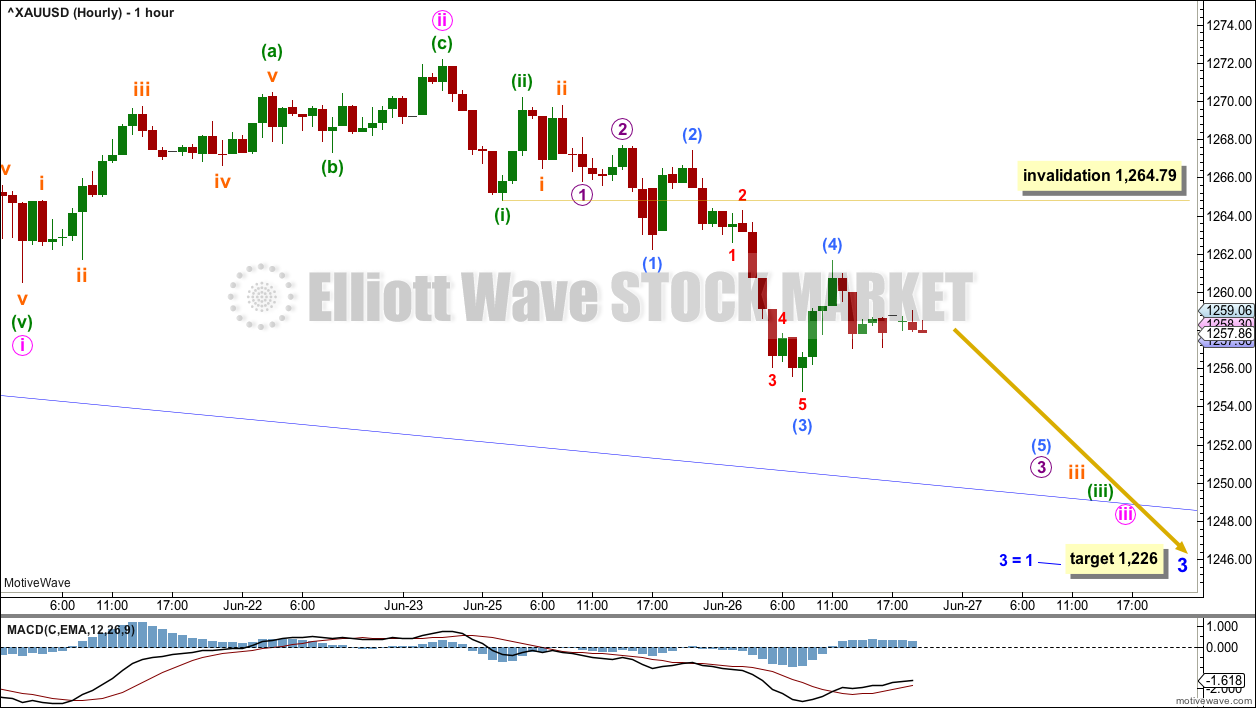

HOURLY CHART

The base channel on the daily chart is copied over to this hourly chart.

Minor wave 3 may only subdivide as an impulse. The target for minor wave 3 to end is equality in length with minor wave 1, because minor wave 2 was shallow. This target fits with the lower target for intermediate wave (C) to end.

Within minor wave 3, minute waves i and ii may now be complete. Minute wave ii may have been a very shallow zigzag. The strong downwards pull of a third wave may have forced it to be more shallow than expected.

There may now be a third wave at five degrees unfolding lower.

Within minute wave iii, the upcoming correction for minuette wave (iv) may not move into minuette wave (i) price territory above 1,264.79.

TECHNICAL ANALYSIS

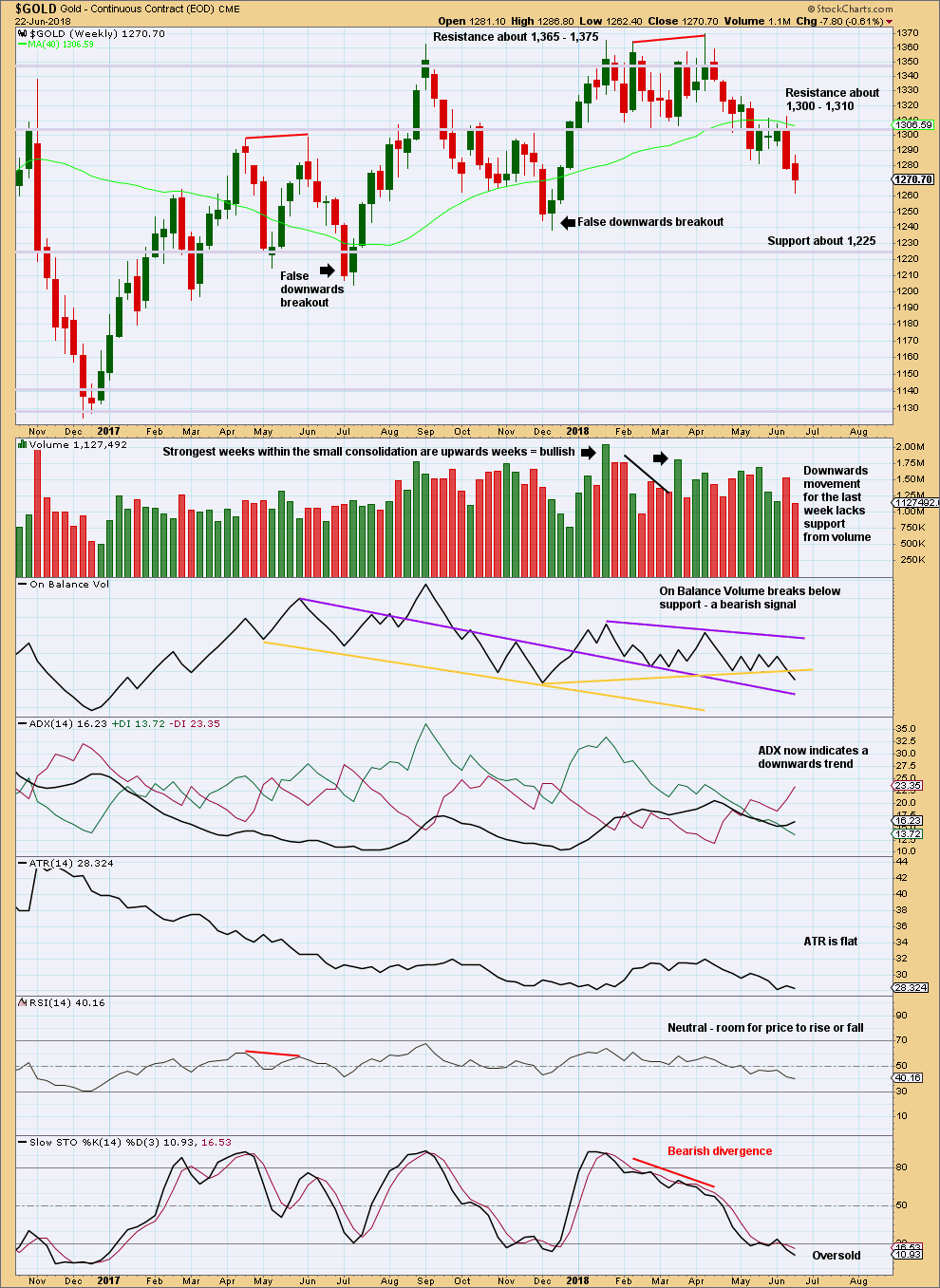

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On Balance Volume gave a reasonable bearish signal last week. The yellow support line, which is breached, has reasonable technical significance: it is reasonably long held, has been tested at least three times before, and has a shallow slope. This supports the new Elliott wave count, which expects more downwards movement from price here.

Stochastics may remain oversold for several weeks when Gold has a strong bear trend. There is a good example of this on the left hand side of the chart. Only would Stochastics indicate an end to the trend when it has been oversold and then exhibits bullish divergence with price. That is not the case here.

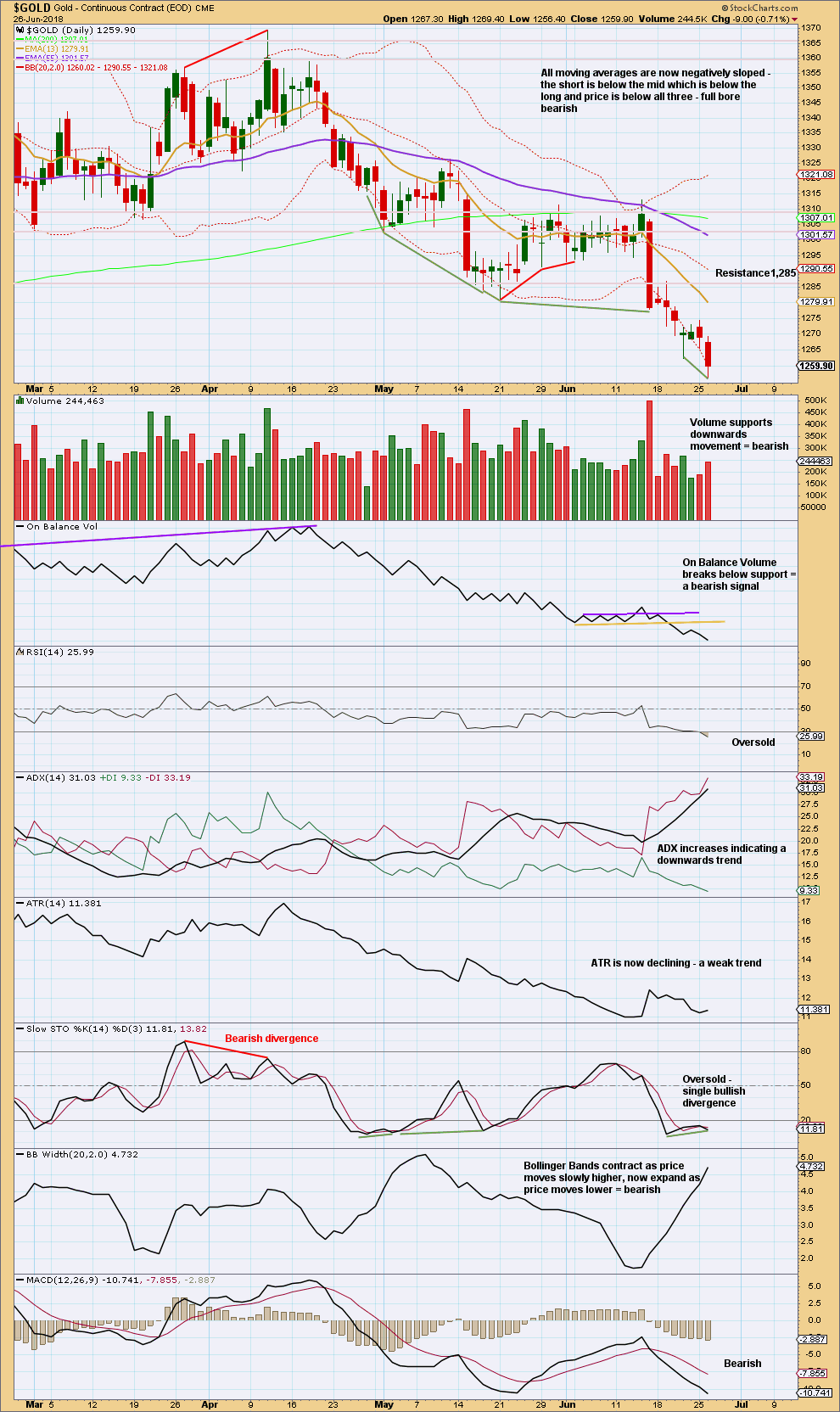

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

With a bearish signal from On Balance Volume at the weekly chart level, it now looks like the downwards breakout this time may be true and not false.

On Balance Volume at the daily chart level remains bearish and supports the new Elliott wave count.

RSI has today just reached into oversold. It may remain oversold for a very few days before a consolidation may develop to resolve it.

ADX is not yet extreme, but it may become so in a very few days.

Stochastics is oversold and exhibits bullish divergence with price again. This trend is nearing extreme, but a low may not be yet in.

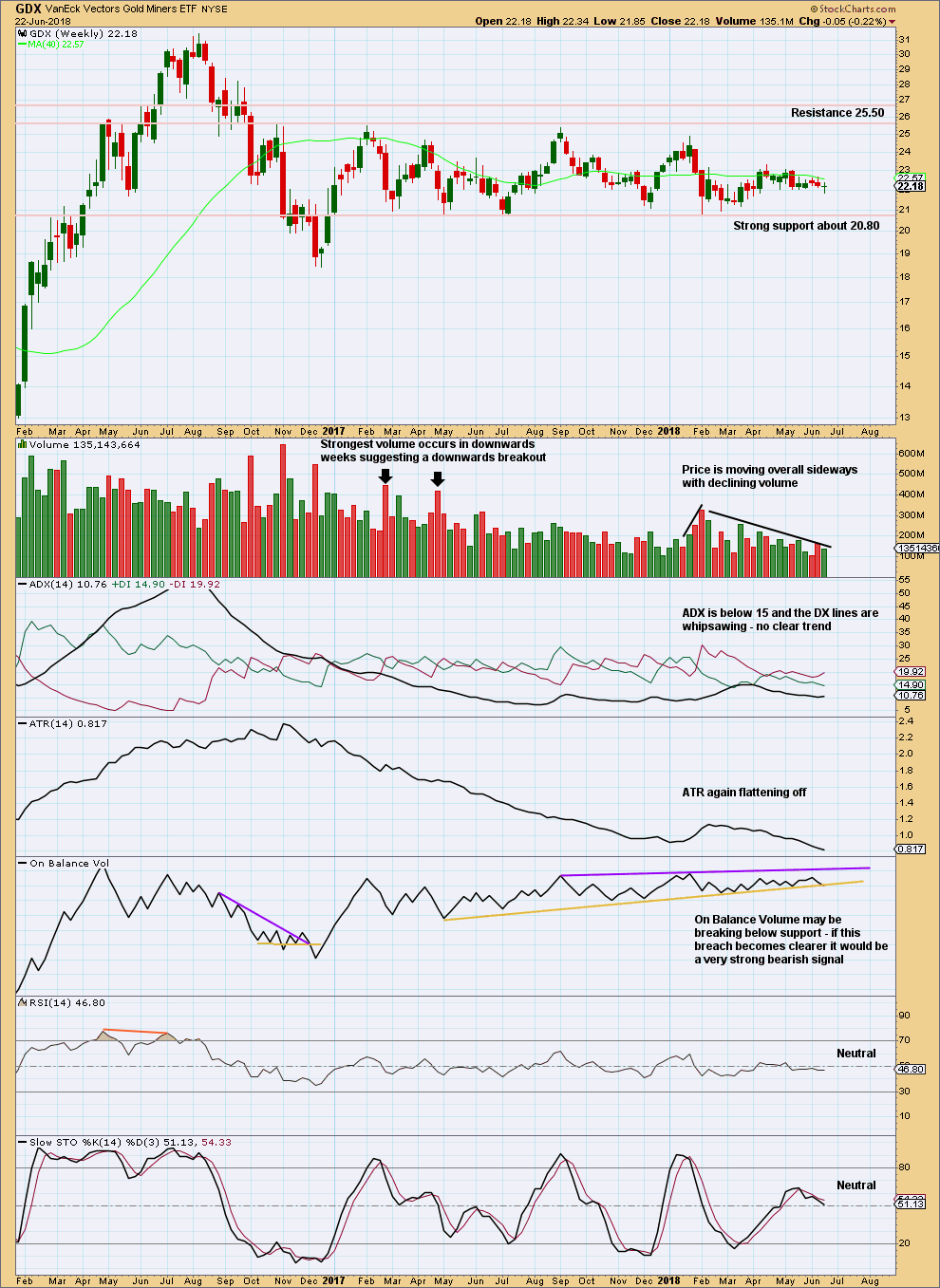

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support about 20.80 has been tested about eight times and so far has held. The more often a support area is tested and holds, the more technical significance it has.

In the first instance, expect this area to continue to provide support. Only a strong downwards day, closing below support and preferably with some increase in volume, would constitute a downwards breakout from the consolidation that GDX has been in for a year now.

Resistance is about 25.50. Only a strong upwards day, closing above resistance and with support from volume, would constitute an upwards breakout.

A downwards week last week completes a small green doji. Overall, this is neutral.

The yellow support line on On Balance Volume has a reasonable slope, but it is very long held and has been tested multiple times. This line has very strong technical significance. If it is clearly breached this week, that would provide a very strong bearish signal for GDX.

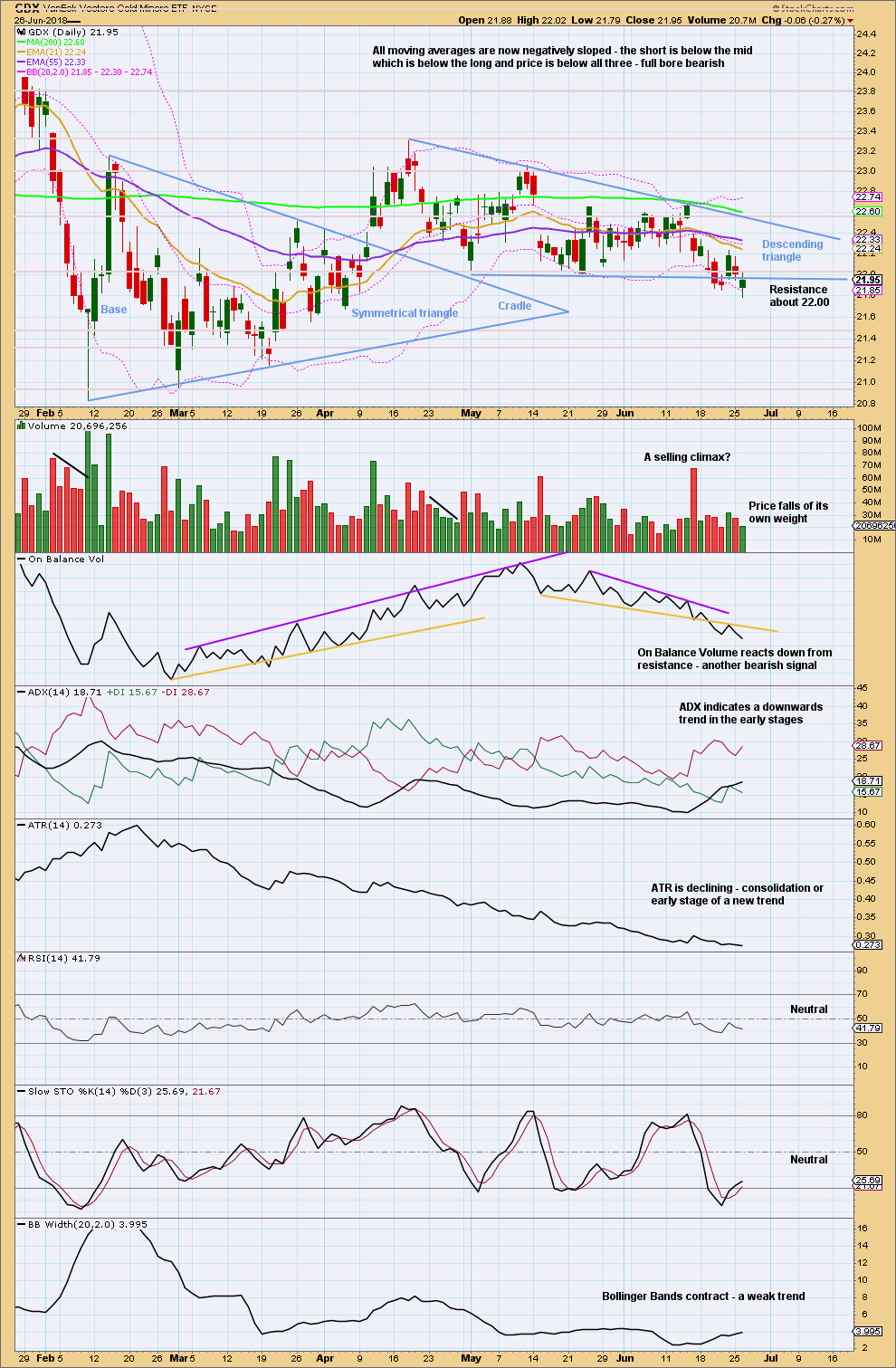

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On Balance Volume is bearish at the daily chart level.

GDX appears to have more room for downwards movement than Gold. The trend is not yet nearing extreme. Look for support about 20.80.

Overall, this chart is bearish to neutral.

Published @ 09:30 p.m. EST.

Updated hourly chart:

For now I’m going to label minuscule wave 2 as an expanded flat, but I’m going to take time this morning on the five minute chart to look at the subdivisions of today’s downwards movement.

All this overlapping… looks like more downwards movement to come to resolve it all.

Captain EW count???

Some one can understand this count?? May be??

Looks like a very bullish “to the moon” count with 3 1st and 2nd waves. IMHO the proportions don’t look good and some of the impulses look like 3’s. I think it’s unrealistic that the bear market ended at the Dec 2015 low which is what this count assumes.

with some adjustment… I can see how a nested series of first and second waves could work….

as it is, that wave count has some problems in terms of how those impulses subdivide

I’m going to do another “what if” beginning with a blank Gold chart this weekend. Sometimes I record the process, to try and give members an insight into the thinking process. I don’t quite get how you like to watch this (personally, I hate video as a learning tool, I prefer to read).

So, do you want me to record this process for you this weekend?

Your educational videos are always welcome

Okay, will do.

Just took a look at the analytics of the last one, and they do get a fair number of views, so I’ll keep doing them from time to time.

I don’t know if I’ll manage to come up with anything new this weekend, but I will give it my best shot.

Thanks Lara. Your videos are nice.

The count has a portion which is invalid. Up to the last high at 1,369.40 (for this data, my BarChart data is slightly different) there is an ending diagonal labelled for C of B.

That diagonal does not meet the rules.

And that’s a key aspect actually. That piece of movement is REALLY hard to figure out, and get a count that meets all EW rules. Getting that right means the count may be right, getting that wrong means the count is wrong.

Lara, is this not a valid count that would see a bullish resolution to the triangle? I hate big triangles… they seem to never end and this could even extend the timeline before we get a breakout.

https://www.tradingview.com/x/OlmyIr0Z/

Yes, that’s also valid.

I’ve charted it for Silver, and yes, it works for Gold too.

At this time it would not diverge from the other wave counts, they’d all need some more downwards movement.

I think I need to update the historic analysis again. Will do that for the end of week video I think.

Great 👍 🤩