Analysis for Thursday had three alternate hourly wave counts, and one was invalidated on Friday. Two wave counts remain, and I must favour the main wave count. I will use the invalidation / confirmation price point to differentiate the two wave counts next week.

Click on the charts below to enlarge.

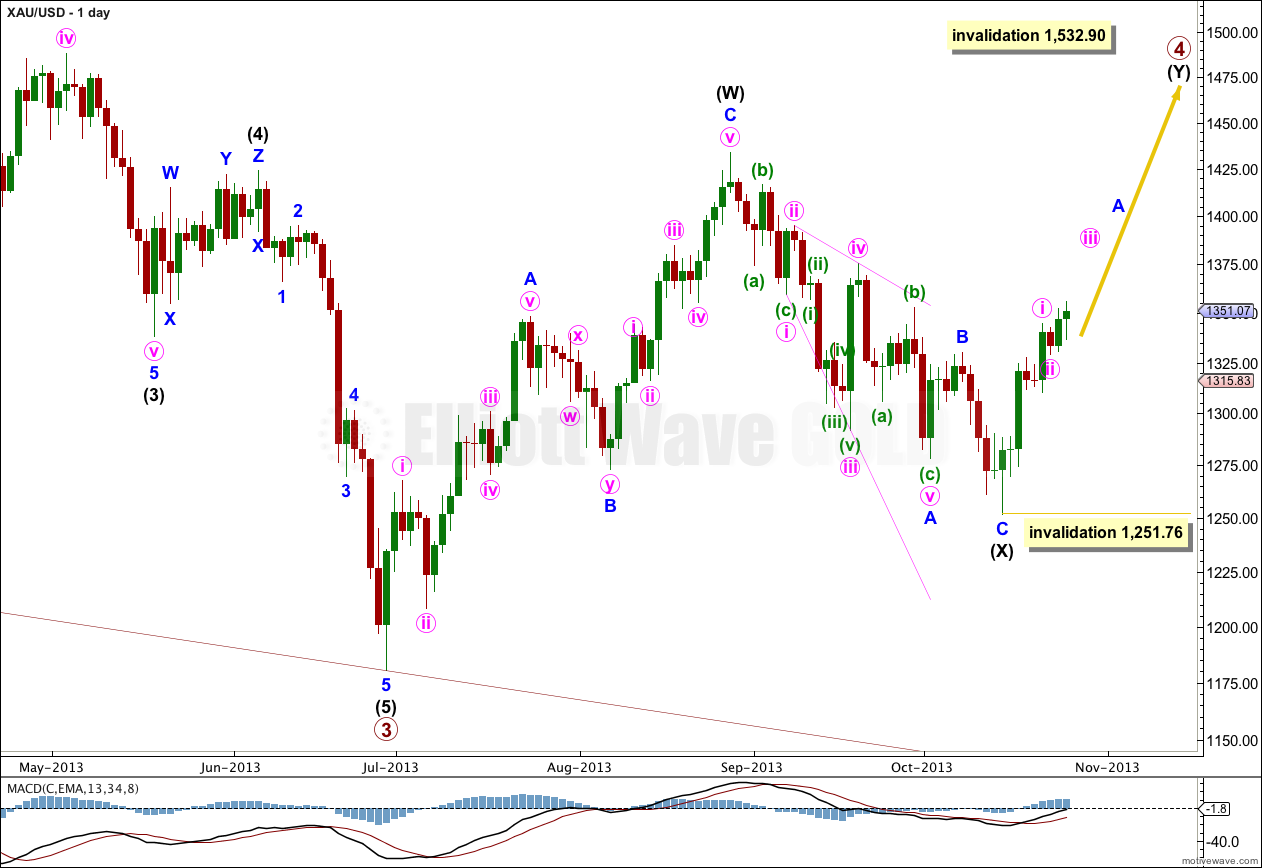

Gold has completed its downwards wave and is in the early stages of the next wave up which should last at least a month.

The structure for primary wave 4 cannot be a flat correction, because what would be the B wave is well less than 90% of what would be the A wave. That is why I have labeled it as a double.

Because intermediate wave (X) is quite shallow I would expect primary wave 4 is most likely a double zigzag rather than a double combination. Double combinations move price sideways and their X waves are usually deeper than this one is. Double zigzags trend against the main direction, and their purpose is to deepen a correction when the first zigzag did not take price deep enough. So I will be expecting intermediate wave (Y) to subdivide as a zigzag and to take price comfortably above 1,433.83. It should last about 35 to 45 days or sessions in total.

Within intermediate wave (Y) no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,251.76.

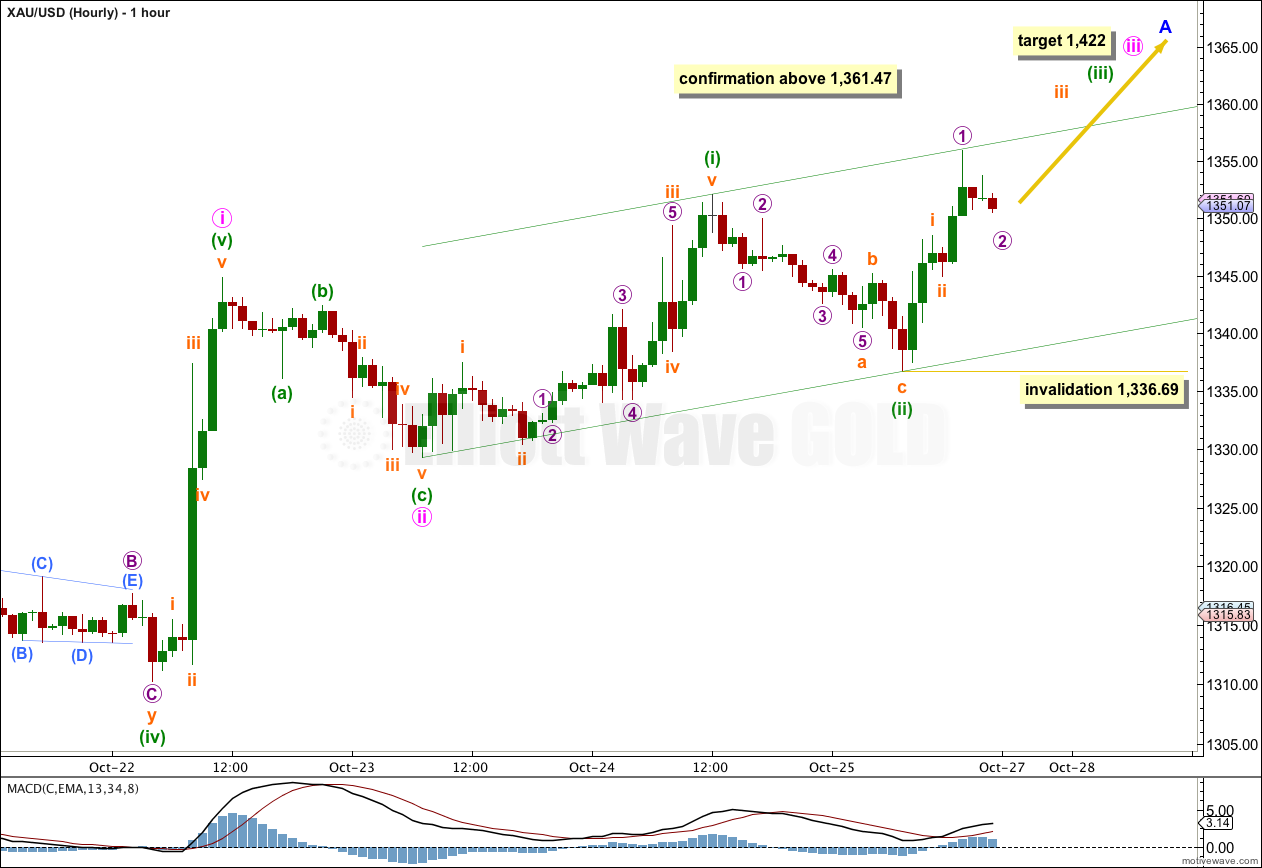

Main Hourly Wave Count.

Despite minute wave ii being very shallow and remarkably brief, this is my main wave count. It has a higher probability than the alternate because the alternate has a now more significant problem.

The problem with low probability outcomes is that they have a low probability. Therefore, one would never expect them to occur as a higher probability outcome would be more likely. Second waves are usually deep. This one was just 17% of minute wave i which is unusual.

If minute wave iii has begun then it has not yet reached the middle. This wave count expects strong upwards momentum on Monday and Tuesday as the middle of a third wave unfolds.

Within minute wave iii, minuette waves (i) and (ii) may be over. The parallel channel drawn about minute wave iii is an acceleration channel. Draw it from the start of minuette wave (i) to the end of minuette wave (ii), then place a parallel copy upon the end of minuette wave (i). If a third wave is underway then it should clearly breach the upper edge of this channel. MACD should show a strong increase in upwards momentum, beyond that seen for minute wave i.

The target at 1,422 is a mid term target which may be reached by the end of next week. At 1,422 minute wave iii would reach equality in length with minute wave (i).

Within minuette wave (iii) no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,336.69.

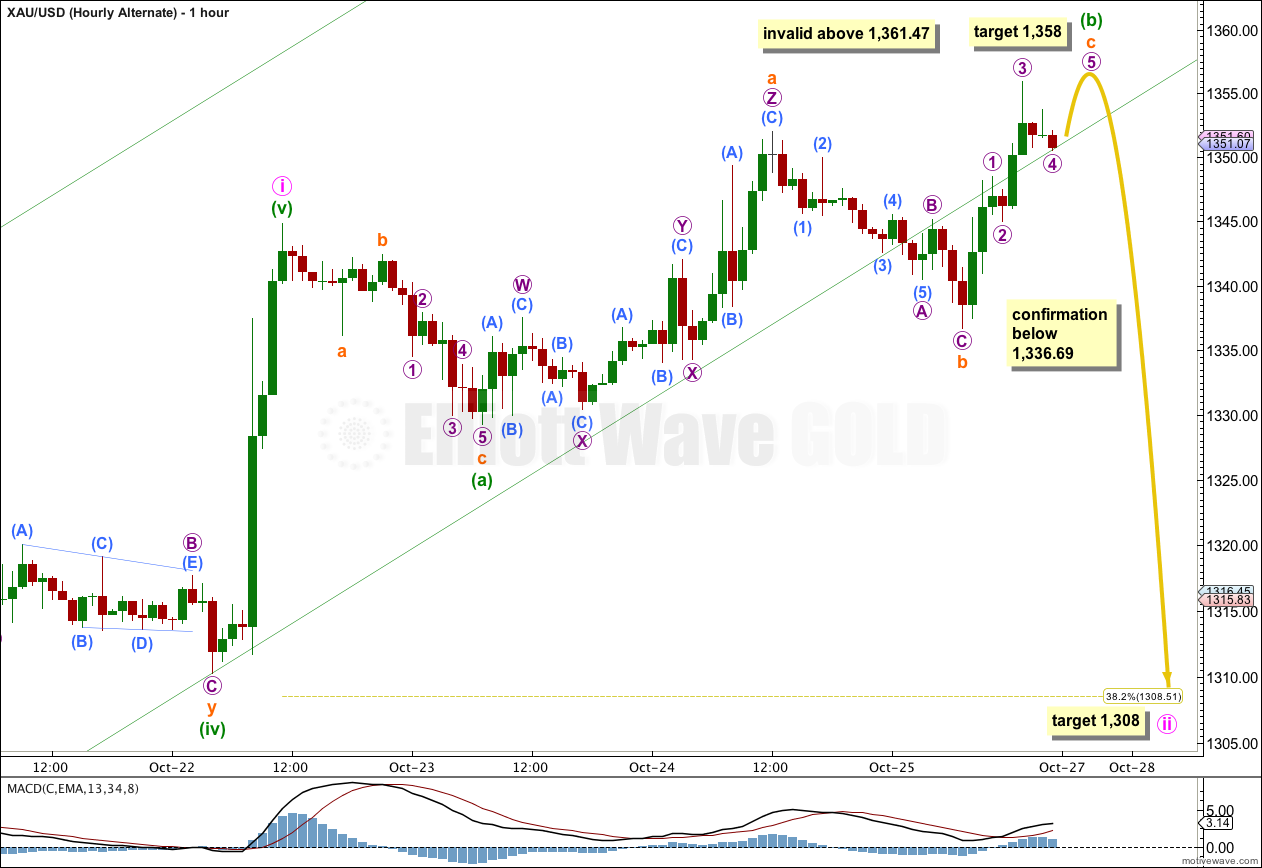

Alternate Hourly Wave Count.

It is still possible that minute wave ii is not over and is continuing as an expanded flat correction.

Unfortunately, there is no maximum limit for a B wave within an expanded flat. There is a guideline that states once the B wave is twice the length of the A wave the probability reduces very significantly, and beyond this point an expanded flat should not be considered. Within expanded flats B waves are most commonly between 100% to 138% of the A wave. In this case minuette wave (b) is now 171% the length of minuette wave (a), so the probability of this wave count has reduced significantly but it still may be considered.

I would only seriously consider this wave count if it proves itself with movement below 1,336.69. At that stage the main wave count would be invalidated.

Within subminuette wave c of minuette wave (b), micro wave 3 is slightly shorter than micro wave 1. This gives a limit to micro wave 5 of no longer than equality with micro wave 3 at 1,361.47. Movement above this point would invalidate the wave count.

Subminuette wave c must subdivide into a five wave structure. If this wave count is correct then subminuette wave c is here subdividing into an impulse which is very close to completion.

If micro wave 4 moves lower to start the new week then the invalidation point at 1,361.47 would have to move correspondingly lower. Micro wave 4 may not move into micro wave 1 price territory below 1,348.53.

At this stage the target for minute wave ii is at the 0.382 Fibonacci ratio of minute wave i at 1,308. When I know where minuette wave (b) may have ended then I would recalculate this target using the ration between minuette waves (a) and (c).