Gold moved sideways and lower during Friday’s session. I had expected it to move higher.

The main hourly wave count was invalidated with movement below 1,319.22. The alternate hourly wave count remains valid, but it no longer has the right look.

We now have a clear five down on the hourly chart. This cannot be minor wave B completed; it must continue yet further, and will probably continue for another two or three days.

Click on the charts below to enlarge.

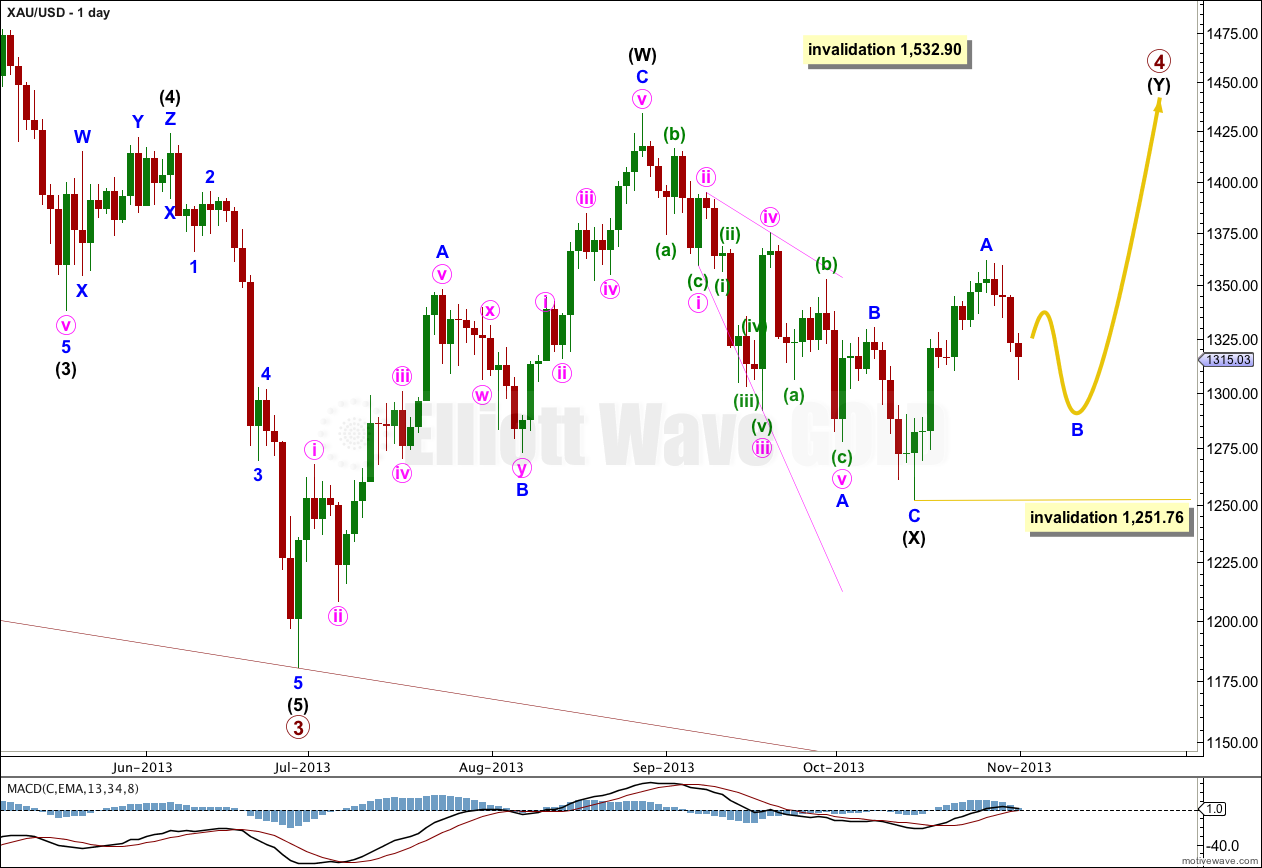

The structure for primary wave 4 cannot be a flat correction, because what would be the B wave is well less than 90% of what would be the A wave. That is why I have labeled it as a double.

Because intermediate wave (X) is quite shallow I would expect primary wave 4 is most likely a double zigzag rather than a double combination. Double combinations move price sideways and their X waves are usually deeper than this one is. Double zigzags trend against the main direction, and their purpose is to deepen a correction when the first zigzag did not take price deep enough. So I will be expecting intermediate wave (Y) to subdivide as a zigzag and to take price comfortably above 1,433.83. It should last about 35 to 45 days or sessions in total.

Within the zigzag of intermediate wave (Y) minor wave B may not move beyond the start of minor wave A. This wave count is invalidated with movement below 1,251.76.

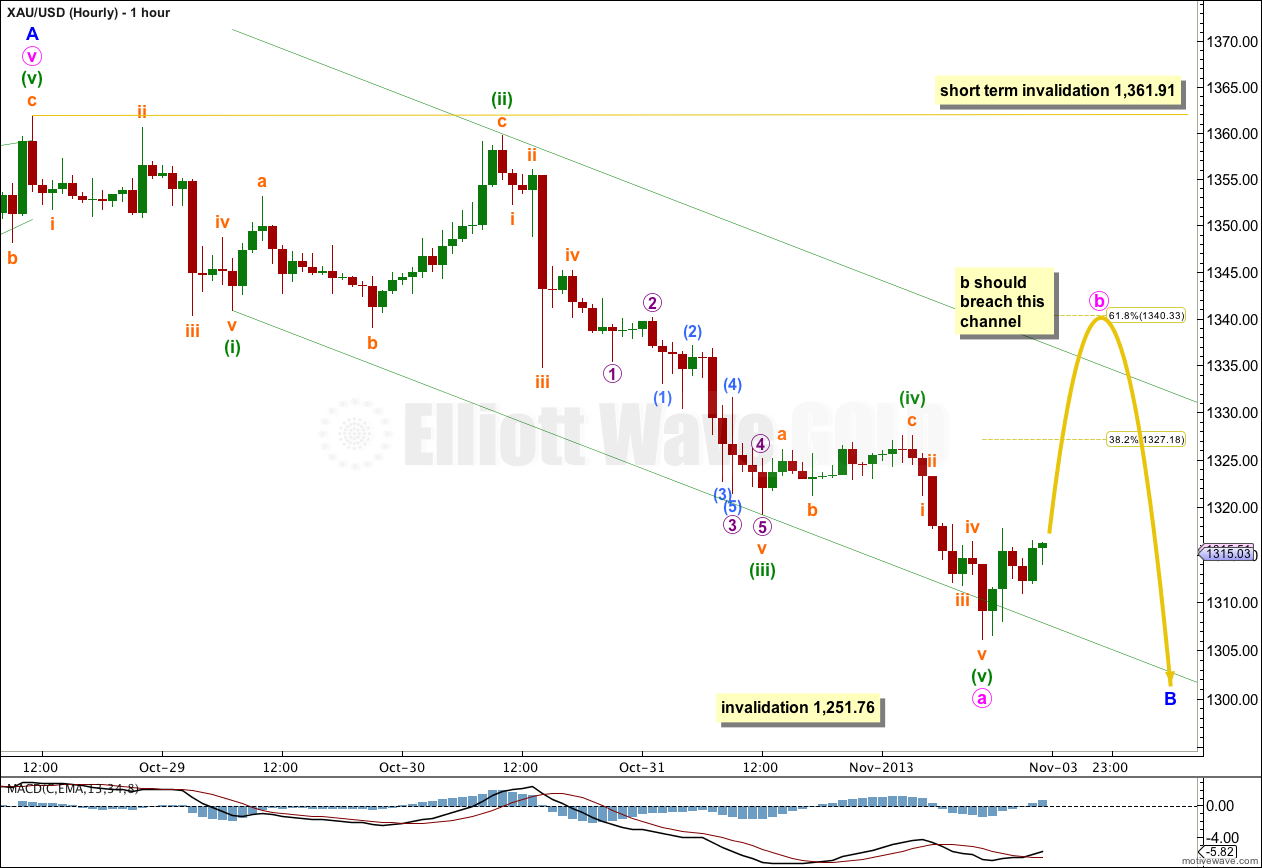

With Friday’s sideways and lower movement there is now a clear five down on the hourly chart. This is likely to be minute wave a within minor wave B, and minor wave B must be incomplete.

Ratios within minute wave a are: there is no Fibonacci ratio between minuette waves (i) and (iii), and minuette wave (v) is just 0.41 longer than equality with minuette wave (i).

I would expect minute wave b to breach the parallel channel containing minute wave a. Thereafter, I would expect another five down for minute wave c to complete minor wave B zigzag.

Minute wave b may end about either the 0.382 or 0.618 Fibonacci ratios of minute wave a. If it is a sideways moving combination or triangle it may only reach the 0.382 Fibonacci ratio. If it is a sharper zigzag then it may reach the 0.618 Fibonacci ratio.

Within the zigzag of minor wave B minute wave b may not move beyond the start of minute wave a. This wave count is invalidated with movement above 1,361.91 prior to minute wave c downward being complete.

When minute wave b is completed then I can calculate a target downwards for minute wave c for you. I cannot do that yet.

Minor wave B may not move beyond the start of minor wave A. This wave count is invalidated with movement below 1,251.76.

Lots of other views out there.

Lara, your counts are so detailed. What are your comments opinion/explanation on Gary Wagner’s larger view on Gold being currently in a 5th wave down (not 4th wave correction). Could you provide some counter arguments against his counting showing the high of Feb 2012 being the closure of the 1st impulse wave in a “Bear” Market? And that we are currently in a 3rd wave of a 5th wave down?

video marker around 9:00 – 11:34

http://www.kitco.com/news/video/show/Chart-This

I appreciate your comments and perspective very much. Thank you.

The video is blurry, I am having difficulty seeing the labels on that count.

He has A-B-C down, followed by something I cannot make out (is it an X?), followed by a five down.

He has not explained how this structure fits together, he does not name what structure he sees unfolding there except to call it a “bear market”.

He also seems to be saying a fifth wave can be a flat or zigzag? I’m not sure. The commentary is not clear either.

I do not think that is a valid wave count.

I believe we will shortly be in a period of Stag-Flation . This should see gold up to $1650 by March imho. I dont know the possible wave count for this.

Hi Lara….!

Is there any chance for a Triangle 4th wave correction? Like this

https://www.tradingview.com/x/lzkCV8Cs/

Most definitely. That is a valid wave count.

My reason for going with a double zigzag (at this stage) is because they are actually more common structures than triangles.

When minor wave B is complete then I will consider the triangle scenario and it may be an alternate wave count, but it would not be my main wave count.