by Lara | Oct 20, 2020 | Public Analysis, USD Index

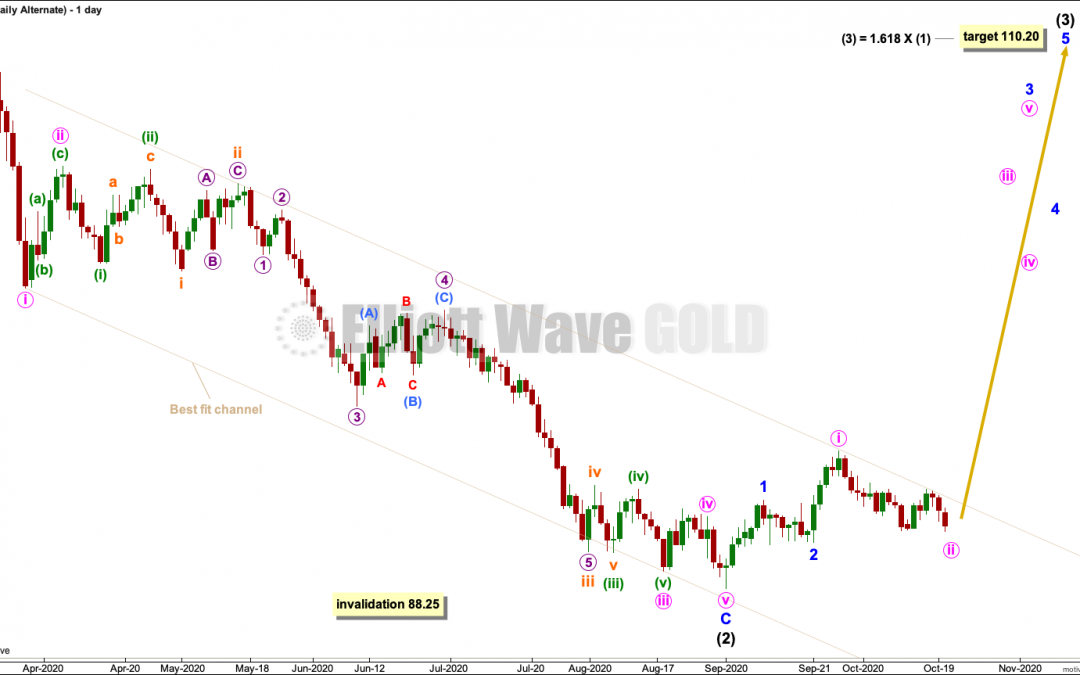

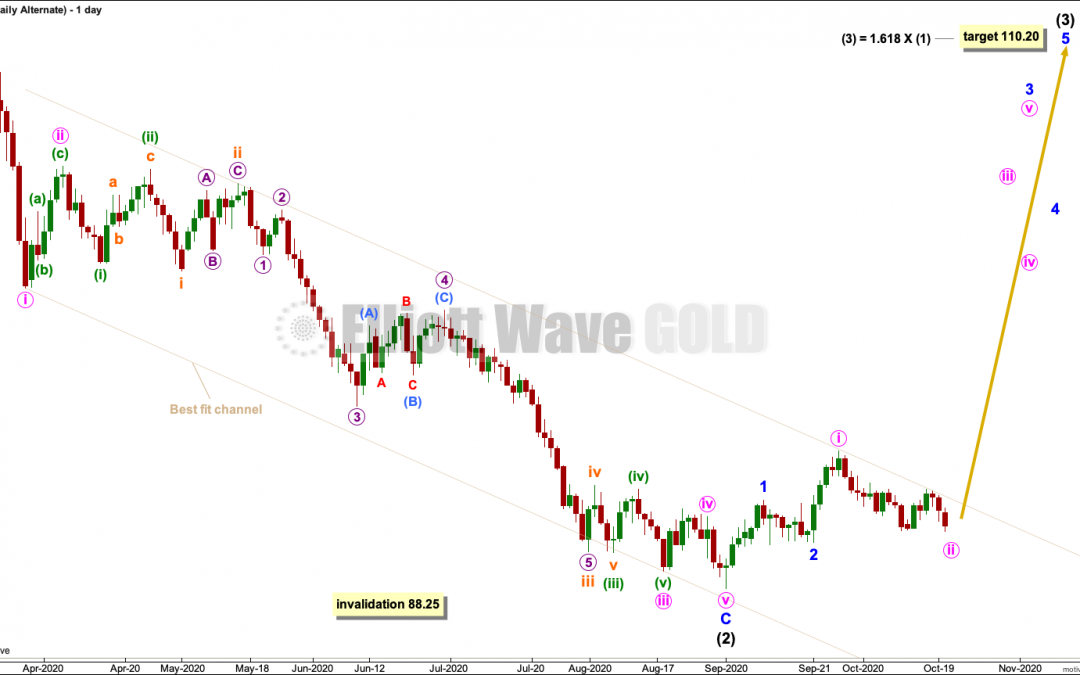

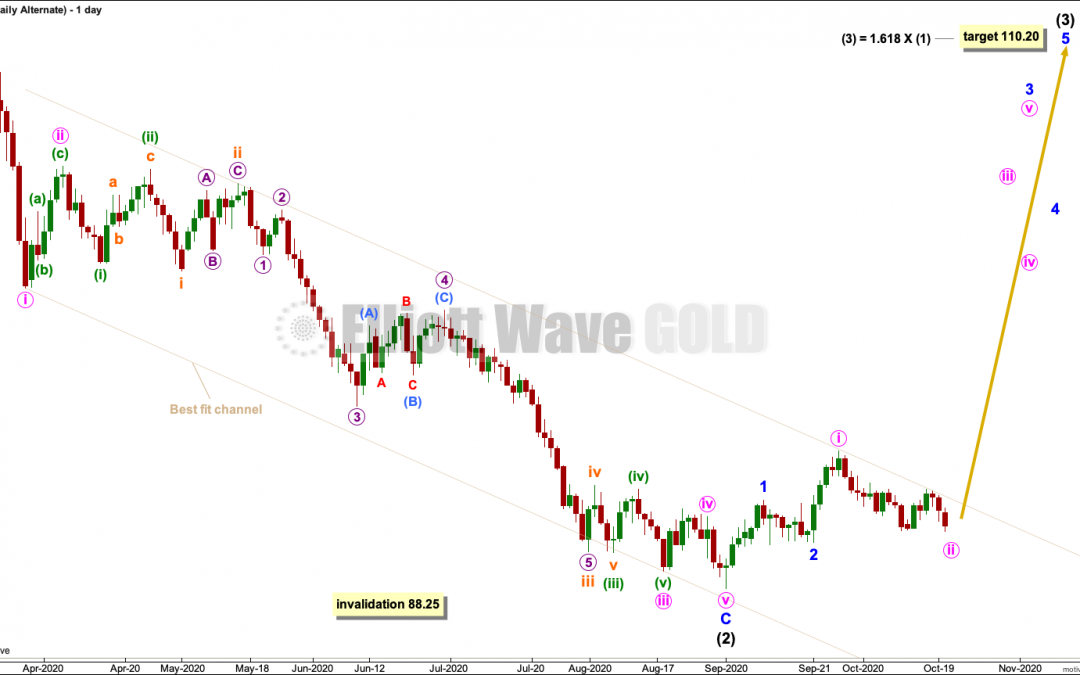

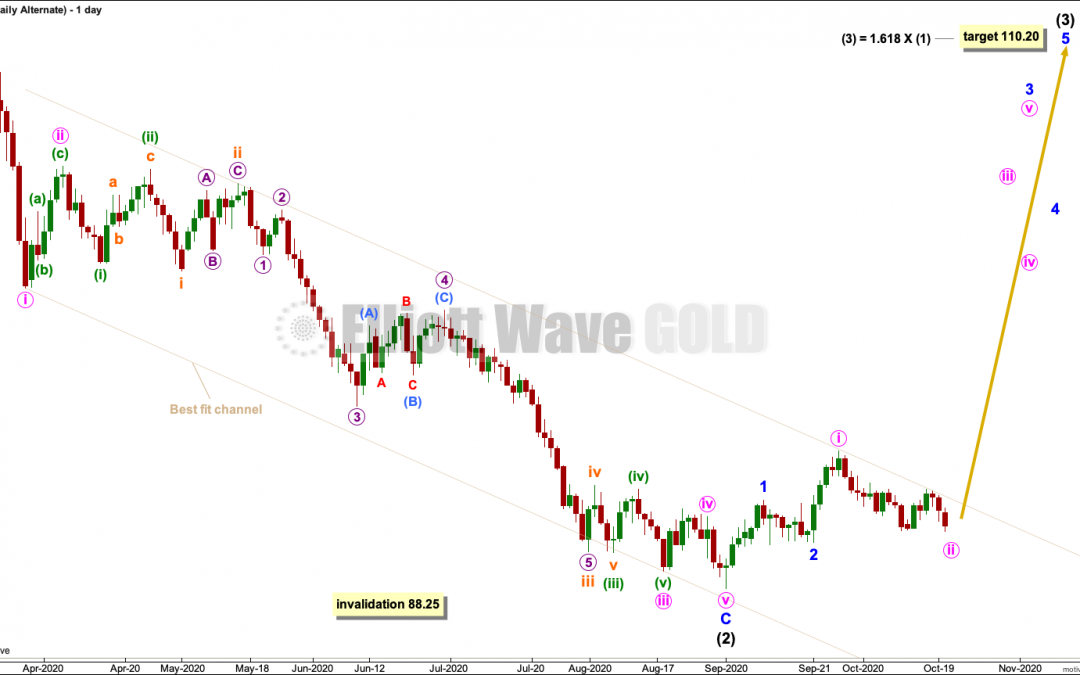

USD Index: Elliott Wave and Technical Analysis | Charts – October 20, 2020 Both a bull and bear wave counts at the quarterly chart level may remain valid. Summary: The bearish Elliott wave count expects a downwards trend has begun. The long-term target is...

by Lara | Nov 7, 2019 | Public Analysis, USD Index

Both bull and bear Elliott wave counts remain valid. Summary: The bearish Elliott wave count expects a downwards trend has begun. The long-term target is at 74.47. The bullish Elliott wave count expects a third wave up is beginning. The first target is at 138.62. The...

by Lara | Jun 12, 2019 | Public Analysis, USD Index |

Two Elliott wave counts remain. The preferred count is bearish and the alternate is bullish. Summary: The bearish Elliott wave count expects a new high to 101.13 and then a trend change. The bullish Elliott wave count expects some downwards movement to 93.24 and then...

by Lara | Nov 15, 2018 | Public Analysis, USD Index

An upwards breakout on the 12th of November was today proven false as price is back below resistance. Summary: The bearish Elliott wave count expects a new high to 98.09 or above and then a trend change. The bullish Elliott wave count expects a trend change now. The...

by Lara | Nov 9, 2018 | Public Analysis, USD Index |

A pullback or a time consuming consolidation was expected after last analysis on the 26th of August. Price continued lower until the 20th of September and from there has bounced up strongly. This analysis will attempt to determine if the bounce is just an upwards...

by Lara | Aug 20, 2018 | Public Analysis, USD Index |

Last analysis expected a little more upwards movement at the daily chart level to complete primary wave A. This is what has happened. Summary: A pullback here or a time consuming sideways consolidation may develop for primary wave B. Thereafter, the upwards trend may...

by Lara | Aug 4, 2018 | Public Analysis, USD Index

Last analysis on the 10th of June expected a deep correction for a B wave. Price has mostly moved sideways, and has now formed a fairly well defined consolidation zone. A correction has developed, but at this stage it is not deep. New updates to this analysis are in...

by Lara | Jun 10, 2018 | Public Analysis, USD Index

Last analysis in March expected upwards movement towards 97.97. Price has thus far continued to move higher, up to 95.02. BEARISH ELLIOTT WAVE ANALYSIS QUARTERLY CHART Click chart to enlarge. A huge double zigzag may be continuing lower. MONTHLY CHART Click chart to...

by Lara | Mar 21, 2018 | Public Analysis, USD Index |

A quick analysis today with a bullish and a bearish Elliott wave count, and classic technical analysis. BEARISH ELLIOTT WAVE ANALYSIS QUARTERLY CHART Click chart to enlarge. A huge double zigzag may be continuing lower. MONTHLY CHART Click chart to enlarge. This...