Last analysis expected a little downwards movement to a short term target at 1,357 before a trend change and upwards movement. Price moved lower to 1,359.25, just 2.25 short of the target, before turning around and moving strongly upwards.

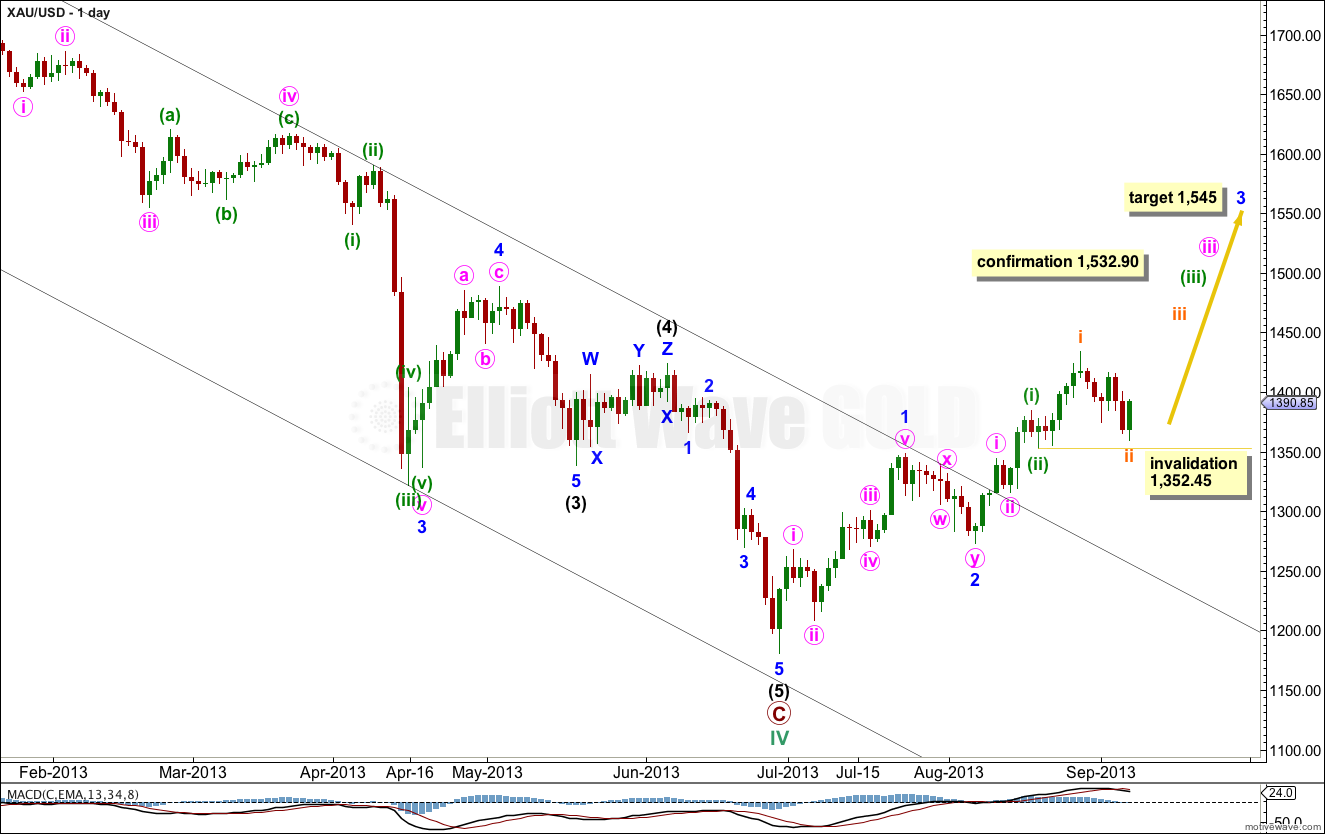

The main wave count remains the same.

Click on the charts below to enlarge.

This wave count agrees with MACD. If upwards movement is within a third wave, then it should show an increase in upwards momentum beyond the end of minor wave 1. Because we have not seen that increase in upwards momentum yet we probably have not seen the middle of the third wave.

At 1,545 minor wave 3 would reach 1.618 the length of minor wave 1.

Within minor wave 3 subminuette wave ii may not move beyond the start of subminuette wave i. This wave count is invalidated at minute wave degree with movement below 1,352.45.

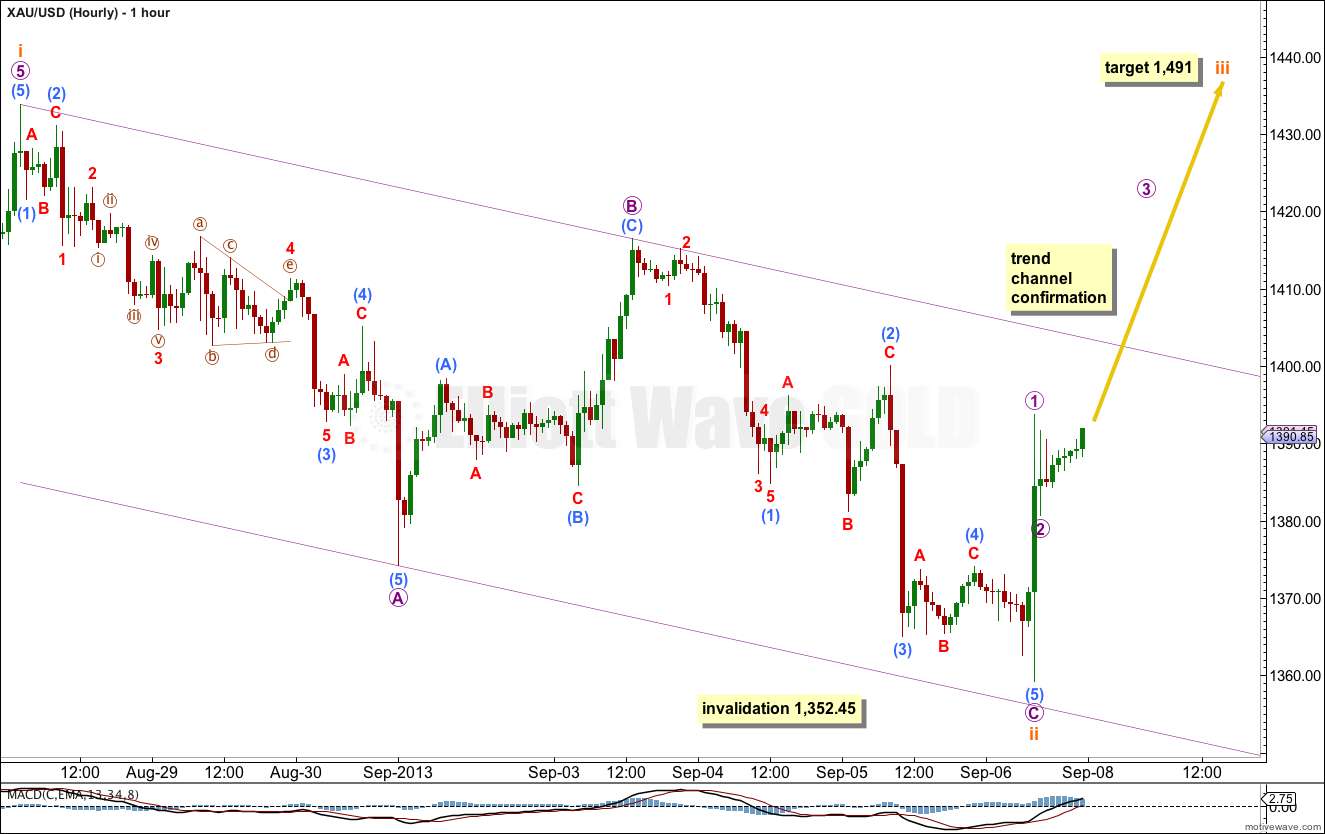

Subminuette wave ii is now a completed zigzag. Micro wave C is 2.49 short of equality with micro wave A.

Ratios within micro wave C are: submicro wave (3) is 3.32 longer than equality with submicro wave (1), and submicro wave (5) is 1.43 longer than 0.382 the length of submicro wave (3).

Draw a parallel channel about subminuette wave ii using Elliott’s technique for a correction. Draw the first trend line from the start of micro wave A, to the end of micro wave B. Place a parallel copy upon the end of micro wave A. When this channel is clearly breached by upwards movement then I will have confidence that subminuette wave ii is over and subminuette wave iii is underway.

It would be extremely unlikely at this stage that subminuette wave ii would extend further, as it has very little room left to move down into and it is already longer in duration than two corrections two degrees higher.

It is more likely that subminuette wave iii has just begun. If this wave count is correct we should see a strong increase in upwards momentum next week as the middle of a third wave unfolds upwards.

At 1,491 suminuette wave iii would reach 1.618 the length of subminutte wave i.

While price remains within the channel for subminuette wave ii we must accept the possibility of further downwards movement. Subminuette wave ii may not move beyond the start of subminuette wave i. This wave count is invalidated with movement below 1,352.45.

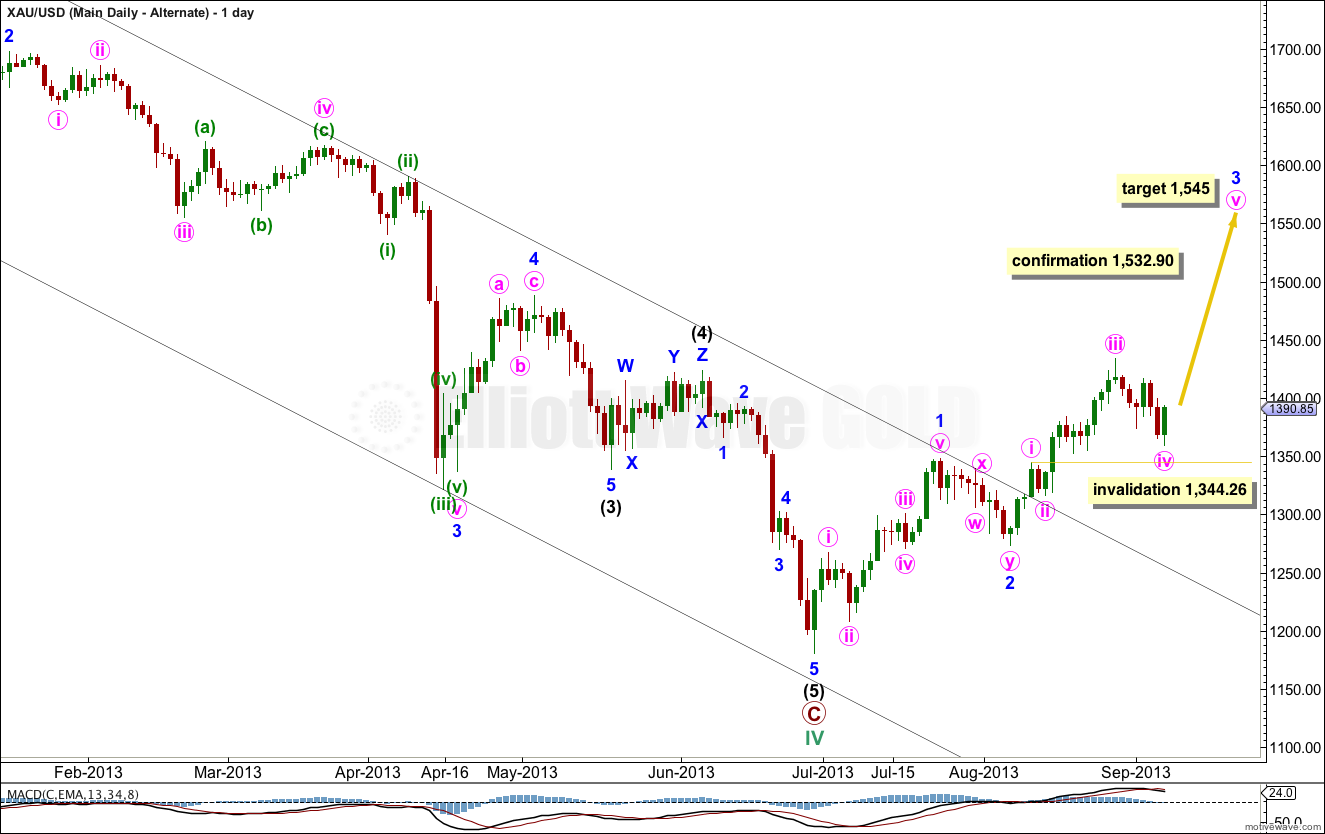

Alternate Daily.

It remains possible that this downwards movement is minute wave iv. If price moves below 1,352.45 this wave count would be confirmed. At that stage the invalidation point would move down to 1,344.26. Minute wave iv may not move into minute wave i price territory.

This wave count does not agree with MACD. The middle of the third wave has not shown an increase in momentum beyond that seen for minor wave 1. For this reason it should be an alternate.