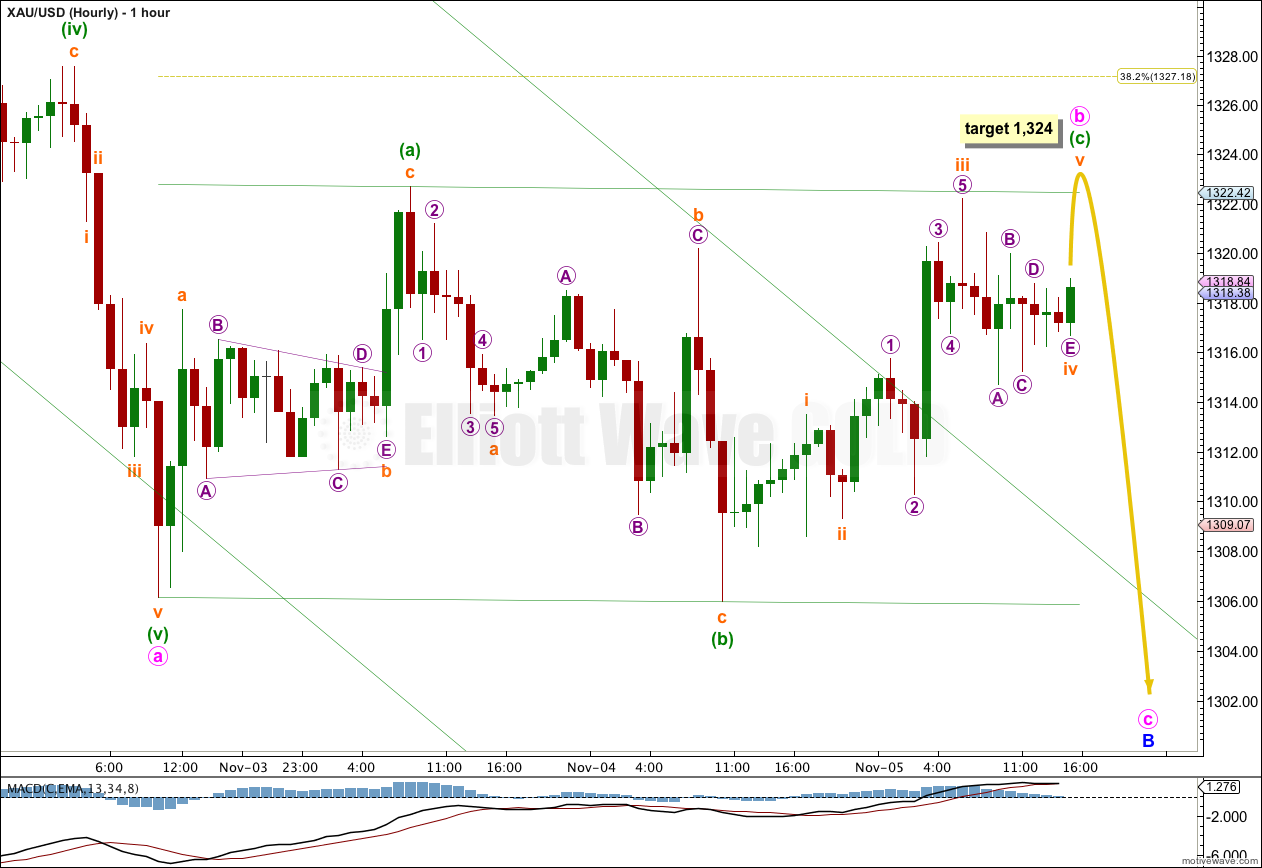

Yesterday’s analysis expected gold to move higher to reach just above 1,323. Price has moved higher exactly as expected, reaching up to 1,322.20. The structure is incomplete and the final fifth wave is now unfolding following a very clear fourth wave triangle.

Click on the charts below to enlarge.

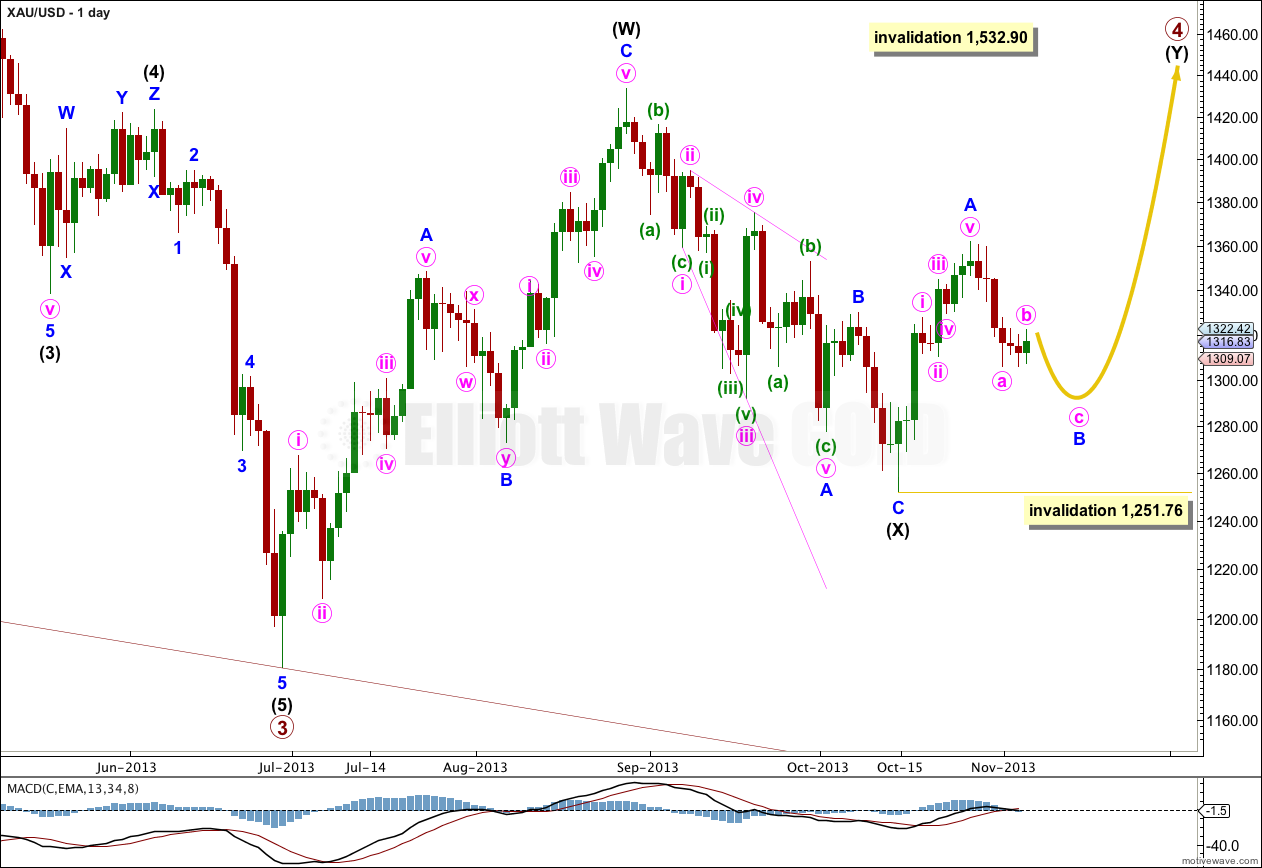

The structure for primary wave 4 cannot be a flat correction, because what would be the B wave is well less than 90% of what would be the A wave. That is why I have labeled it as a double.

Because intermediate wave (X) is quite shallow I would expect primary wave 4 is most likely a double zigzag rather than a double combination. Double combinations move price sideways and their X waves are usually deeper than this one is. Double zigzags trend against the main direction, and their purpose is to deepen a correction when the first zigzag did not take price deep enough. So I will be expecting intermediate wave (Y) to subdivide as a zigzag and to take price comfortably above 1,433.83. It should last about 35 to 45 days or sessions in total.

Within the zigzag of intermediate wave (Y) minor wave B may not move beyond the start of minor wave A. This wave count is invalidated with movement below 1,251.76.

Minuette wave (c) is unfolding as a five wave structure, as expected. Within it subminuette wave iii is just 0.74 longer than 1.618 the length of subminuette wave i. At 1,324 subminuette wave v would reach equality in length with subminuette wave i. This would bring minuette wave (c) to just above the end of minuette wave (a) to avoid a truncation.

When this last fifth wave upward is completed for subminuette wave v then I will expect a trend change.

The next downward wave should last about one to three days, and should take price comfortably below 1,306.15.

When I know where minute wave b has ended then I will calculate a target downward for you for minute wave c. I cannot do that yet; I should be able to do that tomorrow.

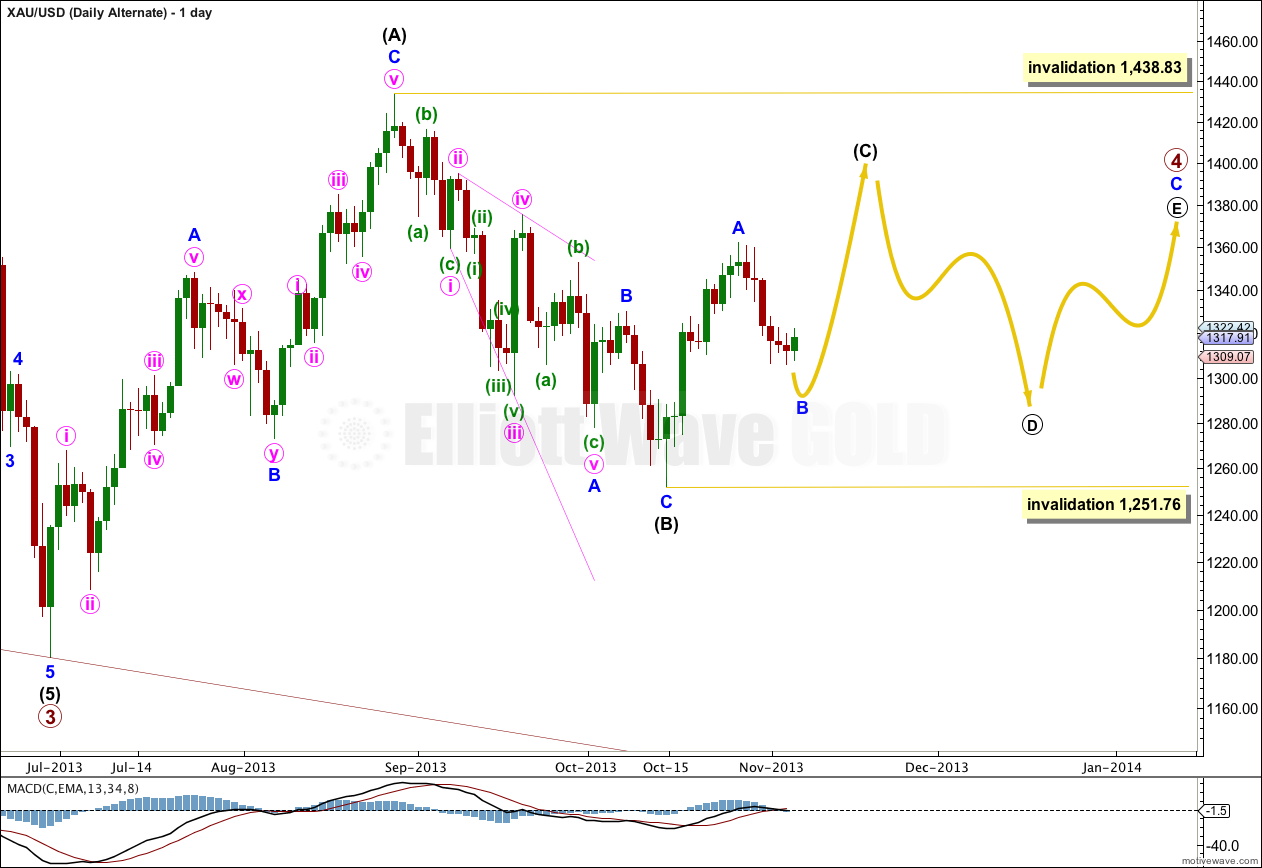

Alternate Daily Wave Count.

It is possible that a large contracting triangle is unfolding for primary wave 4, but it has a lower probability than the main wave count. Double zigzags and combinations are in my experience more common structures than triangles. However, triangles are not rare, they are just less common.

Triangles are very tricky structures to analyse. I normally only consider them when they show themselves clearly, which is close to the end of the structure.

At this stage within a possible triangle only waves A and B would be complete. One of the five subwaves should subdivide into a double zigzag, be more time consuming, and have deeper corrections than the other subwaves.

Within a contracting triangle intermediate wave (C) may not move beyond the end of intermediate wave (A), and intermediate wave (D) may not move beyond the end of intermediate wave (B).

Within a barrier triangle intermediate wave (D) should end about the same level as intermediate wave (B), which in practicality means it may move slightly lower than 1,251.76. As long as the B-D trend line remains flat.

The triangle is invalidated with any movement above 1,438.83, or with much movement below 1,251.76.

Can you upload daily analysis on silver and us oil too