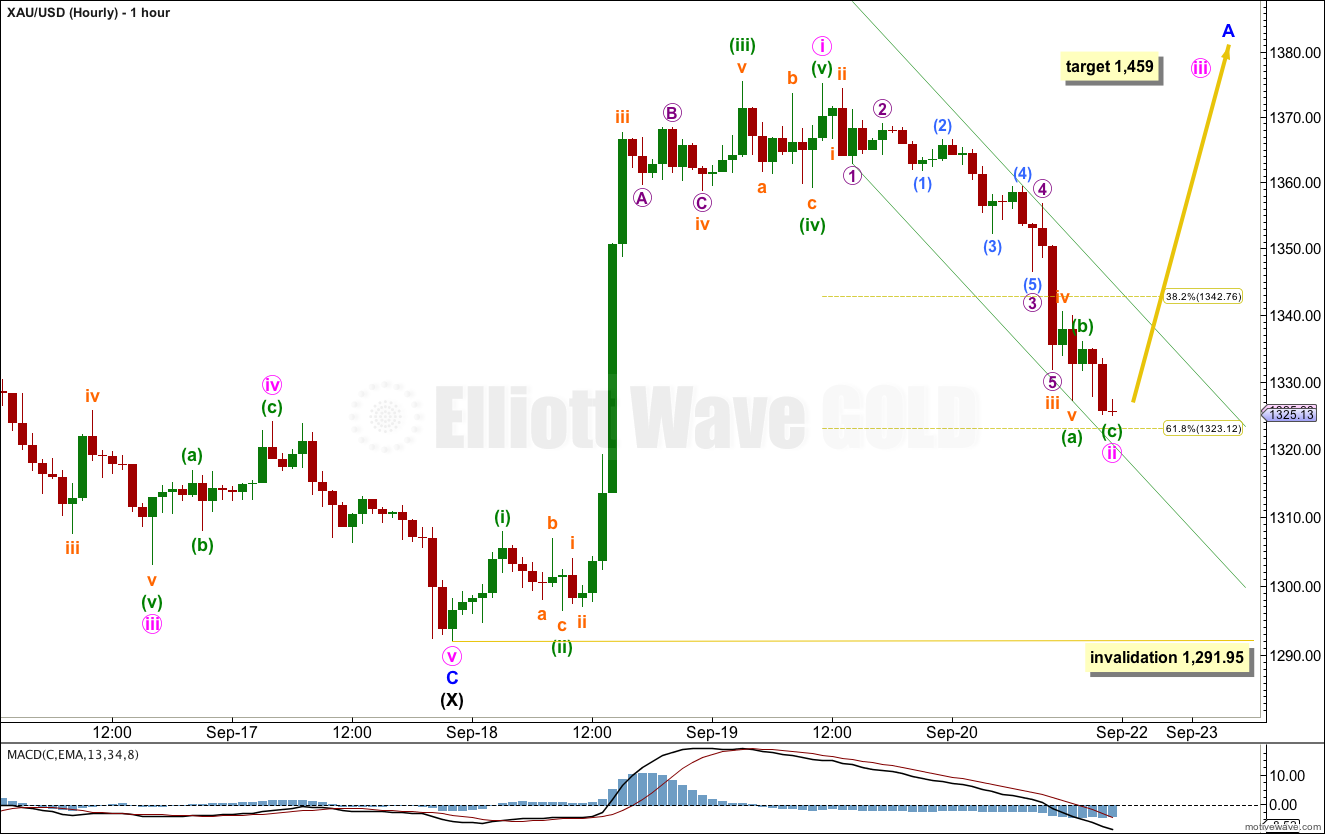

Last analysis had two hourly wave counts. The alternate was confirmed quickly with movement below 1,359.20. The alternate hourly wave count expected more downwards movement to the most likely target at 1,323.12. Friday’s session reached down to 1,324.94. A breach of the small channel on the hourly chart would indicate downwards movement is over. The next wave up should see an increase in momentum.

Click on the charts below to enlarge.

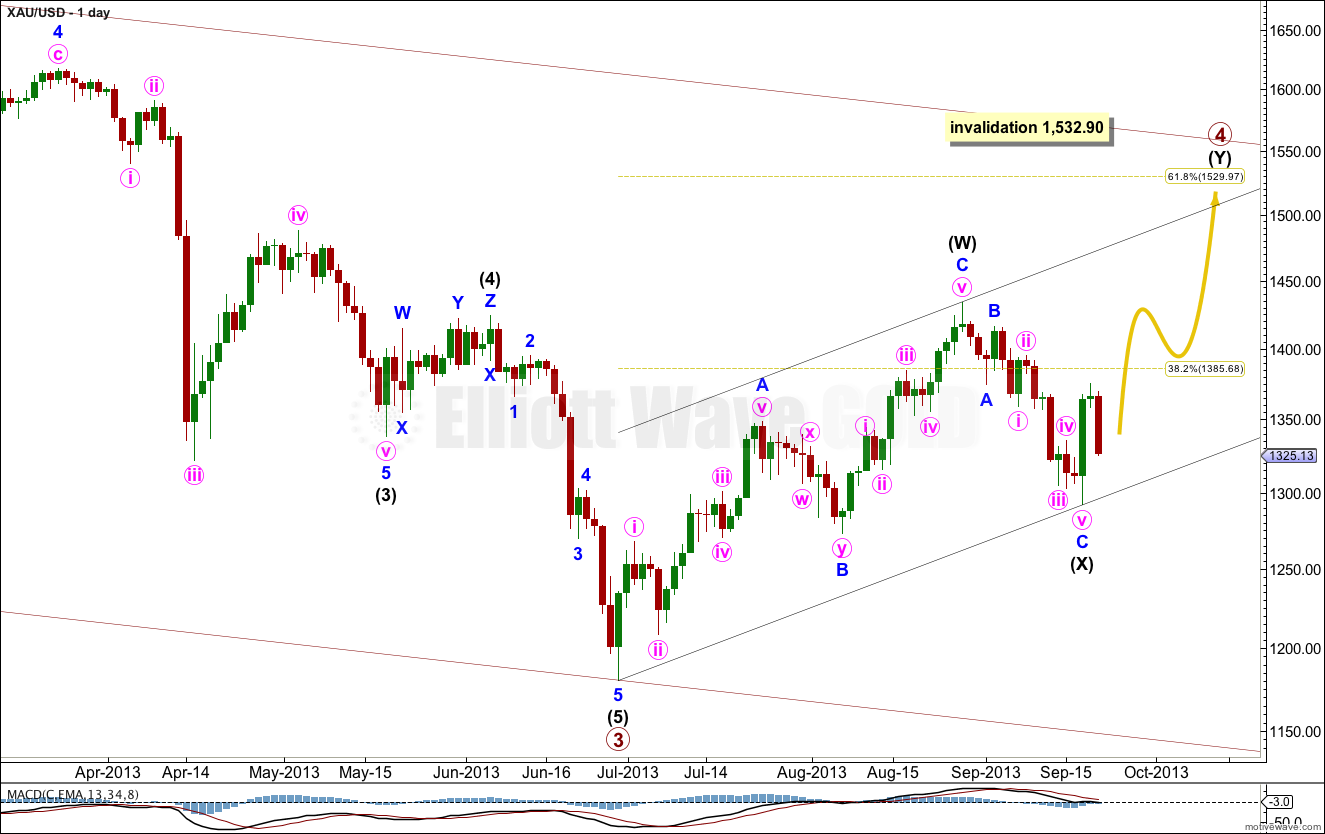

There are still several possible structures for primary wave 4. So far we have a three down from the high at 1,433.83. This three down is less than 90% the length of intermediate wave (W) so it cannot be a B wave within a flat over there. This structure may be a double zigzag or double combination. In a double combination the second structure labeled intermediate wave (Y) may be either a flat or triangle.

It is most likely at this stage that primary wave 4 is continuing as a double zigzag. Intermediate wave (Y) is most likely to be a zigzag.

Primary wave 2 was a deep 68% regular flat correction lasting 54 weeks. Given the guideline of alternation we may expect primary wave 4 to continue for longer than it has so far, possibly for another 10 weeks to last a Fibonacci 21 (give or take one week either side of this). If it completed as a double zigzag there would be nice alternation in structure with primary wave 2.

Primary wave 4 has already passed the 0.382 Fibonacci ratio, so it may end about the 0.618 Fibonacci ratio of primary wave 3 at 1,529.97. It should find resistance at the upper edge of the parallel channel drawn here using Elliott’s first technique.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

So far there may be a five wave impulse upwards for a first wave, followed by a typically deep second wave.

Ratios within minute wave i are: minuette waves (iii) and (i) have no Fibonacci ratio to each other, and minuette wave (v) is just 0.03 longer than equality with minuette wave (i).

So far within minute wave ii the structure has a corrective wave count and subdivides into a three wave zigzag. Minuette wave (c) so far is 0.21 short of 0.236 the length of minuette wave i. However, there is not enough movement up at the end of Friday’s session to confirm that minute wave ii is over.

The parallel channel drawn about minute wave ii is a best fit. When this channel is clearly breached by upwards movement then I will have some confidence that minute wave ii is most likely over and minute wave iii is underway.

At 1,459 minute wave iii would reach 1.618 the length of minute wave i. If minute wave ii moves lower this target must move correspondingly lower also.

It is very likely minute wave ii is over here because minute wave ii may be a completed corrective structure, is in proportion to minute wave i, and has ended at the 0.618 Fibonacci ratio of minute wave i.

The next upwards movement should see some increase in momentum.

Minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement below 1,291.95.

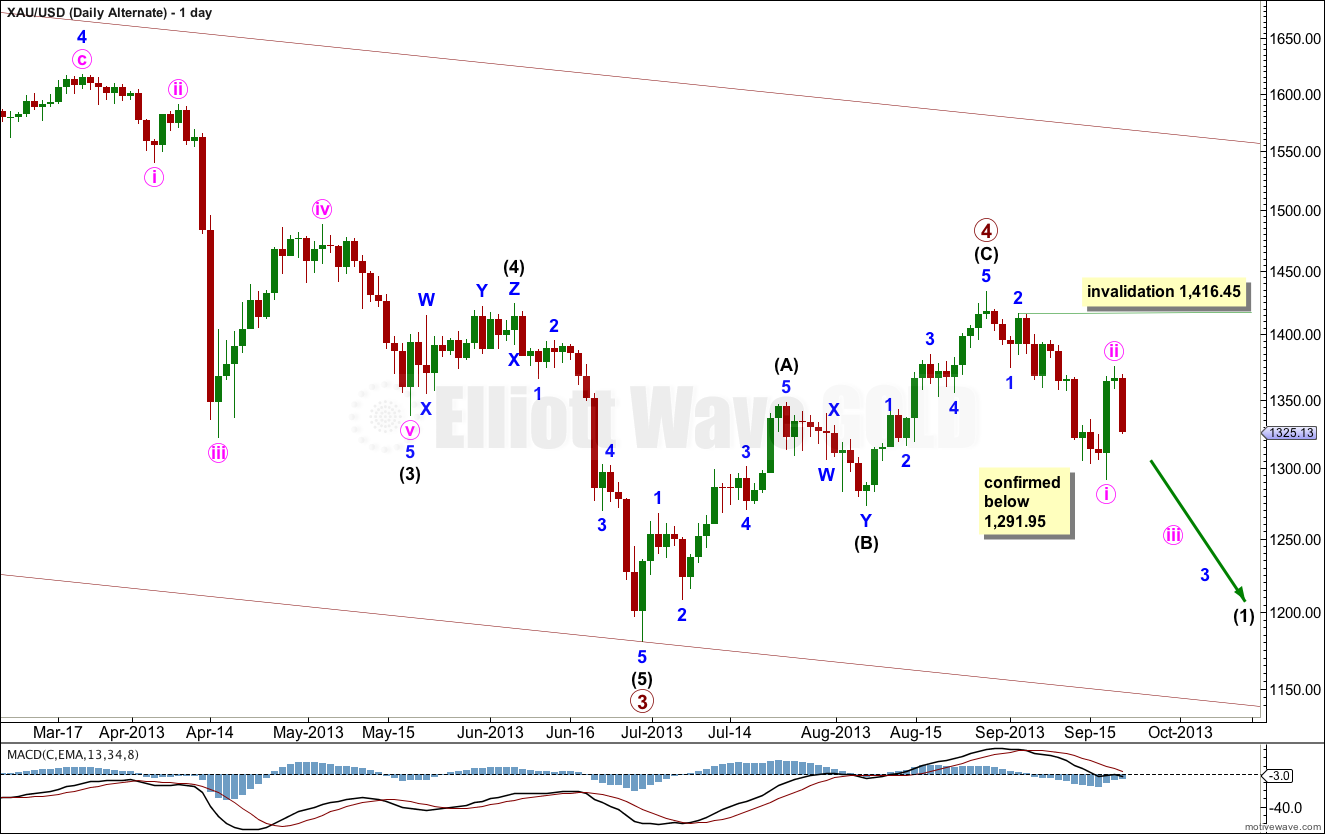

Daily Alternate Wave Count.

I have tried to see as many alternates as I can. This wave count is possible but it has problems of proportion which make it look odd. I will publish it as a slim outlying possibility. I would only use it if it is confirmed with movement below 1,291.95.

If primary wave 4 is over then it lasted only 9 weeks, compared to primary wave 2 which lasted 53 weeks. This gives the monthly chart the wrong look.

Within recent downwards movement minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement above 1,416.45. If price moves above this point next week I would have more confidence in the main wave count.

Hi Lara, thanks for your insight and knowledge to help others. Im trying to come to terms with this type of analysis and so far it seems to be quite accurate. I have pretty much all I have tied up in the GOLD and Silver bullion and am quite concerned about whether to hold this stuff anymore as there seems to be much better alternatives right now. Can you see a major crash coming for the metals or do you think a bottom is more on the cards? Very frustration when monetary policies are determining the outcome instead of ree market price discovery.

Thanks

Ant

Hello Lara.

I ‘ve just found out yout website about elliott analysis about Gold.

Someone spoke me about Elliott method some years ago in Paris (I live in France), but quite difficult for trading.

But I am very happy to read your elliot analysis et may be ask some questions…

For instance, I am going to “add me” to your mailing list.

Regards

Antoine