by Lara | Jul 30, 2021 | US Oil, US Oil Historical

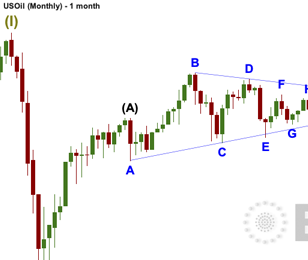

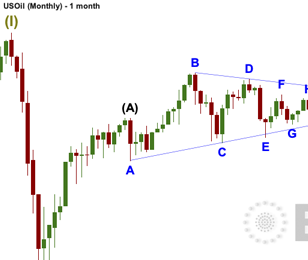

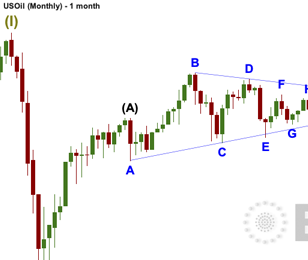

US OIL: Elliott Wave and Technical Analysis | Charts – July 30, 2021 Last week’s Elliott wave and technical analysis expected upwards movement to resume for US Oil. This week price has moved higher as expected. Summary: The main Elliott wave count expects...

by Lara | Jul 24, 2021 | Gold, Lara's Weekly, S&P500, US Oil

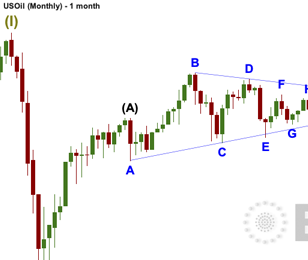

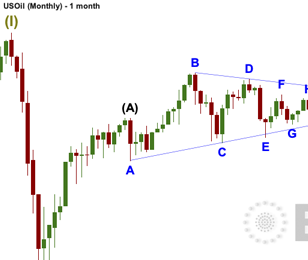

Lara’s Weekly: Elliott Wave and Technical Analysis of S&P500 and Gold and US Oil | Charts – July 23, 2021 S&P 500 A new all time high today does not come with a corresponding high from the AD line. The main Elliott wave count is adjusted but still...

by Lara | Jul 24, 2021 | US Oil, US Oil Historical

US OIL: Elliott Wave and Technical Analysis | Charts – July 23, 2021 Downwards movement breached the short-term invalidation point on both Elliott wave counts. A new daily Elliott wave count was provided inter-week. Two Elliott wave counts for the short term are...

by Lara | Jul 17, 2021 | Gold, Lara's Weekly, S&P500, US Oil

Lara’s Weekly: Elliott Wave and Technical Analysis of S&P500 and Gold and US Oil | Charts – July 16, 2021 S&P 500 Three short-term scenarios were given yesterday. The first was invalidated with a new low below 4,340.70, indicating the second...

by Lara | Jul 16, 2021 | US Oil, US Oil Historical

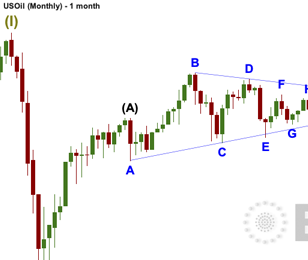

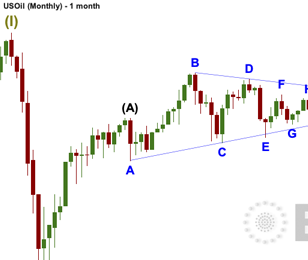

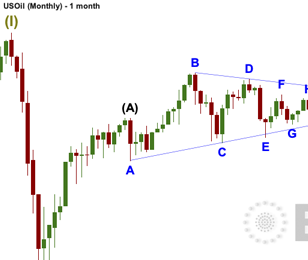

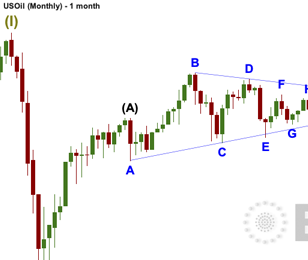

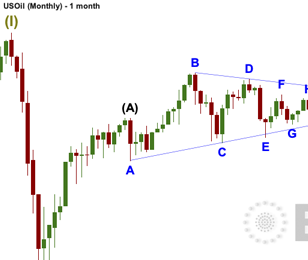

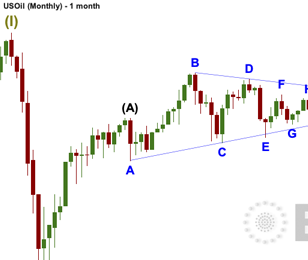

US OIL: Elliott Wave and Technical Analysis | Charts – July 16, 2021 Friday’s session has reached the lower edge of the Elliott channel on the daily chart. Summary: The main Elliott wave count expects upwards movement to resume to the next target at 110.61...

by Lara | Jul 9, 2021 | Gold, Lara's Weekly, S&P500, US Oil

Lara’s Weekly: Elliott Wave and Technical Analysis of S&P500 and Gold and US Oil | Charts – July 9, 2021 S&P 500 The week closes with a new all time high. Signals today from the AD line and inverted VIX are in agreement on which direction price...

by Lara | Jul 9, 2021 | US Oil, US Oil Historical

US OIL: Elliott Wave and Technical Analysis | Charts – July 9, 2021 An outside week closes red. Price remains well above the invalidation point and within the channel on the daily chart. Summary: The Elliott wave count expects upwards movement to continue to a...

by Lara | Jul 2, 2021 | Gold, Lara's Weekly, S&P500, US Oil

Lara’s Weekly: Elliott Wave and Technical Analysis of S&P500 and Gold and US Oil | Charts – July 2, 2021 S&P 500 Again, further upwards movement was expected from the main Elliott wave count. Summary: The primary trend remains up. Pullbacks are a...

by Lara | Jul 2, 2021 | US Oil, US Oil Historical

US OIL: Elliott Wave and Technical Analysis | Charts – July 2, 2021 Upwards movement continues towards targets as expected. Summary: The Elliott wave count expects upwards movement to continue to a short-term target at 76.91, with a longer term target at 87.90....