Last analysis expected more downwards movement towards a target at 1,207 to 1,198. Price has moved lower, but so far is well short of the target.

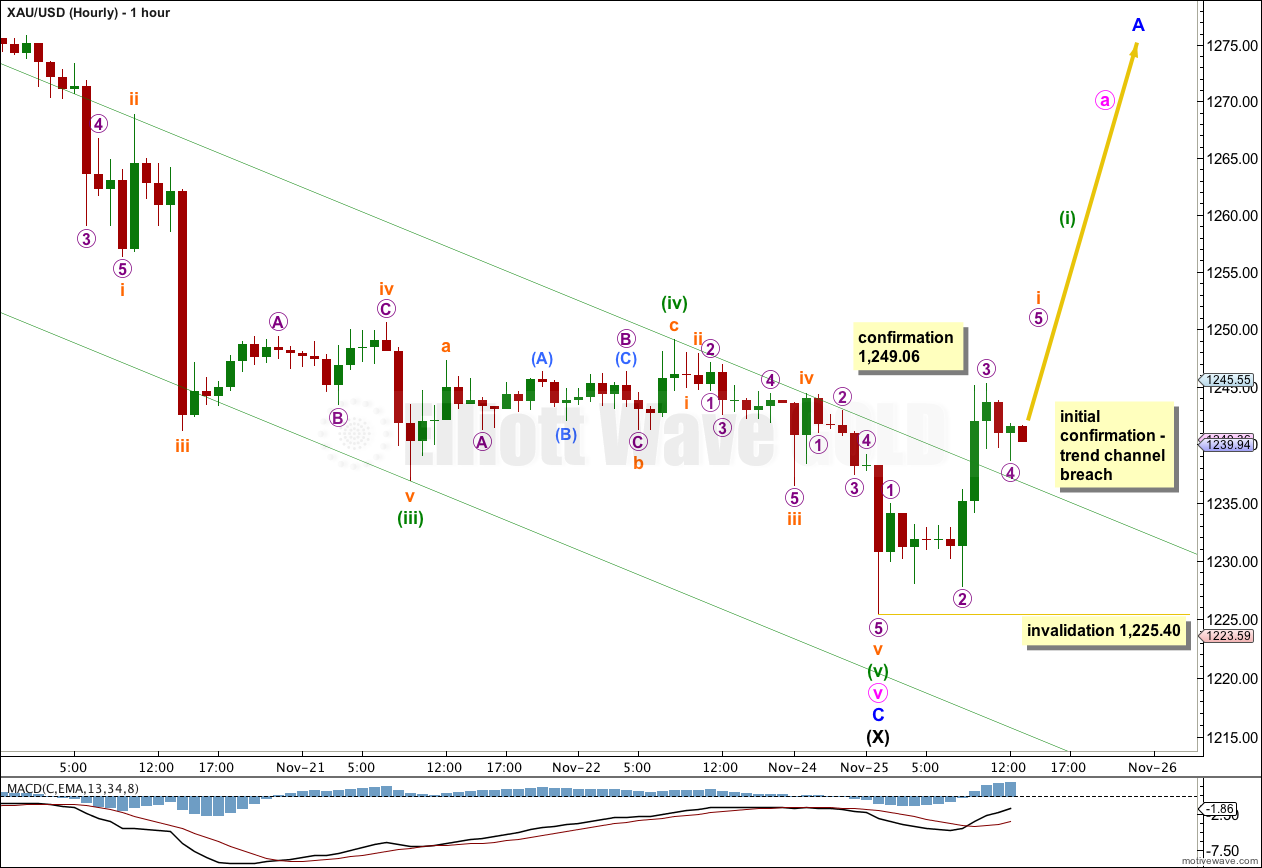

I have two hourly wave counts for you today. I will use confirmation / invalidation points to work with these two wave counts today.

Click on the charts below to enlarge.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete. It is likely to continue as a double combination because within it intermediate wave (X) should be deep.

The purpose of double combinations is to take up time and move price sideways, so I would expect intermediate wave (Y) to end about the same level as intermediate wave (W) at 1,433.83. Double combinations in fourth wave positions are quite common.

If downwards movement reaches 1,205.74 or below then it would be 90% of the prior upwards movement labeled intermediate wave (W). At that stage I would relabel primary wave 4 as a flat correction, A-B-C rather than a combination W-X-Y.

Within the combination intermediate wave (X) may now be a complete zigzag. Minor wave C downwards can be seen as a complete five wave structure.

There is no lower invalidation point for intermediate wave (X); X waves may make new price extremes beyond the start of W waves, and they may behave like B waves within flat corrections. For combinations X waves often end close to the start of W waves.

I have drawn a parallel channel about the zigzag of intermediate wave (X) using Elliott’s technique for a correction. Draw the first trend line from the start of minor wave A to the end of minor wave B. Place a parallel copy upon the end of minor wave A. Minor wave C may have ended slightly short of touching the lower edge of the channel.

I have also drawn a parallel channel about minor wave C downwards using Elliott’s second technique. Draw the first trend line from the highs labeled minute waves ii and iv, place a parallel copy upon the low labeled minute wave iii. Downwards movement may find support at the lower end of this channel.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

At this stage it is possible to see a completed structure at all wave degrees for intermediate wave (X).

The channel drawn about minute wave v is clearly breached by upwards movement. This may be an early indication of a possible trend change.

So far to the upside only three waves have unfolded. If micro wave 4 remains out of micro wave 1 price territory, not moving below 1,234.88, and we see a fifth wave upwards then this wave count will be my only wave count. Movement above 1,249.06 would invalidate the alternate below and confirm this main wave count.

There is no Fibonacci ratio between minor waves A and C.

Ratios within minor wave C are: there is no Fibonacci ratio between minute waves i and iii, and minute wave v is just 0.59 short of equality with minute wave iii.

Ratios within minute wave v are: minuette wave (iii) is 2.45 short of 2.618 the length of minuette wave (i), and minuette wave (v) has no Fibonacci ratio to either of minuette waves (i) or (iii).

Ratios within minuette wave (v) are: subminuette wave iii is 0.47 longer than 2.618 the length of subminuette wave i, and subminuette wave v is 0.65 longer than 1.618 the length of subminuette wave iii.

Because intermediate wave (X) is less than 90% the length of intermediate wave (W) on the daily chart I would expect that primary wave 4 is a double combination, double zigzag or contracting triangle (in order of probability). I would expect the next movement for intermediate wave (Y) to be a flat or zigzag. If it is a flat then minor wave A should subdivide as a three, most likely a zigzag.

Within the new upwards movement of minor wave A when the first wave for subminuette wave i is completed then subminuette wave ii downwards should be a deep correction. I would expect it to most likely reach down to about the 0.618 Fibonacci ratio of subminuette wave i. It may find support at the upper edge of the channel drawn here on the hourly chart.

Subminuette wave ii may not move beyond the start of subminuette wave i. This wave count is invalidated with movement below 1,225.40.

If this wave count is invalidated by downwards movement then I would use the alternate wave count below.

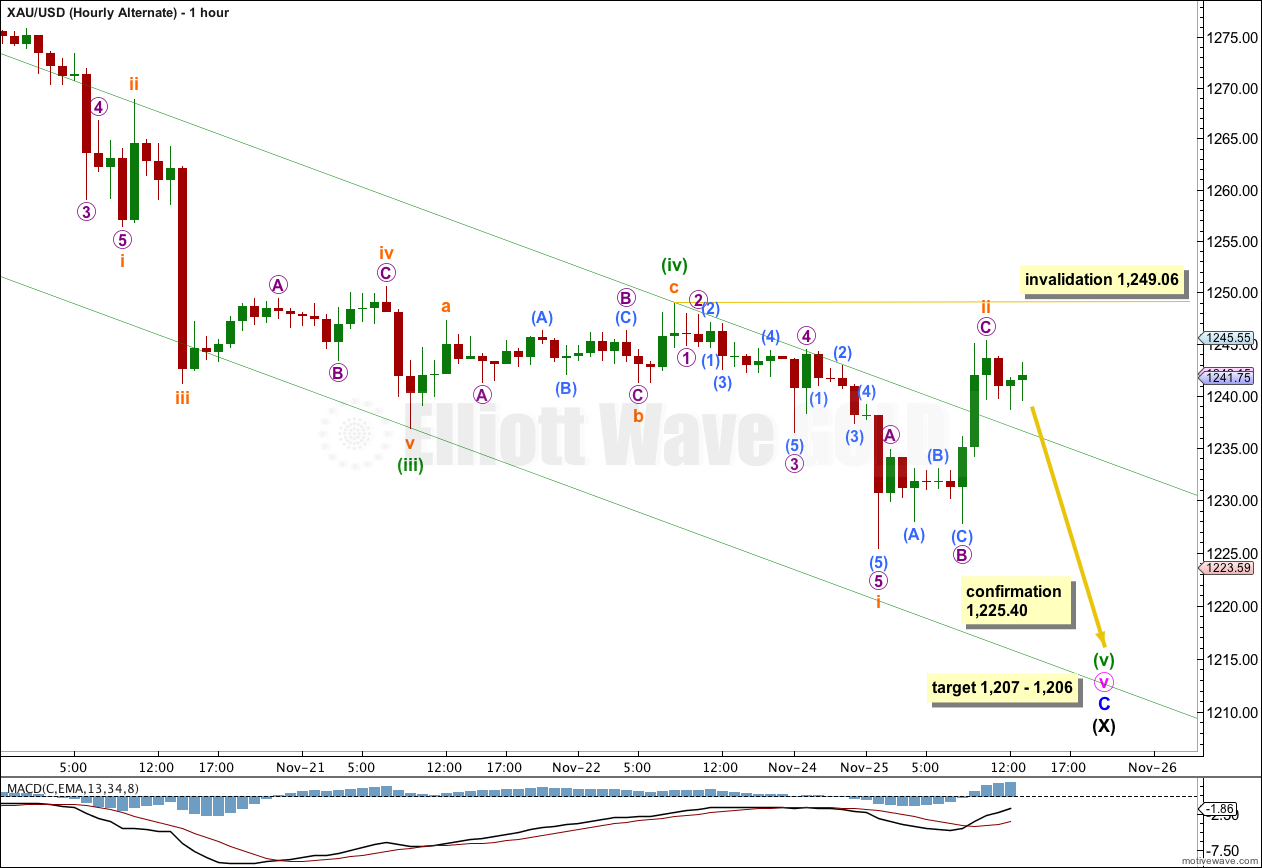

Alternate Hourly Wave Count.

By simply moving the labeling within the last fifth wave of minuette wave (v) down one degree it is possible that this structure is incomplete.

If minuette wave (v) is extending then only subminuette wave i within it may be complete.

So far upwards movement for subminuette wave ii subdivides into a deep three wave structure. This may be a typically deep second wave correction. Movement below 1,234.88 would be the first indication that this alternate may be correct. Movement below 1,225.40 would confirm it. At that stage I would have some confidence in the target.

At 1,206 minor wave C would reach equality in length with minor wave A. Within minute wave v minuette wave (v) would be equal in length with minuette wave (iii) at 1,207.

Subminuette wave ii may not move beyond the start of subminuette wave i. This wave count is invalidated with movement above 1,249.06.

hi Lara..

whats the likelihood now, that the downtrend since late august is actually a 5th wave down?

..with yesterdays upspurt being the start of a wave2 correction of the 5th’s wave3 down.

(ie. this wave2 to backtest the bottom rail of the broken uptrend.)

not very likely.

if this is a fifth wave then primary wave 4 ended in only 9 weeks. it’s counterpart primary wave 2 lasted 53 weeks. they don’t have to be of the same duration, but they should be somewhat in proportion for the wave count to have the “right look”.

that would have all the wrong look.