Yesterday’s analysis expected to see a little upwards movement before price turned down. Upwards movement did not happen and price moved sideways in a small range to complete a small red doji candlestick. I have three hourly wave counts for you.

Summary: The short term situation is unclear. We may see one small final upwards push before some downwards movement which may last about three to nine days, or price may move lower from here. Overall I expect to see a small correction against the current short term upwards trend.

This analysis is published about 10:45 p.m. EST. Click on charts to enlarge.

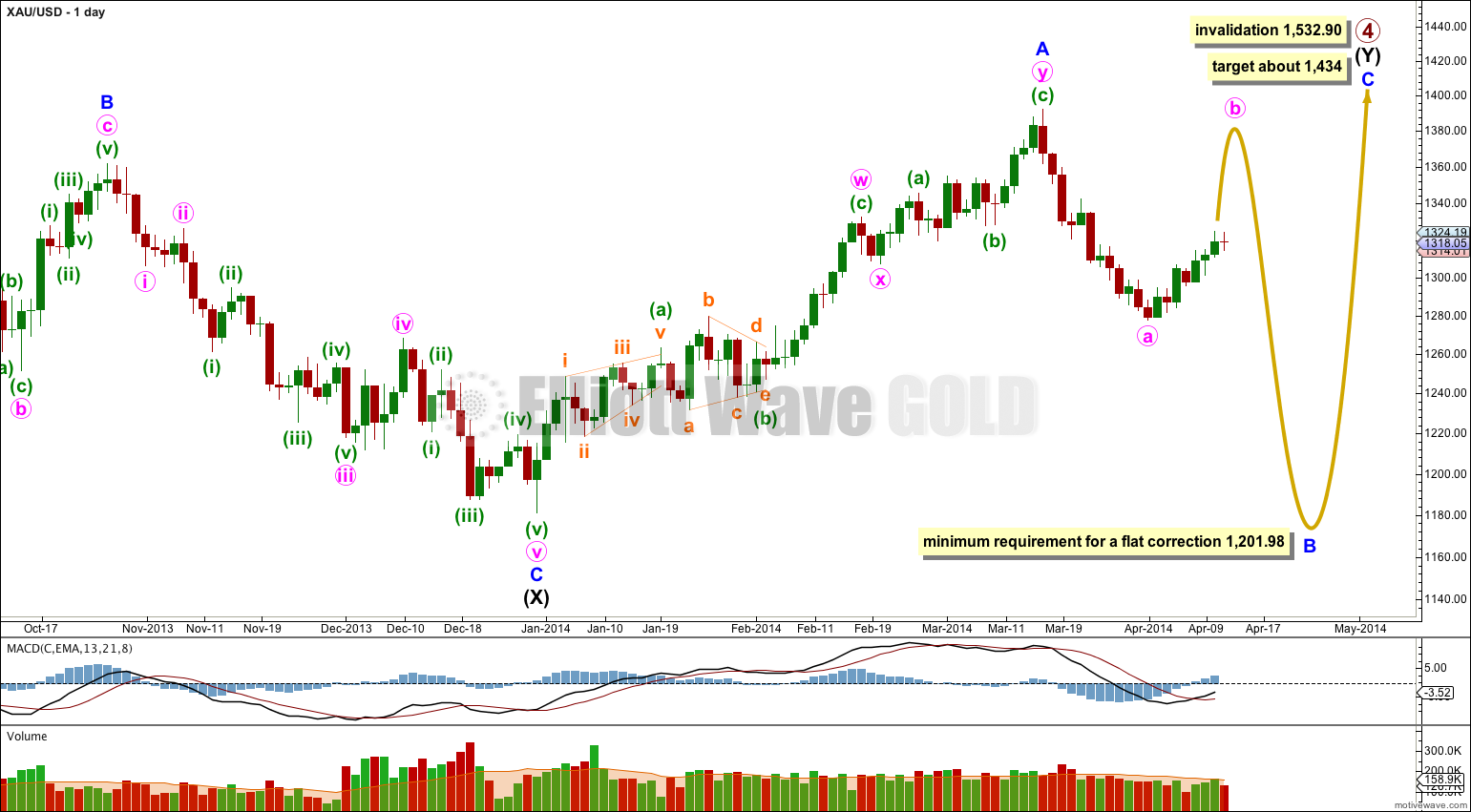

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure: either a flat correction (main hourly wave count) or a double zigzag (alternate hourly wave count). Minor wave B should continue for a few more weeks and may make a new low below 1,180, and is reasonably likely to do so in coming weeks.

Primary wave 4 may also be a large contracting triangle, but at this stage this idea does not have the “right look” and so I will not publish a chart for it. I will continue to follow this idea and will publish a chart in coming weeks for it if it shows itself to be correct. At this stage there is no divergence between wave counts for a triangle or a double combination.

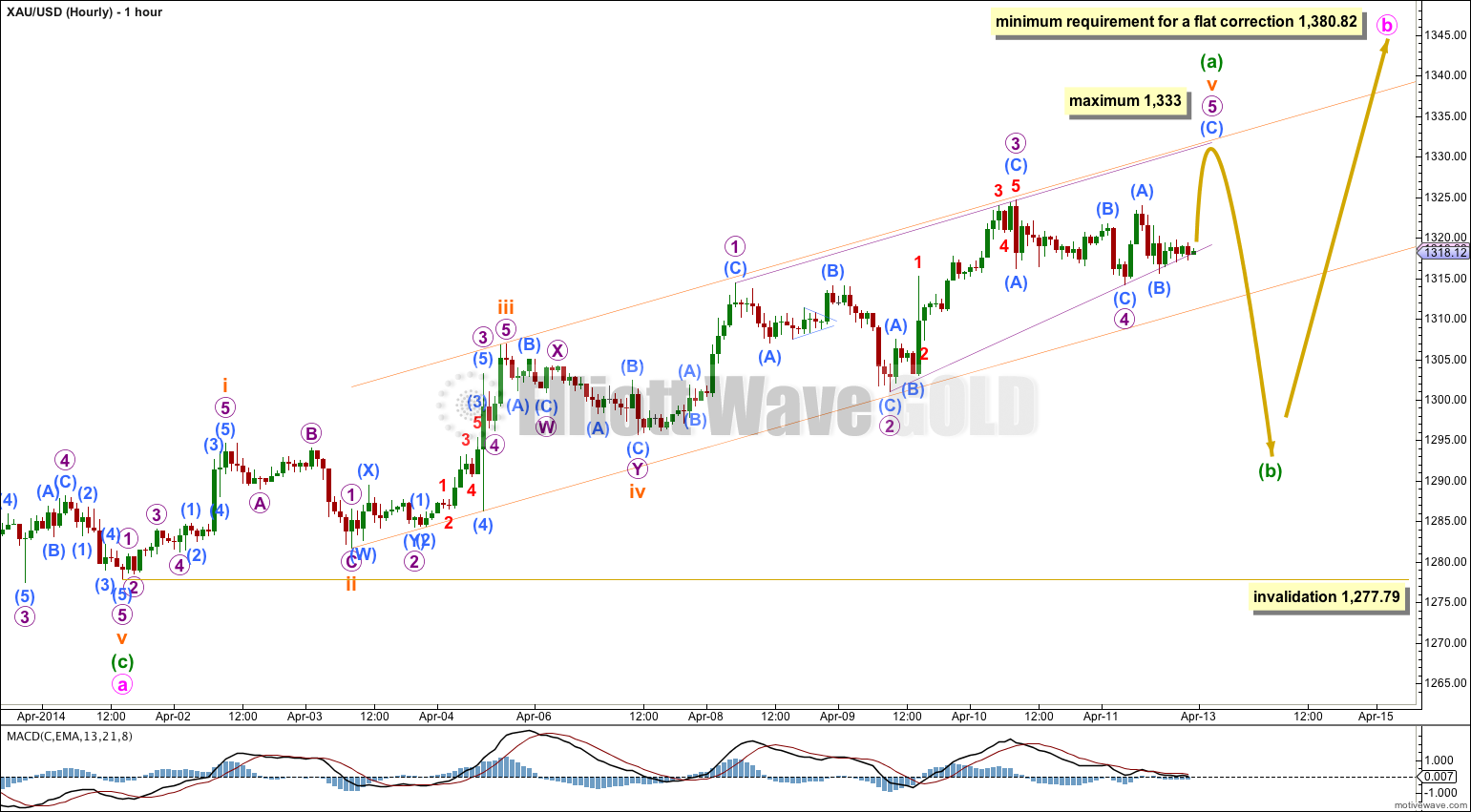

This main wave count follows the idea that minor wave B may be unfolding as a flat correction. Within the flat correction minute wave a subdivides as a single zigzag. Minute wave b within the flat must reach a minimum of 90% the length of minute wave a at 1,380.82.

Minute wave b is most likely to subdivide as a single or double zigzag in order to reach 1,380.82.

Within a zigzag minuette wave (a) must subdivide as a five wave structure. It may be an almost complete impulse.

Within minuette wave (a) subminuette wave iii is 2.07 short of 1.618 the length of subminuette wave i. Subminuette wave v may be unfolding as an ending expanding diagonal.

I am considering the possibility of a diagonal today for two reasons: micro wave 4 slightly overlaps micro wave 1 price territory so this final fifth wave cannot be an impulse, and the subdivisions within micro wave 3 fit best as a zigzag.

The diagonal looks like it is contracting because micro wave 4 is shorter than micro wave 2. But micro wave 3 is longer than micro wave 1; sometimes I have noticed within diagonals their third waves have a tendency to be the longest. Micro wave 5 would reach equality in length with micro wave 1 at 1,333. It should end before that point. It would be likely to end at or before reaching the upper edge of the channel.

I have redrawn the channel about minuette wave (a) as a best fit. I want to see this channel very clearly breached by downwards movement to have confidence in a short term trend change.

Minuette wave (a) would have lasted nine days if it ends on Monday. I would expect minuette wave (b) to last at least three days, and maybe up to eight or nine days. It should show up very clearly on the daily chart. It may be be very choppy and overlapping, and it may include a new price extreme beyond its start.

Minuette wave (b) may not move beyond the start of minuette wave (a) below 1,277.79.

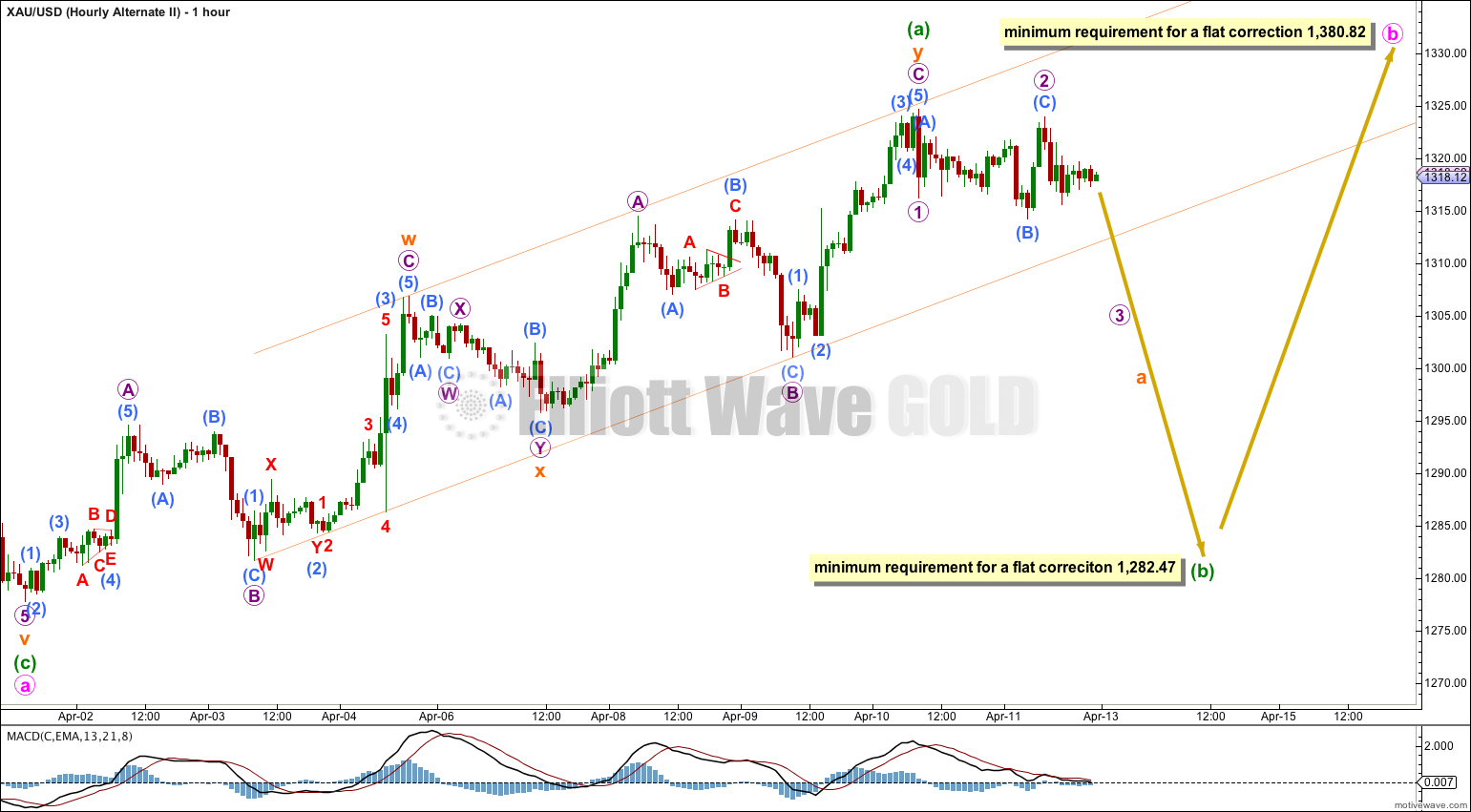

This alternate wave count sees the upwards movement for minuette wave (a) as a completed double zigzag.

Minor wave B downwards is still seen as an incomplete flat correction, and so within it minute wave b upwards must reach a minimum of 90% the length of minute wave a at 1,380.82.

Minute wave b may itself be unfolding as a flat correction, with minuette wave (a) within it a “three” and now minuette wave (b) downwards must also be a “three” and it must reach a minimum of 90% the length of minuette wave (a) at 1,282.47.

Minuette wave (b) may unfold as any corrective structure, and within it there may be a new high above 1,324.61 so there is no upper invalidation point for this wave count.

Minuette wave (b) may move beyond the start of minuette wave (a) below 1,277.79. There is no lower invalidation point.

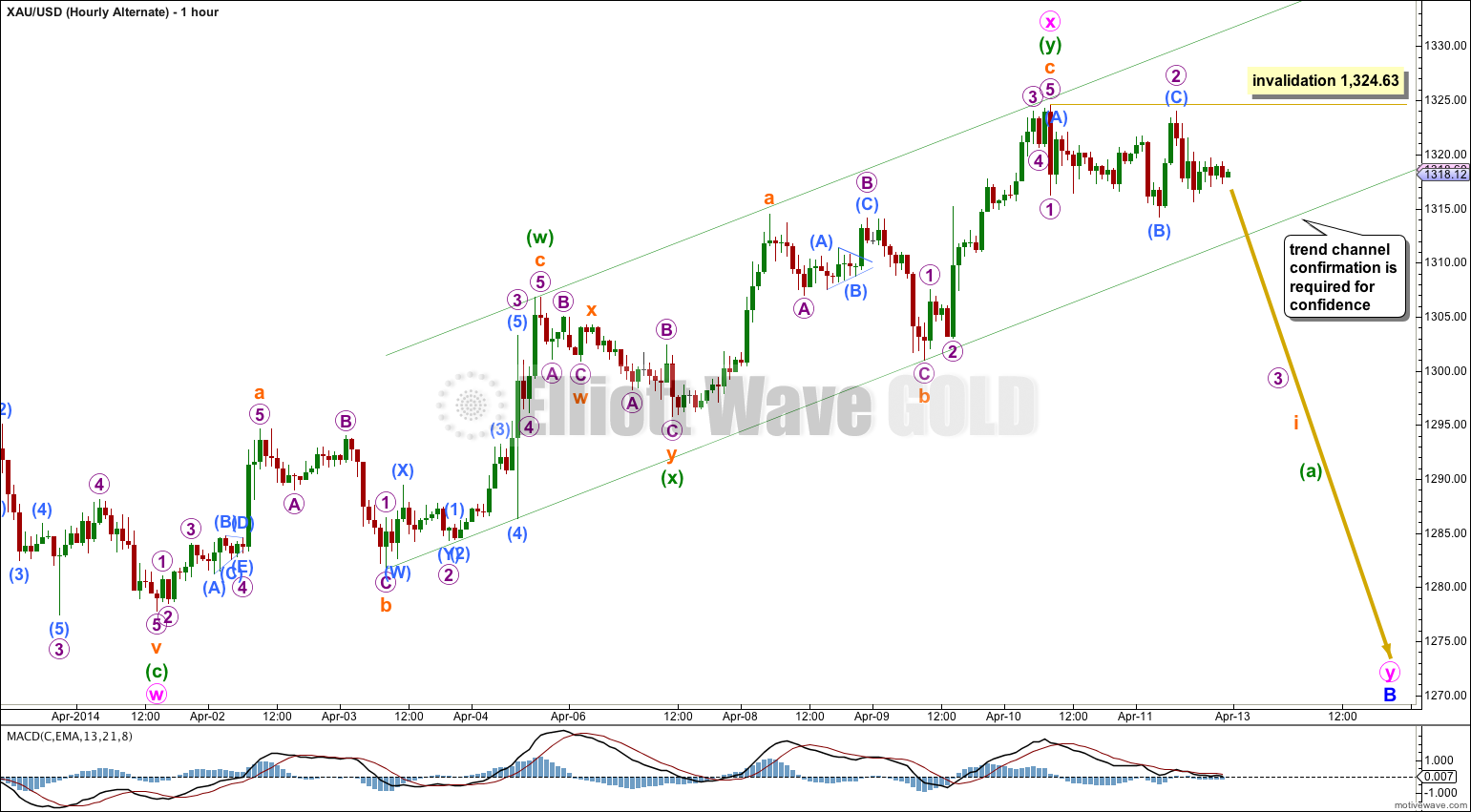

Alternate Hourly Wave Count.

This alternate wave count follows the idea that minor wave B downwards may be unfolding as a double zigzag. The first zigzag downwards is labeled minute wave w. The double should be joined by a “three” in the opposite direction which may subdivide as any corrective structure labeled minute wave x.

Minute wave x may be a complete double zigzag. Within multiples the subwaves of W, Y and Z can only subdivide as simple A-B-C corrections because the maximum number of corrections in a multiple is three. But X waves can subdivide as any corrective structure, including a multiple. X waves are most commonly zigzags (especially within a double zigzag) and least likely to be multiples.

If minute wave x is complete then within the new downwards movement no second wave may move beyond the start of a first wave. This wave count is invalidated with movement above 1,324.63.

I would want to see the best fit parallel channel clearly breached with downwards movement before I had any confidence in a trend change.

Alternatively, we may also label this alternate in the same way as either of the main hourly wave counts: minute wave x may be an incomplete single zigzag with minuette wave (a) close to completion or minute wave x may be an incomplete flat correction.

The scenario presented here fits the alternate wave count for minor wave B as a double zigzag, but it cannot fit the main wave count for minor wave B as a flat correction.

This scenario requires the next movement downwards to subdivide as a five wave structure; if minor wave B downwards is a double zigzag and the second zigzag in the double has just begun, then within it the A wave must subdivide as a five.

If this wave count remains valid and the next movement downwards is a clear five wave structure, then this wave count will have the highest probability.

Hi Lara, GDX turned down 2 days ago