Technical analysis at the end of this week focuses on candlestick patterns along with a very few key indicators. A strong pattern at the end of the week suggests the direction for next week for Gold.

Summary: It looks very likely that a low is in place for Gold for the short to mid term. A bounce up now to about 1,307 is expected to last a few weeks, possibly as long as 21 weeks. It is expected to have a consolidation within it.

Always trade with stops to protect your account. Risk only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts and several weekly alternates is here, video is here.

There are six weekly charts published in the last historic analysis. All but two expect more downwards movement at this time; the two bullish wave counts have been invalidated below 1,236.54. The remaining four bearish wave counts are updated in this analysis.

MAIN ELLIOTT WAVE COUNT

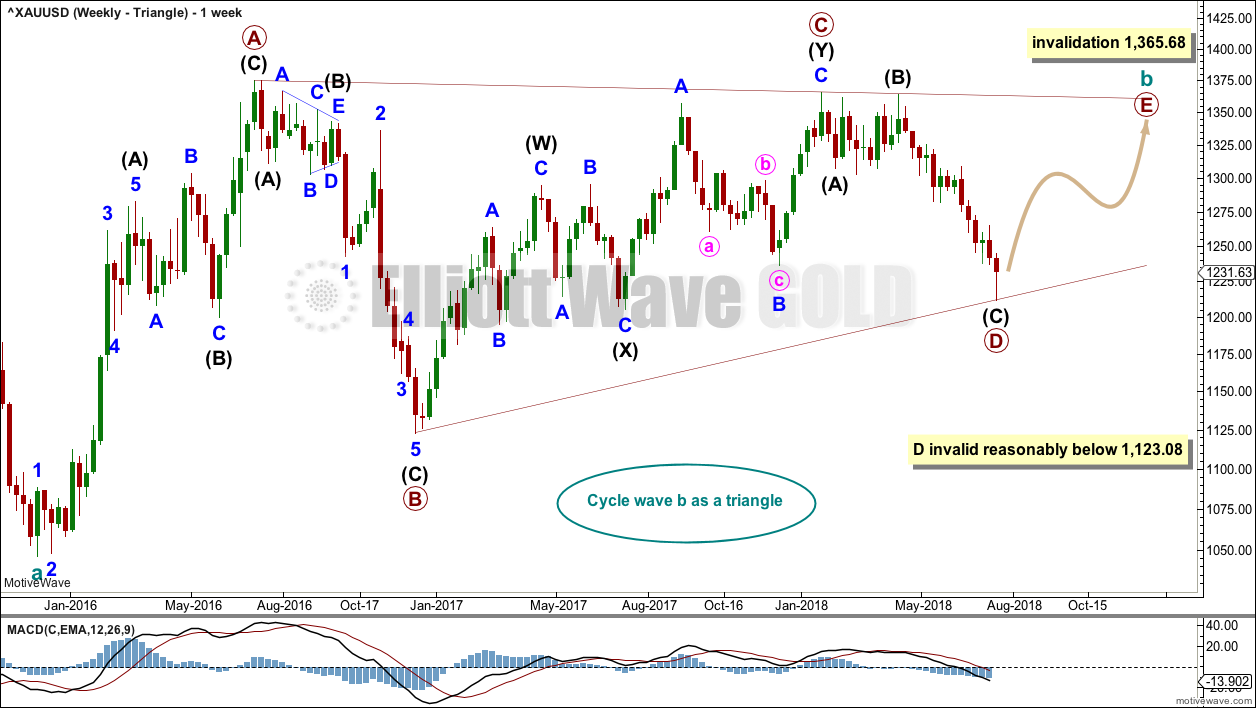

WEEKLY CHART – TRIANGLE

The triangle so far has the best fit and look.

Cycle wave b may be an incomplete triangle. The triangle may be a contracting or barrier triangle, with a contracting triangle looking much more likely because the A-C trend line does not have a strong slope. A contracting triangle could see the B-D trend line have a stronger slope, so that the triangle trend lines converge at a reasonable rate. A barrier triangle would have a B-D trend line that would be essentially flat, and the triangle trend lines would barely converge.

Within a contracting triangle, primary wave D may not move beyond the end of primary wave B below 1,123.08. Within a barrier triangle, primary wave D may end about the same level as primary wave B at 1,123.08, so that the B-D trend line is essentially flat. Only a new low reasonably below 1,123.08 would invalidate the triangle.

Within both a contracting and barrier triangle, primary wave E may not move beyond the end of primary wave C above 1,365.68.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Primary wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best.

Primary wave D must be a single structure, most likely a zigzag. It is possible that primary wave D could be over.

One triangle sub-wave tends to be close to 0.618 the length of its predecessor; if primary wave D is over at this weeks low, it is just 3.64 below this point.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

DAILY CHART – TRIANGLE

It is possible at the end of this week that primary wave D is over. The structure may be seen complete and technical analysis indicates a low may now be in place.

It is also possible that minor wave 5 could continue lower next week. This idea would be invalidated at the hourly chart level with a new high above 1,247.37, so a new high next week above this price point would add confidence that a low is in place.

At this stage, the best target calculation for primary wave E would be 0.618 the length of primary wave D. This yields a target that is within a very strong area of resistance.

When intermediate waves (A) and (B) within primary wave E may be complete, then the ratio between intermediate waves (A) and (C) may be used to add to the target calculation at a second degree. At that stage, it may change or widen to a zone.

Primary wave E would be most likely to fall reasonably short of the A-C trend line.

In the first instance, primary wave E may be expected to last about a Fibonacci 21 weeks.

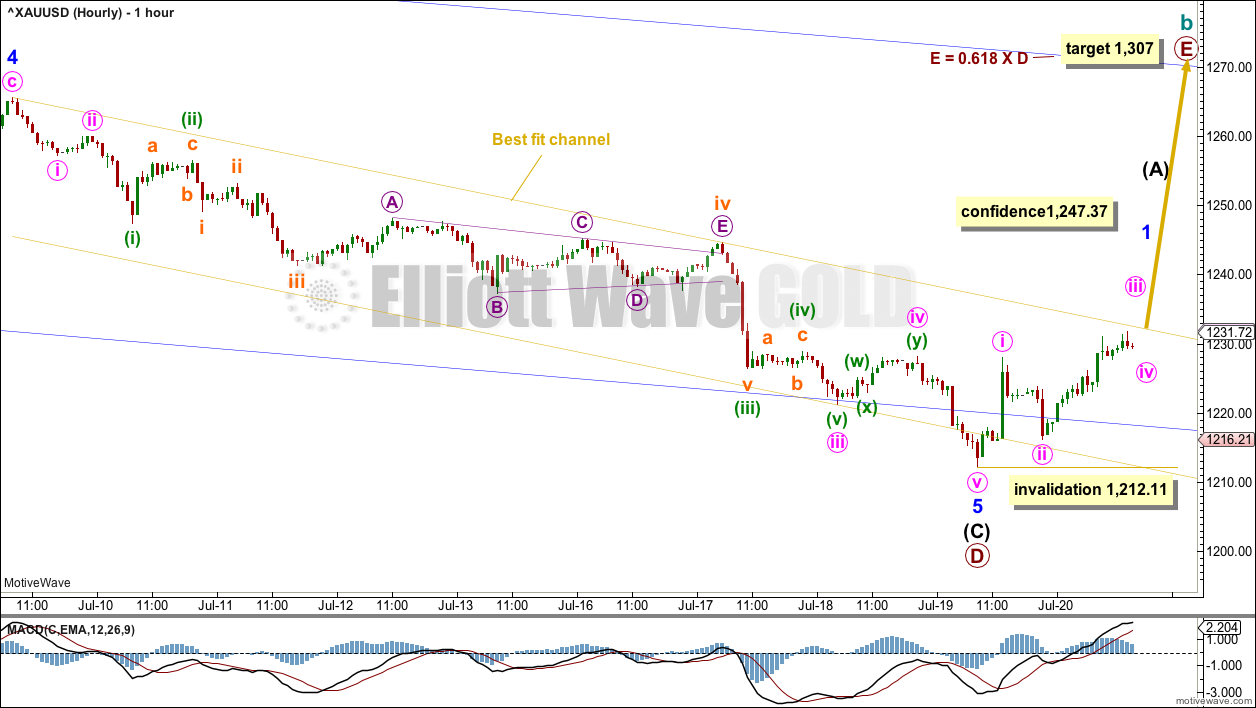

MAIN HOURLY CHART

Because there is reasonable support at the end of this week for the idea of a low in place, at least for the mid term, this is the preferred hourly chart.

It is possible to see minor wave 5 as a complete impulse, ending with an overshoot of the lower edge of the blue Elliott channel.

If minor wave 5 is over, then within the new upwards wave to start primary wave E no second wave correction may move beyond the start of its first wave below 1,212.11.

A new high above 1,247.37 would invalidate the alternate hourly wave count and provide strong confidence in this second wave count.

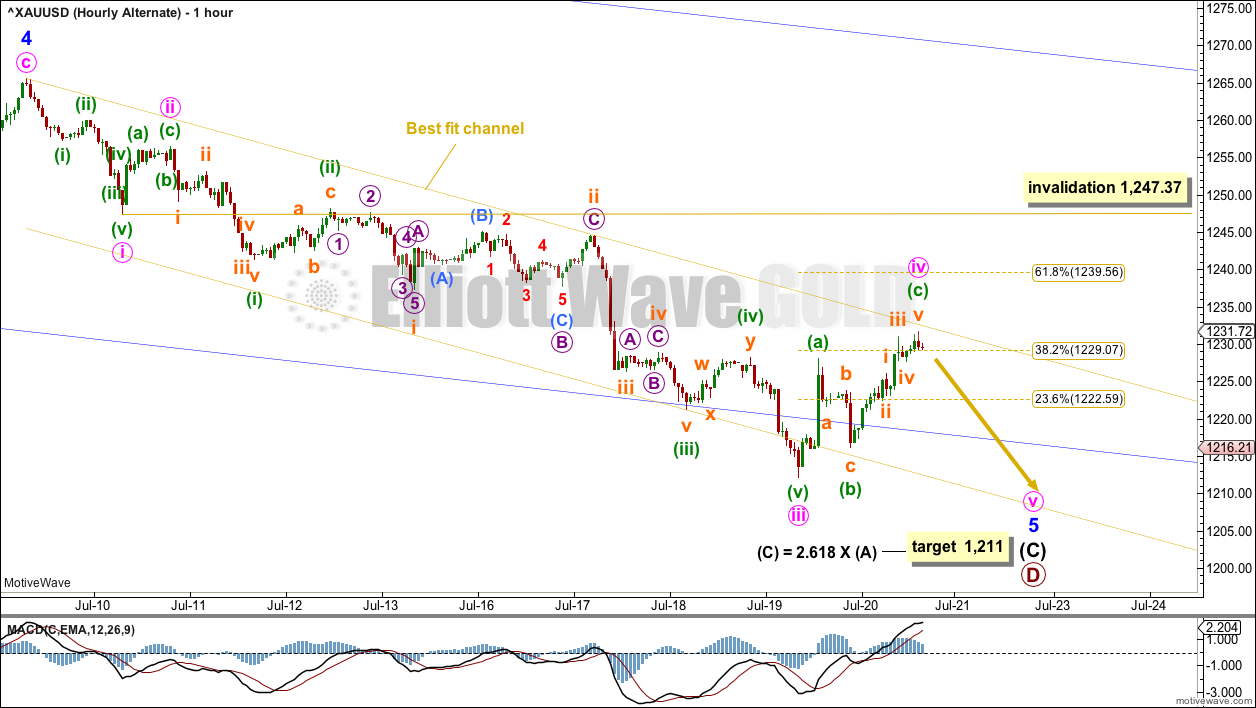

ALTERNATE HOURLY CHART

There is more than one way to see downwards movement of minor wave 5. This alternate hourly chart allows for more downwards movement to complete the impulse.

Within minor wave 5, minute waves i, ii and now iii may be complete. Minute wave iv may not move back up into minute wave i price territory above 1,247.37.

Minute wave ii was a relatively deep 0.50 single zigzag. Minute wave iv may be a complete shallow 0.44 zigzag. There is no alternation in structure, but a little alternation in depth.

Minute wave iv may have ended about the upper edge of the best fit channel.

One final new low may complete the whole structure for primary wave D.

WEEKLY CHART – FLAT

It is possible that cycle wave b may be a flat correction. Within a flat correction, primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. Primary wave B may make a new low below the start of primary wave A at 1,046.27 as in an expanded flat correction.

Only a new low reasonably below 1,123.08 would provide reasonable confidence in this wave count.

Intermediate wave (C) must subdivide as a five wave structure; it may be unfolding as an impulse. Within the impulse, minor waves 1, 2 and now 3 may be complete and minor wave 4 may not move into minor wave 1 price territory above 1,307.09.

Minor wave 2 was a double zigzag lasting nine weeks. To exhibit alternation and reasonable proportion minor wave 4 may be a flat, combination or triangle and may last a little longer than nine weeks as these types of corrections tend to be longer lasting than zigzags or zigzag multiples.

WEEKLY CHART – COMBINATION

It is essential when a triangle is considered to always consider alternates. Too many times over the years I have labelled a triangle as unfolding or even complete, only for it to be invalidated and the structure turning out to be something else.

When a triangle is invalidated, then the most common structure the correction turns out to be is a combination.

If cycle wave b is a combination, then the first structure in a double may be a complete zigzag labelled primary wave W.

The double may be joined by a three in the opposite direction, a zigzag labelled primary wave X.

The second structure in the double may be a flat correction labelled primary wave Y. It may also be a triangle, but that would expect essentially the same movement as the weekly triangle chart and so shall not yet be considered while there is no divergence in the expected pathway for price.

Within a flat correction for primary wave Y, the current downwards wave of intermediate wave (B) may be a single or multiple zigzag; for now it shall be labelled as a single. Intermediate wave (B) must retrace a minimum 0.9 length of intermediate wave (A) at 1,147.34. Intermediate wave (B) may move beyond the start of intermediate wave (A) as in an expanded flat.

Within the zigzag of intermediate wave (B), minor waves A and B may be complete. Minor wave C must subdivide as a five wave structure; at this stage, it may be an incomplete impulse. Within minor wave C, minute waves i and ii may be complete. Within minute wave iii, no second wave correction may move beyond the start of its first wave above 1,308.89.

This wave count is the most immediately bearish of the four remaining weekly wave counts.

When intermediate wave (B) is complete, then intermediate wave (C) would be expected to make at least a slight new high above the end of intermediate wave (A) at 1,365.68 to avoid a truncation. Primary wave Y would be most likely to end about the same level as primary wave W at 1,374.91, so that the whole structure takes up time and moves price sideways, as that is the purpose of double combinations.

While double combinations are very common, triples are extremely rare. When the second structure in a double is complete, then it is extremely likely that the whole correction is over.

WEEKLY CHART – DOUBLE ZIGZAG

Finally, it is also possible that cycle wave b may be a double zigzag or a double combination.

The first zigzag in the double is labelled primary wave W. This has a good fit.

The double may be joined by a corrective structure in the opposite direction, a triangle labelled primary wave X. The triangle would be only a little over halfway through.

Within the triangle of primary wave X, intermediate wave (C) may now be complete. If it continues any lower, then it may not move beyond the end of intermediate wave (A) below 1,123.08.

This wave count may now expect choppy overlapping movement in an ever decreasing range for several more months. After the triangle is complete, then an upwards breakout would be expected from it.

Primary wave Y would most likely be a zigzag because primary wave X would be shallow; double zigzags normally have relatively shallow X waves.

Primary wave Y may also be a flat correction if cycle wave b is a double combination, but combinations normally have deep X waves. This would be less likely.

This wave count has good proportions and no problems in terms of subdivisions.

TECHNICAL ANALYSIS

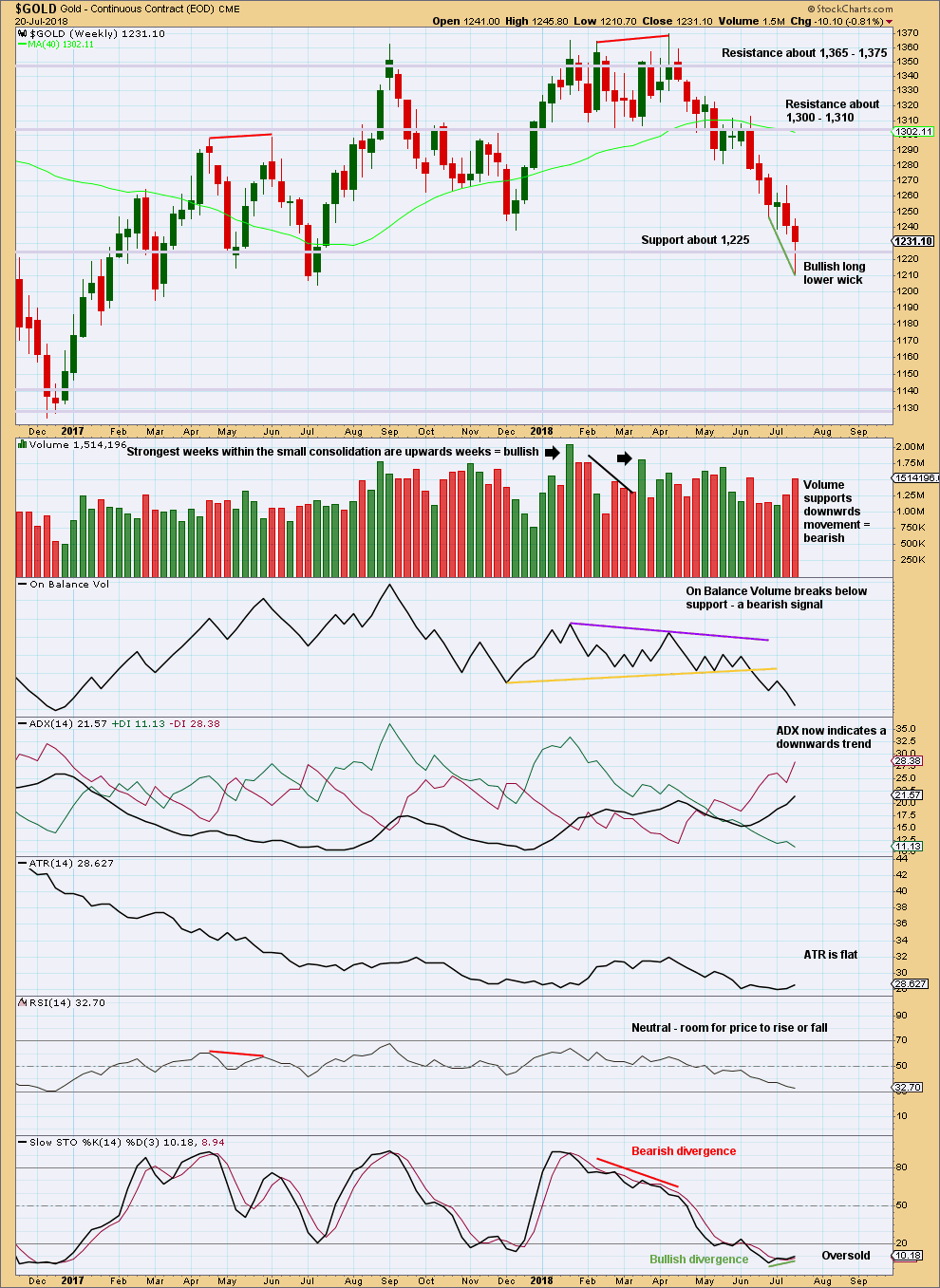

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The reasonably long lower wick on this weekly candlestick is given weight in this analysis.

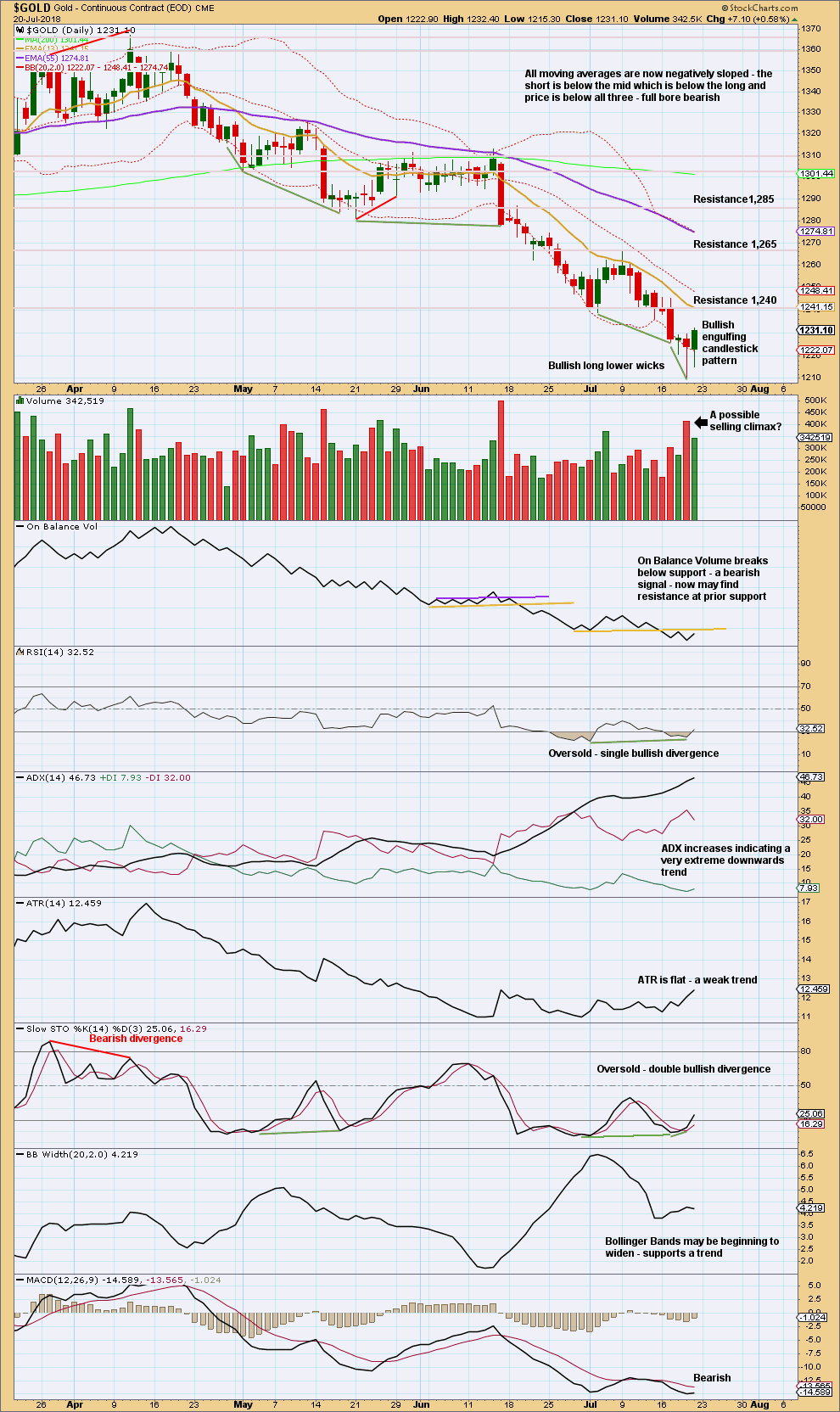

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is now a small cluster of three long lower daily candlestick wicks. In conjunction with a Bullish Engulfing candlestick pattern, single bullish divergence between price and RSI while RSI is oversold, and now double bullish divergence between price and Stochastics while Stochastics is oversold, it looks increasingly like a low may now be in place for the short to mid term at least.

ADX does indicate this downwards trend is very extreme, so looking at other indicators for a cluster of signals is the approach I will take this week.

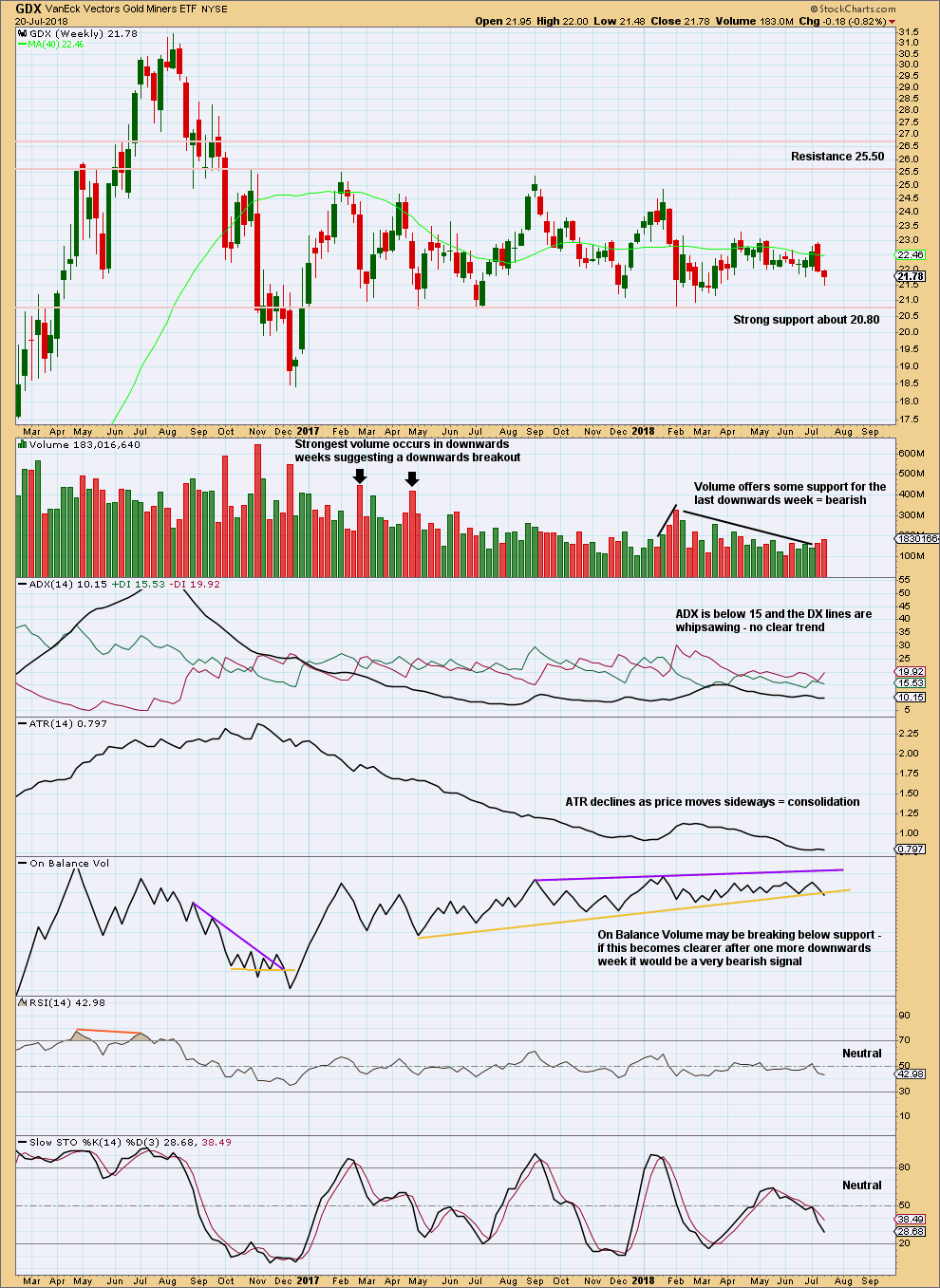

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX has been range bounce since January 2017. This is a very long sideways consolidation. The longer it continues, the more sustained the eventual breakout will be. Volume suggests the breakout may more likely be downwards.

Support about 20.80 has been tested about eight times and so far has held. The more often a support area is tested and holds, the more technical significance it has.

In the first instance, expect this area to continue to provide support. Only a strong downwards day, closing below support and preferably with some increase in volume, would constitute a downwards breakout from the consolidation.

Resistance is about 25.50. Only a strong upwards day, closing above resistance and with support from volume, would constitute an upwards breakout.

There is again some support this week for downwards movement from volume.

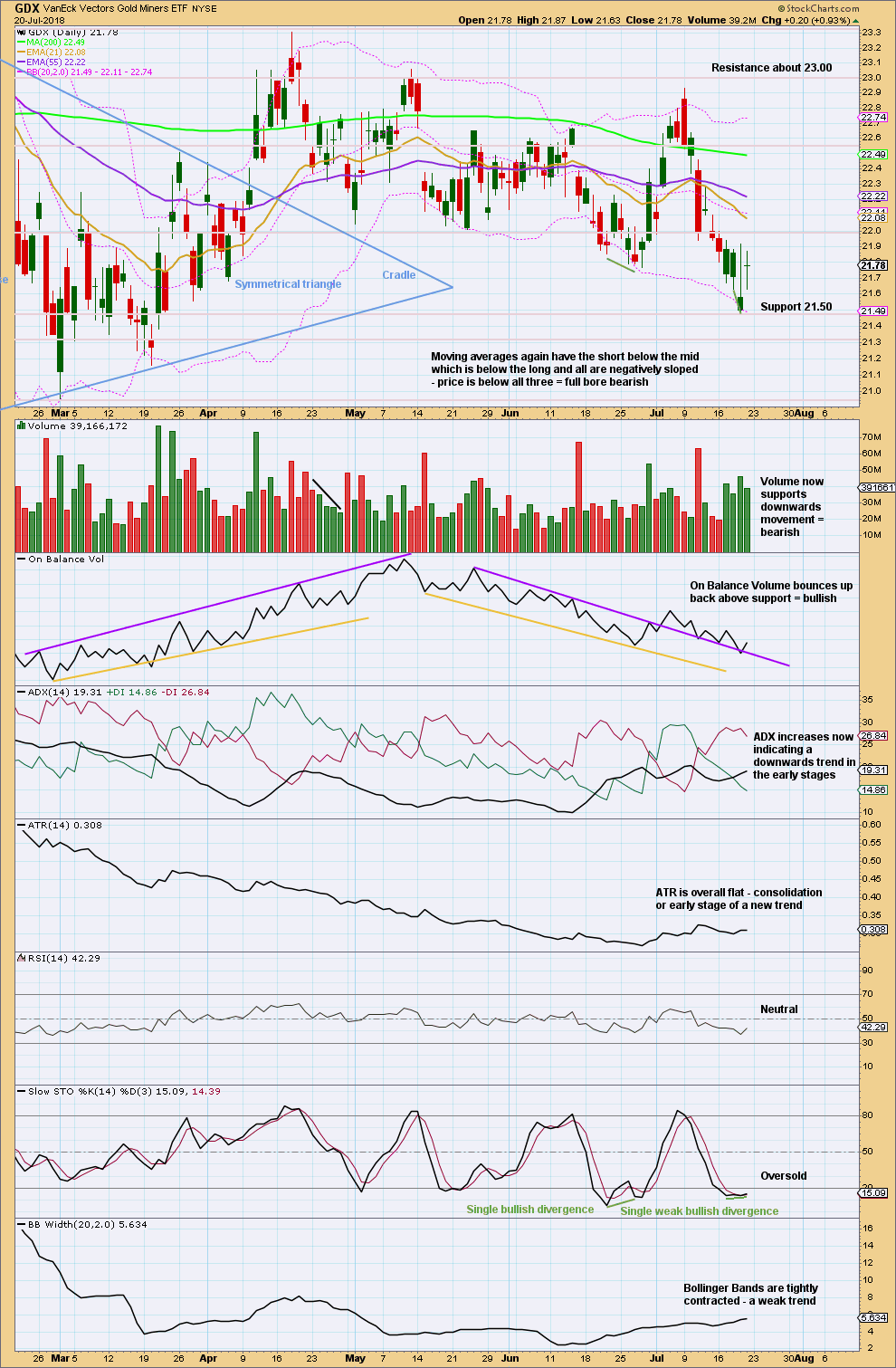

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

While Gold now looks reasonably bullish for at least the short term, GDX does not. GDX looks reasonably bearish. If price can break below support at 21.50, then next support is about 21.30.

Published @ 08:24 p.m. EST on 21st July, 2018.

as I’m preparing today’s analysis, there’s currently one of those phantom spikes that BarChart data see just after the close of the NY session.

from past experience, the direction of these spikes often seems to indicate future price direction. this one is upwards

the spike sometimes disappears, sometimes not.

Strange. They have been to the downside previously, but it makes sense for an upward one now. It must have disappeared quickly as I don’t see it on the BarChart site. Thanks for sharing.

main hourly update:

I’m not really liking the look of minor 1 TBH. but sometimes Gold does have quicker fourth waves than it’s counterpart second waves. We saw that tendency show up recently for minor 4; it lasted 4 days to minor 2 lasting 18 days. so this is acceptable for this market.

this wave count expects some increase in momentum upwards in a couple to a few days. third waves for Gold can start a little slowly, accelerating towards their middle and exploding at their ends.

alternate hourly update:

if there is yet to be one final low before a turn, then very shortly there may be some increase in downwards momentum as the middle of a third wave unfolds lower

Gold Symmetry is a thing of beauty. A breakout should come in the next few months. Up or Down?

https://www.tradingview.com/x/nGepfmf3/

That is indeed a beautiful chart. Thank you for sharing Dreamer.

Sorry to be pedantic, but if the beautiful symmetry is to be maintained, shouldn’t the breakout happen next month, or am I missing something?

Perfection is overrated

The RH second shoulder could move a little lower.

OR

for the main EW count we’re expecting a bounce here to remain below resistance at 1,305 – 1,310. Only when that’s done would it expect a downwards breakout. So that fits very well with this idea of symmetry.

A small inverted H&S pattern on the hourly also supports the idea that a bottom is in for now. Initial target projects to 1,248ish

https://www.tradingview.com/x/cZHCqT5K/

Yes indeed. Thank you Dreamer! I hope you are having a lovely and relaxing weekend.