A little more downwards movement was expected from last week’s classic technical analysis.

At least four Elliott wave counts remain valid, so classic technical analysis is vital to indicate which one is most likely.

Summary: Silver has been coiling for about a year now. Volume suggests a downwards breakout may be more likely; this does not always work, but it does work more often than it fails.

Price will breakout from the consolidation. Expect a very strong and fast movement when it does. A technical principle is the longer price consolidates the longer the resulting trend will be. Expect after a breakout to see Silver trend for about a year or so.

Being positioned early may be profitable. A hedge here, exercised with patience, may be a good approach. If hedging, then risk only up to 5% in total for both positions. Place stops just beyond resistance and support. Final resistance is about 18.65 and final support may be about 15.65 (it could be as low as 14.34).

If price breaks below 15.65 that may be a downwards breakout. If it has support from volume then have more confidence in it. Look out for a possible throwback after a breakout.

Always trade with stops, and invest only 1-5% of equity on any one trade.

Last monthly charts can be viewed here.

New updates to this analysis are in bold.

ELLIOTT WAVE COUNTS

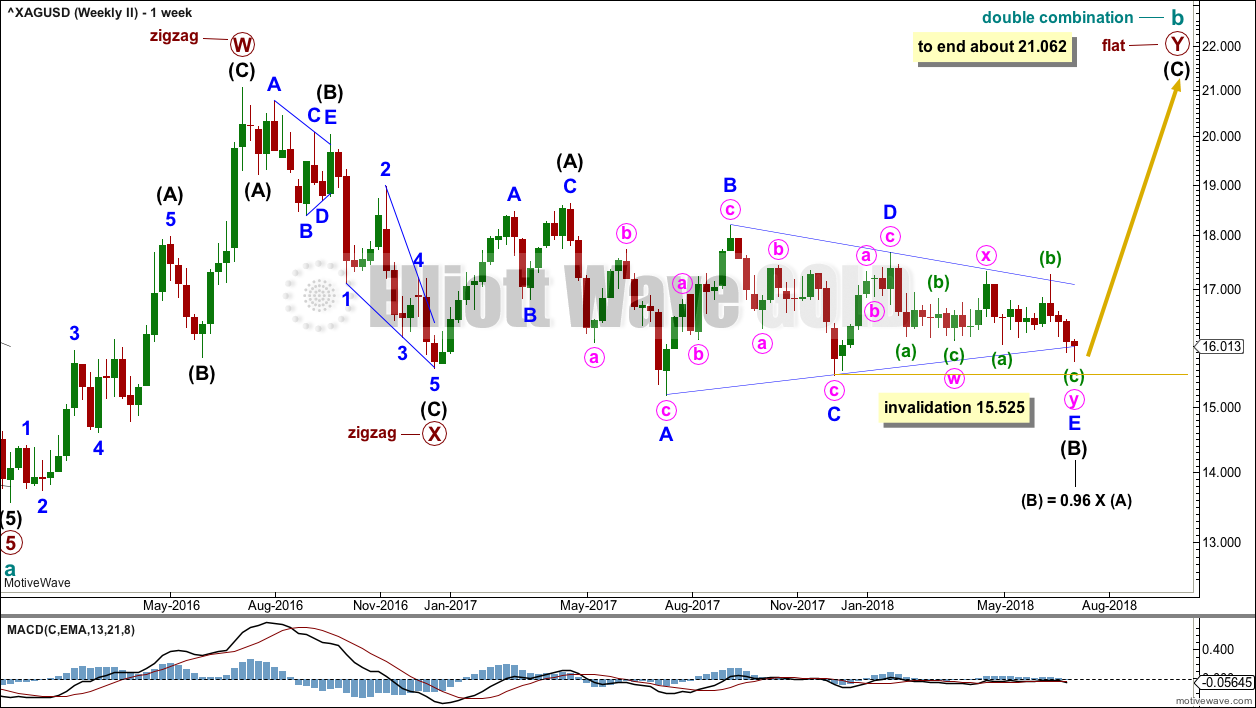

MAIN WAVE COUNT

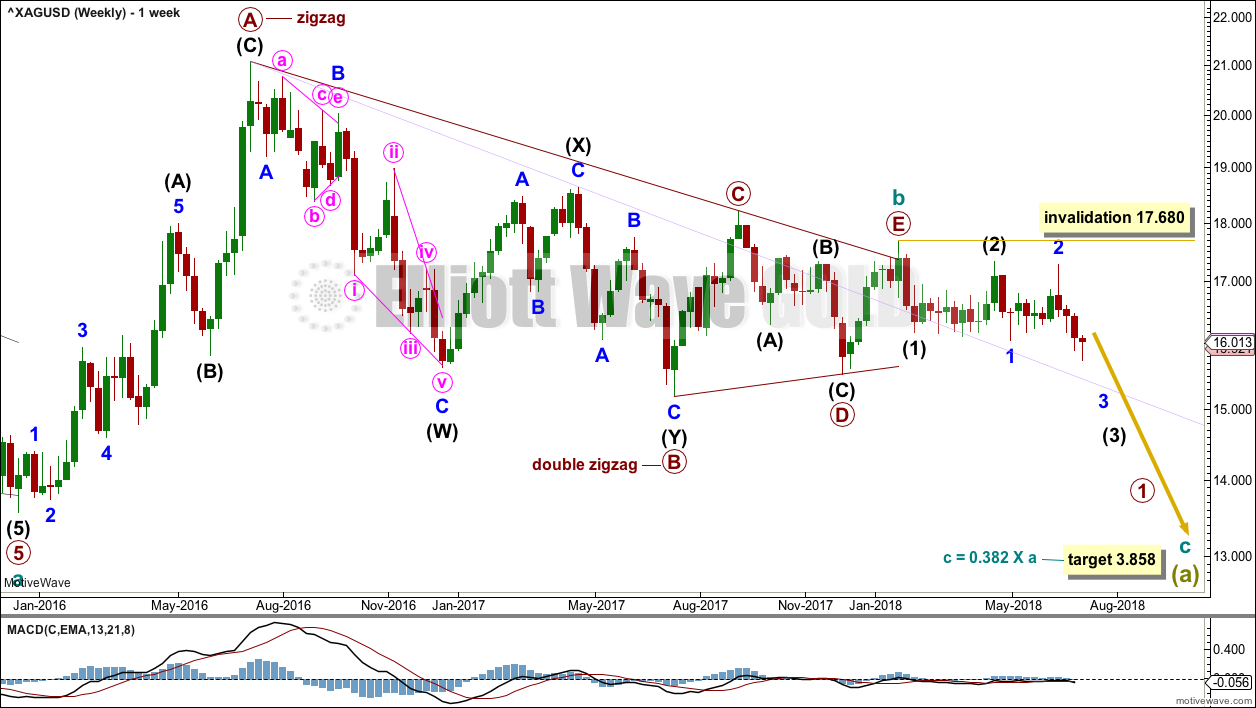

WEEKLY CHART

At this stage, with the Gold analysis switching from bull to bear, I no longer wish to try and pick a winner for Silver. Classic technical analysis may be used to suggest which Elliott wave count may be more likely, but this market is much more tricky to analyse than Gold. A better approach may be to now remain neutral and wait for a breakout. That approach requires either a hedge to be set up within the consolidation, or a more patient approach to wait for a breakout before entering in the direction of the breakout.

A new low now below 15.525 would invalidate the bullish wave counts and only leave this first wave count valid.

The first wave count expects that the bear market, which began from the April 2011 high, is incomplete.

Cycle wave a is seen as a five wave impulse for this main wave count. There are multiple corrective structures possible still for cycle wave b.

This first weekly chart sees cycle wave b as a now possibly complete regular contracting triangle. I have considered the idea that the triangle may be continuing sideways as a nine wave triangle, but the trend lines do not work: the highs labelled intermediate wave (2) and minor wave 2 would sit above the A-C trend line. This would look very wrong, so the idea is discarded.

Primary wave E of the triangle may have ended with an overshoot of the A-C trend line. If this wave count is correct, then price should have reversed already. Within the new downwards trend, no second wave correction may move beyond the start of the first wave above 17.680.

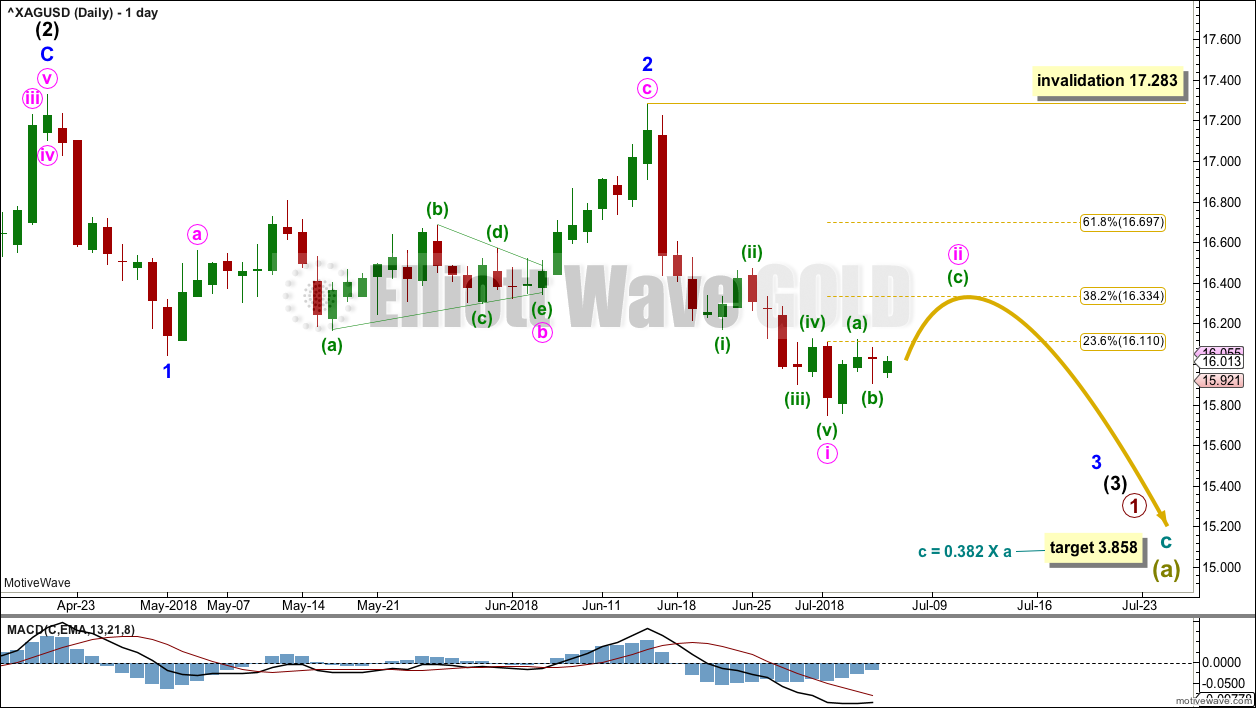

DAILY CHART

Intermediate waves (1) and (2) may now be complete.

Intermediate wave (3) may only subdivide as an impulse. Within intermediate wave (3), minor waves 1 and 2 may now be complete.

Minor wave 3 may only subdivide as an impulse. Within minor wave 3, minute wave ii may not move beyond the start of minute wave i above 17.283.

Minute wave ii may end about either of the 0.382 or 0.618 Fibonacci ratios, with the 0.382 Fibonacci ratio favoured as the strong downwards pull of a third wave at two degrees may force minute wave ii to be more brief and shallow than otherwise.

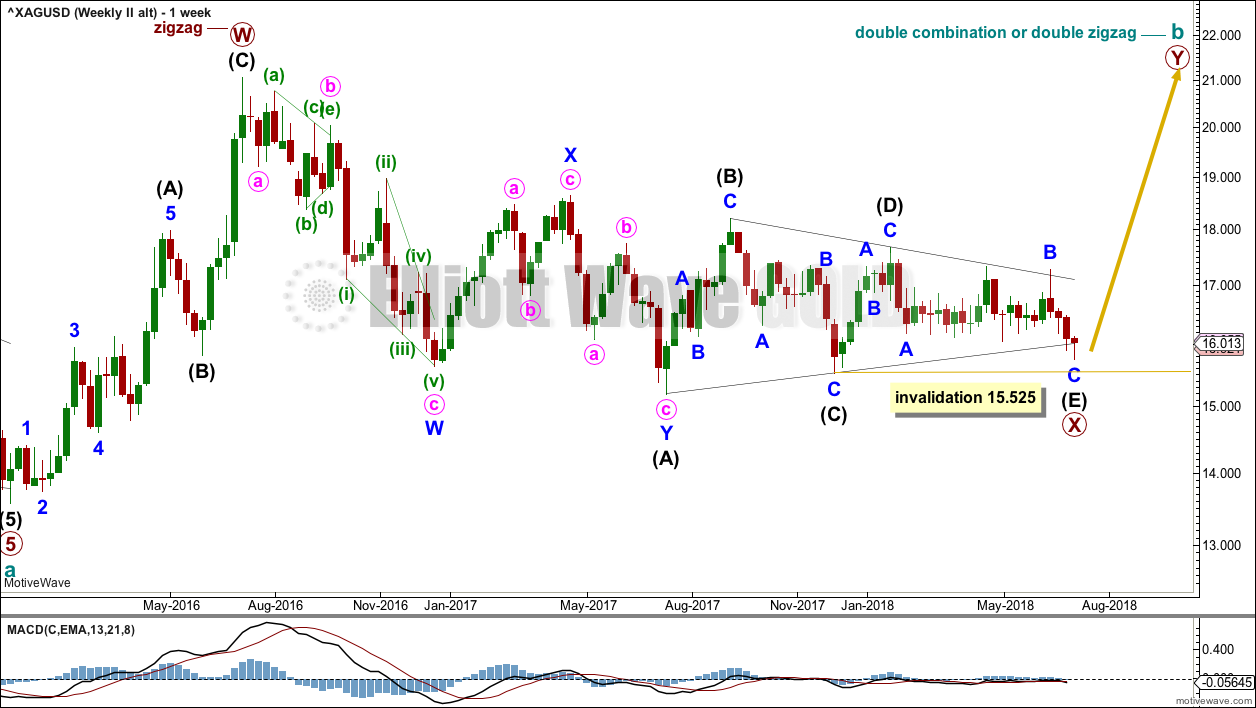

SECOND WAVE COUNT

WEEKLY CHART

Cycle wave b may be completing as a double combination: zigzag – X – flat. The second structure, a flat correction for primary wave Y, may be underway.

Within a flat correction, intermediate wave (B) must retrace a minimum 0.9 length of intermediate wave (A) at 15.938. Intermediate wave (B) has met this minimum requirement; the rule for a flat correction is met. Intermediate wave (B) may be a completed triangle. Within the triangle, if minor wave E continues, then it may not move beyond the end of minor wave C below 15.525.

The purpose of combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double normally ends about the same level as the first.

DAILY CHART

Minor wave E has overshot the A-C trend line. This is not the most common look for an E wave of a triangle, but it does sometimes happen. This wave count expects that a low should be now in place for the end of intermediate wave (B).

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 15.748.

SECOND WAVE COUNT – SECOND WEEKLY CHART

This wave count is identical to the Second Weekly Chart above up to the high labelled primary wave W. Thereafter, it looks at sideways movement as a huge triangle labelled primary wave X. This fits very well with MACD hovering about zero.

Cycle wave b may be either a double zigzag or a double combination. Although both of these structures are labelled W-X-Y note that they are quite different and belong to two different families of corrections.

Double zigzags belong to the zigzag family of corrections. Single and multiple zigzags usually have strong slopes against the prior trend. To achieve a strong slope their X waves are usually brief and shallow, most especially brief. Here, primary wave X is not brief, but it is shallow.

Double combinations belong to the sideways group of corrections. The second structure in a double combination (and the third if there is one) exists to take up time and move price sideways. To achieve a sideways look their X waves are usually deep and may be time consuming. Here, primary wave X is not deep, but it is time consuming.

If cycle wave b is a double zigzag, then primary wave Y may move reasonably higher than the end of primary wave W at 21.062 to achieve its purpose of deepening the correction.

If cycle wave b is a double combination, then primary wave Y must subdivide as a flat correction and may end about the same level as primary wave W at 21.062, so that it achieves its purpose of taking up time and moving price sideways.

At this early stage, within primary wave Y, no second wave correction may move beyond the start of its first wave below 16.046.

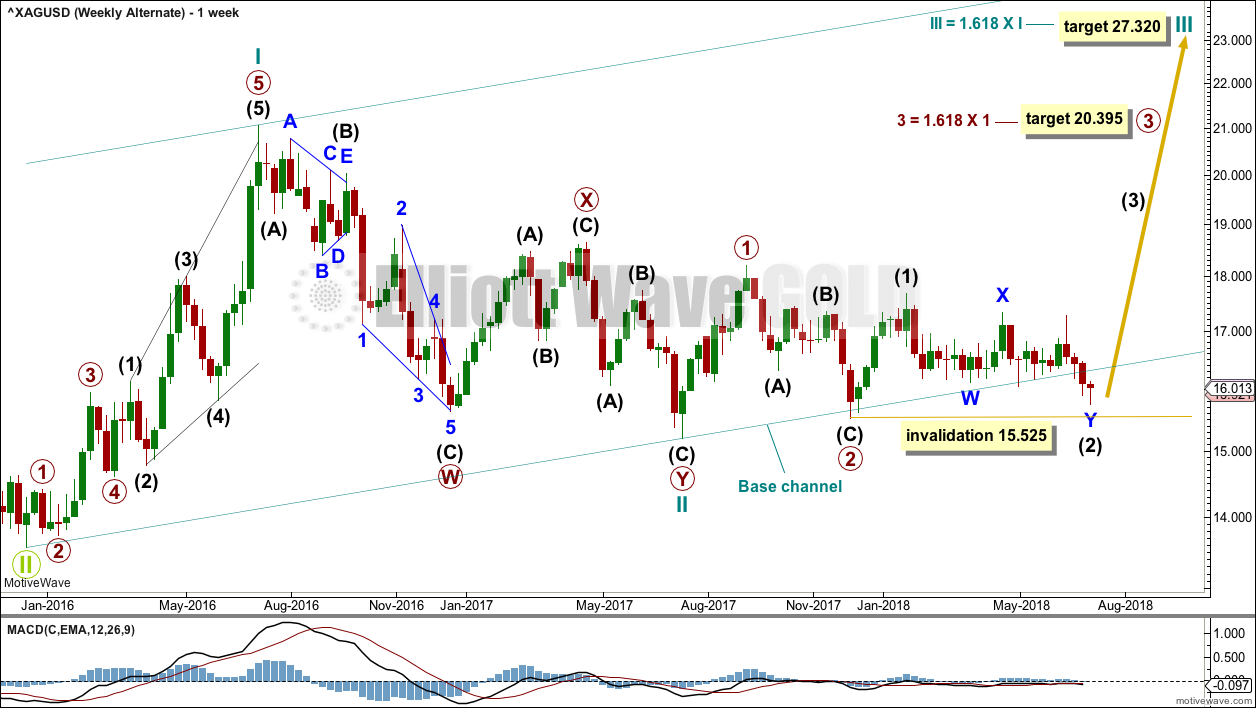

ALTERNATE WAVE COUNT

WEEKLY CHART

This alternate wave count looks at the possibility that the bear market may be over for Silver and a new bull market may have begun.

A series of three overlapping first and second waves may now be complete for cycle waves I and II, primary waves 1 and 2, and intermediate waves (1) and (2).

A third wave now at three large degrees may be beginning.

Targets calculated for third waves assume the most common Fibonacci ratios to their respective first waves. As price approaches each target, if the structure is incomplete or price keeps rising through the target, then the next Fibonacci ratio in the sequence would be used to calculate a new target.

Within primary wave 3, intermediate wave (2) may not move beyond the start of intermediate wave (1) below 15.525.

The large base channel is drawn about cycle waves I and II. A lower degree second wave correction should find support (in a bull market) about a base channel drawn about a first and second wave one or more degrees higher. This base channel is now breached at the weekly chart level with one full daily candlestick below and not touching it, so the probability of this alternate wave count is reduced. The probability is too low now in my judgement to publish a daily chart for this wave count.

TECHNICAL ANALYSIS

WEEKLY CHART

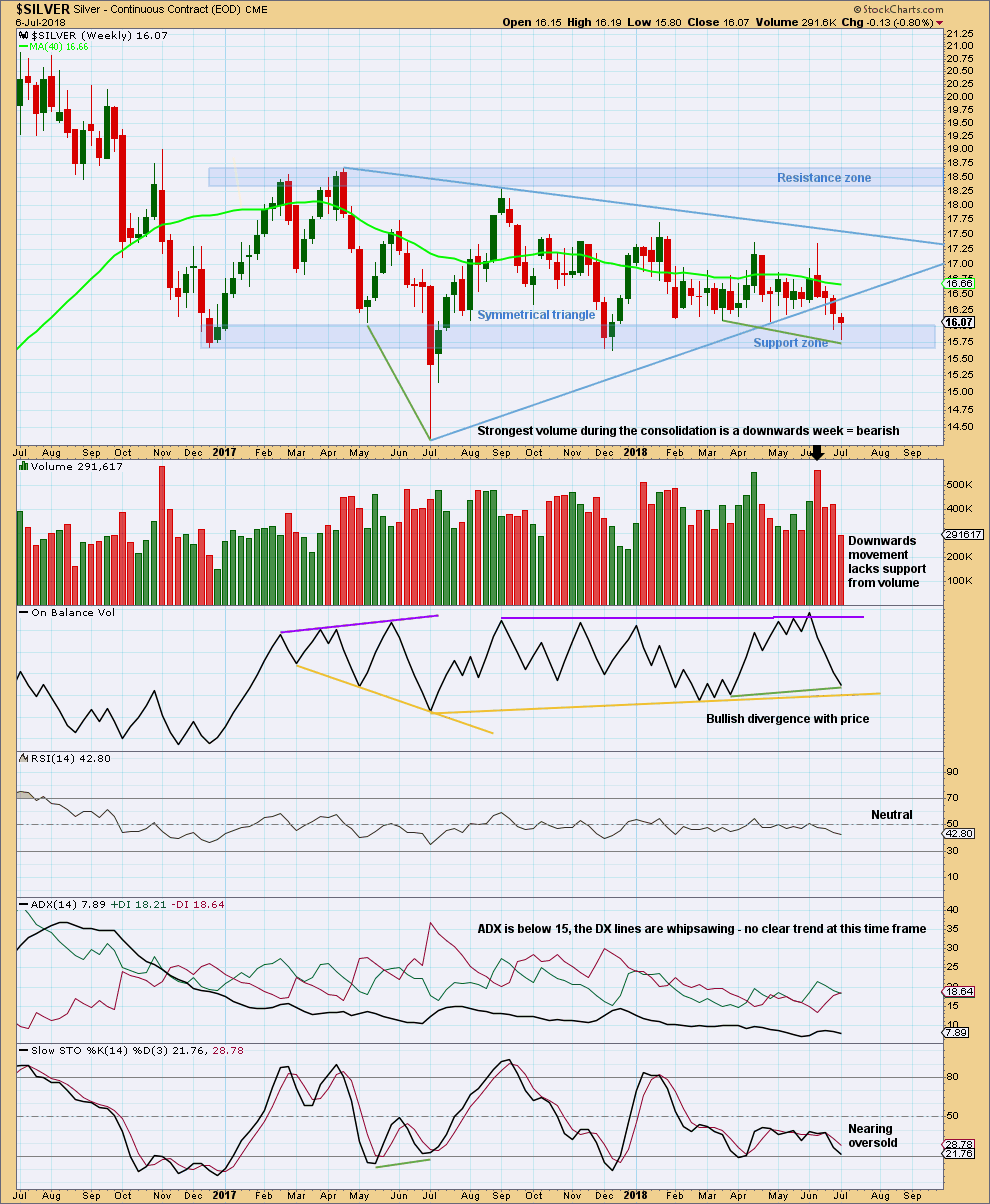

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price remains range bound. It has been coiling now for about a year. A technical principle is the longer price remains within a consolidation the longer the resulting trend will be after price breaks out.

Resistance is in a zone about 18.30 to final resistance about 18.65. Support is in a zone about 16.00 to final support about 15.65. So far, during this consolidation, it is a downwards week that has the strongest volume; this suggests a downwards breakout may be more likely than upwards.

With price now at the lower edge of the support zone, look for a possible downwards breakout shortly. If price closes below 15.65, that would be a downwards breakout. If that happens, look for a possible throwback to resistance before price starts to move strongly lower. A downwards breakout does not require support from volume for confidence; but if volume does support it, then we may have more confidence in it.

On Balance Volume has been giving conflicting bullish and bearish signals in recent weeks. At this stage, the strong fall of On Balance Volume for the last two weeks looks mostly bearish.

Two long lower wicks on the last two weekly candlesticks, along with price at the lower edge of support, looks bullish. While price remains above support, the best approach may be to expect a bounce here.

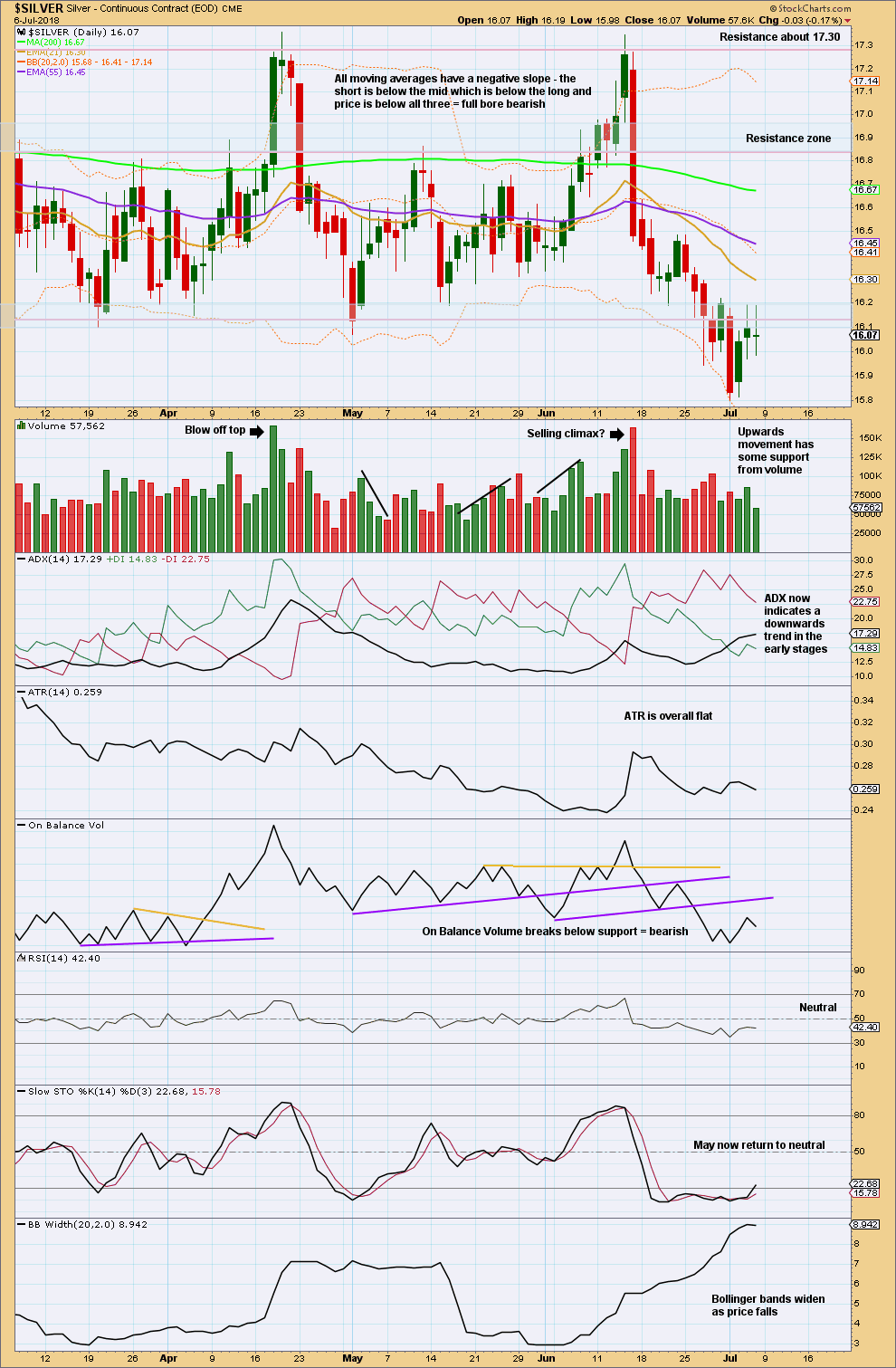

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The daily chart shows only the end of the coil of this large consolidation that has lasted about a year.

The volume profile is slightly bullish for the short term, but candlesticks are neutral with long and even upper and lower wicks. There is strong resistance now about 16.2, which previously provided support.

A bear flag may be developing.

Published @ 03:45 a.m. EST on 7th July, 2018.

Sold a little over half my silver position at $16. Stop loss on the remainder is at $15.51 while we wait this out.

setting up a hedge here may be profitable, when it eventually breaks out?

it’s been coiling for so long now, and the range is now so small, the breakout is closer

Thank you. Long our out is my only song. Maybe I’ll grow into something more when it is time to short SPY.