by Lara | Dec 8, 2020 | Gold

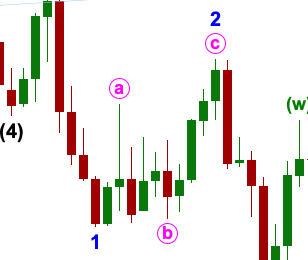

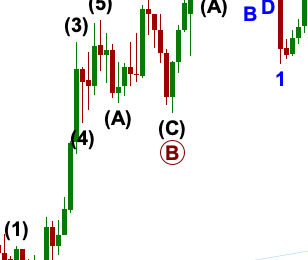

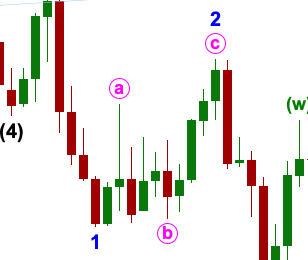

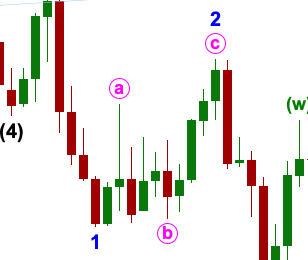

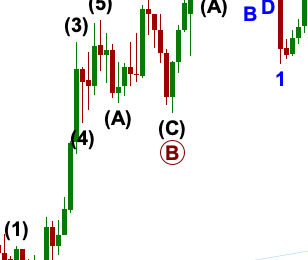

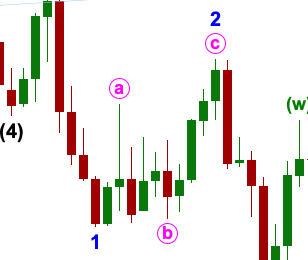

GOLD: Elliott Wave and Technical Analysis | Charts – December 8, 2020 Again, upwards movement remains within the channel. There is still a series of lower lows and lower highs off the high of August 7, 2020. Summary: The first wave count is bearish for the...

by Lara | Nov 13, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – November 13, 2020 Price remains range bound at the end of this week. Classic technical analysis still supports the alternate wave counts, but they will remain alternates until price adds reasonable confidence....

by Lara | Oct 22, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – October 22, 2020 Downwards movement today has breached a small channel but remains above the short-term invalidation point. The short-term Elliott wave analysis is changed, but the bigger picture remains the...

by Lara | Sep 25, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – September 25, 2020 A small inside day leaves all three Elliott wave counts the same. Summary: The first Elliott wave count now expects upwards movement to 2,160. A target calculated from the classic...

by Lara | Sep 3, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – September 3, 2020 A triangle pattern may be completing. All three Elliott wave counts remain valid. Summary: The pullback may be over. The upwards trend may resume. The next target is now at 2,180. A new low...

by Lara | Aug 12, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 12, 2020 The pullback has continued lower. Today three daily charts are published. Invalidation of a bullish Elliott wave count would add confidence in a bearish wave count. Summary: The pullback may be...

by Lara | Jul 21, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – July 21, 2020 Upwards movement continues to increase in strength as members were warned may happen. The final target for the main wave count remains the same. Summary: The upwards trend may still remain...

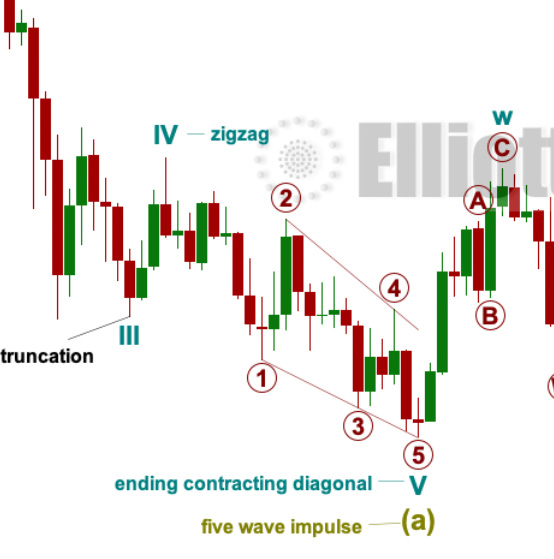

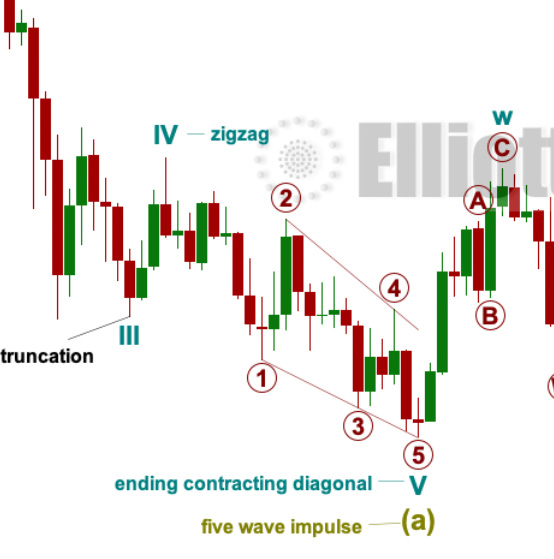

by Lara | Jun 30, 2020 | Education, Public Analysis, Reference

Comprehensive List of Elliott Wave Rules and Guidelines The following is a comprehensive list of all Elliott wave rules and guidelines. Rules are almost the same as Elliott’s original rules as outlined in Frost and Prechter’s Elliott Wave Principle. A few...

by Lara | Jun 29, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – June 29, 2020 Price remains range bound and all three Elliott wave counts remain valid. Summary: The next target is at 1,820. The final target is at 1,980. However, Stockcharts data has still not confirmed an...