Last week’s US Oil analysis expected more downwards movement towards 89.83 for the end of a third wave. Price did not move lower. Instead, it has moved a little higher and sideways. The third wave was already over, and sideways and higher movement is the following fourth wave.

Overall the wave count is not much changed on the daily chart. The structure of this long impulse is still incomplete and I will still expect some more downwards movement.

Click on the charts below to enlarge.

The bigger picture sees US Oil in a new downwards trend to last from one to several years. When I can see a clear five wave structure downwards on the daily chart I will have confidence in a trend change at cycle degree. So far the downwards structure for the first wave at minor degree is incomplete, and I cannot say that there is yet a clear five down.

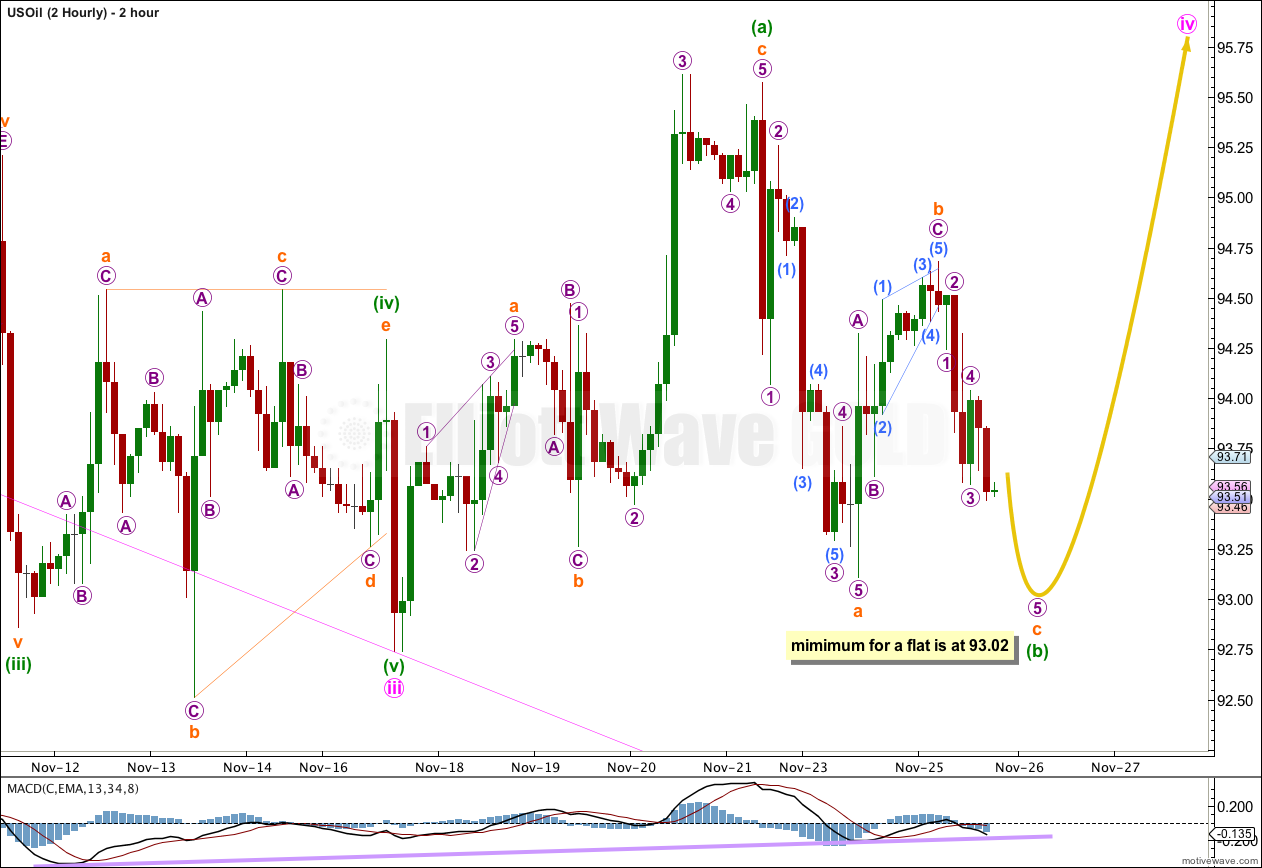

Within the downwards movement the strongest downwards momentum is within the third wave. Minute wave iii is over and was just 0.40 longer than 2.618 the length of minute wave i. We may not see a Fibonacci ratio for minute wave v, but if we do the most likely would be equality with minute wave i, which would see minute wave v 6.70 in length.

Ratios within minute wave iii are: there is no Fibonacci ratio between minuette waves (iii) and (i), and minuette wave (v) is 0.08 short of 0.382 the length of minuette wave (i).

I have used Elliott’s first channeling technique to draw a parallel channel about this downwards impulse. Draw the first trend line from the lows labeled minute waves i to iii, then place a parallel copy upon the high labeled minute wave ii. I would expect minute wave iv to be likely to find resistance at the upper edge of this channel.

So far minute wave iv has lasted seven days. The structure is incomplete. It may finish in another two to three days.

Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement above 105.54.

Minute wave iii was over already at the time last analysis was prepared. It has managed to just avoid a truncated fifth; minuette wave (v) ends slightly below the end of minuette wave (iii).

Minute wave iv is unfolding as either a flat correction, double combination or double zigzag.

If downwards movement reaches 93.02 or below then this labeling will remain as it is. I would expect minuette wave (b) to most likely end between 100% to 138% of minuette wave (a) at 92.74 to 91.66. The following upwards movement for minuette wave (c) must subdivide as a five wave structure and would be extremely likely to make a new high above 95.57 to avoid a truncation and a very rare running flat.

If downwards movement fails to reach the minimum of 90% of minuette wave (a) at 93.02 then I would relabel this structure W-X-Y and expect a double combination or double zigzag. I would expect a double combination as most likely because the X wave within it is reasonably deep. A combination would expect minuette wave (y) to end about the same point, or very slightly above the end of minuette wave (w) at 95.57 so that the whole structure moves sideways. Minuette wave (y) would most likely unfold as a flat correction.

The least likely possibility for minute wave iv would be a double zigzag because within them X waves are not usually this deep.

The last possibility for minute wave iv would be a triangle. This would expect another two or three days of very choppy, overlapping and sideways movement.

Overall the best guide to when this fourth wave correction is over may be the channel on the daily chart. If upwards movement over the next couple of days reaches the upper edge of the channel then I would expect minute wave iv to be over.

Finally, there is an alternate possibility that minute wave iv was over at 95.57 as a brief zigzag. This would not provide much alternation with minute wave ii, and minute wave iv would have lasted only two days. Only if we see a clear five down on the hourly chart would I consider this outlying possibility.