Movement above 1,374.17 invalidated the main wave count and confirmed the alternate. Yesterday I judged the two wave counts to have a close to even probability.

It is time to review the bigger picture. I will review my main and alternate historic wave counts today.

Click on the charts below to enlarge.

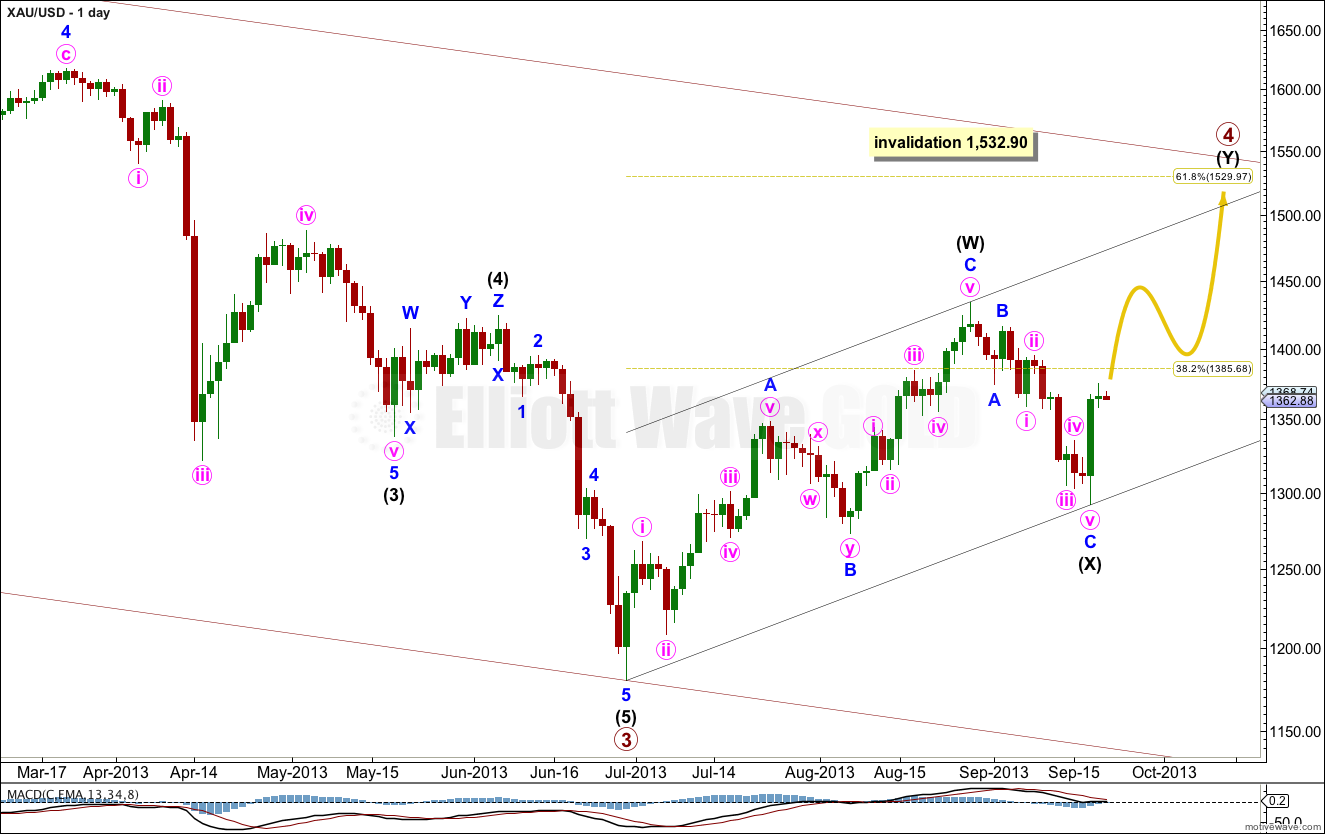

Main Wave Count.

This is now my main historic wave count, previously it was an alternate. It looks most likely that downwards movement is unfolding as a five wave impulse from the all time high at 1,921.15. So far we have primary waves 1, 2 and 3 complete. Primary wave 4 is and incomplete double zigzag or double combination.

Primary wave 3 is 12.54 short of 1.618 the length of primary wave 1.

Primary wave 2 was deep 68% correction as a running flat. I will expect alternation between primary waves 2 and 4.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

There are still several possible structures for primary wave 4. So far we have a three down from the high at 1,433.83. This three down is less than 90% the length of intermediate wave (W) so it cannot be a B wave within a flat over there. This structure may be a double zigzag or double combination. In a double combination the second structure labeled intermediate wave (Y) may be either a flat or triangle.

It is most likely at this stage that primary wave 4 is continuing as a double zigzag. Intermediate wave (Y) is most likely to be a zigzag.

Primary wave 2 was a deep 68% regular flat correction lasting 54 weeks. Given the guideline of alternation we may expect primary wave 4 to continue for longer than it has so far, possibly for another 10 weeks to last a Fibonacci 21 (give or take one week either side of this). If it completed as a double zigzag there would be nice alternation in structure with primary wave 2.

Primary wave 4 has already passed the 0.382 Fibonacci ratio, so it may end about the 0.618 Fibonacci ratio of primary wave 3 at 1,529.97. It should find resistance at the upper edge of the parallel channel drawn here using Elliott’s first technique.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

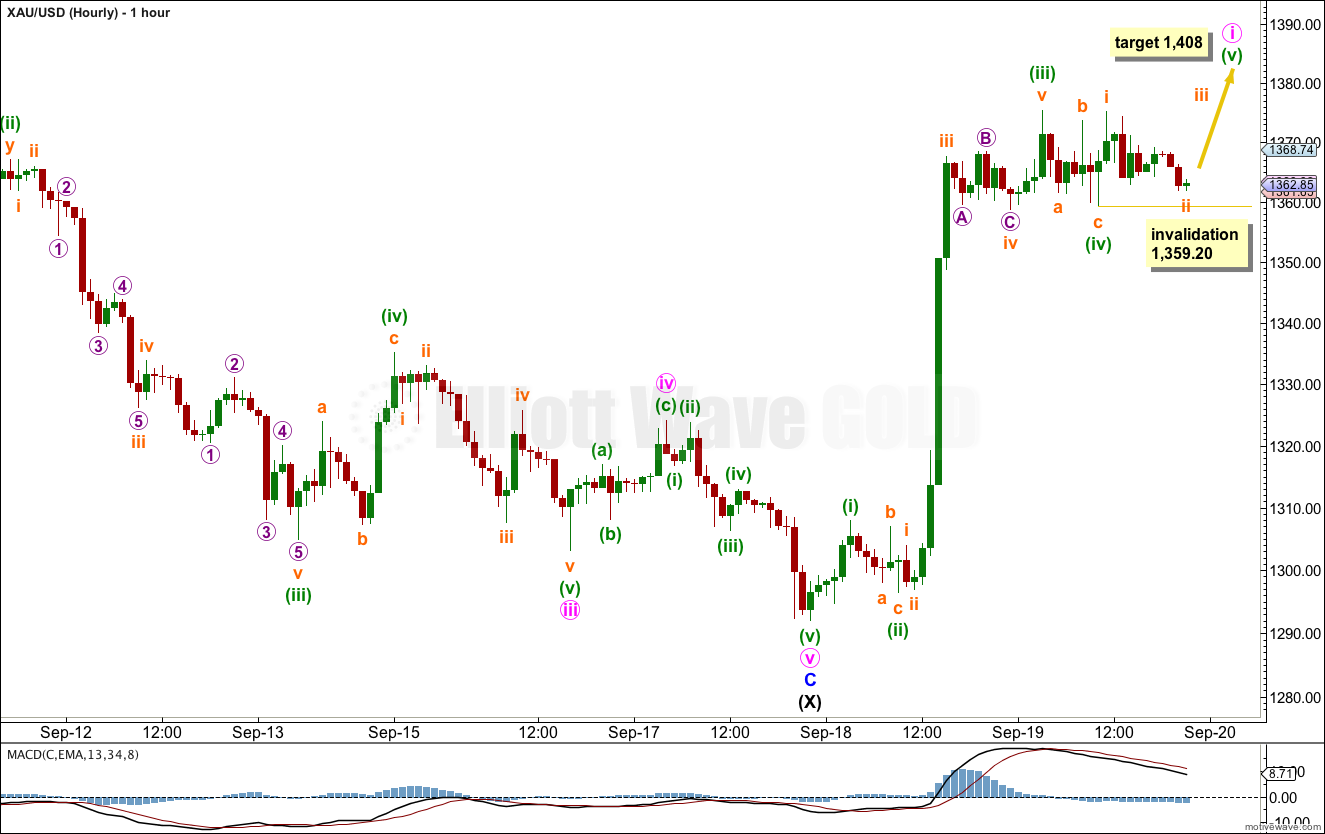

Main Hourly Wave Count.

This main hourly wave count expects minute wave i is incomplete. At 1,408 minuette wave (v) would reach 0.618 the length of minuette wave (i).

Within minute wave i there is no Fibonacci ratio between minuette waves (iii) and (i). This makes it more likely we shall see a Fiboancci ratio between minuette wave (v) and either of (i) or (iii).

Within minuette wave (v) subminuette wave ii may not move beyond the start of subminuette wave i. This main wave count is invalidated with movement below 1,359.20.

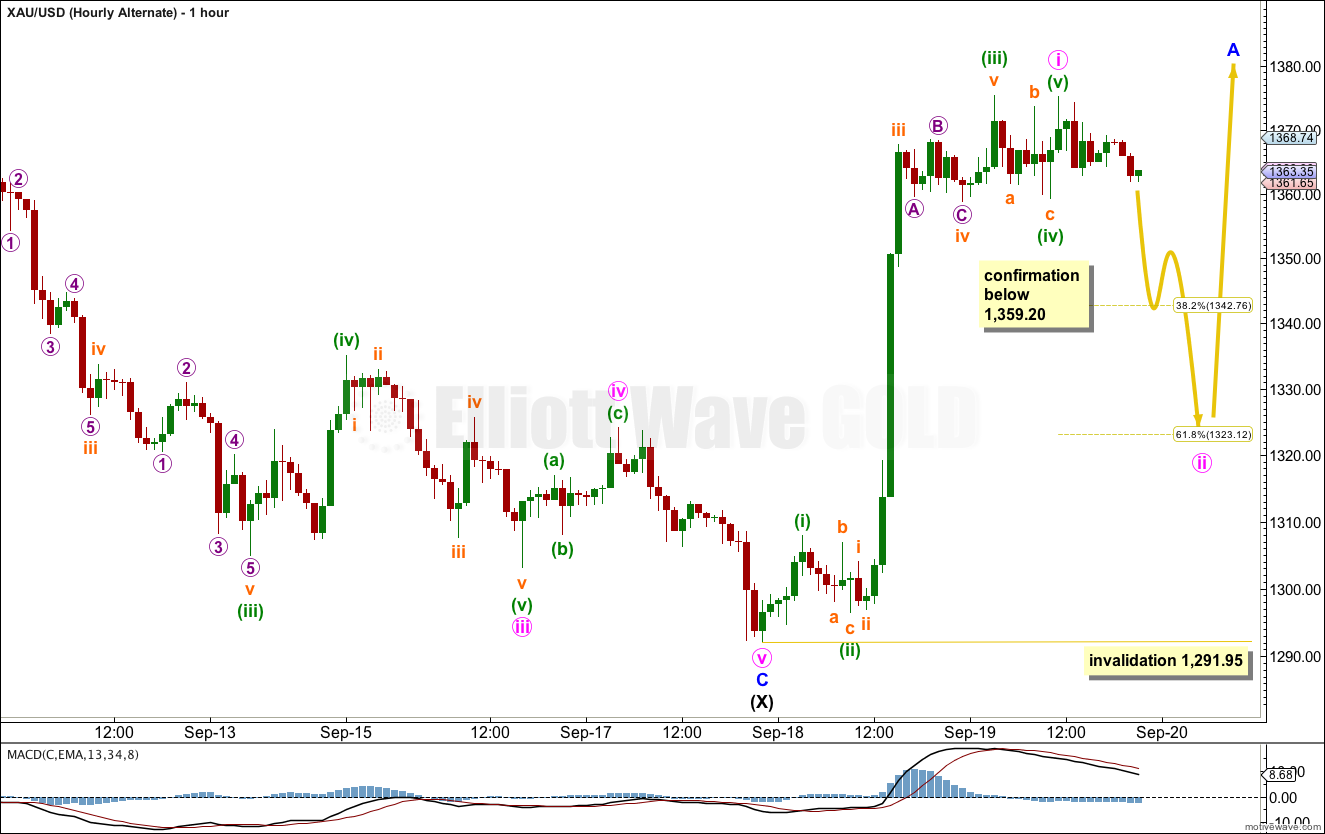

Alternate Hourly Wave Count.

It is possible that minute wave i is over and a second wave has just begun.

Within minute wave i there is no Fibonacci ratio between minuette waves (i) and (iii), but minuette wave (v) is just 0.03 longer than equality with minuette wave (i).

The only reason why this is an alternate is because there is a very slight truncation at the end of minute wave i. Otherwise this wave count would have a better fit. It has a very good probability despite the truncation.

Movement below 1,359.20 would invalidate the main wave count and confirm this alternate. At that stage I would have confidence gold is in a second wave correction which could last one to a few days. The most likely structure for minute wave ii is a zigzag, and the most likely price point for it to end is at the 0.618 Fibonacci ratio of minute wave i at 1,323.12.

Minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement below 1,291.95.

Historic Alternate Wave Count.

This wave count was my prior main historic wave count. It is now an alternate.

This wave count sees the correction for cycle wave IV as a completed zigzag and recent upwards movement the start of a new cycle degree wave to last one to several years. At 1,961 cycle wave V would reach equality in length with cycle wave I.

Cycle wave IV may not move into cycle wave I price territory. Movement below 1,032.70 would invalidate this alternate providing further confirmation for the main historic wave count.

Assuming it reverses back up from here ( low at $1324.8), that ‘Alternate Hourly Wave Count’ after breaking$1359.20, was a great prediction.

yes, hopefully….

so far it all looks good…. we shall see next week!

Unless you are looking at past price/time action all future probabilities must be constantly adapted with the price/time structures at hand. That is the factor that is separating the EW analysis we see right here from most of what is available elsewhere. Great analytical thinking going on right here.

Thanks!

Yes. It all has to fit into the bigger picture.