by Lara | Mar 1, 2021 | Gold

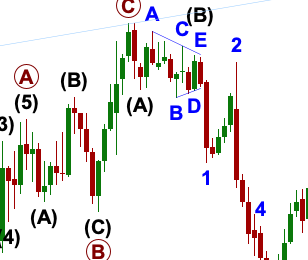

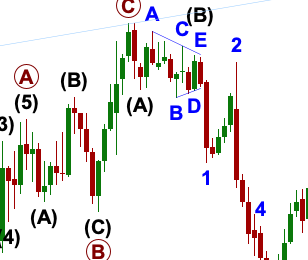

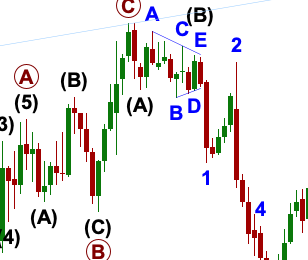

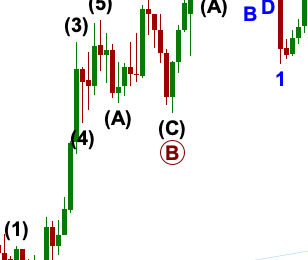

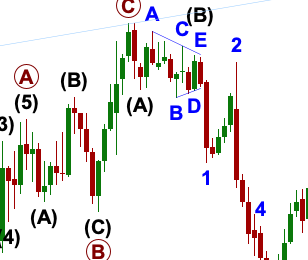

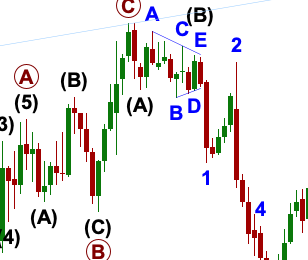

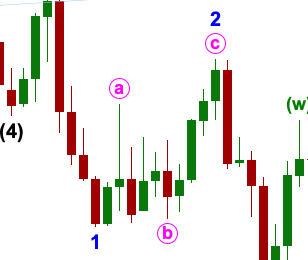

GOLD: Elliott Wave and Technical Analysis | Charts – March 1, 2021 An inside day closes red with a bearish long upper candlestick wick. This fits both Elliott wave counts for the short term. Summary: The first wave count is bearish for the bigger picture and has...

by Lara | Feb 5, 2021 | Gold

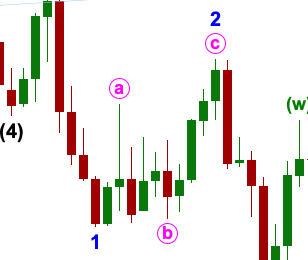

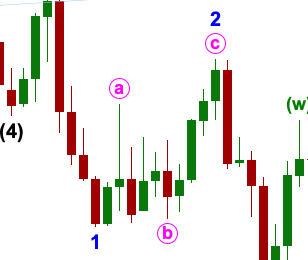

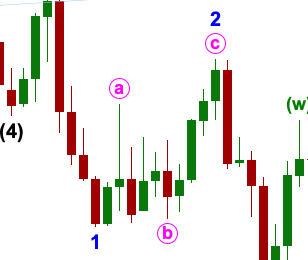

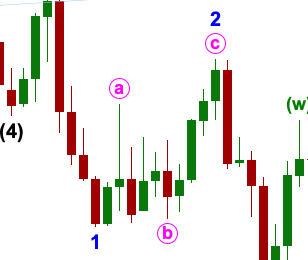

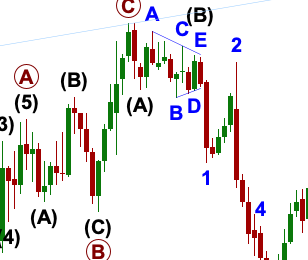

GOLD: Elliott Wave and Technical Analysis | Charts – February 5, 2021 Downwards movement overall this week fits the first Elliott wave count well. After a strong downwards session on Thursday, a reaction in a bounce was expected for the short term on Friday....

by Lara | Jan 14, 2021 | Gold

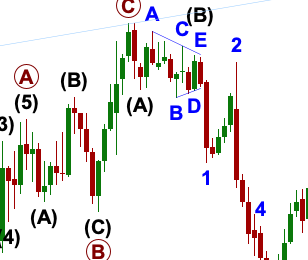

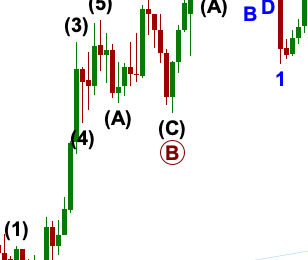

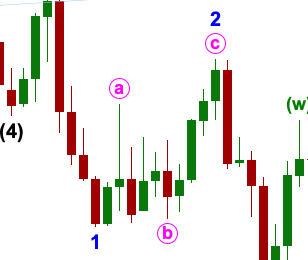

GOLD: Elliott Wave and Technical Analysis | Charts – January 14, 2021 Another small range day continues what looks like a small pause within a trend. Both Elliott wave counts remain the same. Summary: The first wave count is bearish for the bigger picture and...

by Lara | Jan 12, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – January 12, 2021 Another small range day with weak volume looks like a small pause within an ongoing trend. Both Elliott wave counts remain valid. Summary: The first wave count is bearish for the bigger...

by Lara | Dec 17, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – December 17, 2020 Price is now at the upper edge of the acceleration channel and remains below the invalidation point on the daily chart. Summary: The first wave count is bearish for the bigger picture, and it...

by Lara | Nov 26, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – November 26, 2020 A very small range day while New York is closed for Thanksgiving Day leaves the analysis unchanged. Summary: The first wave count is bearish for the bigger picture, and it has a main and an...

by Lara | Nov 25, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – November 25, 2020 A small shallow bounce was expected for the short term. Elliott wave targets remain the same. Summary: The first wave count is bearish for the bigger picture, and it has a main and an...

by Lara | Nov 3, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – November 3, 2020 The main Elliott wave counts expected upwards movement, which remains below the invalidation point for the alternate Elliott wave counts. All Elliott wave counts remain valid. Summary: The...

by Lara | Oct 12, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – October 12, 2020 Upwards movement has continued as expected. The Elliott wave structure on the hourly chart looks incomplete. Summary: The first and second Elliott wave counts expect upwards movement to 2,160....