Downwards movement in a small range remains above the invalidation point. The hourly wave counts remain the same but now have a more even probability.

Summary: We may either see the continuation of a new upwards trend for about two weeks, or we may see very choppy overlapping and slightly higher movement for a few days. The situation is unclear but overall at this stage the short term trend is up.

This analysis is published about 04:25 p.m. EST. Click on charts to enlarge.

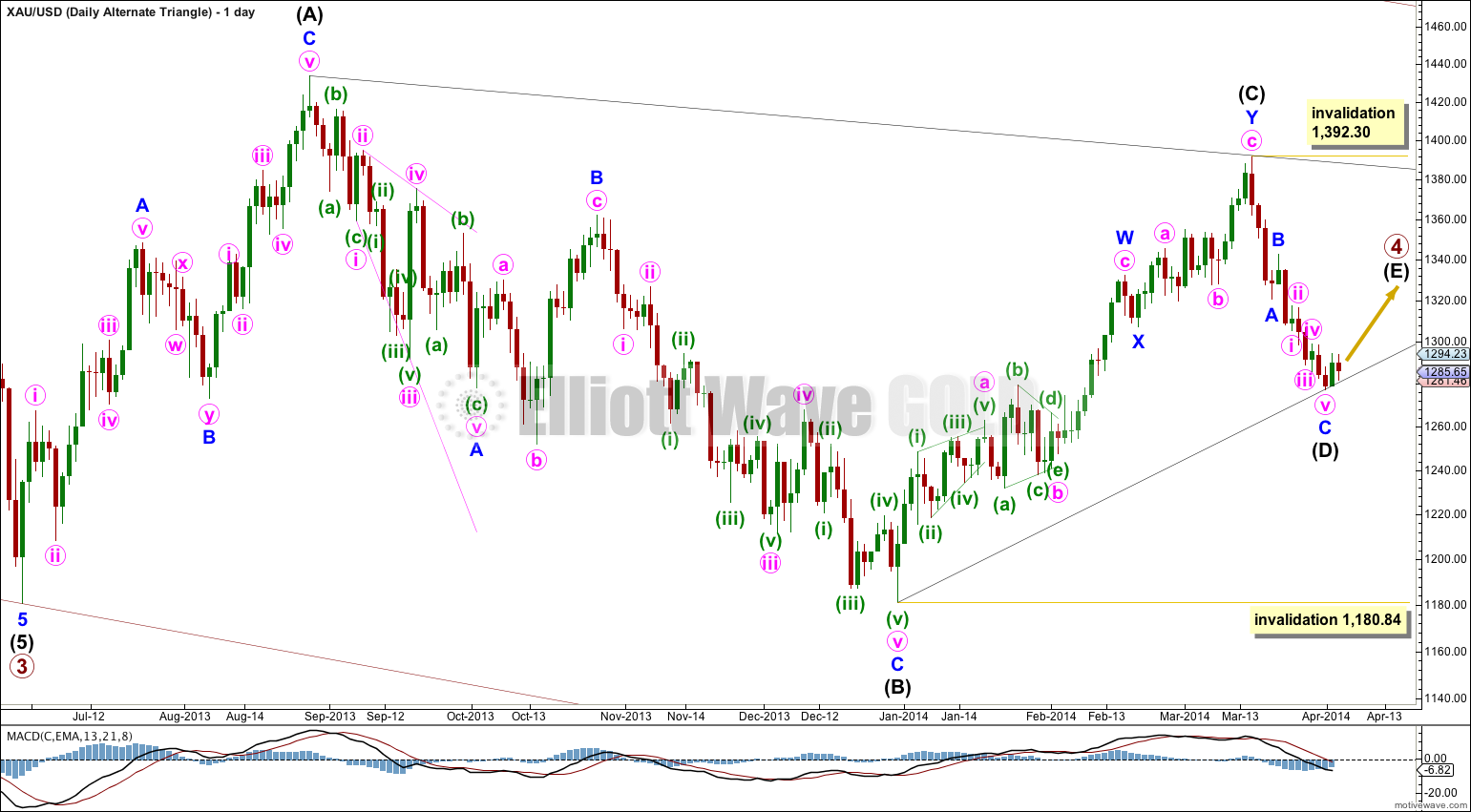

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

The first upwards wave within primary wave 4 labeled intermediate wave (W) subdivides as a three wave zigzag. Primary wave 4 cannot be an unfolding zigzag because the first wave within a zigzag, wave A, must subdivide as a five.

Primary wave 4 is unlikely to be completing as a double zigzag because intermediate wave (X) is a deep 99% correction of intermediate wave (W). Double zigzags commonly have shallow X waves because their purpose it to deepen a correction when the first zigzag does not move price deep enough.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) may be either a flat or a triangle. For both these structures minor wave A must be a three.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

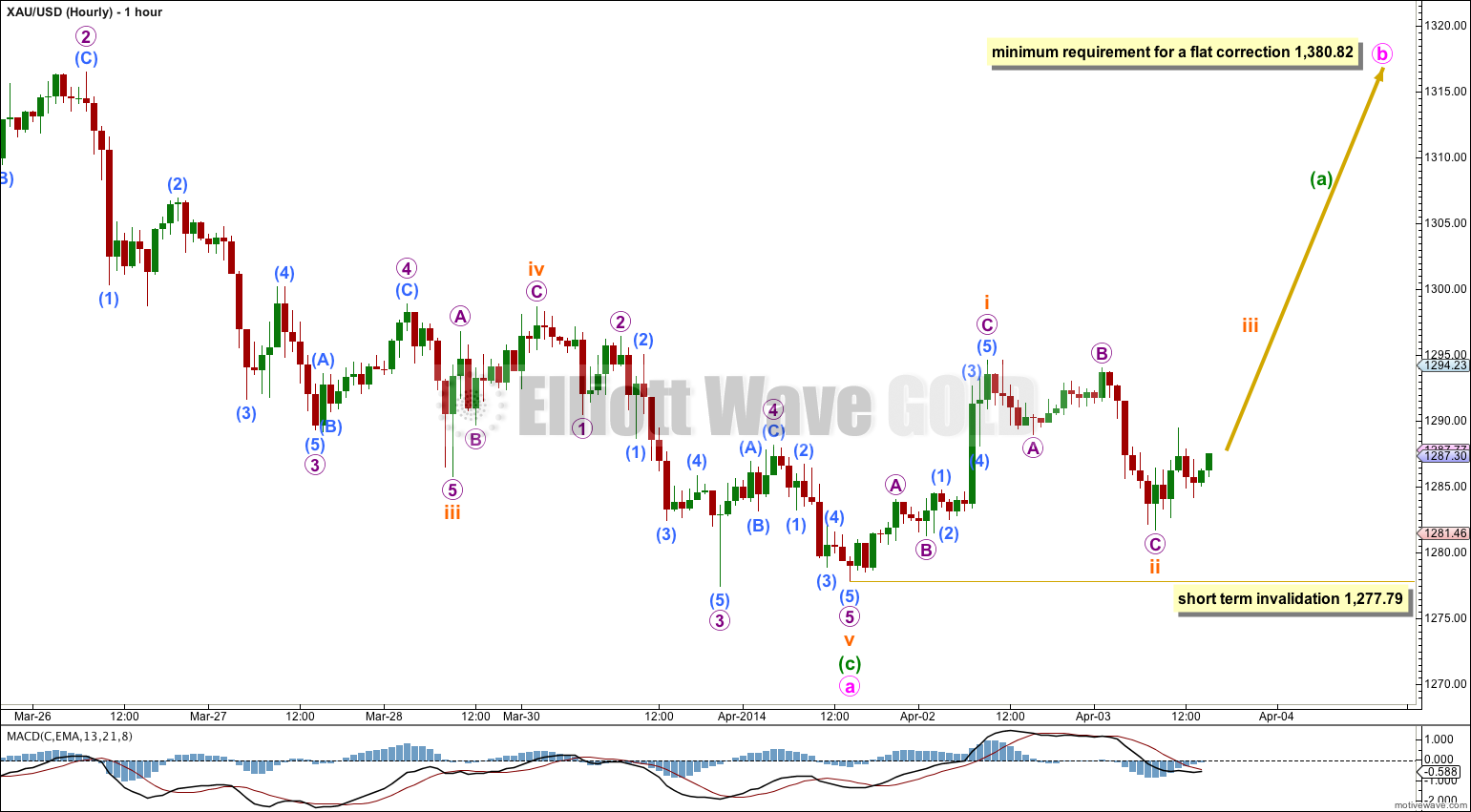

This main wave count expects upwards movement for about two weeks. This wave count expects minor wave B to unfold as a flat correction.

Upwards movement ending at 1,294.60 for subminuette wave i subdivides best as a three wave structure, as it did not continue higher to complete a five. This indicates a leading diagonal may be unfolding for minuette wave (a). Within a leading diagonal subwaves 2 and 4 must be single zigzags, and subwaves 1, 3 and 5 are most commonly single zigzags also although they may also be impulses.

Leading diagonals although not rare are not exactly very common either. This reduces the probability of this wave count to more even with the alternate.

Within the possible diagonal subminuette wave ii may not move beyond the start of subminuette wave i. This wave count is invalidated with movement below 1,277.79.

Minute wave b may make a new high beyond the start of minute wave a at 1,392.30. This wave count has no upper invalidation point for this reason.

Minute wave b within the flat correction must reach a minimum of 90% the length of minute wave a at 1,380.82. If minor wave B is an expanded flat correction then minute wave b may end at or above 1,398.80 where it would be 105% the length of minute wave a.

Minute wave b within the flat may take the form of more than thirteen possible corrective structures. It is most likely to be a zigzag. At this stage the first five up is incomplete. I will not start to look at the different implications of various alternates until that is complete.

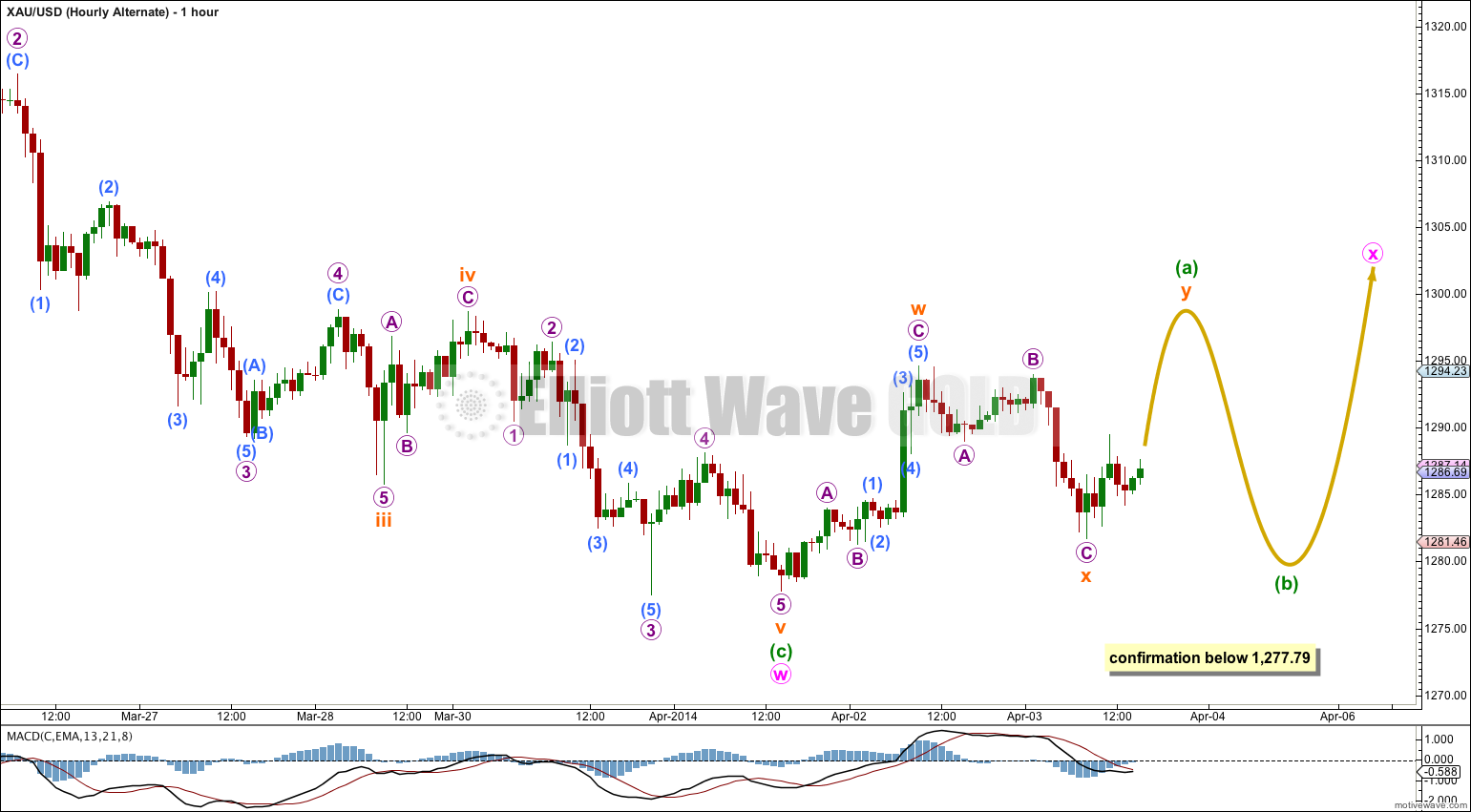

Alternate Hourly Wave Count.

If minor wave B is a double zigzag then within it the first structure of the double, a zigzag labeled minute wave w, is now complete.

The double should be joined by a “three” in the opposite direction labeled minute wave x. There is no minimum upwards requirement for an X wave within doubles.

Minute wave x may subdivide as any corrective structure. If minor wave B is a double zigzag I would expect minute wave x to be relatively shallow.

The purpose of double zigzags is to deepen a correction when the first zigzag does not move price deep enough. Considering the lower target for minor wave B on the daily chart of 1,201.98 a double zigzag would nicely fit the purpose. This indicates a shallow X wave may unfold.

At this stage there are several different possible structures I can see which may be unfolding for minute wave X. I am labeling it with the most likely structure as I see it today but this labeling may change. Overall, I would expect to see very choppy overlapping movement for several days yet. This could still fit nicely with my wave count for Silver which expects slow upwards movement for a few days.

I am labeling minuette wave (a) within minute wave x as an incomplete double zigzag or double combination. If minuette wave (a) subdivides as a three that indicates minute wave x is either a flat correction, triangle, or a multiple. All of these possibilities expect very choppy overlapping movement, and all of them may include a new low below 1,277.79.

If the main wave count is invalidated in the next few days with movement below 1,277.79 then this is the alternate I would use.

Alternate Daily Wave Count – Triangle.

It is also possible that primary wave 4 may continue as a regular contracting (or barrier) triangle.

Within the triangle one of the subwaves, intermediate wave (C), is a double zigzag. The remaining subwaves may not be double zigzags and must be single zigzags. If intermediate wave (D) is a zigzag then it is likely now to be over. This would be a remarkably shallow D wave within a triangle, and it does not look right. The probability of this alternate is today reduced.

This alternate wave count now only requires a final zigzag upwards for intermediate wave (E) which may not move beyond the end of intermediate wave (C) above 1,392.30.