Yesterday’s analysis expected downwards movement with an increase in momentum towards a short term target at 1,251.

So far downwards movement has reached $3.34 below the target and momentum has increased.

Click on the charts below to enlarge.

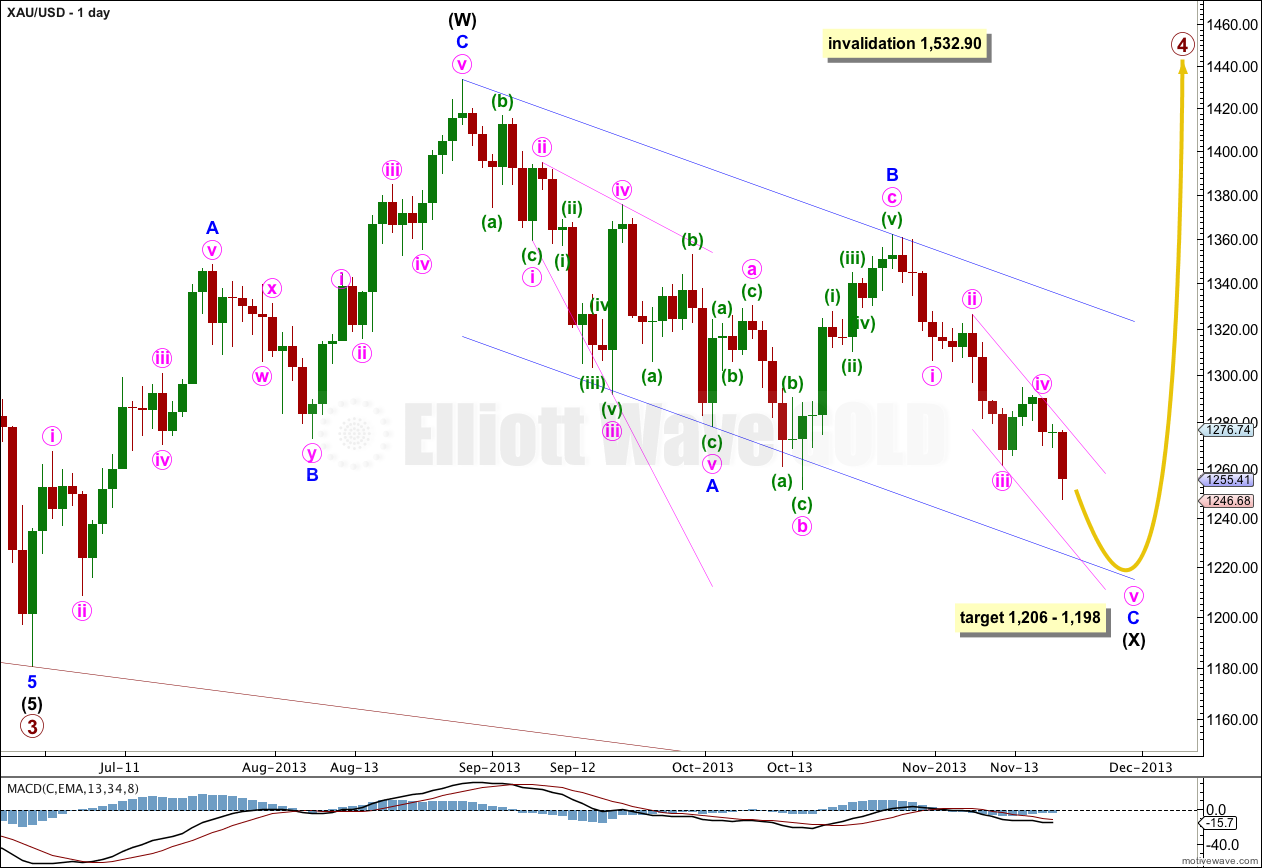

Gold is still within a large fourth wave correction at primary wave degree which is incomplete. It is now more likely to continue as a double combination because within it intermediate wave (X) should be deep.

The purpose of double combinations is to take up time and move price sideways, so I would now expect intermediate wave (Y) to end about the same level as intermediate wave (W) at 1,433.83. Double combinations in fourth wave positions are quite common.

If downwards movement reaches 1,205.74 or below then it would be 90% of the prior upwards movement labeled intermediate wave (W). At that stage I would relabel primary wave 4 as a flat correction, A-B-C rather than a combination W-X-Y.

Within the combination intermediate wave (X) is unfolding as a zigzag. Minor wave C downwards must complete as a five wave structure. At 1,206 minor wave C would reach equality in length with minor wave A. Within minor wave C at 1,198 minute wave v would reach 1.618 the length of minute wave i. This gives an $8 target zone for downwards movement to end. I will try to narrow this zone as the structure gets closer to the end.

There is no lower invalidation point for intermediate wave (X); X waves may make new price extremes beyond the start of W waves, and they may behave like B waves within flat corrections. For combinations X waves often end close to the start of W waves.

I have drawn a parallel channel about the zigzag of intermediate wave (X) using Elliott’s technique for a correction. Draw the first trend line from the start of minor wave A to the end of minor wave B. Place a parallel copy upon the end of minor wave A. I will expect minor wave C to find support at the lower end of this channel, and it may end there.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Although price is now below the previously calculated target for minuette wave (iii) to end, the structure on the five minute chart indicates that this third wave is not yet over. The target has been recalculated.

At 1,234 minuette wave (iii) would reach 2.618 the length of minuette wave (i).

Within minuette wave (iii) there is no Fibonacci ratio between subminuette waves i and iii. This makes it more likely we shall see a Fibonacci ratio exhibited between subminuette wave v and either of i or iii. At 1,236 subminuette wave v would reach 1.618 the length of subminuette wave iii.

The green channel about minute wave v is drawn prematurely. When minuette wave (iii) is completed I will redraw the channel. Draw the first trend line from the lows of minuette waves (i) to (iii), then place a parallel copy upon the high of minuette wave (ii). I would expect minuette wave (iv) to most likely find resistance at the upper edge of the channel, and minuette wave (v) downwards may find support at the lower edge.

Minuette wave (iv) may not move into minuette wave (i) price territory. This wave count is invalidated with movement above 1,270.14.

Lara,

So far GCZ low @$1235.80 right on target of 1234-1236. Lernardi Fibonacci must be smiling…lol

Lara,

Nice work, that was right on….

La méthode Elliott est complexe, déroutante.Elle demande du temps, de l’humilité, de la précision, de la souplesse d’esprit…

Mais elle est fascinante pour ceux qui savent la maitriser. LARA, nous a montré sur ce coup là, toute sa maitrise…!

Good tracking, Lara…!

Thank you Antoine! (and thanks Google translate)

Another third wave picked. Third waves are the “holy grail” for traders using Elliott wave.

Fascinating methodology and always explained clearly. Very well done. You are in the zone! AAA+