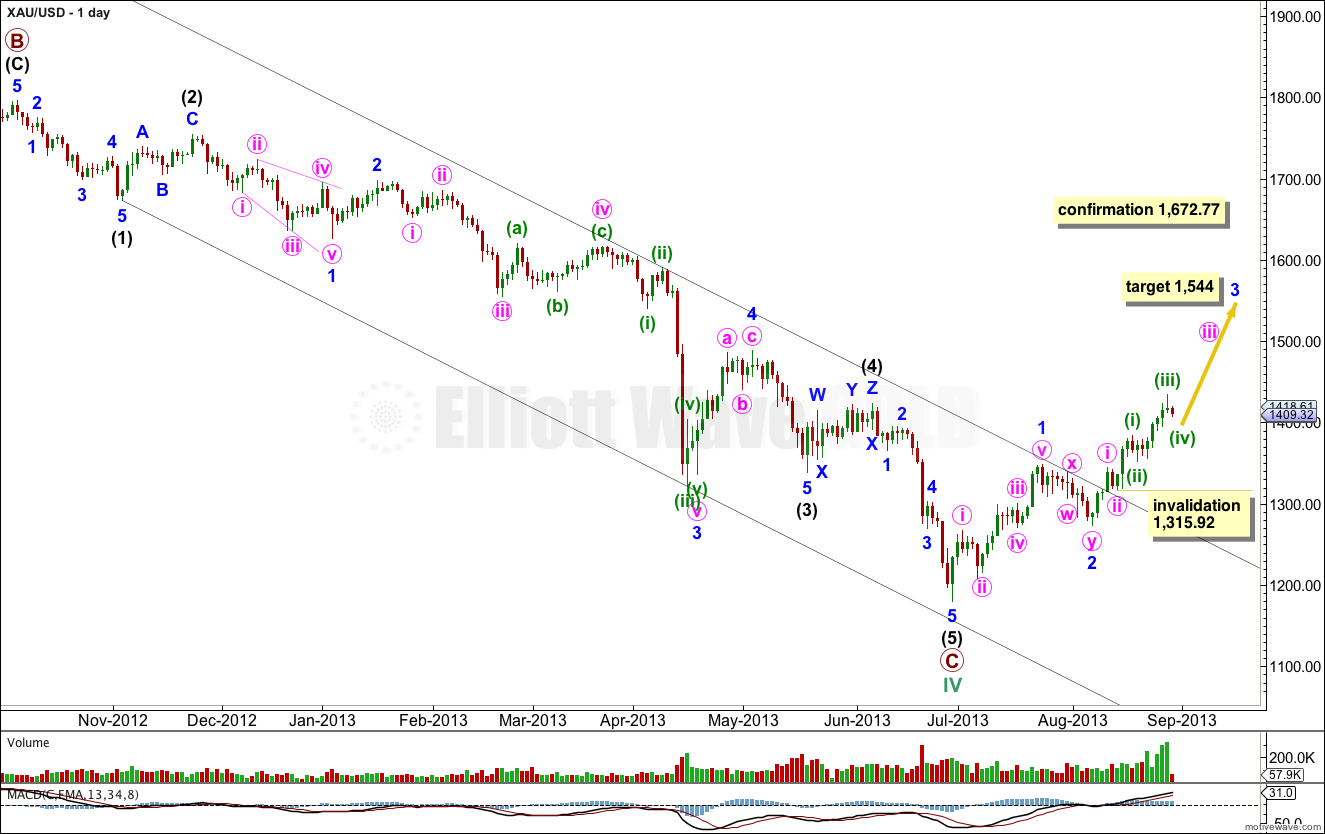

I am changing my wave count today at the daily chart level.

The short to mid term outlook is unchanged, and the subdivisions on the hourly chart remain the same.

Click on the charts below to enlarge.

Primary wave C may be complete. Primary wave C is 28.96 short of 1.618 the length of primary wave A.

Ratios within primary wave C are: there is no Fibonacci ratio between intermediate waves (3) and (1), and intermediate wave (5) is 13.77 short of 0.618 the length of intermediate wave (3).

Within intermediate wave (1) there are no adequate Fibonacci ratios between minor waves 1, 3 and 5.

Ratios within intermediate wave (3) are: minor wave 3 is 24.72 longer than 2.618 the length of minor wave 1 (a 6.8% variation; I consider less than 10% acceptable), and minor wave 5 is 11.74 longer than 0.382 the length of minor wave 3.

Ratios within minor wave 3 are: minute wave iii is 10.78 longer than 2.618 the length of minute wave i, and minute wave v has no Fibonacci ratio to minute wave i.

Ratios within intermediate wave (5) are: minor wave 3 has no Fibonacci ratio to minor wave 1, and minor wave 5 is just 1.61 short of equality with minor wave 3.

A best fit parallel channel is so far clearly breached by upwards movement, no matter how the channel is drawn. This indicates a probable trend change.

Within the new upwards trend of cycle wave V, within minute wave iii no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,315.92.

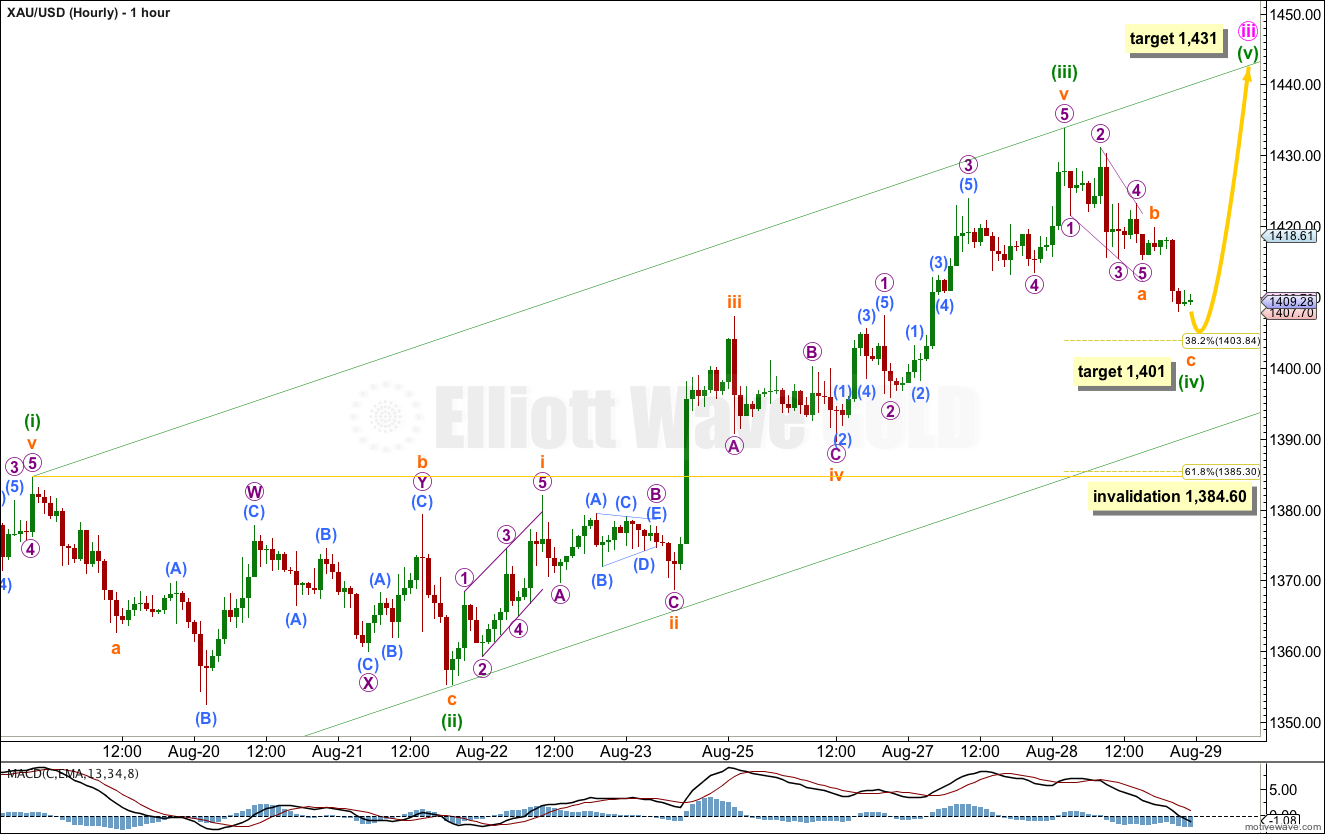

The subdivisions and degree of labeling for this hourly chart are the same as previous analysis.

Within minute wave iii minuette wave (iii) is now complete and has no Fibonacci ratio to minuette wave (i). This means it is more than likely minuette wave (v) shall exhibit a Fibonacci ratio to minuette waves (i) or (iii). When minuette wave (iv) has ended I can add to the target calculation for minute wave iii to end at minuette wave degree. I may be able to do that tomorrow for you.

At 1,401 subminuette wave c within minuette wave (iv) would reach equality with subminuette wave a. This would bring minuette wave (iv) to just below the 0.382 Fibonacci ratio of minuette wave (iii).

Mineutte wave (iv) may also be deeper if it is to show alternation in depth with minuette wave (ii). Minuette wave (ii) was a shallow 43% of minuette wave (i). Minuette wave (iv) could end about 1,385.30, the 0.618 Fibonacci ratio of minuette wave (iii).

Minuette wave (iv) may show alternation in structure. Minuette wave (ii) was time consuming zigzag, with a complicated subminuette wave b within it. Minuette wave (iv) may be a briefer simpler zigzag, or it may yet continue further as a flat, combination or triangle.

Minuette wave (iv) is so far showing up on the daily chart with a red candlestick. It may be close to completion, or it may last another one or two days at the most.

Minuette wave (iv) may not move into minuette wave (i) price territory. This wave count is invalidated with movement below 1,384.60.

When minuette wave (iv) is completed then further upwards movement for minuette wave (v) should unfold. At 1,431 minute wave iii would reach 1.618 the length of minute wave i.

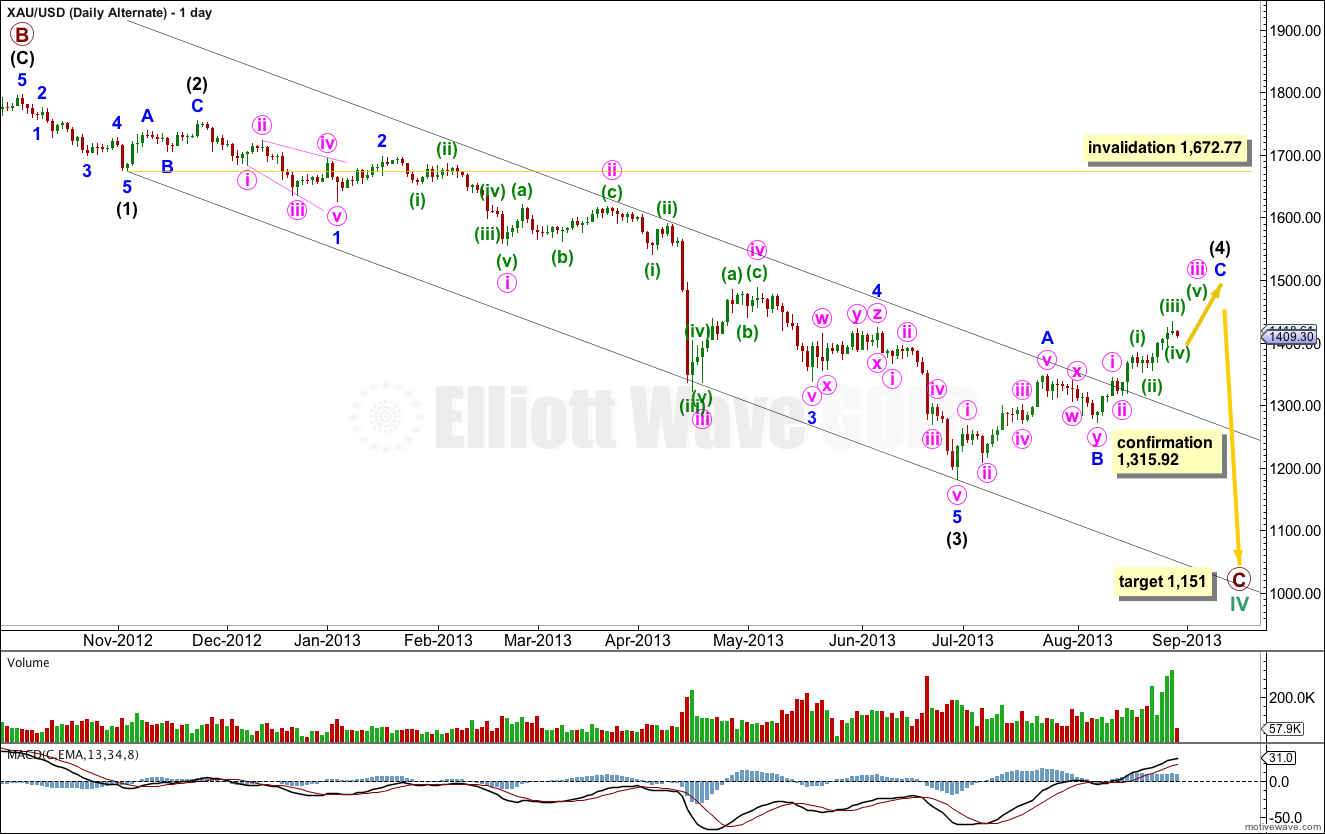

Alternate Wave Count.

It remains possible that primary wave C is not over and requires on final fifth wave down. However, the size of intermediate wave (4) now is so much larger than intermediate wave (2) that this wave count no longer has the right look.

I would only now seriously consider it if the main wave count is invalidated with movement below 1,315.92.

Intermediate wave (4) may not move into intermediate wave (1) price territory. This wave count is invalidated with movement above 1,672.77.