Last week’s gold analysis expected downwards movement towards a target at 1,329. Price has not moved lower, but nor has it moved above the invalidation point at 1,419.78. Price has moved sideways for the week.

Sideways movement looks like a contracting triangle. This is either a fourth wave correction or an X wave within a larger fourth wave correction. I have two wave counts for you this week looking at these two possibilities.

Click on the charts below to enlarge.

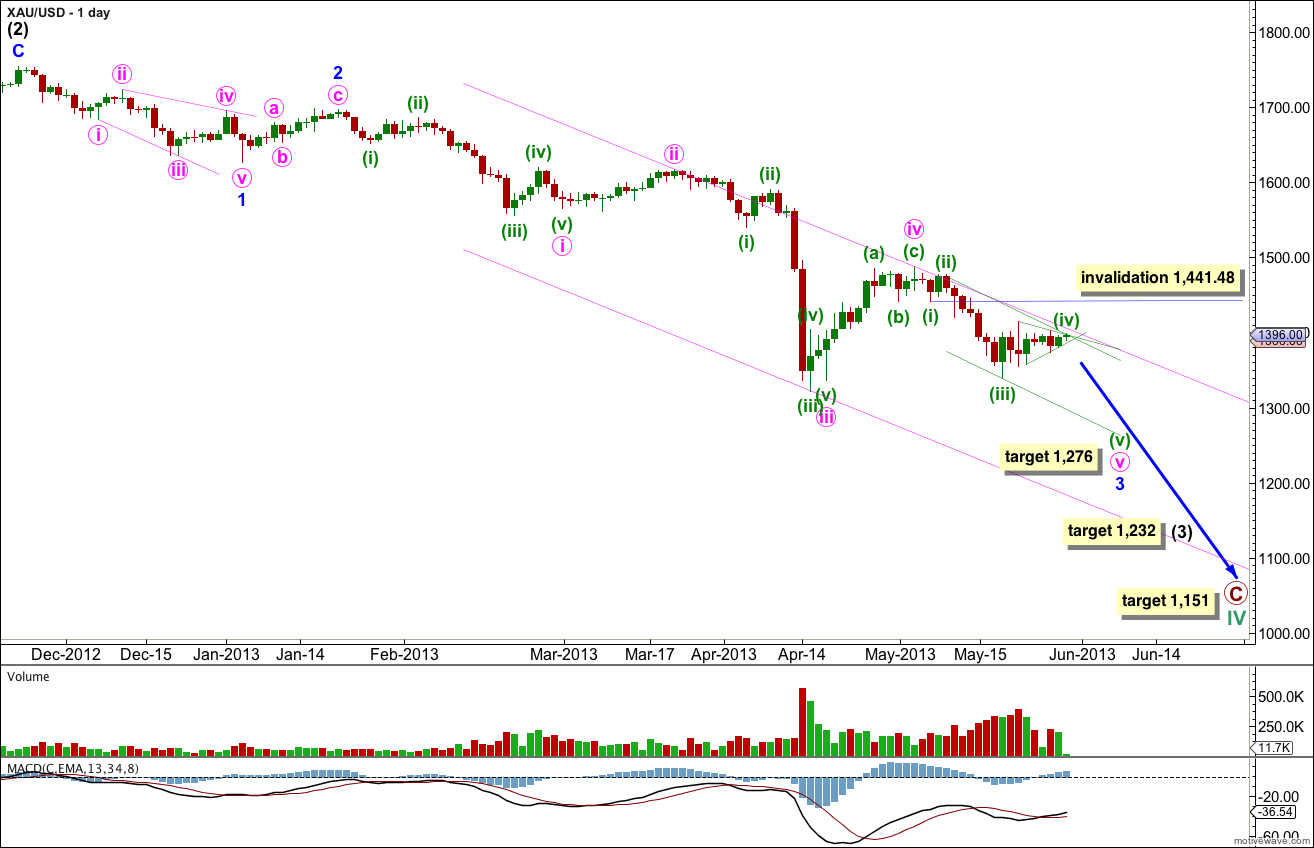

Main Wave Count.

This daily chart focuses on the new downwards trend of primary wave C.

Within primary wave C intermediate waves (1) and (2) are complete. Intermediate wave (3) is underway and may have just passed the middle of it.

Within intermediate wave (3) minor waves 1 and 2 are complete and minor wave 3 may have just passed its middle.

Within minor wave 3 minute waves i, ii, iii and iv are complete. Minute wave v may be incomplete.

At 1,276 minute wave v would reach 1.618 the orthodox length of minute wave i. Because there is no Fibonacci ratio between minute waves i and iii I expect we shall see a Fibonacci ratio between minute wave v and either of iii or i.

Draw a channel about minor wave 3 using Elliott’s second technique. Draw the first trend line from the highs of minute waves ii and iv, then place a parallel copy upon the low of minute wave iii. Expect minute wave v to end midway within this channel most likely, or to find support at the lower edge if it gets down there. When this channel is breached by subsequent upwards movement then minor wave 3 should be over and minor wave 4 should be underway.

At 1,232 intermediate wave (3) would reach 4.236 the length of intermediate wave (1).

At 1,151 primary wave C would reach 1.618 the length of primary wave A.

Within minuette wave (iii) subminuette wave iv may not move into subminuette wave i price territory. This wave count is invalidated at minor degree with movement above 1,441.48.

The triangle may be minuette wave (iv) within minute wave v.

All the triangle subwaves subdivide into zigzags or zigzag multiples so far. The final wave of subminuette wave e should be over. Any further upwards movement for subminuette wave e may not move beyond the end of subminuette wave c for a contracting triangle. This wave count is invalidated with movement above 1,402.23.

If this wave count is invalidated with upwards movement we may use the alternate below.

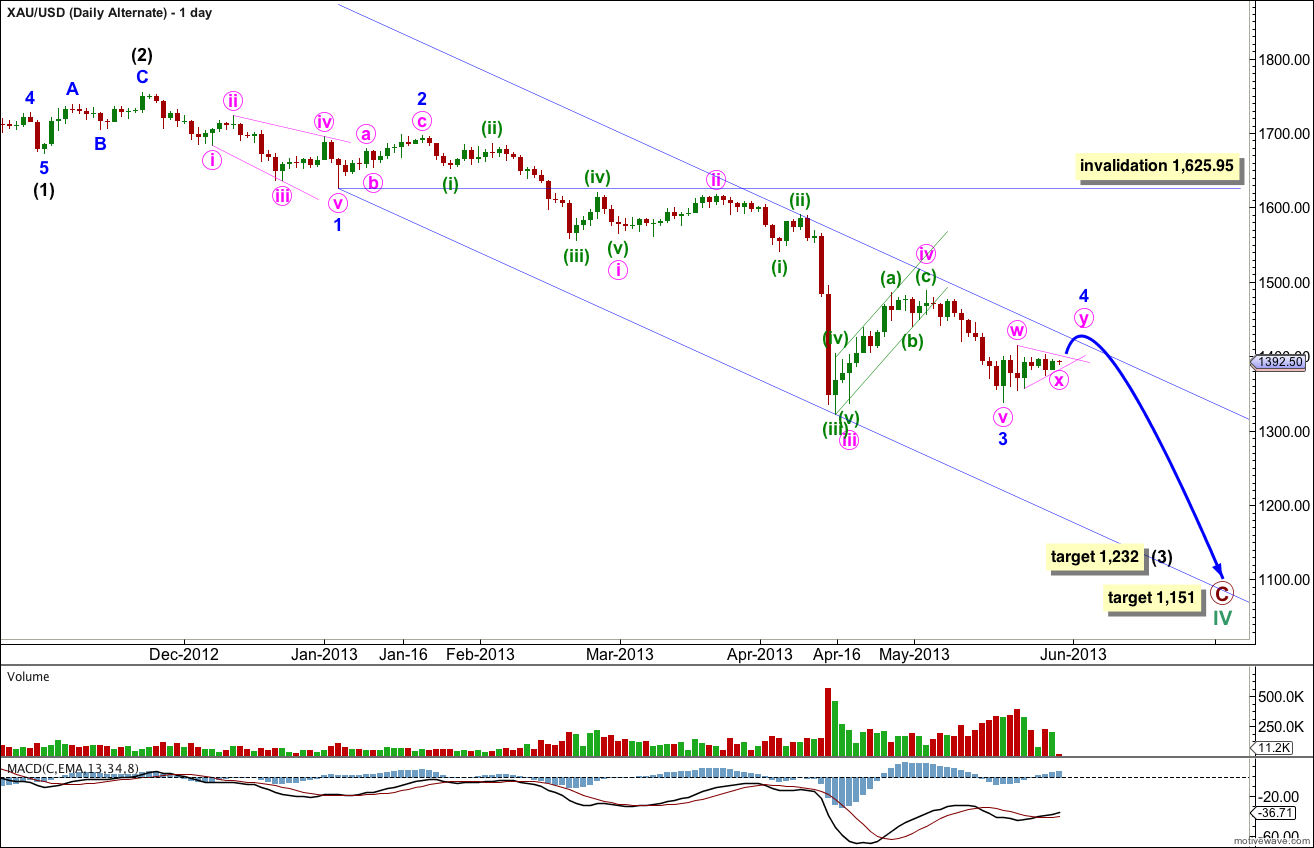

Alternate Wave Count.

At the daily chart level this alternate is the same as the main wave count up to the point labeled minute wave iv within minor wave 3. Thereafter, this alternate sees the last wave downwards as a five wave impulse for a truncated fifth wave for minute wave v to end minor wave 3.

Because this wave count sees a truncation it has a slightly lower probability than the main wave count.

Within recent sideways movement the triangle may have begun at the high labeled minute wave w within minor wave 4. Minor wave 4 may be unfolding as a double zigzag or double combination, with the first structure minute wave w a complete zigzag, the three joining the two structures labeled minute wave x unfolding as a triangle. Minute wave y is most likely to be a zigzag, but it may also be a flat correction.

If price moves above 1,402.23 then the triangle is completed and the next movement is upwards. If the next wave upwards travels the same distance as the widest part of the triangle it would end at 1,449.09.

Minute wave y is most likely to subdivide as a zigzag lasting a few days.

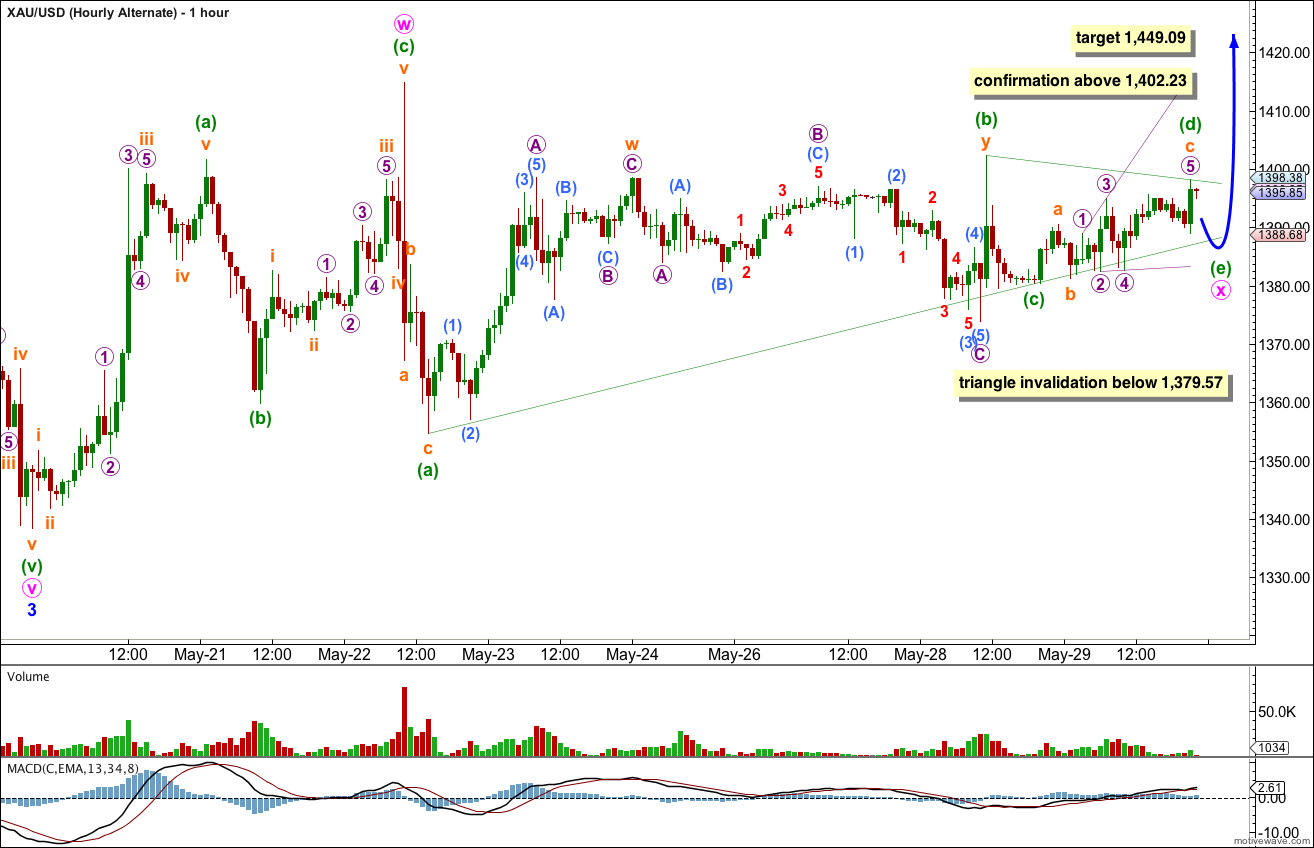

Within the recent sideways movement the subdivisions are seen here the same as the main wave count, except the degree of labeling is higher.

At the hourly chart level this alternate does not have as good a look as the main wave count.

Within a contracting triangle minuette wave (e) may not move beyond the end of minuette wave (c). This triangle is invalidated with movement below 1,379.57.