Last week’s analysis expected downwards movement for the week, with a second wave correction to come. The first wave was already over and the second wave unfolded as a very deep zigzag, ending just below the invalidation point on the daily chart. The hourly chart was invalidated.

The wave count remains mostly the same this week.

Click on the charts below to enlarge.

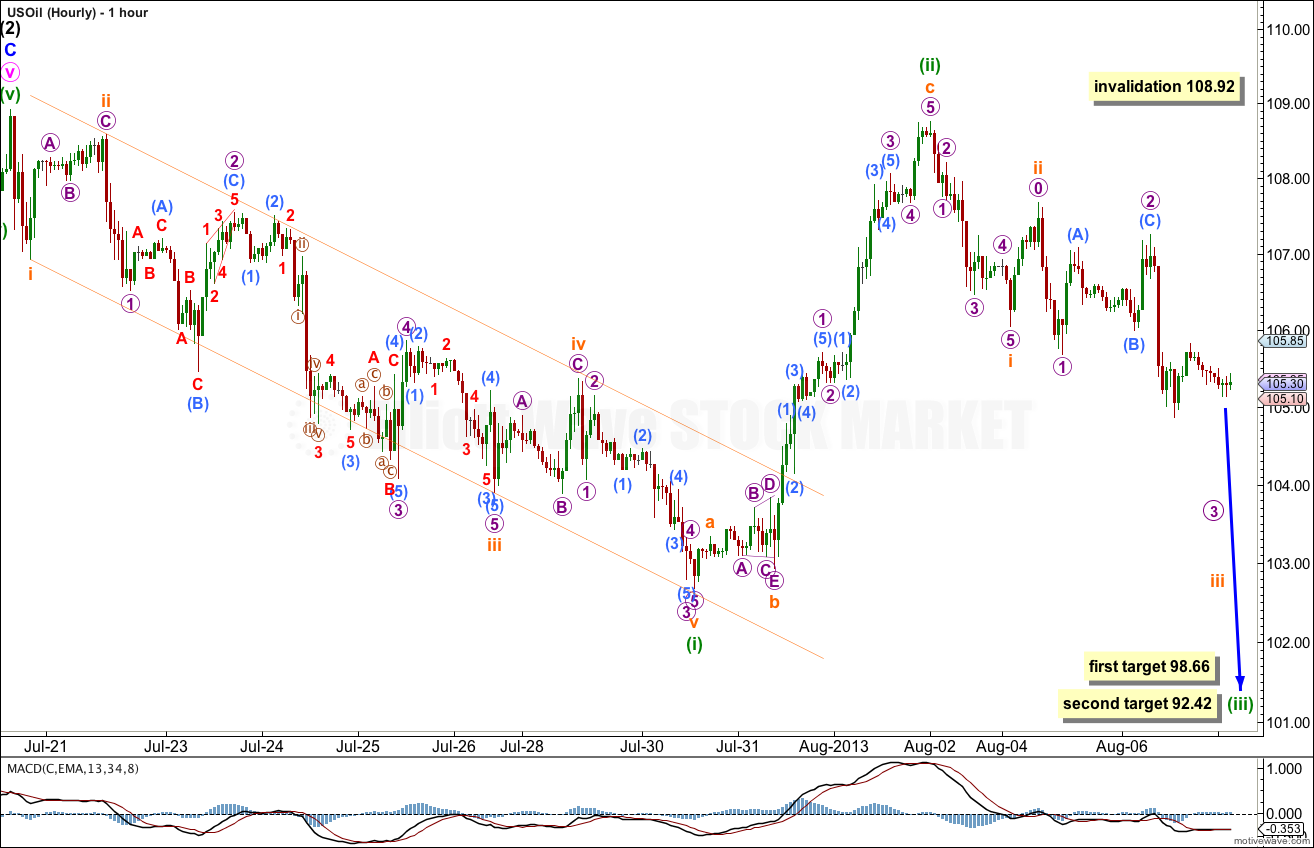

Within a cycle degree c wave downwards primary waves 1 and 2 are complete. Within primary wave 3 intermediate waves (1) and (2) are complete, with the start of intermediate wave (3) at 108.92.

There is a clear evening doji star candlestick pattern at the high of intermediate wave (2) indicating a trend change here.

At 55.09 intermediate wave (3) would reach 1.618 the length of intermediate wave (1).

Within intermediate wave (3) no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 108.92.

The low at 102.68 was the end of a five wave impulse.

Ratios within minuette wave (i) are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is 0.20 short of 0.618 the length of subminuette wave iii.

Ratios within subminuette wave iii are: micro wave 3 is 0.11 longer than 1.618 the length of micro wave 1, and micro wave 5 is 0.11 short of equality with micro wave 1.

A parallel channel drawn about minuette wave (i) using Elliott’s first technique perfectly shows where subminuette wave iv found resistance. This impulse is textbook perfect. I wish I had seen it last week!

Minuette wave (ii) is a very deep sharp zigzag. Because there is no further room left for upwards movement if this wave count is correct then minuette wave (iii) must begin here. We should see an increase in downwards momentum over the next week for US Oil.

Minuette wave (ii) subdivides as a deep sharp zigzag with subminuette wave b an expanding triangle. There is no Fibonacci ratio between subminuette waves a and c.

Ratios within subminuette wave c of minuette wave (ii) zigzag are: micro wave 3 is 0.04 short of equality with micro wave 1, and micro wave 5 is just 0.02 longer than 0.382 the length of micro wave 1.

At 98.66 minuette wave (iii) would reach 1.618 the length of minuette wave (i). Because minuette wave (ii) was so deep it is also fairly likely that minuette wave (iii) may reach 2.618 the length of minuette wave (i) at 92.42. If price keeps dropping through the first target then the second target is the next likely end.

Minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated with movement above 108.92.