Yesterday’s analysis expected a little upwards movement to find resistance at the upper edge of a channel drawn on the hourly chart, before a trend change and more downwards movement. This is exactly what happened.

The target at 1,260 is short / mid term and has not been met yet. This structure is incomplete.

Click on the charts below to enlarge.

The bigger picture sees gold in a downwards trending five wave impulse at cycle degree for cycle wave a. Within this downwards impulse primary waves 1 through to 4 are complete. The final fifth wave down has begun.

The big maroon channel is drawn on the weekly chart using Elliott’s first technique, and copied over here. Draw the first trend line from the low of primary wave 1 at 1,532.90 to the low of primary wave 3, then place a parallel copy upon the high of primary wave 2 at 1,796.05. Expect primary wave 5 to find support at the lower end of this channel (or possibly to overshoot the channel if we see a fifth wave thrust).

At 1,046 primary wave 5 would reach equality in length with primary wave 1.

Within primary wave 5 minor wave 3 within intermediate wave (1) would reach 2.618 the length of minor wave 1 at 1,260.

Within primary wave 5 no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement above 1,433.83.

I have two hourly wave counts again for you today. The main hourly wave count has a higher probability than the alternate.

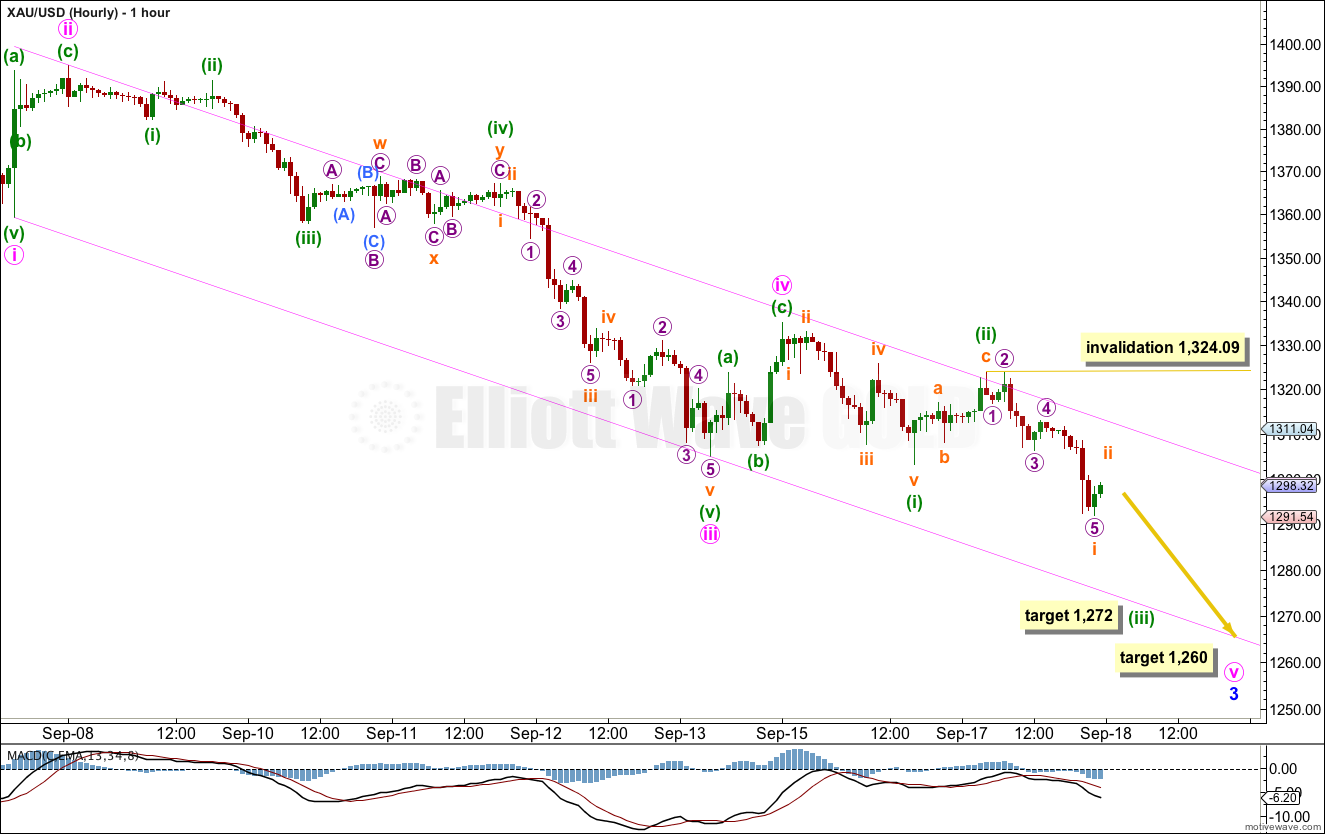

Main Hourly Wave Count.

This wave count expects that minor wave 3 is incomplete. This is my main wave count because it expects a Fibonacci ratio between minor waves 3 and 1, and it agrees perfectly with MACD. Normally I expect to see a second wave coincide with MACD crossing the zero line, as it does for minute wave ii at the top left of the chart. I expect the fourth wave to coincide with MACD coming to touch the zero line which it does for minute wave iv. The strongest MACD reading should correspond to close to the end of the third wave as this does, and the middle third wave within the third wave should correspond with the strongest reading on the histogram for MACD.

Minute wave iii is 2.61 short of 1.618 the length of minute wave i.

Ratios within minute wave iii are: minuette wave (iii) is 0.19 longer than 2.618 the length of minuette wave (i), and minuette wave (v) has no Fibonacci ratio to minuette waves (iii) or (i).

Ratios within minuette wave (i) of minute wave v are: micro wave 3 is 1.57 short of 2.618 the length of micro wave 1, and micro wave 5 has no Fibonacci ratio to micro wave 1.

Within minute wave v at 1,272 minuette wave (iii) would reach 1.618 the length of minuette wave i.

I would expect downwards movement for minuette wave (iii) to find support at the lower edge of this channel drawn using Elliott’s first technique. Draw the first trend line from the lows of minute waves i to iii, then place a parallel copy upon the high of minute wave ii.

The short / mid term target for minor wave 3 remains the same. At 1,260 minor wave 3 would reach 1.618 the length of minor wave 1.

Within minuette wave (iii) subminuette wave ii may not move beyond the start of subminuette wave i. This wave count is invalidated with movement above 1,324.09.

If price moves above this point then the alternate below should be used. It has a lower probability.

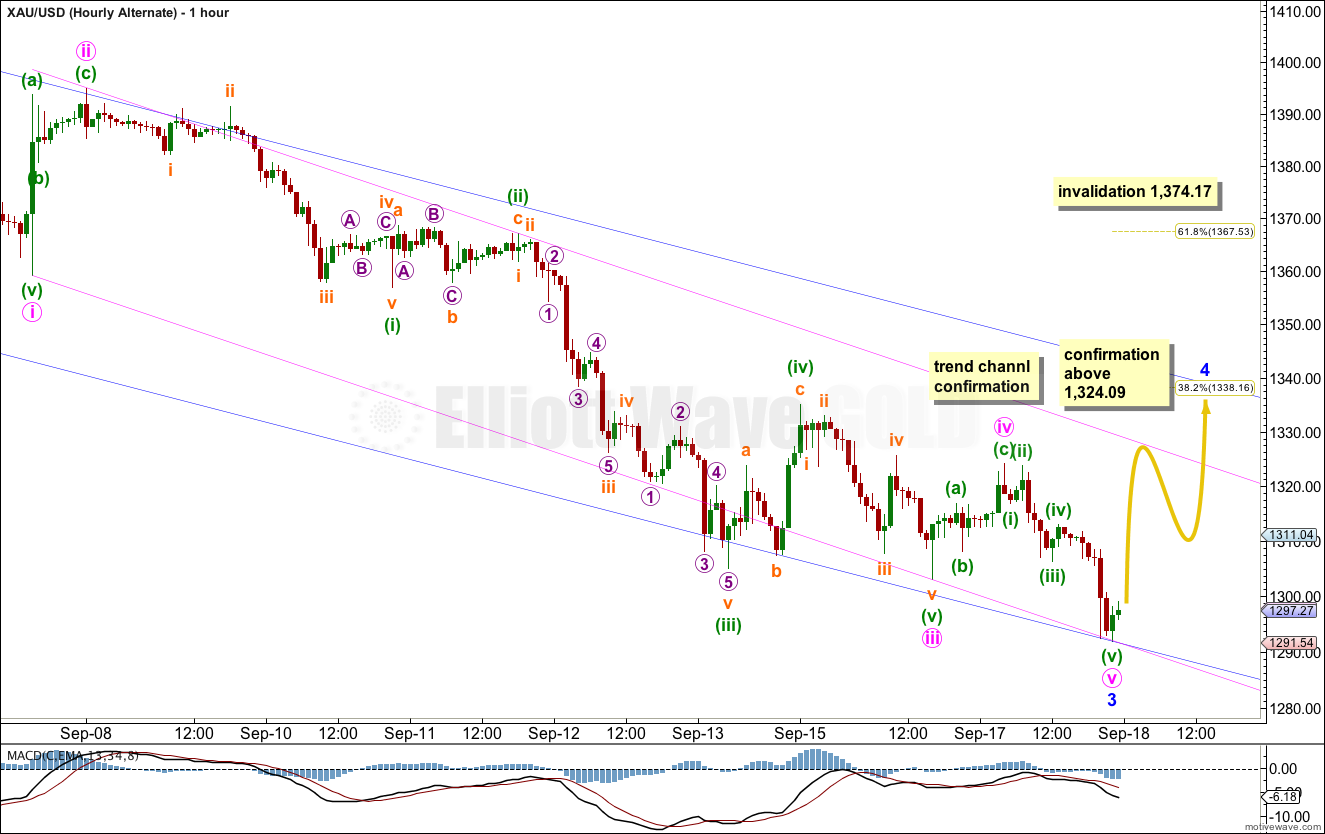

Alternate Hourly Wave Count.

If price moves above 1,324.90 this wave count would be confirmed as correct. Movement above the upper edge of the pink parallel channel would provide trend channel confirmation that minor wave 3 is over and minor wave 4 should be underway.

If this happens then draw a new channel about this downwards movement. Draw the first trend line from the low of minor wave 1 shown on the daily chart, to the low of minor wave 3 here. Place a parallel copy upon the high of minor wave 2, also shown on the daily chart. Expect minor wave 4 to find resistance at the upper edge of that channel – blue trend lines.

For this alternate there would be no Fibonacci ratio between minor waves 3 and 1.

Ratios within minor wave 3 are: minute wave iii is just 0.72 short of 1.618 the length of minute wave i, and minute wave v is 2.94 short of 0.382 the length of minute wave iii.

Ratios within minute wave iii are: minuette wave (iii) is just 0.53 longer than 1.618 the length of minuette wave (i), and minuette wave (v) has no Fibonacci ratio to minuete waves (i) or (iii).

This wave count would expect very choppy, overlapping sideways and upwards movement for about one to a few days for minor wave 4. It should be a shallow flat, combination or triangle. Minor wave 2 was a sharp deep 71% zigzag. Minor wave 4 would most likely end at the 0.382 Fibonacci ratio of minor wave 3 at 1,338.16.

Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement above 1,374.17.

Dear Lara,

Thanks for excellent analysis.

I think that there is a mistake on your part in wave count : In minute 5 , you have forgotten to show minuette 1. I feel that minuette 5 of minute 5 ended at 1296.25 not at 1291.75 as shown in your diagram. minuette 5 of minute 5 is ending diagonal. From there onwards, yesterday’s spike happened, which may be a of Y.

Kindly correct me if I am wrong.

Thanks.

I’m looking at my main hourly chart for the 17th and I can see minuette wave (i) within minute wave v? So I’m really not sure what you mean.

The sharp upwards movement which followed after this analysis is part of a of Y yes, which is what my next day saw it as for the alternate wave count.

If you are still confused and would like a clear answer to where we differ please post a link to a chart.