by Lara | Feb 7, 2020 | Natural Gas, Public Analysis |

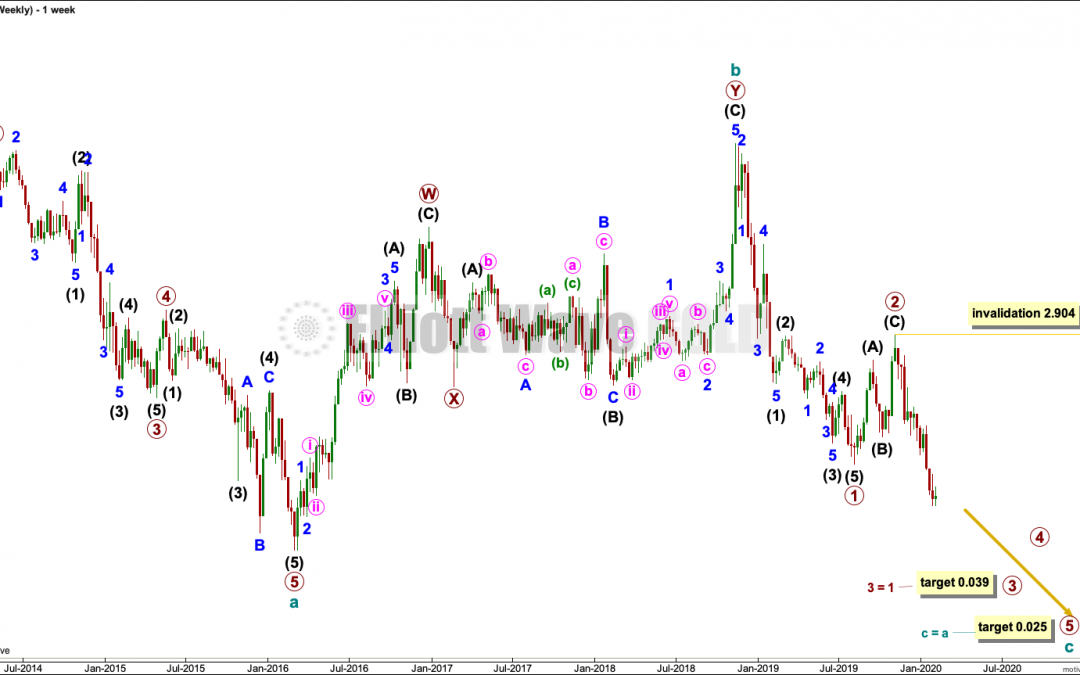

Natural Gas: Elliott Wave and Technical Analysis | Charts – February 6, 2020 Last analysis of Natural Gas, April 2017, expected more upwards movement overall to complete a cycle degree B wave. The target was at 4.731. Upwards movement reached 4.903 (November...

by Lara | Apr 9, 2017 | Copper, GBPUSD, Natural Gas, Public Analysis, Trading Room |

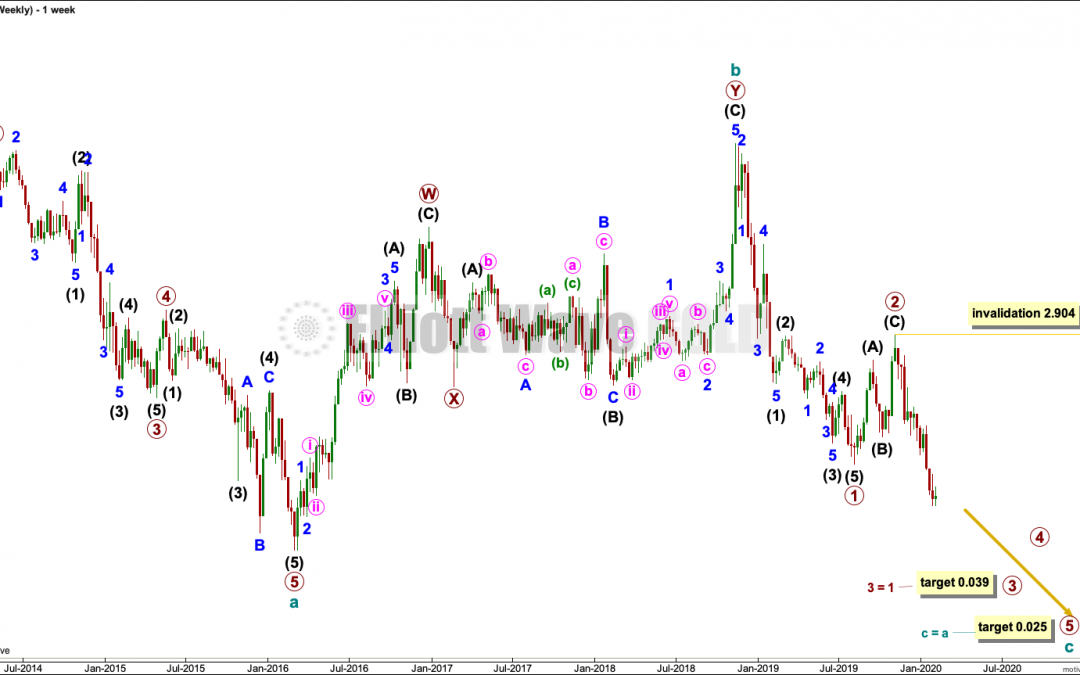

Today’s Trading Room looks at Copper, Natural Gas and GBPUSD. To learn what the Trading Room is about see first Trading Room analysis here. Trading Room will focus on classic technical analysis. Elliott wave analysis will be for support and for targets /...

by Lara | Mar 31, 2017 | Copper, Natural Gas, Public Analysis, Trading Room |

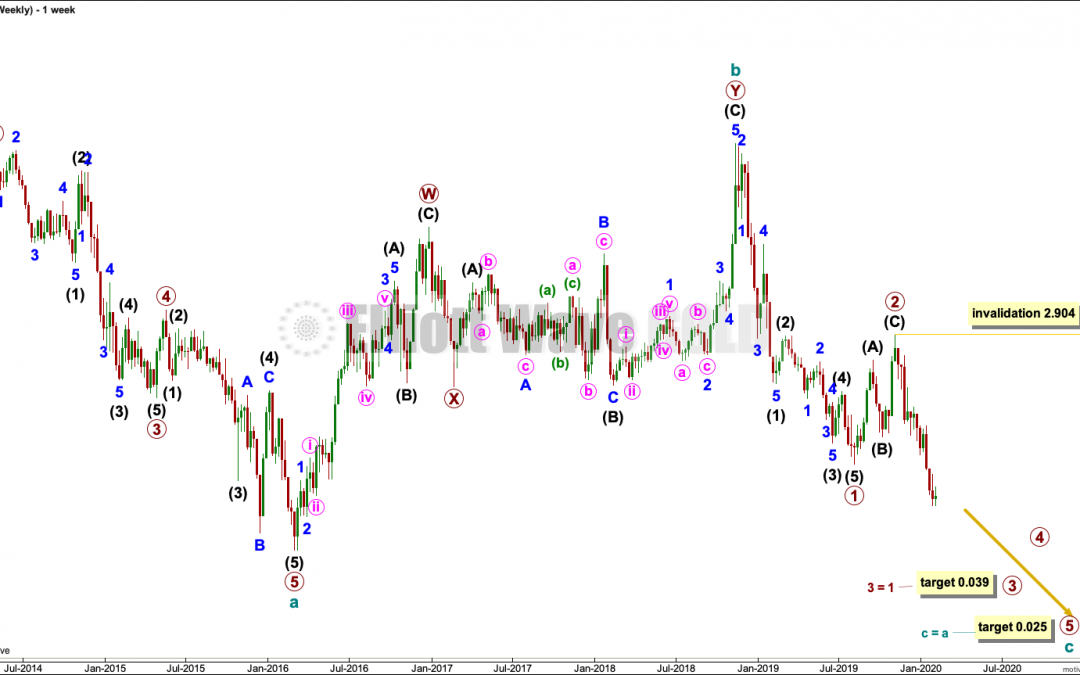

Today’s Trading Room looks at Copper and Natural Gas. To learn what the Trading Room is about see first Trading Room analysis here. Trading Room will focus on classic technical analysis. Elliott wave analysis will be for support and for targets / invalidation...

by Lara | Mar 20, 2017 | Natural Gas, Public Analysis, Trading Room, US Oil, USDJPY

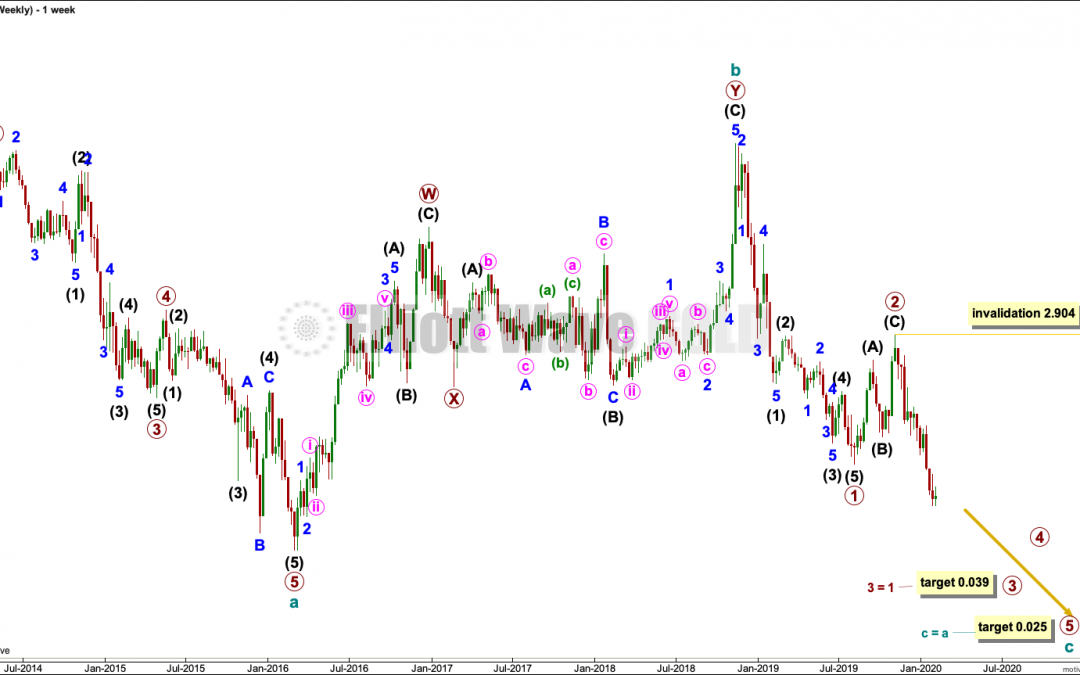

Today’s Trading Room looks at US Oil only. To learn what the Trading Room is about see first Trading Room analysis here. Trading Room will focus on classic technical analysis. Elliott wave analysis will be for support and for targets / invalidation points. US...

by Lara | Mar 15, 2017 | Copper, Natural Gas, USD Index, USDJPY

This post updates recommendations made three days ago. OPEN POSITIONS Click table to enlarge. Copper has moved higher and is now very close to the invalidation point. If the analysis is correct, it should turn down here. If not, another loss will be booked. USDJPY has...

by Lara | Mar 14, 2017 | Copper, Natural Gas, Public Analysis, Trading Room, US Oil, USD Index, USDJPY |

This post updates recommendations made two days ago. OPEN POSITIONS Click table to enlarge. Only one position should now be underwater. USD Index and NGas positions should be comfortably positive. Although recommendations are made on when to take profits, this may not...

by Lara | Mar 13, 2017 | Copper, EURGBP, Natural Gas, Public Analysis, Trading Room, US Oil, USD Index, USDJPY |

Today’s Trading Room looks at Copper, US Oil, NGas, USD Index, EURBGP and USDJPY. To learn what the Trading Room is about see first Trading Room analysis here. Trading Room will focus on classic technical analysis. Elliott wave analysis will be for support and...

by Lara | Feb 22, 2017 | EURGBP, EURUSD, Natural Gas, Public Analysis, Trading Room, USDJPY |

Today’s Trading Room looks at NGas, EURUSD, USDJPY and EURGBP. To learn what the Trading Room is about see first Trading Room analysis here. Trading Room will focus on classic technical analysis. Elliott wave analysis will be for support and for targets /...

by Lara | Feb 15, 2017 | Natural Gas, Public Analysis, Trading Room, USDJPY |

Today’s Trading Room looks at Natural Gas and USDJPY. To learn what the Trading Room is about see first Trading Room analysis here. Trading Room will focus on classic technical analysis. Elliott wave analysis will be for support and for targets / invalidation...