A strong upwards movement to end the week favours the Elliott wave triangle count. However, to increase the count’s probability, the confidence price point still needs to be passed.

Summary: It is again possible for Gold that a low may be in place, but this needs some confirmation with a new high above 1,216.30. While price remains below 1,216.30, it is possible that the last four sessions are a small bounce within an ongoing downwards trend. A lack of support from volume for this bounce supports this view. If price keeps falling for Gold, expect it to reach below 1,147.

For GDX, a highly significant break below support occurred two weeks ago. The long term target is at 16.02. The small bounce of the last few days may now continue a little higher or sideways, look for resistance at 19.74.

Always trade with stops to protect your account. Risk only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts and several weekly alternates is here, video is here.

Weekly charts will all again be reviewed at the end of this week.

MAIN ELLIOTT WAVE COUNT

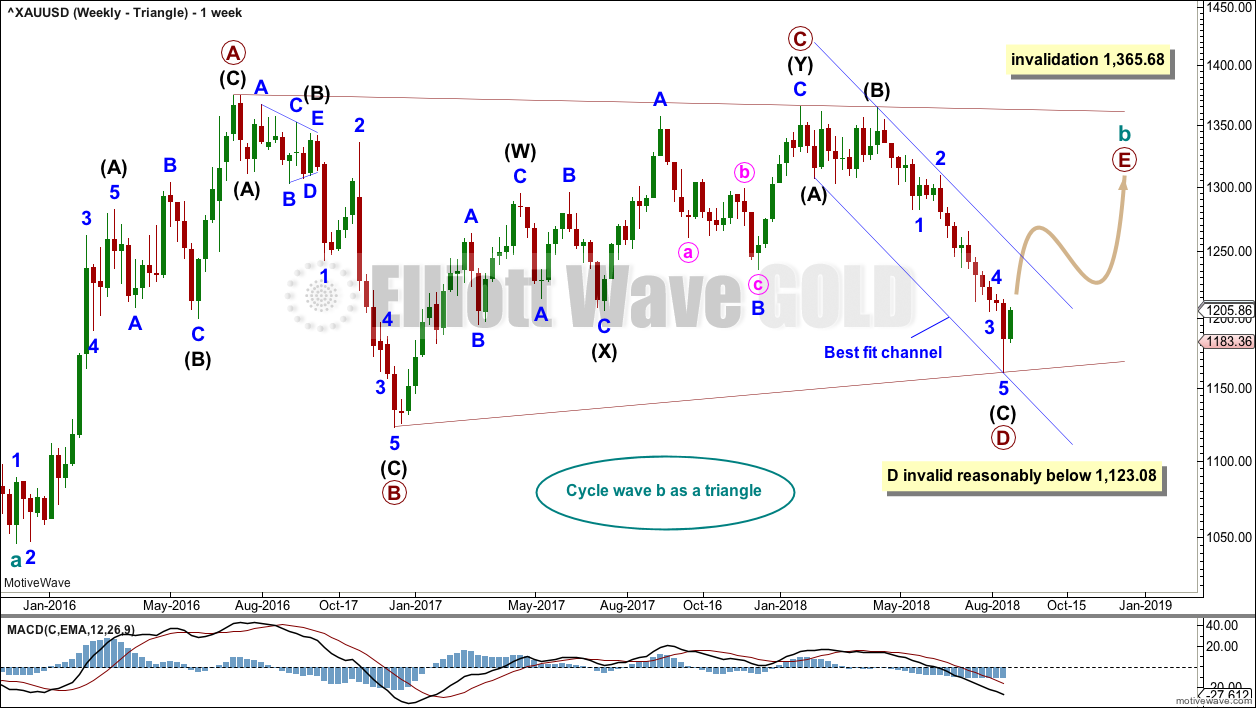

WEEKLY CHART – TRIANGLE

There are four remaining weekly wave counts at this time for cycle wave b: a triangle, flat, combination or double zigzag.

All four weekly wave counts will again be considered at the end of this week.

The triangle so far has the best fit and look.

Cycle wave b may be an incomplete triangle. The triangle may be a contracting or barrier triangle, with a contracting triangle looking much more likely because the A-C trend line does not have a strong slope. A contracting triangle could see the B-D trend line have a stronger slope, so that the triangle trend lines converge at a reasonable rate. A barrier triangle would have a B-D trend line that would be essentially flat, and the triangle trend lines would barely converge.

Within a contracting triangle, primary wave D may not move beyond the end of primary wave B below 1,123.08. Within a barrier triangle, primary wave D may end about the same level as primary wave B at 1,123.08, so that the B-D trend line is essentially flat. Only a new low reasonably below 1,123.08 would invalidate the triangle.

Within both a contracting and barrier triangle, primary wave E may not move beyond the end of primary wave C above 1,365.68.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Primary wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best.

Primary wave D must be a single structure, most likely a zigzag.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

A channel is drawn on all charts about the downwards wave of primary wave D. Here, it is labelled a best fit channel. If this channel is breached by upwards movement, that may provide reasonable confidence in this weekly triangle wave count and put serious doubt on the other three weekly wave counts.

This wave count now expects a consolidation for primary wave E to back test resistance at prior support, and then a significant new downwards wave for cycle wave C. For the long term, this is the most bearish wave count.

DAILY CHART – TRIANGLE

Primary wave D may again be complete. For Barchart data, there is a Morning Doji Star candlestick reversal pattern at the low.

A new high above 1,216.30 would be required for reasonable confidence that a low is in place. This price point is the start of minor wave 5. A new high above the start of minor wave 5 may not be a second wave correction within minor wave 5, so at that stage minor wave 5 should be over.

While price remains below 1,216.30, it will remain possible that primary wave D could continue lower. However, primary wave D for this triangle wave count should end here or very soon, so that the B-D trend line has a reasonable slope ensuring the triangle trend lines converge at a reasonable rate. If primary wave D were to continue much lower, the B-D trend line would have too shallow a slope for a normal looking Elliott wave triangle.

A target for primary wave E is the strong zone of resistance about 1,305 to 1,310. Primary wave E is most likely to subdivide as a zigzag (although it may also subdivide as a triangle to create a rare nine wave triangle), and it should last at least a Fibonacci 13 weeks. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

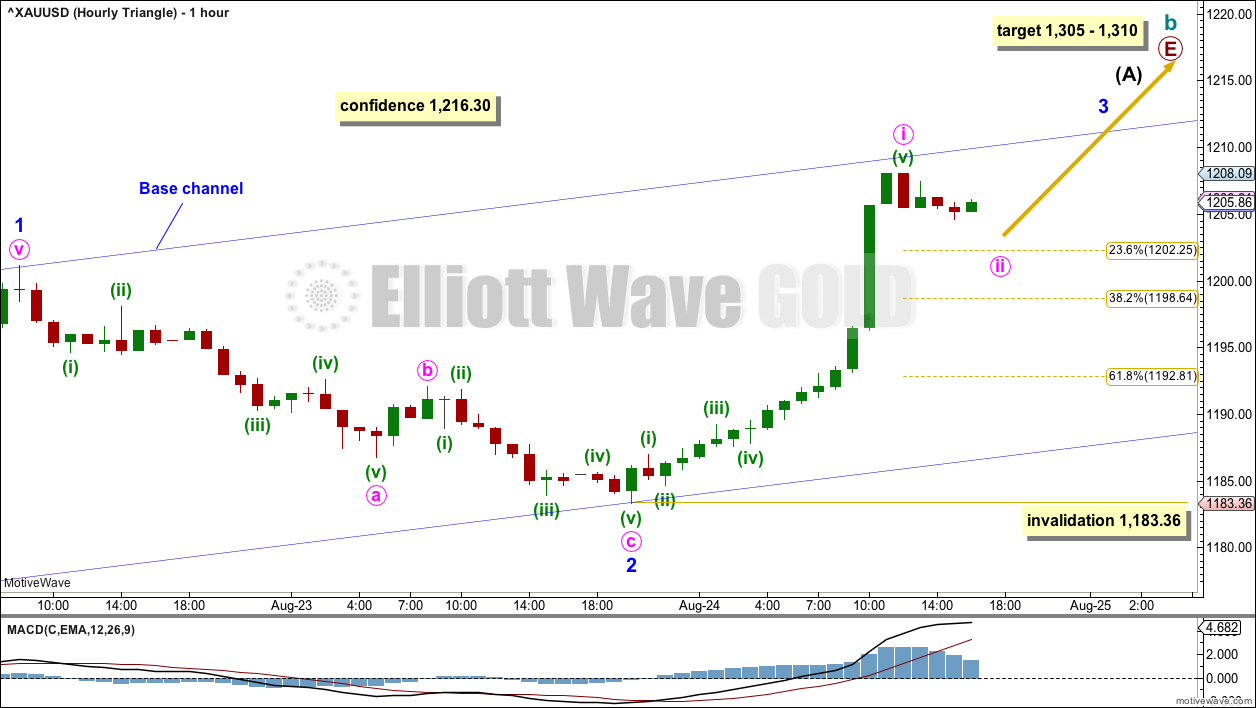

HOURLY CHART

The blue base channel is copied over to this hourly chart from the daily chart. Lower degree second wave corrections along the way up should find support about the lower edge of this channel.

Within a new upwards trend, minor waves 1 and 2 may be complete. Minor wave 2 was relatively shallow at 0.44 the depth of minor wave 1. This is not very common for Gold, but sometimes it does happen.

Within minor wave 3, the upcoming correction for minute wave ii may not move beyond the start of minute wave i below 1,183.36.

This hourly wave still requires a new high above 1,216.30 for reasonable confidence.

WEEKLY CHART – COMBINATION

It is essential when a triangle is considered to always consider alternates. Too many times over the years I have labelled a triangle as unfolding or even complete, only for it to be invalidated and the structure turning out to be something else.

When a triangle is invalidated, then the most common structure the correction turns out to be is a combination.

If cycle wave b is a combination, then the first structure in a double may be a complete zigzag labelled primary wave W.

The double may be joined by a three in the opposite direction, a zigzag labelled primary wave X.

The second structure in the double may be a flat correction labelled primary wave Y. My research on Gold so far has found that the most common two structures in a double combination are one zigzag and one flat correction. I have found only one instance where a triangle unfolded for wave Y. The most likely structure for wave Y would be a flat correction by a very wide margin, so that is what this wave count shall expect.

Within a flat correction for primary wave Y, the current downwards wave of intermediate wave (B) may be a single or multiple zigzag; for now it shall be labelled as a single. Intermediate wave (B) must retrace a minimum 0.9 length of intermediate wave (A) at 1,147.34. Intermediate wave (B) may move beyond the start of intermediate wave (A) as in an expanded flat.

Because the minimum requirement for intermediate wave (B) is not yet met, this wave count requires that minute wave v of minor wave C of intermediate wave (B) continues lower. This is the most immediately bearish of all four weekly wave counts.

When intermediate wave (B) is complete, then intermediate wave (C) would be expected to make at least a slight new high above the end of intermediate wave (A) at 1,365.68 to avoid a truncation. Primary wave Y would be most likely to end about the same level as primary wave W at 1,374.91, so that the whole structure takes up time and moves price sideways, as that is the purpose of double combinations.

While double combinations are very common, triples are extremely rare. I have found no examples of triple combinations for Gold at daily chart time frames or higher back to 1976. When the second structure in a double is complete, then it is extremely likely (almost certain) that the whole correction is over.

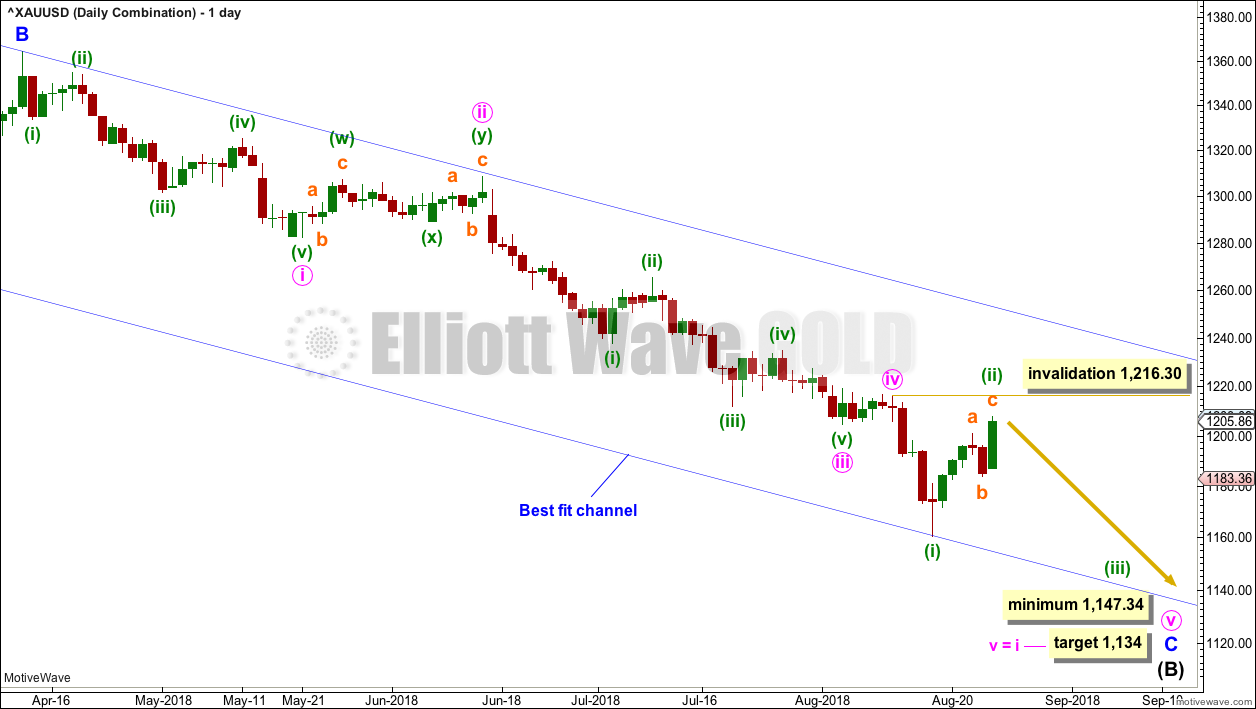

DAILY CHART – COMBINATION

It is time to follow this wave count at both daily and hourly time frames as it now diverges from the other wave counts.

Minor wave C of intermediate wave (B) may be an incomplete five wave impulse. Within the impulse, minute waves i, ii, iii and iv may all be complete and minute wave v may now be unfolding.

Within minute wave v, the current small bounce may be minuette wave (ii), which may not move beyond the start of minuette wave (i) above 1,216.30.

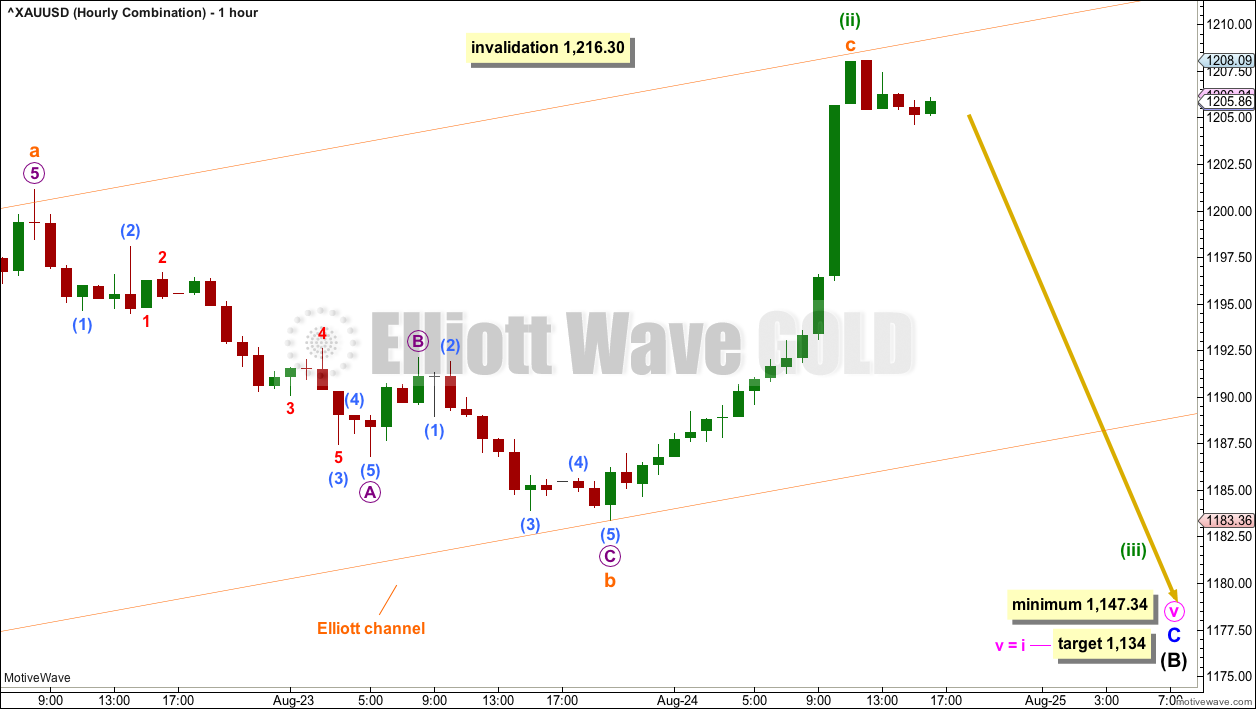

HOURLY CHART

Upwards movement for Friday may have been a continuation of minuette wave (ii).

The orange Elliott channel here is drawn in exactly the same way as the blue base channel on the triangle wave count. A breach of this channel by downwards movement would be a reasonable indication that this wave count may be correct.

The target remains the same.

WEEKLY CHART – FLAT

It is possible that cycle wave b may be a flat correction. Within a flat correction, primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. Primary wave B may make a new low below the start of primary wave A at 1,046.27 as in an expanded flat correction.

Only a new low reasonably below 1,123.08 would provide reasonable confidence in this wave count.

Intermediate wave (C) must subdivide as a five wave structure; it may be unfolding as an impulse. Within intermediate wave (C), minor waves 1, 2 and now 3 may be complete. A consolidation to last about 5 to 13 weeks may now develop for minor wave 4. Minor wave 4 may not move into minor wave 1 price territory above 1,307.09.

This wave count differs from the triangle wave count in that it expects a possibly more brief and more shallow correction to unfold here.

The blue channel here is drawn using Elliott’s first technique. Minor wave 4 would be most likely to remain contained within this channel, and may find resistance about the upper edge if it gets there. A strong breach of this channel by upwards movement would reduce the probability of this wave count.

Minor wave 2 was a double zigzag lasting nine weeks. To exhibit alternation and reasonable proportion minor wave 4 may be a flat, combination or triangle and may last a little longer than nine weeks as these types of corrections can be longer lasting than zigzags or zigzag multiples.

WEEKLY CHART – DOUBLE ZIGZAG

Finally, it is also possible that cycle wave b may be a double zigzag or a double combination.

The first zigzag in the double is labelled primary wave W. This has a good fit.

The double may be joined by a corrective structure in the opposite direction, a triangle labelled primary wave X. The triangle would be about two thirds complete.

Within the triangle of primary wave X, intermediate wave (C) may now be complete. It may not move beyond the end of intermediate wave (A) below 1,123.08. The A-C trend line for both a barrier and contracting triangle should have some reasonable slope. For the triangle of primary wave X to have the right look, intermediate wave (C) should end here or very soon indeed.

This wave count may now expect choppy overlapping movement in an ever decreasing range for several more months. After the triangle is complete, then an upwards breakout would be expected from it.

Primary wave Y would most likely be a zigzag because primary wave X would be shallow; double zigzags normally have relatively shallow X waves.

Primary wave Y may also be a flat correction if cycle wave b is a double combination, but combinations normally have deep X waves. This would be less likely.

This wave count has good proportions and no problems in terms of subdivisions.

TECHNICAL ANALYSIS

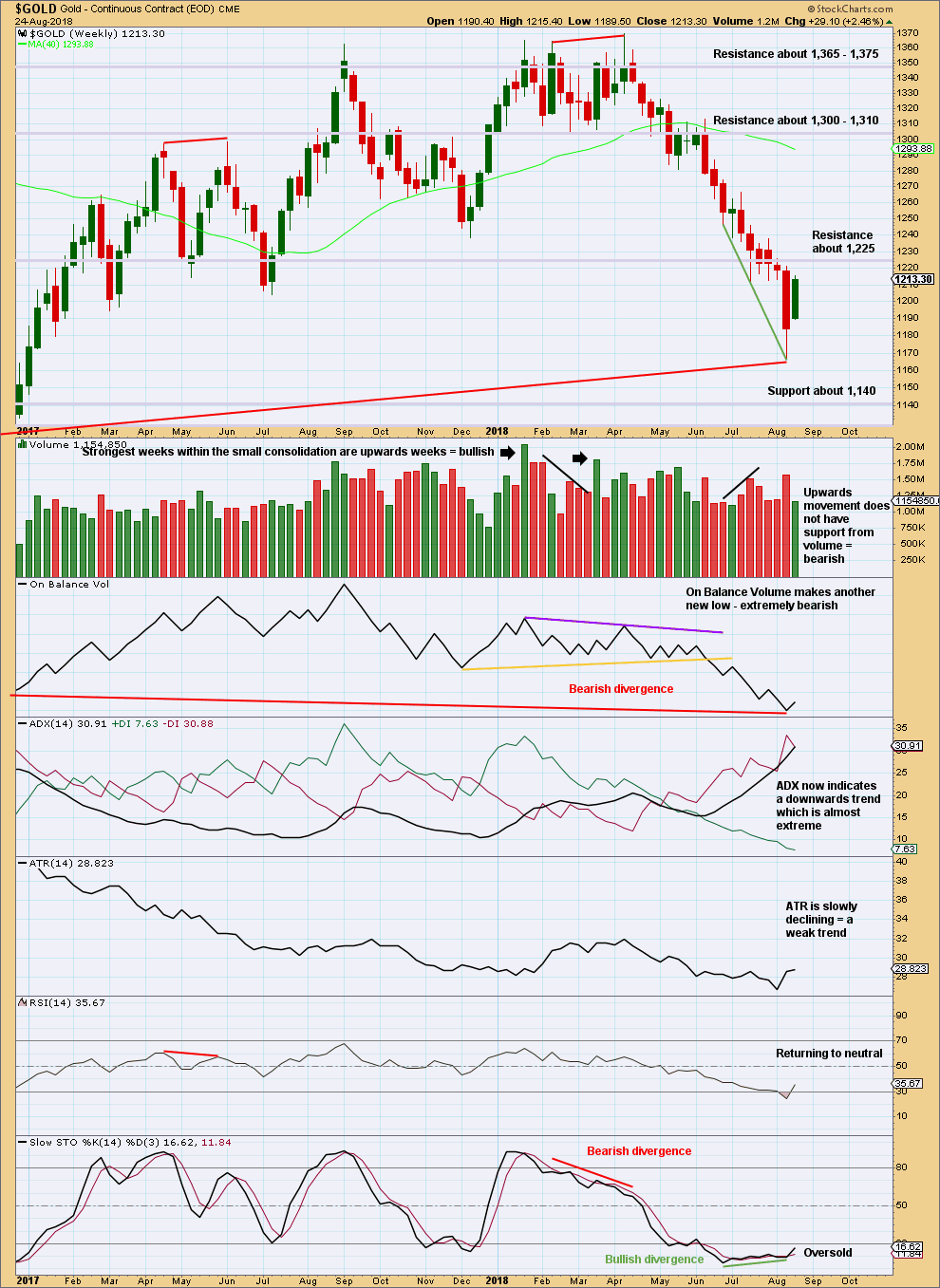

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On Balance Volume is lower than its prior point at the end of November 2015. This divergence is extremely bearish but does not rule out a consolidation unfolding here; the divergence does strongly support the Triangle wave count, which expects a consolidation or bounce up to test resistance now and then a continuation of a major bear market.

When Gold has a strong trend, ADX may remain very extreme for long periods of time and RSI can move more deeply into oversold. However, most recent lows since November 2015 were all found when RSI just reached oversold, so some caution here in looking out for a possible consolidation or trend change would be reasonable.

A reasonable upwards week this week looks like either a small consolidation within an ongoing downwards trend or the start of a new upwards trend. The lack of support from volume suggests a consolidation.

If price does continue lower, then look for next support about 1,140.

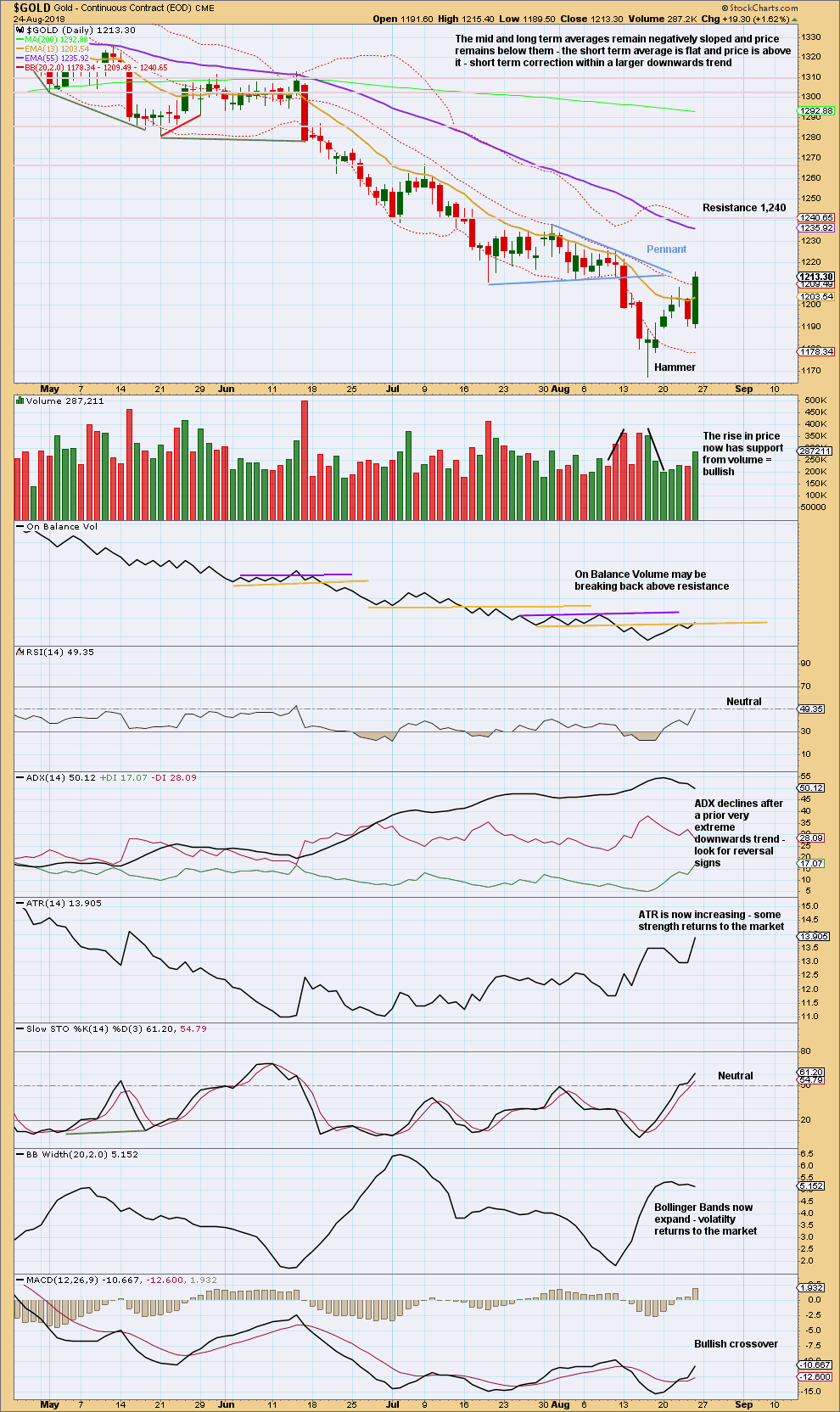

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A downwards breakout below the Pennant pattern has support from volume. The target using the length of the flagpole which precedes the Pennant is 1,157. This target was not met.

Support below is now about 1,140.

When a trend is very extreme, it is time to look out for candlestick reversal patterns and a possible trend reversal to the opposite direction, or a reasonable sideways move to relieve extreme conditions. Here, there is a Hammer reversal pattern at the low (it is almost a Dragonfly doji, but there is a little too great an upper shadow for that pattern). This is a warning that a low may now be in place.

Friday’s upwards day is fairly strong and has good support from volume. There is now rising price with rising volume that now looks more bullish.

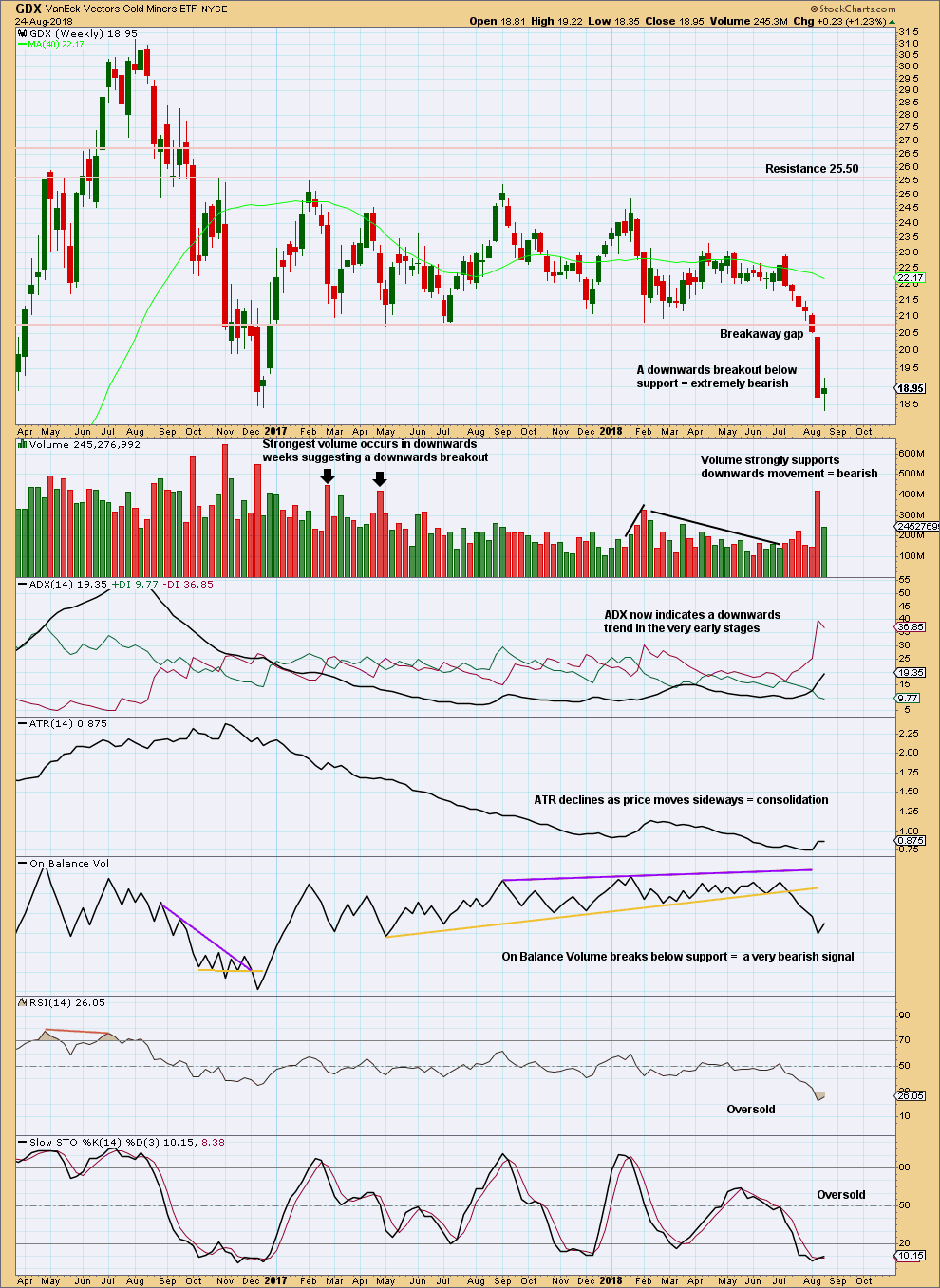

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX is now moving lower exactly as expected.

After a breakout, a technical principle is the longer that price consolidates sideways the longer the resulting trend may be expected to be. Also, the longer that price meanders sideways the more energy may be released after a breakout. This is what is happening now for GDX.

The target for this downwards trend to end is calculated using the measured rule. The widest part of the consolidation is added to the breakout point at 20.80 giving a target at 16.02. That is not yet met.

At the weekly chart level, there is a clear downwards breakout with a breakaway gap. As breakaway gaps should not be closed, they may be used to set stops that may be set just above a downwards breakaway gap.

Upwards movement for this last week may be the start of a bounce to back test resistance.

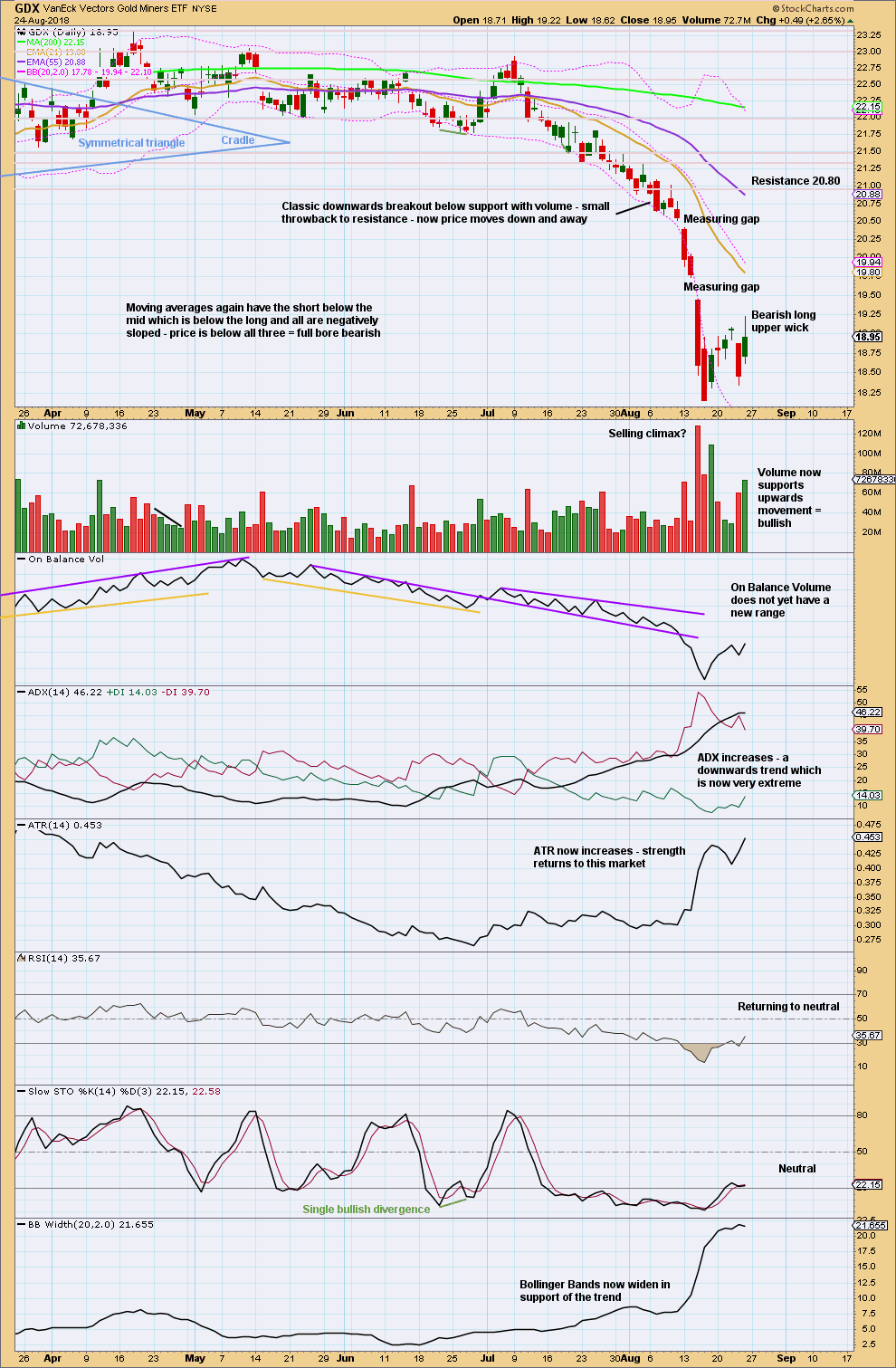

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX has now closed below support on a strong downwards day with support from volume. New lows are the lowest for GDX since December 2016. This is extremely significant for GDX.

GDX is in a downwards trend. Bounces and consolidations may be used as opportunities to join the trend. The bounce looked weak up until Friday. Now with support from volume for upwards movement the bounce may be incomplete.

The last measuring gap may provide resistance. A closure of this gap with a new high above 19.74 would be significant; at that stage, it would not be a measuring gap but an exhaustion gap. Assume it is a measuring gap, until proven otherwise.

Looking back over the last 3 1/2 years at GDX, at the daily chart level, I see it can reach extreme levels and remain there while price continues to move a reasonable distance. Only when it has reached very extreme and then exhibits strong divergence may an end to a strong trend be indicated. I would advise members trading GDX at this time to take some time to look over price action of the last few years, with ADX and RSI especially, and study carefully what happened towards at the end of strong trends.

Please remember to protect your trading accounts by careful risk management. Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

A possible target for this downwards trend to end may be now calculated using the measured rule, giving a target about 16.02.

Published @ 02:11 a.m. EST on 25th August, 2018.

Hourly triangle wave count updated:

No change at this time. Minute ii looks complete and shallow.

Now this count would expect an increase in upwards momentum.

imo gold price should be looking to top with nothing more than a modest upturn. lets see how far up it can get; a break below 1207 will likely set up an eventual break below 1200… lets see how this pans out…

How does this count relates any one of Lara’s counts???

Sam’s work is posted time to time.

Thanks

It’s a bad count. I wouldn’t trust his work.

1) You can’t have an ending diagonal for a wave 3 [Red 3 of Gold c of Green A is showing incorrectly as an ending diagonal in a wave 3 position]

2) Wave c can’t end past wave a and wave e can’t end past wave c for a triangle [Red b of Gold b of Green B of Blue IV]

Thanks Dreamer. There are many out there promoting EW. I do not trust any of those.

What Dreamer said.

I came across an advert on Twitter from a brokerage which had a graphic with what was purported to be Elliott wave. I let them know it was invalid, it had W-X-Y-X-Z within W-X-Y-X-Z. I pointed out the rule broken, and was told “investor psychology changes, so Elliott wave can change”.

Yeah, right.

Pretty sure their EW “analyst” simply hasn’t learned EW rules and is producing shoddy work. And they’re fine with that. And any change to EW rules needs to be based upon rigorous research and solid data. Which I pointed out to them also. Most politely.

There is an awful lot of absolute rubbish out there calling itself Elliott wave. It really does my head in. Because IMO it’s really not hard to learn the rules. It only takes 5 minutes to read them all every day until they’re stuck in ones head.

If newer members (and older ones too) learn nothing else from me but how to spot this rubbish, then I will have done a good job of teaching you Elliott wave.

I don’t think you need to learn how to do it yourself, but if you have the knack by all means fill your boots. All you need is to not waste time on rubbish, and find a decent Elliotician to follow.

I can see so many errors in that chart, IMO it could be a useful learning tool to spot the mistakes.

Sorry all, rant over.

I have actually had people tell me the Prechter &Frost book is wrong when chapter and verse is cited to point a pattern designation error!

Verne, it sounds like Gold won’t break 2016 high in this year. What if it did happen? A new wave count? I’m not that intelligent to figure it out, so I paid for subscription lol GDXJ has formed a double bottoms though. We’ll see.

Verne:

Frost and Prechter is still the gold standard for EW texts.

And, IMO, any change to the rules as laid out there absolutely MUST be supported by research and data.

Weiquan:

The Weekly – Double Zigzag wave count would be expecting new highs, it could come this year if intermediate wave (E) to complete primary wave X is not too time consuming. That’s the best bullish case I’ve been able to see to date.

On weekly GDX TA the candlestic pattern appears to be bullish reversal pattern Harami. Steve Nison calls it pregnant woman.

Short term it may be trend change???

No, it’s not a Harami. According to Nison “Japanese Candlestick Charting Techniques” a Harami requires a large real body followed by a small real body sitting inside the large body. The small body needs to be quite small, a spinning top pattern.

In this instance although the second body is within the first, the second body is much too large to be considered a spinning top.

It is still fairly bullish though. But not properly a Harami.

Lara, this statement about GDX in the summary at the top conflicts with new more bullish GDX comments below the GDX daily chart. Maybe it should be updated or removed? Thanks,

“The small bounce of the last few days now looks to be over, so look out for the downwards trend to most likely resume.”

I am so sorry everybody! That’s fixed now. Thanks Dreamer.

If GDX doesn’t close that last measuring gap, then this is just a short term consolidation. But if that gap is closed, then a longer term higher bounce back up to resistance about 20.80 should be expected.

If that happens, then it would provide a leisurely entry opportunity to join a long term downwards trend at the best price possible.

If it doesn’t happen, then positions opened upon the breakout may be held long term.