Last analysis expected a little upwards movement to a short term target at 1,338 before price turned and continued the new downwards trend. Price did move higher, falling 2.86 short of the target, before turning around to make a slightly new low.

Click on the charts below to enlarge.

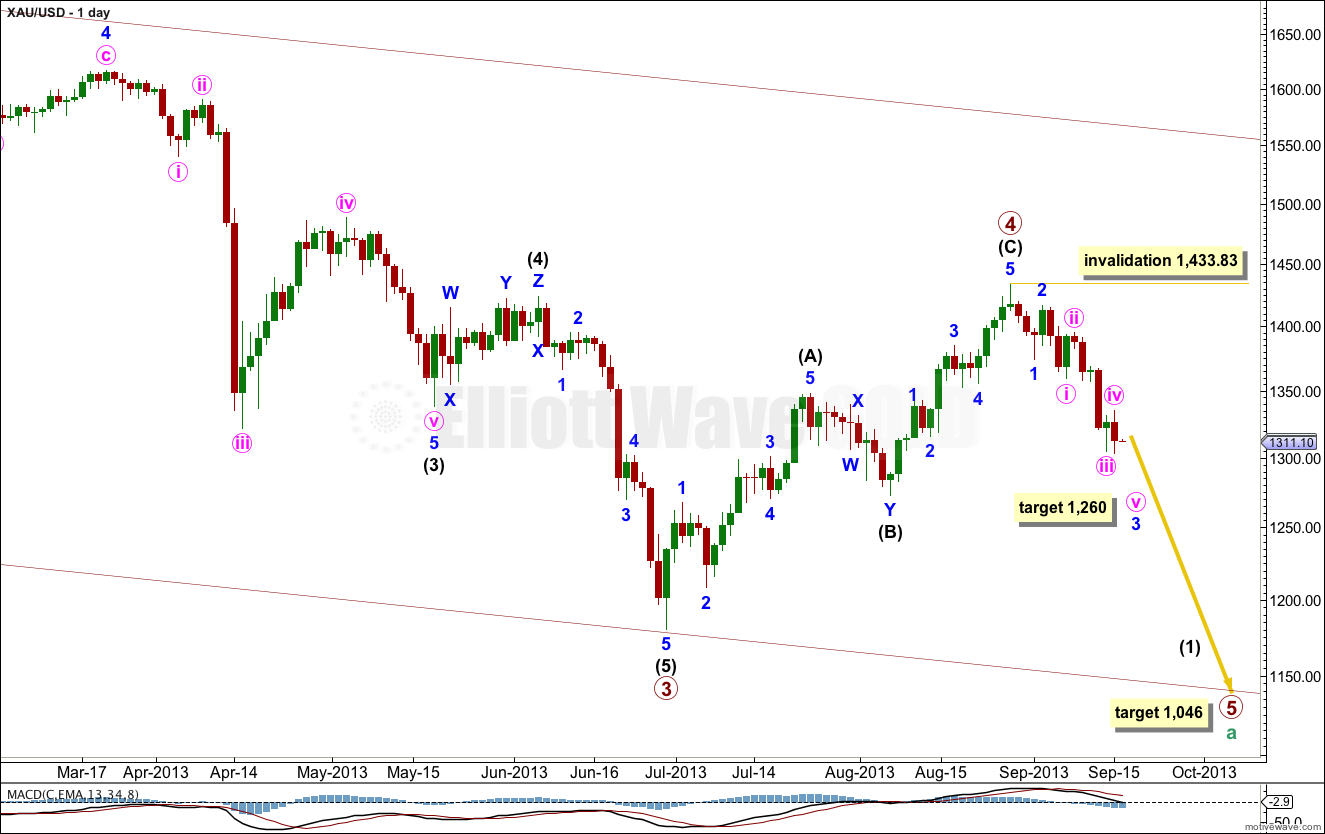

The bigger picture sees gold in a downwards trending five wave impulse at cycle degree for cycle wave a. Within this downwards impulse primary waves 1 through to 4 are complete. The final fifth wave down has begun.

Within primary wave 5 I have moved the labeling all up one degree today. This has a more typical look.

The big maroon channel is drawn on the weekly chart using Elliott’s first technique, and copied over here. Draw the first trend line from the low of primary wave 1 at 1,532.90 to the low of primary wave 3, then place a parallel copy upon the high of primary wave 2 at 1,796.05. Expect primary wave 5 to find support at the lower end of this channel.

At 1,046 primary wave 5 would reach equality in length with primary wave 1.

Within primary wave 5 minor wave 3 within intermediate wave (1) would reach 2.618 the length of minor wave 1 at 1,260.

Within primary wave 5 no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement above 1,433.83.

I have two hourly wave counts for you today. The first hourly wave count has a slightly higher probability than the second.

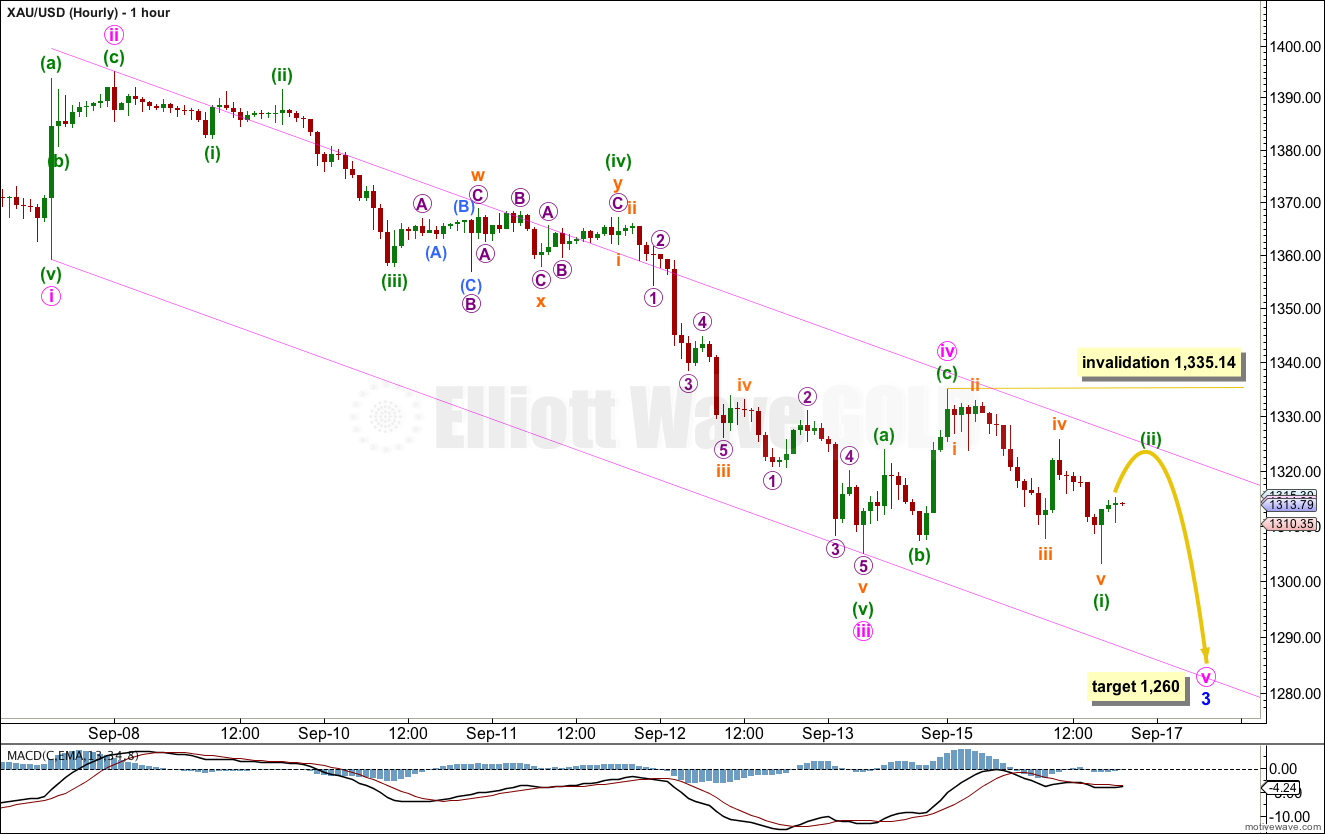

First Hourly Wave Count.

Minute wave iv (in last analysis labeled one degree lower, minuette wave (iv) ) is now a completed zigzag.

Minute wave iii is 2.61 short of 1.618 the length of minute wave iii.

Ratios within minute wave iii are: minuette wave (iii) is 0.19 longer than 2.618 the length of minuette wave (i), and minuette wave (v) has no Fibonacci ratio to minuette waves (iii) or (i).

Minute wave ii is a deep 62% zigzag, and within it minuette wave (c) is shorter than minuette wave (a) and is 1.16 longer than 0.382 the length of minuette wave (a). Minute wave iv shows nice alternation: it is a shallow 34% zigzag, and within it minuette wave (c) is longer than minuette wave (a) and is 2.71 short of 1.618 the length of minuette wave (a).

A channel drawn about minor wave 3 using Elliott’s first technique shows where minute wave iv almost ended.

It is possible that minor wave 3 is over. Movement above 1,335.14 would indicate this could be possible. However, this has a lower probability as minute wave v would be very short, making only a slight new low, and minor wave 3 would then have no Fibonacci ratio to minor wave 1.

What is more likely is that within minute wave v only minuette wave (i) is complete. Minuette wave (ii) should move higher and should find resistance about the upper edge of the channel. When that is completed some increase in downwards momentum would be expected as minuette wave (iii) moves to new lows.

Minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated with movement above 1,335.14.

If price moves above 1,335.14 in the next 24 hours then the second hourly wave count below should be used.

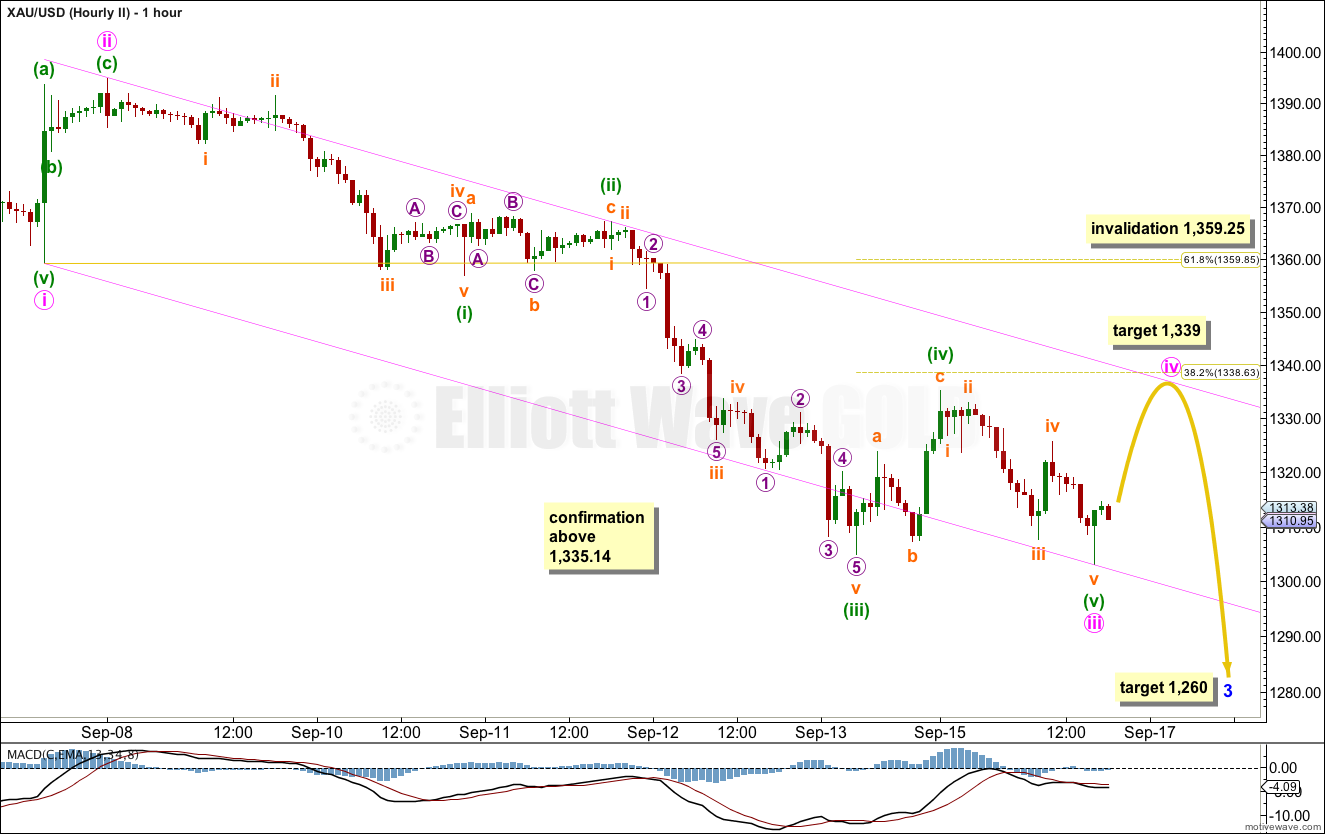

Second Hourly Wave Count.

This wave count is the same as the first hourly wave count up to the high labeled minute wave ii. Thereafter, it differs slightly. At this stage the expected direction is the same, but after that these wave counts diverge. Both must be considered.

This wave count sees minuette wave (i) within minute wave iii as ending lower down, and minute wave iii as just over. Upwards movement is a fourth wave for minute wave iv.

Minute wave iii is just 0.72 short of 1.618 the length of minute wave i.

Ratios within minute wave iii are: minuette wave (iii) is just 0.53 longer than 1.618 the length of minuette wave (i), and minuette wave (v) has no Fibonacci ratio to minuete waves (i) or (iii).

This second wave count also agrees with MACD in that the strongest downwards movement is the middle of the third wave. It fits very nicely in its channel (so far).

Draw this channel from the ends of minute waves i to iii, and place a parallel copy upon the end of minute wave ii. Expect minute wave iv to find resistance at the upper end of this channel. Minute wave ii was a relatively deep zigzag so given the guideline of alternation we may expect minute wave iv to most likely be a shallow flat, combination or triangle. It may end about the 0.382 Fibonacci ratio of minute wave iii at 1,339.

Minute wave iv may not move into minute wave i price territory. This second wave count is invalidated with movement above 1,359.25.

The key difference to these two wave counts is the subdivisions of the small piece of movement which on this second wave count are labeled micro wave C within subminuette wave iv within minuette wave (i) within minute wave iii. This second wave count must see this movement as a motive wave, a five wave structure. The first wave count sees it as a three. On the five minute chart it subdivides most easily as a three. For this reason this second wave count has a lower probability than the first.

Within this wave count minuette wave (ii) is a regular flat correction with a slightly truncated C wave. This small truncation slightly reduces the probability of this wave count.

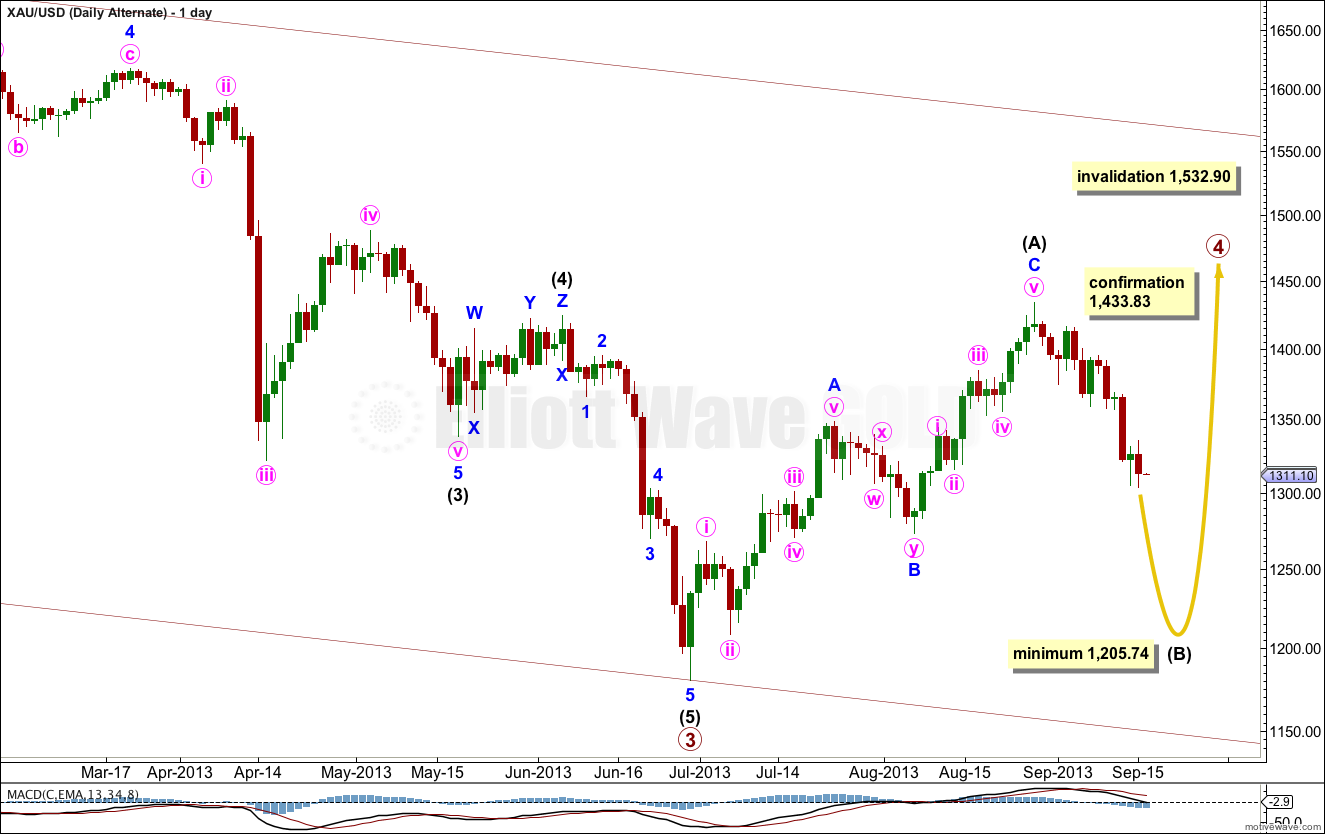

Alternate Daily Wave Count.

Alternatively, primary wave 4 may be an incomplete flat correction (or double combination). A flat correction requires intermediate wave (B) to reach a minimum of 90% the length of intermediate wave (A) at 1,205.74. A double combination does not have a minimum point for downwards movement, but it still requires a corrective structure downwards to complete.

At this stage this alternate does not diverge from the main wave count. They both expect downwards movement. It is the structure which is different. This alternate expects a corrective structure downwards, most likely a zigzag, where the main wave count expects an impulse.

Careful attention to structure in the coming weeks will clarify if this alternate is viable.

At this stage this alternate has a lower probability because it would see primary wave 4 not show alternation in structure with primary wave 2.