Downwards movement has invalidated one of the three wave counts. The other two are still viable (with some adjustment). I now have a clear price point which will differentiate the two wave counts for next week, and I now judge one to have a higher probability than the other.

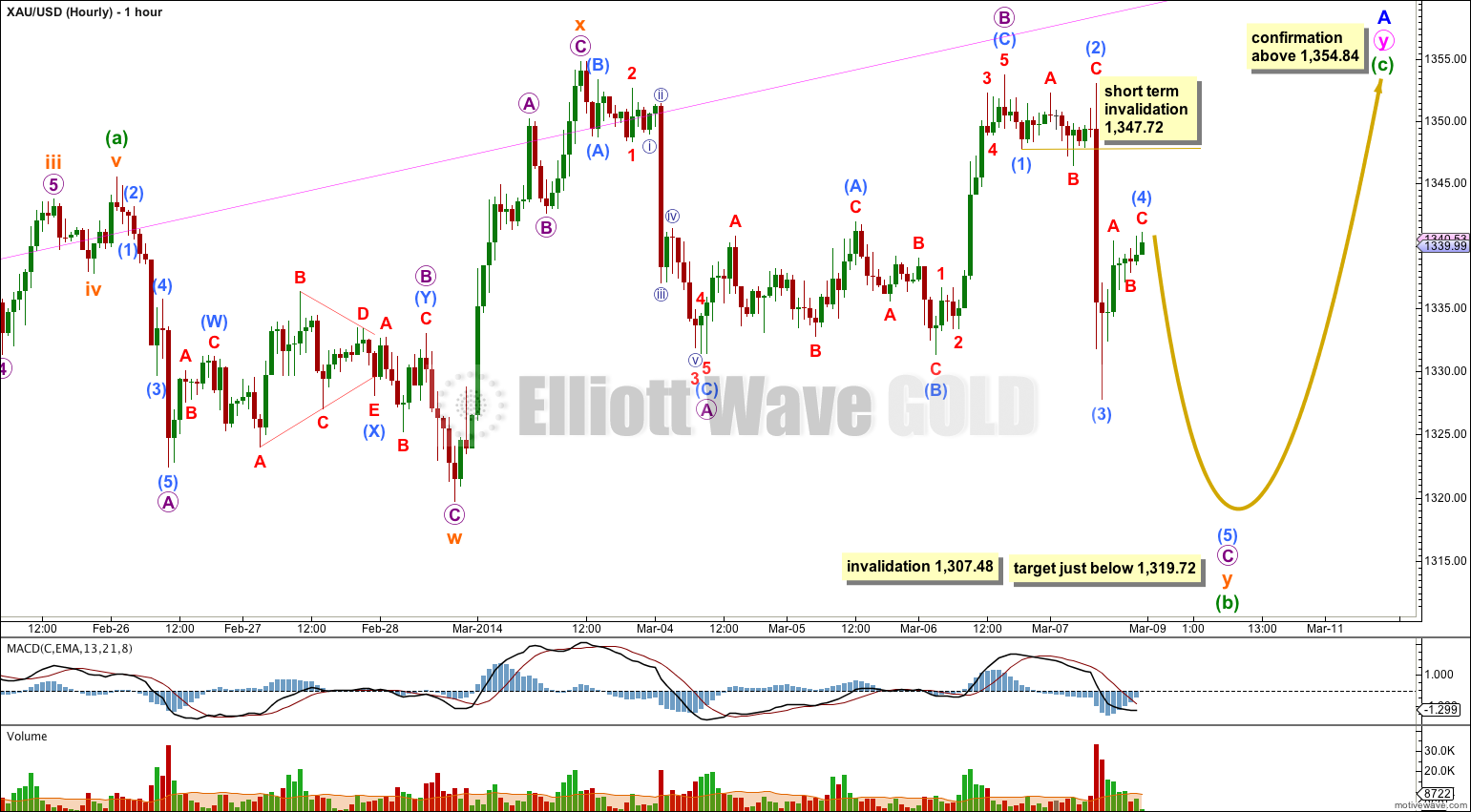

Summary: The situation is slightly clearer. It is most likely we shall see the completion of a correction for a minute wave (b) which should be followed by more upwards movement which may last about up two weeks. In the short term I expect more downwards movement to about 1,319 to 1,316. This is the same for both wave counts.

This analysis is published about 07:45 p.m. EST. Click on charts to enlarge.

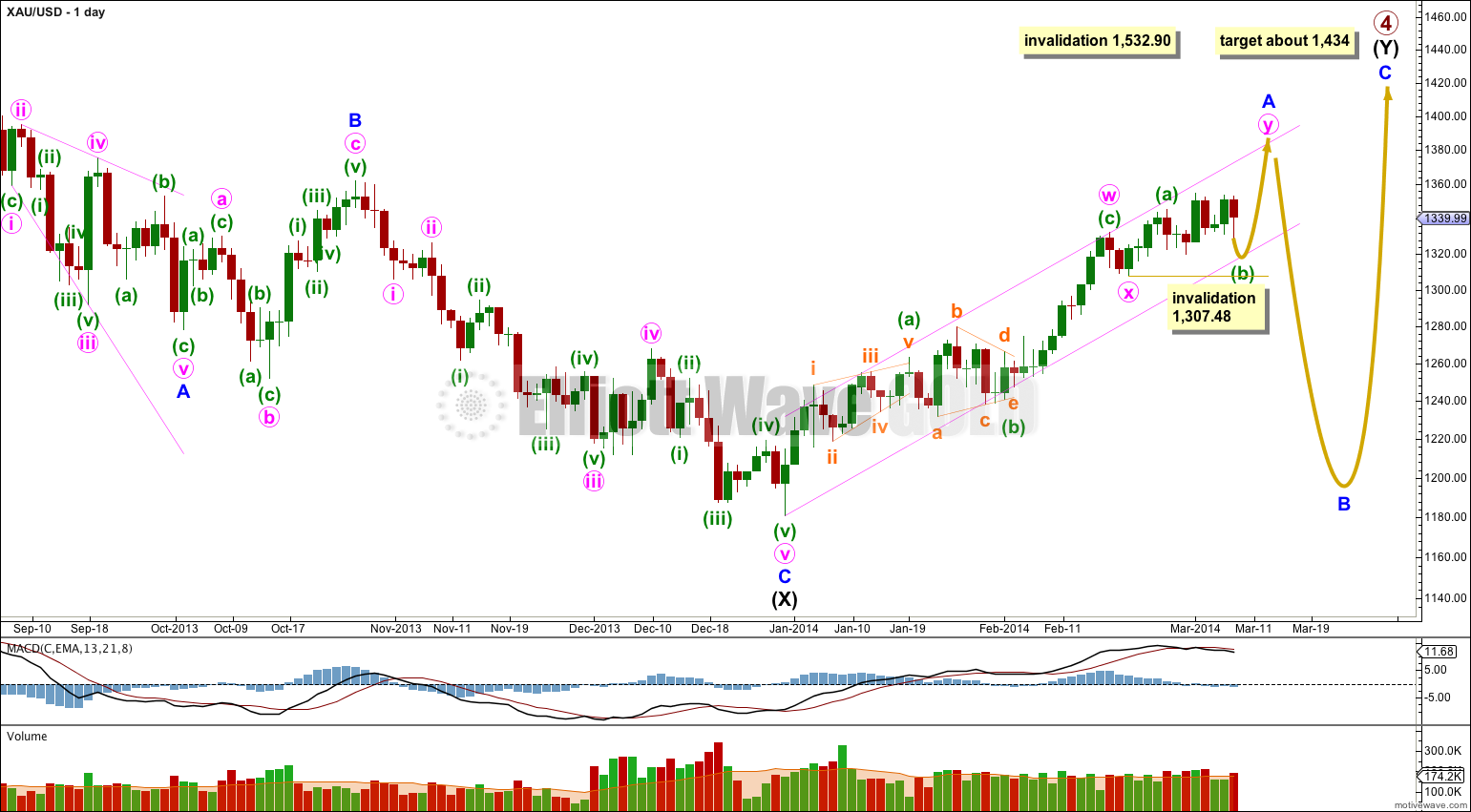

Main Wave Count.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

The first upwards wave within primary wave 4 labeled here intermediate wave (W) subdivides as a three wave zigzag. Primary wave 4 cannot be an unfolding zigzag because the first wave within a zigzag, wave A, must subdivide as a five.

Primary wave 4 is unlikely to be completing as a double zigzag because intermediate wave (X) is a deep 99% correction of intermediate wave (W). Double zigzags commonly have shallow X waves because their purpose it to deepen a correction when the first zigzag does not move price deep enough.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) may be either a flat or a triangle. For both these structures minor wave A must be a three, and is most likely to be a zigzag.

Minor wave A is an incomplete double zigzag. The second zigzag in the double is incomplete.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

The triangle was invalidated by downwards movement. Minute wave (b) subdivides perfectly as a double combination, a zigzag – X – flat correction. Only the final piece of downwards movement is required to complete minute wave (b).

The purpose of double combinations is to move price sideways and take up time. Thus the second structure in a double usually ends about the same level as the first, and often very slightly beyond the first. I would expect subminuette wave y to end slightly below the end of subminuette wave w at 1,319.72.

The expected direction for the next movement is the same for both wave counts.

Pros:

1. It has a very good look on the daily chart.

2. On the hourly chart so far all subdivisions fit perfectly.

3. This wave count nicely explains the overlapping movement of the last few days.

4. Ratios within minuette wave (c) of minute wave w are: subminuette wave iii is just 0.42 short of 1.618 the length of subminuette wave i, and subminuette wave v is just 2.43 longer than equality with subminuette wave iii. The ratios within this movement are excellent for both wave counts.

5. Within the first zigzag, minute wave w, minuette wave (c) is just 2.66 longer than equality with minuette wave (a).

Cons:

1. None that I can see today. The problem of MACD not hovering about zero is resolved as this structure is not a triangle but a combination.

Because this wave count fits perfectly and has no problems it has a higher probability than the alternate wave count below.

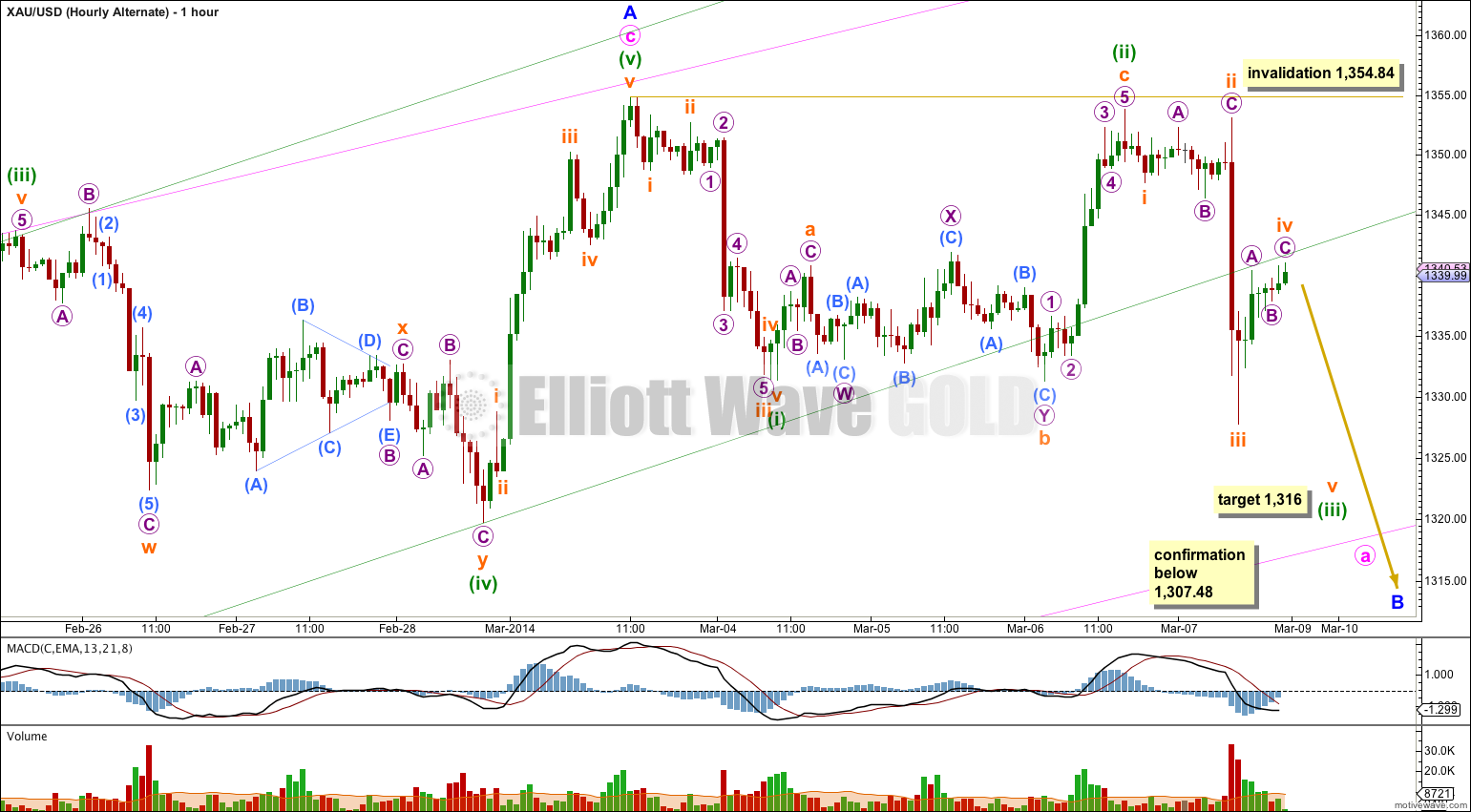

Alternate Wave Count.

This was yesterday’s first wave count. It now has a lower probability.

If minor wave A is complete then minor wave B has begun. This wave count now diverges with the expectation for Silver significantly enough to further reduce its probability, while the main wave count is in line with my expectations for Silver.

This wave count sees minuette wave (iii) over at 1,343.35 and minor wave A may be complete.

Within minor wave B the first 5-3-5 downwards is incomplete. At 1,316 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

This wave count requires confirmation below 1,307.48, at that point the main wave count would be invalidated.

Pros:

1. Ratios within minute wave c are: minuette wave (iii) has no Fibonacci ratio to minuette wave (i), and minuette wave (v) is just 0.60 longer than 0.382 the length of minuette wave (iii). Ratios within minuette wave (iii) are: subminuette wave iii is just 0.09 short of 1.618 the length of subminuette wave i, and subminuette wave v is just 1.12 longer than equality with subminuette wave i. These Fibonacci ratios are startlingly good, which is actually reasonably typical for Gold.

2. Minuette wave (iv) is seen as a double combination which has the best fit for this movement.

Cons:

1. On the daily chart minuette wave (iii) does not have the “right look”.

2. Within minor wave A there is no Fibonacci ratio between minute waves a and c.

3. Upwards movement labeled minuette wave (v) to end minor wave A looks best as a three, but this wave count sees it as a five.

4. This wave count diverges with expectations for Silver significantly. Either it is wrong, or my Silver analysis is wrong.

Within the new downwards trend at this stage no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 1,354.84.

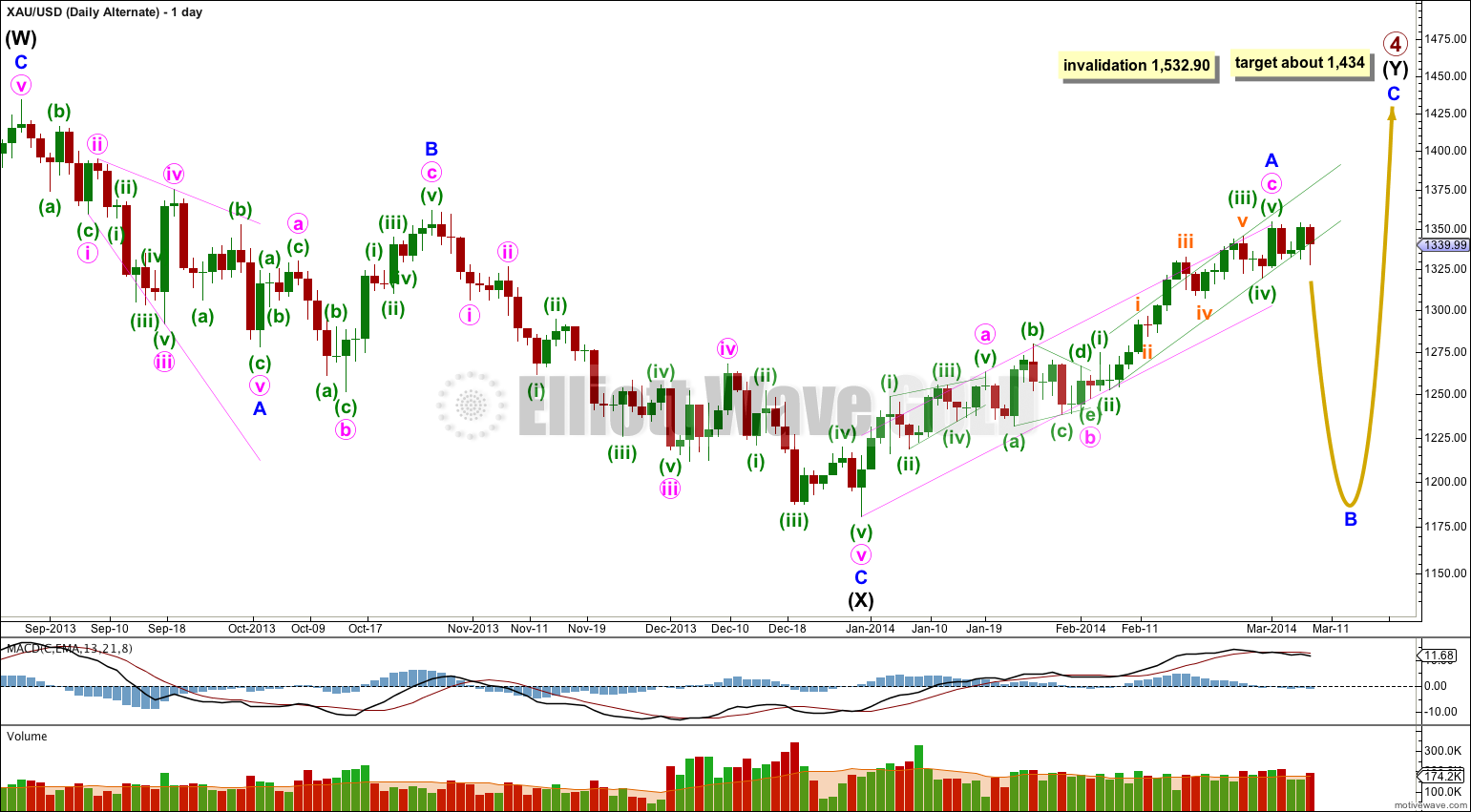

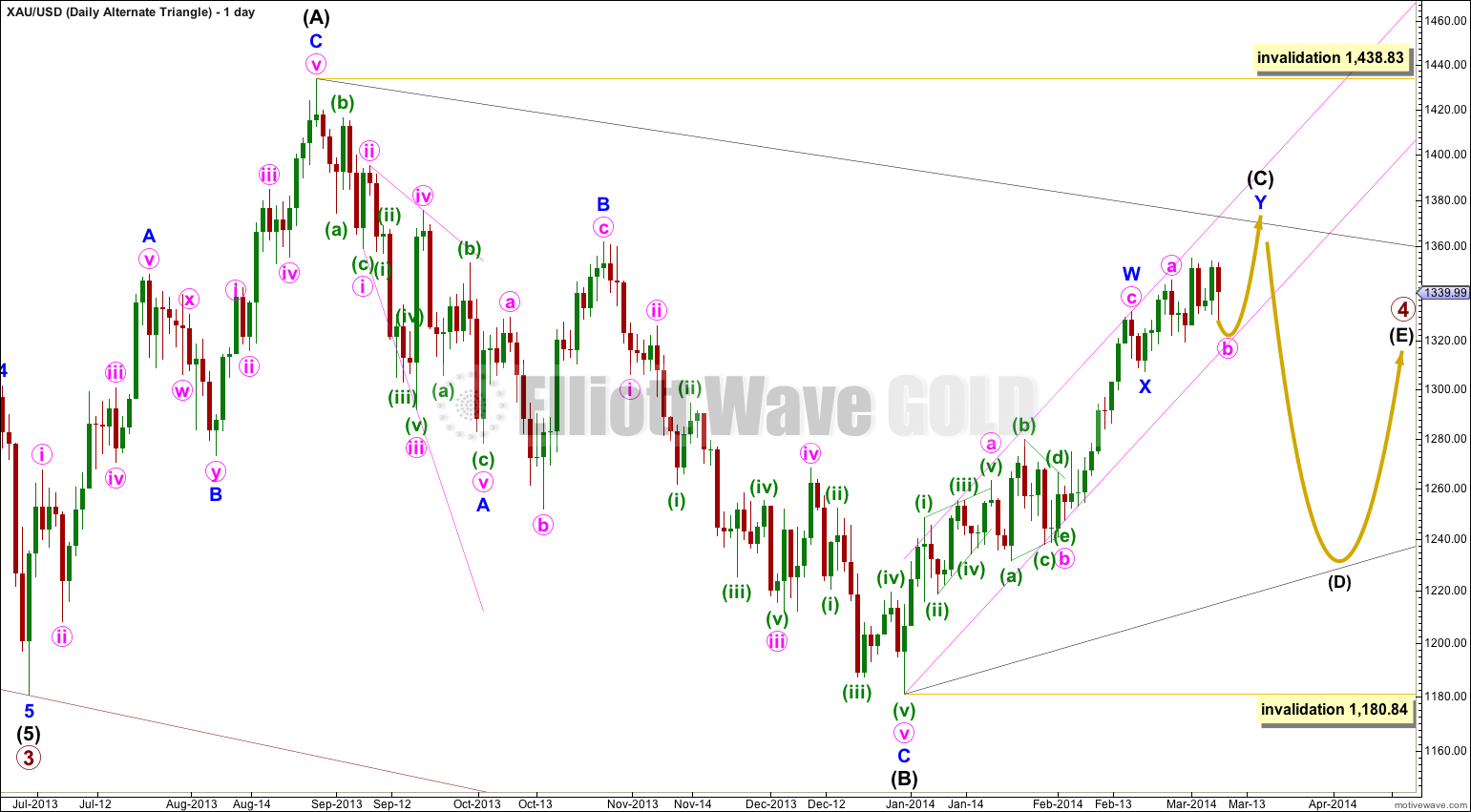

Alternate Daily Wave Count – Triangle.

It is also possible that primary wave 4 may continue as a regular contracting (or barrier) triangle.

This wave count has a good probability. It does not diverge from the main wave count and it will not diverge for several weeks yet.

Triangles take up time and move price sideways. If primary wave 4 unfolds as a triangle then I would expect it to last months rather than weeks.